Surgical Equipment Market Share, Size, Trends, Industry Analysis Report

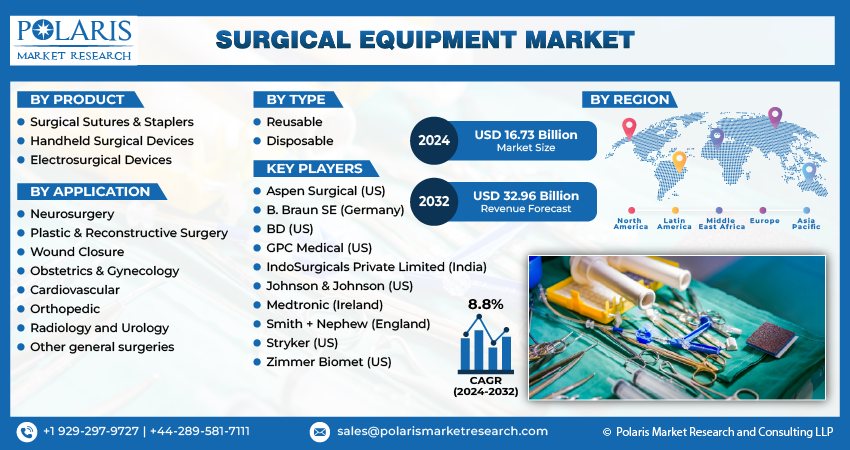

By Product (Surgical Sutures & Staplers, Handheld Surgical Devices, Electrosurgical Devices); By Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 120

- Format: PDF

- Report ID: PM4888

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

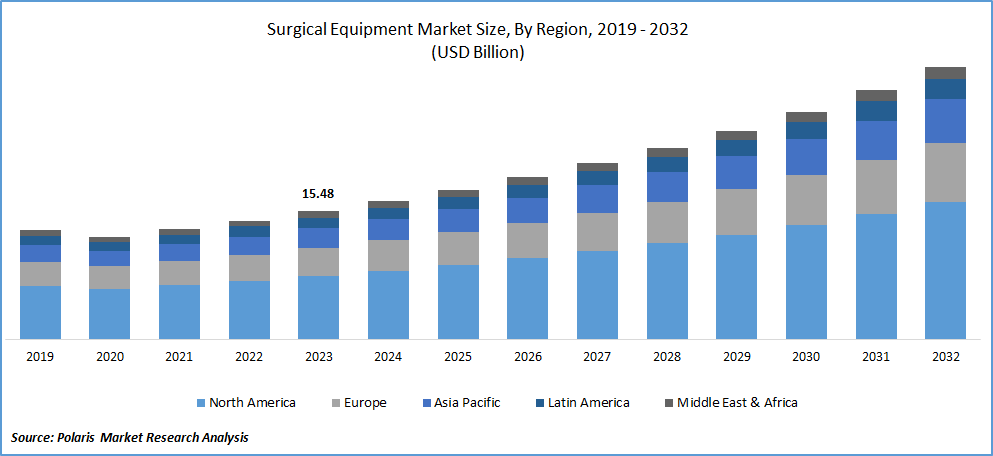

Surgical Equipment Market size was valued at USD 15.48 billion in 2023. The market is anticipated to grow from USD 16.73 billion in 2024 to USD 32.96 billion by 2032, exhibiting the CAGR of 8.8% during the forecast period.

Market Overview

The surgical equipment is witnessing higher demand with the rising number of people opting for surgeries to promote their health. The growing number of people infected with the diseases; primarily cardiovascular health issues is driving the adoption of advanced medical equipment among healthcare providers. This in a way encouraging surgical equipment manufacturers to extend their production capacity with strategic expansion activities and investments. For instance, in January 2024, Surgical Instruments Group Holdings announced its plan to establish a manufacturing facility with an investment of INR 231 crore in the next two to three years in Hyderabad, India.

To Understand More About this Research:Request a Free Sample Report

The use of advanced healthcare equipment is expected to boost new innovations in the coming years. In February 2024, Gauhati Medical College Hospital's (GMCH) State Cancer Institute announced the use of robotic surgery for cancer treatment. The growing demand for surgical equipment is eventually enabling market players to expand their supply chain to meet growing demand.

For instance, in February 2024, King’s College London’s School of Biomedical Engineering & Imaging Sciences unveiled a new manufacturing facility to produce surgical instruments and active implants.

Moreover, the significant rise in the cesareans in the world is fueling the need for surgical equipment. Countries with a higher population rate, such as India and China, are likely to boost the demand for multiple surgeries, including obstetrics. According to the World Health Organization, approximately 29% of the births in the world are expected to be done by cesarean section by 2030.

However, growing awareness about the medical challenges associated with surgical procedures is contributing to the demand for minimal or non-invasive treatment plans around the world. This is expected to hinder the demand for surgical equipment in the next few years.

Growth Drivers

Rising Use of Surgical Robots

Most of the people were unable to access surgical interventions due to the lower availability of healthcare infrastructure and limited surgical professionals. Technology is changing the healthcare industry in several aspects, primarily the deployment of artificial robots providing surgical treatment, which is promoting the affordability and success rates of surgeries. For instance, the first surgical robot in India, SSI Mantra, which was launched in July 2022 at the Rajiv Gandhi Cancer Institute, finished the 100 surgeries after six months of introduction.

