Enhanced Due Diligence Market Size, Share, Trends, & Industry Analysis Report

By Vertical (BFSI, Government & Public Sector), and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 123

- Format: PDF

- Report ID: PM6491

- Base Year: 2024

- Historical Data: 2020-2023

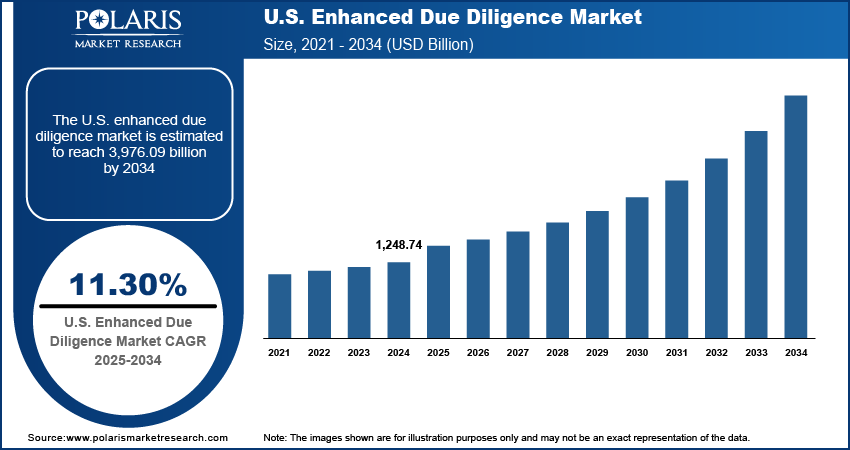

What is the enhanced due diligence market size?

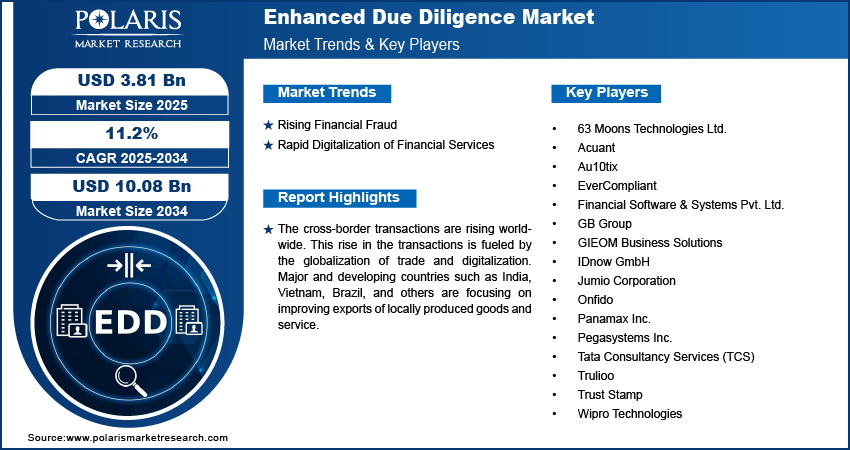

The global enhanced due diligence market size was valued at USD 3.20 billion in 2024, growing at a CAGR of 11.2% from 2025–2034. Key factors driving demand is growth of financial frauds, and rapid digitalization of financial service.

Key Insights

- BFSI segment is expected to register a CAGR of 10.9% over the forecast period driven by increased in financial frauds and government regulations.

- IT and telecommunication segment is expected to witness a substantial share over the forecast period driven by government regulations on data privacy and cybersecurity

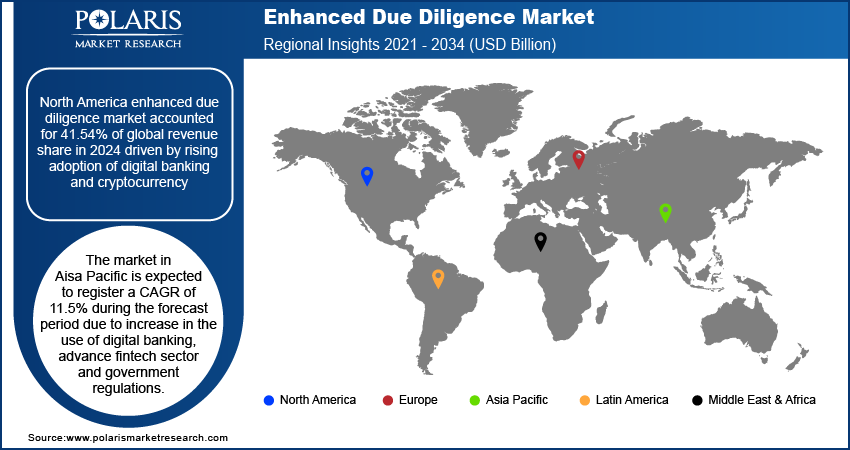

- North America enhanced due diligence market accounted for 41.54% of global revenue share in 2024 driven by increased in digital banking and strict government laws.

