Ceramic Tiles Market Size, Share, Trends, Industry Analysis Report

By Product Type (Porcelain Tiles, Glazed Ceramic Tiles), By Construction Type, By Application, By End-User, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM6493

- Base Year: 2024

- Historical Data: 2020-2023

Overview

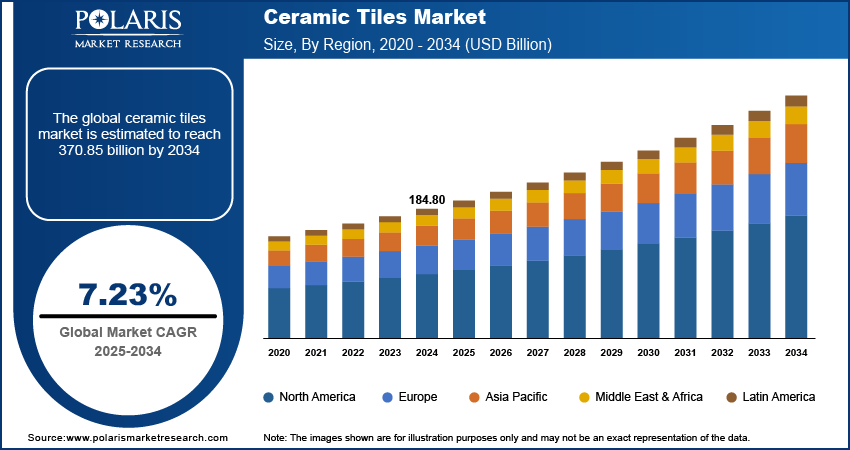

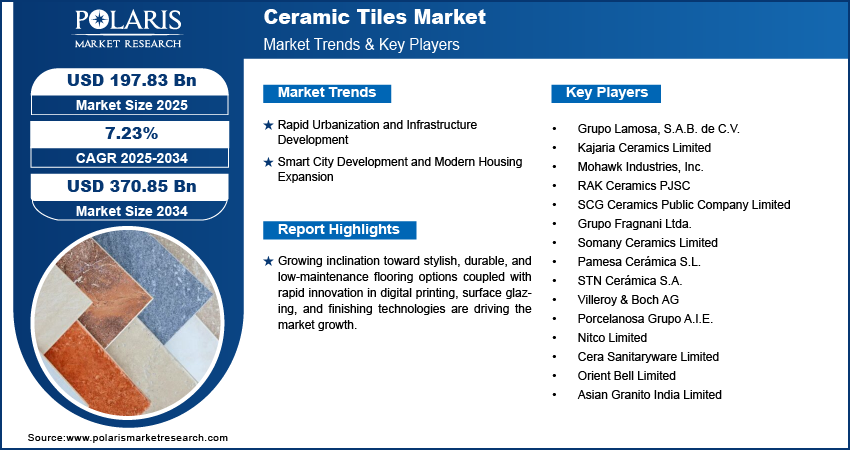

The global ceramic tiles market size was valued at USD 184.80 billion in 2024, growing at a CAGR of 7.23% from 2025 to 2034. Rapid urbanization and infrastructure development along with smart city development and modern housing expansion is propelling the market growth.

Key Insights

- Porcelain tiles dominated the market in 2024 due to their resilience, water resistance, and adaptability in both indoor and outdoor uses.

- Replacement and renovation segment contributed significantly, driven by increasing consumer demand for fashionable, low-maintenance, and energy-saving flooring throughout home renovation works.

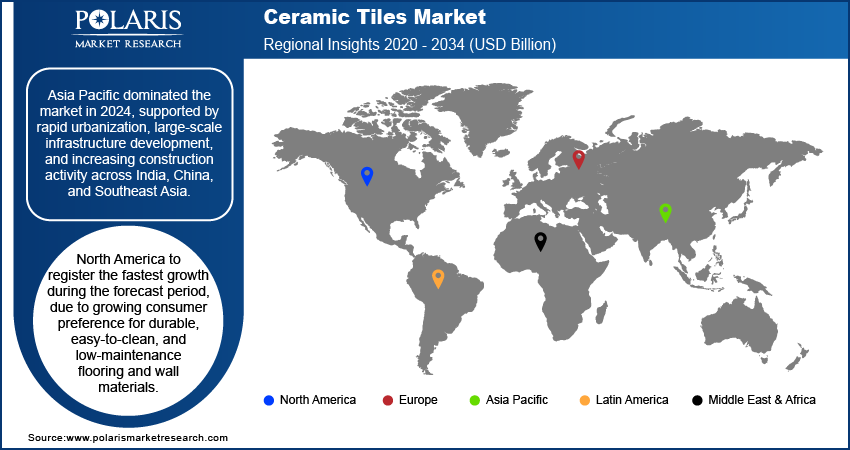

- Asia Pacific dominated the global market in 2024, driven by accelerating urbanization, massive infrastructure construction, and increasing construction activity in India, China, and Southeast Asia.