Increasing Funding From Governments

Government initiatives to improve healthcare infrastructure and accessibility to better care for its citizens are expected to facilitate ample opportunities for surgical equipment market growth in the long run. For instance, in July 2023, an advanced robotic surgery system was introduced at Nizam’s Institute of Medical Sciences by the Telangana government with an investment of INR 35 crore. The government announced a grant of INR 154 crore for the consumption of high-end medical equipment.

Restraining Factors

Higher Costs of Surgeries are Likely to Impede Market Growth

The limited knowledge about the benefits of surgeries and growing concerns about side effects are likely to limit the number of surgeries that take place in the world, thereby reducing the adoption of surgical equipment in the long run. The higher cost of surgeries and lower accessibility, coupled with the decrease in the availability of experienced healthcare professionals to handle surgical care, are expected to restrict market expansion.

Report Segmentation

The market is primarily segmented based on product, type, application, and region.

|

By Product |

By Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Surgical Sutures & Staplers Segment is Expected to Witness the Highest Growth During the Forecast Period

The surgical sutures and staplers’ segment will grow rapidly, owing to rise in wounds, the rising number of accidents, and the diabetes population in the world. According to the Medical News article 2023, around 6.3% of the global population witnesses the incidence of chronic diabetic ulcers. As more people register the need for wound care in hospitals, from primary health centres to super specialty clinics, there will be a huge demand for surgical sutures and staplers in the marketplace.

By Type Analysis

Disposable Segment Accounted for the Largest Market share in 2023

The disposable segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is mainly driven by increasing concerns about the spread of infection. The affordability and convenience of disposable surgical equipment, coupled with the lower cost of maintenance, stimulate one-time use of medical products. Furthermore, rising companies' efforts to improve their supply chain networks are increasing the availability of high-quality, single-use surgical equipment in the global marketplace. For instance, in March 2024, Surgical Holdings announced the launch of the new consumables division to bolster its supply chain strength for disposable surgical instruments in collaboration with the distribution agent, Telic.

By Application Analysis

Radiology and Urology Segment Held the Significant Market Revenue share in 2023

The radiology and urology segment held a significant share. This is attributable to the increasing need for brain surgeries and the uptick in brain tumors cases. For instance, in March 2024, Apollo Surgery introduced new radiosurgery platform, ZAP-X, in India. Furthermore, rising cases of stones & malignant cases is facilitating the need for surgical interventions in the market.

Regional Insights

North America Region Registered the Largest share of the Global Market in 2023

The North America region held the dominant share in 2023. Region’s growth is primarily due to rise in surgical interventions with surge in lifestyle borne chronic ailments involving cardio-vascular, and chronic kidney disorders, and painful cancer-based abnormalities. For instance, as per the statistics published by the National Kidney Foundation (NKF), nearly, 10 percent of the U.S. population are suffering with problem of kidney stones during their lifetime.

APAC expected to grow at the rapid pace. This is due to the presence of a larger population with healthcare needs, creating numerous opportunities for the surgical equipment market. According to the Asian Institute of Nephrology and Urology, around 10% of the Indian population suffers from chronic kidney health conditions. India received Rs 1.89 crore in healthcare procedures pertaining to neurology and urology in 2022 and is projected to grow at a compound annual growth rate of 8 to 9%. This will certainly boost the expansion of the surgical equipment market in the region.

Key Market Players & Competitive Insights

Rising Product Developments will Drive the Competition

The surgical equipment market is competitive. The increasing number of companies focusing on the use of artificial intelligence, the Internet of Things, and machine learning capabilities in the development of surgical equipment to promote a higher rate of precision is driving competition in the global market. For instance, in April 2023, Advocate Aurora Research Institute, in collaboration with KelaHealth, a predictive analytics company, initiated a research project to transform surgery with the integration of machine learning and artificial intelligence.

Some of the major players operating in the global market include:

- Aspen Surgical (US)

- B. Braun SE (Germany)

- BD (US)

- GPC Medical (US)

- IndoSurgicals Private Limited (India)

- Johnson & Johnson (US)

- Medtronic (Ireland)

- Smith + Nephew (England)

- Stryker (US)

- Zimmer Biomet (US)

Recent Developments in the Industry

- In August 2023, CK Birla Group joined forces with Intuitive India to introduce the Da Vinci Surgical Robot to reduce post-surgery complications among patients and increase accuracy.

- In May 2023, Stryker introduced its Ortho Q Guidance system along with the guidance software for hip and knee procedures, assisting surgeons in the surgical operations.

Report Coverage

The surgical equipment market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, type, application, and their futuristic growth opportunities.

Surgical Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.73 billion |

|

Revenue forecast in 2032 |

USD 32.96 billion |

|

CAGR |

8.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Surgical Equipment Market Size Worth $ 32.96 Billion By 2032

The top market players in Surgical Equipment Market are Aspen Surgical, B. Braun SE, BD, GPC Medical, IndoSurgicals Private Limited

North America contribute notably towards the Surgical Equipment Market

Surgical Equipment Market exhibiting the CAGR of 8.8% during the forecast period.

Surgical Equipment Market report covering key segments are product, type, application, and region.