- The industry in Asia Pacific is expected to register a CAGR of 11.5% during the forecast period driven by rising cross border transactions.

Industry Dynamics

- Growth in number of financial frauds are driving the demand for EDD tools.

- Rapid digitalization of financial service is driving the enhanced due diligence market

- Rising cross border transactions is fueling the growth of the industry.

- High implementation costs and complex regulatory compliance requirements is limiting the growth.

Market Statistics

- 2024 Market Size: USD 3.20 Billion

- 2034 Projected Market Size: USD 10.08 Billion

- CAGR (2025-2034): 11.2%

- North America: Largest Market Share

AI Impact on the Industry

- Analyzes large volumes of customer data to generate accurate and real-time risk scores which reduce manual efforts.

- Improve fraud detection by using machine learning model.

- Enable real time monitoriung, surveillance of customer and transactional behavior.

The enhanced due diligence had emerged as a crucial segment within the broader E-KYC ecosystem. It played a pivotal role in enabling financial institutions, fintech companies, and other regulated entities to comply with stringent anti-money laundering and counter-terrorism financing regulations. EDD went beyond standard customer verification processes, focusing on high-risk clients, politically exposed persons, complex ownership structures, and jurisdictions with weak AML controls. By offering deeper risk profiling, beneficial ownership tracing, and ongoing transaction monitoring, EDD became an indispensable compliance function across global financial systems.

Over the past few years, the market had witnessed strong growth momentum, driven primarily by increasing regulatory scrutiny, rising instances of financial crime, and the proliferation of digital financial services. Global regulators, including the Financial Action Task Force (FATF), the European Union, and national authorities in major economies, had tightened compliance frameworks, compelling institutions to adopt advanced due diligence solutions.

The cross-border transactions are rising worldwide. This rise in the transactions is fueled by the globalization of trade and digitalization. Major and developing countries such as India, Vietnam, Brazil, and others are focusing on improving exports of locally produced goods and services. This has increased the number of international transactions. As a result, the demand these businesses and financial operations expose firms to diverse risks, due to which the demand for enhanced checks on international partners and customers is rising. Enhanced due diligence verifies identity across jurisdictions, assesses jurisdictional risk, and investigates complex ownership structures. Consequently, driving the demand and thereby driving the industry growth.

Drivers & Opportunities

What are the Factors Driving the Enhanced Due Diligence Market?

Rising Financial Fraud: The incidence of financial fraud and money laundering is rising. These financial crimes include cyber-enabled fraud, identity theft, trade-based money laundering, and terrorist financing. Traditional customer due diligence frameworks have proven insufficient to address these threats, which has prompted a shift toward more advance due diligence practices that could identify hidden risks. As a result, banks, fintechs, and payment providers are investing in advance EDD tools that continuously assess behavioral changes and verify the authenticity of customers and corporate entities. These tools analyzed transaction histories, device fingerprints, and geolocation data to detect suspicious activity patterns before fraudulent transactions could occur, which drives the demand for the EDD globally, thereby fueling the industry growth.

Rapid Digitalization of Financial Services: The digitalization of the financial services is rising worldwide. Financial institutions are shifting to online banking, mobile payments, and crypto platforms. This has increased the exposure to fraud, money laundering, and regulatory scrutiny. As a result, there is a growing demand for automated EDD solutions which is capable of real-time identity verification, risk scoring, and transaction monitoring. Moreover, fintech and neobanks are expanding and have high customer acquisition and borderless operations which has further fueled the need for the tool that verify details, due to which institutions are deploying advance EDD tools that integrate biometric verification, big data analytics, and blockchain-based identity systems, thereby driving the growth.