- India dominated the market in Asia Pacific, led by government-supported housing and urban development that encouraged modern and affordable housing.

- North America estimated to grow rapidly, driven by increasing demand for durable, easy-to-clean, and low-maintenance products in residential and commercial areas.

- The U.S. led the North American market, due to increasing renovation and remodeling activity in homes, offices, and commercial spaces with a focus on design aspects and sustainability.

- Key players operating in the market include Grupo Lamosa, S.A.B. de C.V., Kajaria Ceramics Limited, Mohawk Industries, Inc., RAK Ceramics PJSC, SCG Ceramics Public Company Limited, Grupo Fragnani Ltda., Somany Ceramics Limited, Pamesa Cerámica S.L., STN Cerámica S.A., Villeroy & Boch AG, Porcelanosa Grupo A.I.E., Nitco Limited, Cera Sanitaryware Limited, Orient Bell Limited, and Asian Granito India Limited.

Industry Dynamics

- Rapid urbanization and massive infrastructure development are boosting the use of ceramic tiles in residential, commercial, and industrial construction.

- Development of smart cities and new housing expansion are increasing the use of high-tech tiles with aesthetic appeal and functional resistance.

- Low energy usage and production rates are restraining the market growth as production requires high fuel consumption and increasing operating costs.

- Growth in 3D and inkjet printing technologies offers high opportunities by facilitating personalized designs, rich textures, and high-definition finishes that benefit from changing architectural trends.

Market Statistics

- 2024 Market Size: USD 184.80 Billion

- 2034 Projected Market Size: USD 370.85 Billion

- CAGR (2025–2034): 7.23%

- Asia Pacific: Largest Market Share

The ceramic tiles market comprises robust and visual surfacing products aimed at flooring, wall cladding, and decorative use in residential, commercial, and industrial areas. Ceramic tiles are extensively employed due to their durability, low maintenance, and resistance to stains and moisture. Innovation in digital printing, glazing, and environmentally friendly manufacturing techniques is promoting design versatility, quality, and sustainability.

The increasing trend towards fashionable, long-lasting, and low-maintenance flooring materials is propelling the demand for ceramic tiles. Consumers are more inclined to use tiles that are economical and aesthetically pleasing, ensuring them popularity as a top choice for contemporary residential and commercial construction.

Rising innovation in digital print technology, surface glazing, and finishing technologies is allowing manufacturers to create highly personalized tiles with varied textures, colors, and designs. In April 2024, i4F collaborated with Akgün Group-Duratiles to launch new generation click-together ceramic tiles, boasting a floating floor installation system with ultra-thin grout lines and drop-lock mechanisms for quicker installation, simple removal, and lower labor costs. These innovations are transforming the ceramic tile industry, providing more flexibility and design accuracy for homeowners and architects.

Drivers & Opportunities

Rapid Urbanization and Infrastructure Development: Rapid urbanization, particularly in emerging economies, is fueling the demand for contemporary residential and commercial floor coverings. According to the United Nations, urbanization is expected to add nearly 2.5 billion people to global urban areas by 2050. This population shift is broadening construction activity and spurring consistent expansion in the ceramic tiles market.

Smart City Development and Modern Housing Expansion: The increasing development of smart cities and technologically integrated residential projects is also driving large-scale use of ceramic tiles. According to the Organization for Economic Co-operation and Development (OECD), the worldwide Internet of Things (IoT) market in smart cities will expand from USD 300 billion in 2021 to more than USD 650 billion by 2026. Therefore, rising demand for urban infrastructure continues to boost the need for premium materials such as ceramic tiles in new urban planning.

Segmental Insights

By Product Type

The ceramic tiles market, based on product type, is divided into porcelain tiles, glazed ceramic tiles, unglazed ceramic tiles, mosaic tiles, and others. Porcelain tiles led the market share in 2024 due to their strength, resistance to water, and applications indoors and outdoors. Porcelain tiles are used extensively for commercial establishments with heavy foot traffic and new residential developments.

Glazed ceramic tiles are forecast to record rapid growth over the forecasting period, driven by developments in digital printing and surface glazing technologies improving design flexibility and visual attractiveness.

By Construction Type

Based on construction type, the market is segmented into new construction and renovation & replacement. In 2024, the new construction segment held the largest share, driven by swift urbanization, expansion of infrastructure, and residential development in emerging economies.

The renovation and replacement segment expected to grow rapidly during the forecast period as a result of customer preference for stylish, low-maintenance, and energy-efficient flooring solutions while remodeling and refurbishing homes.

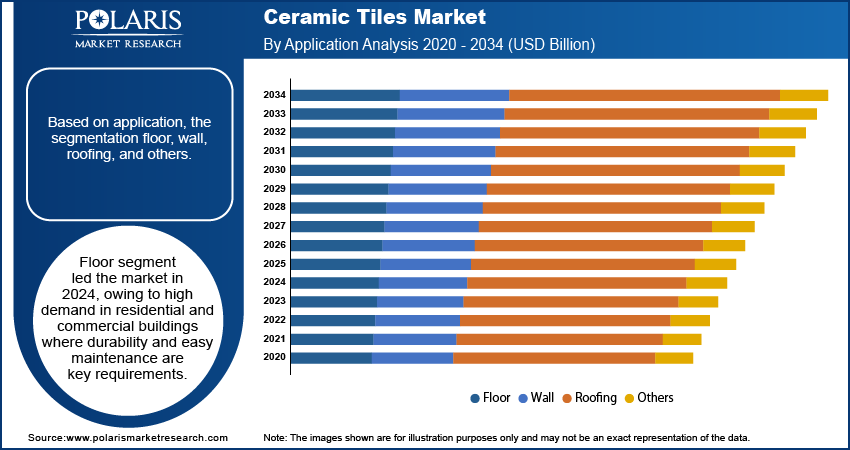

By Application

Based on application, the ceramic tiles market is categorized into floor, wall, roofing, and others. The floor segment held the leading market share in 2024 due to increasing demand in residential and commercial properties due to durability and low maintenance being major requirements.

Wall tiles are anticipated to grow at a fast pace, due to rising adoption across bathrooms, kitchens, and decorative facades.

By End-User

By end-user, the market is segmented into residential, commercial, and industrial. The residential market dominated the market in 2024, boosted by increasing homeownership, trends in interior design, and increased disposable income.

The commercial segment is anticipated to witness robust growth throughout the forecast period, driven by the growing construction of offices, retail stores, and hospitality complexes where durability and aesthetics are paramount.

By Distribution Channel

Based on distribution channel, the market is segmented into independent retailers, large home centers, online retail, and direct sales to contractors. Independent retailers led the market in 2024, driven by a broad range of products and customized services to local clientele.

Large home centers expected to show rapid growth due to extensive networks of distribution and promotion campaigns that appeal to homeowners and professional consumers.

Regional Analysis

Asia Pacific held the dominating share in ceramic tiles market, driven by accelerating urbanization, massive infrastructure development, and building activity growth across China, India, and Southeast Asia. Growing middle-class populations and rising disposable incomes further are driving demand for stylish but affordable interior design in homes, fueling strong tile consumption in residential and commercial segments.

India Ceramic Tiles Market Overview

India led the market in Asia Pacific, fueled by government-supported housing and urban development initiatives. In India's Union Budget 2024–25, the Smart Cities Mission was allocated USD 19.67 billion. 7,502 projects (93%) out of a total of 8,062 were completed by March 2025. Such programs, combined with the government's emphasis on affordable housing, are fueling the adoption of ceramic tiles throughout the nation's growing urban areas.

North America Ceramic Tiles Market Insights

North America is expected to expand at a high rate over the forecast period, driven by increasing customer demand for tough, easy-to-maintain, and low-maintenance floor and wall materials, fueling consistent demand for ceramic tiles in residential, commercial, and institutional segments. Developments in digital print technologies and the availability of large-format tiles are improving design flexibility and aesthetics, facilitating architectural and interior design creativity.

The U.S. Ceramic Tiles Market Analysis

The U.S. is leading the market in North America, owing to the rising renovation and remodeling activity throughout residential and commercial buildings. As per the 2023 U.S. Houzz & Home Study conducted by the American Institute of Architects (AIA), the median home renovation expenditure in 2022 increased 22% year over year, reflecting the augmented investment in home renovation projects.

Europe Ceramic Tiles Market Assessment

Europe held significant market share fueled by sustainability objectives and adherence to EU green building codes, which promote the utilization of environmentally friendly and energy-efficient tiles. The continent also exhibits increasing demand for high-end, designer, and bespoke tiles in upscale residential and commercial applications. Ongoing product development with emphasis on sustainable production methodology, is supporting European tile manufacturers sustain their competitive advantage in the international market.

Key Players & Competitive Analysis

The global ceramic tiles industry is characterized by high competition and ongoing innovation in technology, design, and manufacturing efficiency. Top players are focusing on sophisticated digital printing, automated glazing, and eco-friendly manufacturing processes to increase aesthetic flexibility and lower environmental footprints. The industry is observing a growing trend towards large-format tiles, anti-slip surfaces, and long-lasting, easy-to-maintain surfaces for residential and commercial use.

Major players in the world Ceramic Tiles market include Grupo Lamosa, S.A.B. de C.V., Kajaria Ceramics Limited, Mohawk Industries, Inc., RAK Ceramics PJSC, SCG Ceramics Public Company Limited, Grupo Fragnani Ltda., Somany Ceramics Limited, Pamesa Cerámica S.L., STN Cerámica S.A., Villeroy & Boch AG, Porcelanosa Grupo A.I.E., Nitco Limited, Cera Sanitaryware Limited, Orient Bell Limited, and Asian Granito India Limited.

Key Players

- Grupo Lamosa, S.A.B. de C.V.

- Kajaria Ceramics Limited

- Mohawk Industries, Inc.

- RAK Ceramics PJSC

- SCG Ceramics Public Company Limited

- Grupo Fragnani Ltda.

- Somany Ceramics Limited

- Pamesa Cerámica S.L.

- STN Cerámica S.A.

- Villeroy & Boch AG

- Porcelanosa Grupo A.I.E.

- Nitco Limited

- Cera Sanitaryware Limited

- Orient Bell Limited

- Asian Granito India Limited

Ceramic Tiles Industry Developments

In June 2024, Transom Capital–backed Galleher combined with Virginia Tile, uniting their operations to form a national distributor of flooring, tile and surface products. Virginia Tile, which specialized in ceramic, porcelain and decorative surfaces across 19 showrooms in 12 U.S. states, joined forces with Galleher’s broader flooring and accessory network to expand geographic reach and product depth.

In June 2024, One Equity Partners acquired a significant minority stake in Gruppo Siti B&T, the Italian firm that builds turnkey plants, machinery, and consumables for the ceramic, quartz, and tile industries. Siti supplies over 2,500 manufacturers worldwide, offering full plant design, equipment, aftermarket services, and upgrades tailored to ceramic tile, quartz surface, and stone production.

Ceramic Tiles Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Porcelain Tiles

- Glazed Ceramic Tiles

- Unglazed Ceramic Tiles

- Mosaic Tiles

- Others

By Construction Type Outlook (Revenue, USD Billion, 2020–2034)

- New Construction

- Renovation and Replacement

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Floor

- Wall

- Roofing

- Others

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Independent Retailers

- Large Home Centers

- Online Retail

- Direct Sales to Contractors

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ceramic Tiles Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 184.80 Billion |

|

Market Size in 2025 |

USD 197.83 Billion |

|

Revenue Forecast by 2034 |

USD 370.85 Billion |

|

CAGR |

7.23% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 184.80 billion in 2024 and is projected to grow to USD 370.85 billion by 2034.

The global market is projected to register a CAGR of 7.23% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Grupo Lamosa, S.A.B. de C.V., Kajaria Ceramics Limited, Mohawk Industries, Inc., RAK Ceramics PJSC, SCG Ceramics Public Company Limited, Grupo Fragnani Ltda., Somany Ceramics Limited, Pamesa Cerámica S.L., STN Cerámica S.A., Villeroy & Boch AG, Porcelanosa Grupo A.I.E., Nitco Limited, Cera Sanitaryware Limited, Orient Bell Limited, and Asian Granito India Limited.

The porcelain tiles segment dominated the market revenue share in 2024.

The renovation and replacement segment is projected to witness the fastest growth during the forecast period.