Enhanced Due Diligence Market – Vertical Trends

|

Vertical |

Trends |

Description |

|

Banking, Financial Services, and Insurance (BFSI) |

Deepening Integration of AI-Driven EDD |

A key trend in this vertical is the integration of artificial intelligence and machine learning into due diligence workflows, enabling continuous monitoring of high-risk entities, sanction screening, and beneficial ownership tracing.

|

|

Government and Public Sector |

Emphasis on Transparency and Beneficial Ownership |

Governments worldwide are strengthening public procurement integrity and anti-corruption frameworks, making EDD a central component of compliance. A major trend is the establishment of central beneficial ownership registries and third-party screening systems for public contracts |

|

IT and Telecommunications |

Expanding Role in Digital Identity and Partner Risk |

The trend here centers on third-party and vendor due diligence, as companies increasingly manage complex global supply chains. |

|

Healthcare and Life Sciences |

Rising Focus on Vendor Vetting and Fraud Mitigation |

A key trend is the extension of EDD processes to pharmaceutical supply chains, especially for ensuring ethical sourcing of raw materials and preventing counterfeit drugs |

|

Energy and Utilities |

EDD as a Pillar of ESG and Sanction Compliance |

In the energy and utilities vertical, EDD is increasingly intertwined with environmental, social, and governance (ESG) compliance. Companies now perform deeper due diligence on contractors, suppliers, and joint venture partners to ensure ethical conduct and sustainability alignment |

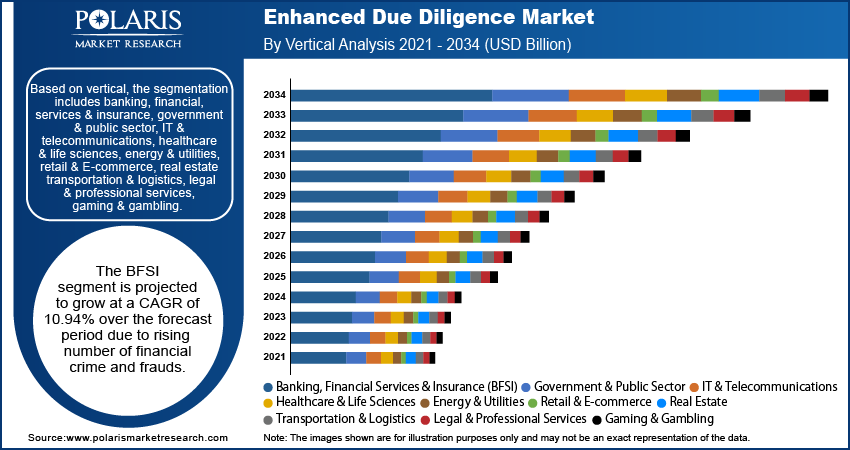

Segmental Insights

Which Segment by Vertical is Projected to Grow at Significant Growth Rate?

Based on vertical, the segmentation includes banking, financial, services & insurance, government & public sector, IT & telecommunications, healthcare & life sciences, energy & utilities, retail & E-commerce, real estate, transportation & logistics, legal & professional services, gaming & gambling. The BFSI segment is projected to grow at a CAGR of 10.9% over the forecast period due to rising number of financial crime and frauds. The BFSI sector is facing increase in number of threats of fraud, money laundering, terrorist financing, and cybercrime. This has fueled the demand for the enhanced due diligence tools to detect and mitigate risks associated with politically exposed persons, shell companies, and suspicious cross-border transactions. Moreover, government globally are implementing stringent regulations on the sector to prevent threat, which is further driving the demand for the EDD tools in the segment.

Why IT & Telecommunication Segment is Expected to Witness Significant Growth?

IT & telecommunication segment is expected to witness a significant share over the forecast period due government regulations on data privacy and cybersecurity. Laws such as GDPR, CCPA, and cross-border data transfer rules are driving the demand for the advance due diligence tools to prevent data misuse and breaches. Moreover, IT and telecom companies work with large number of global supply chains and outsourced services. EDD helps identify reputational, compliance, and operational risks associated with vendors in high-risk or sanctioned regions, thereby driving the segment growth.

Regional Analysis

How North America Captured Largest Market Share?

North America enhanced due diligence market accounted for 41.54% of global revenue share in 2024 driven by rising adoption of digital banking platforms and cryptocurrency. This increase in the adoption has increased the complexity of transactions and customer profiles, due to which the demand for the EDD tools is rising in the region. Moreover, the region has one of the most tough regulations such as Bank Secrecy Act (BSA), the Patriot Act, and the Anti-Money Laundering Act of 2020 which require financial institutions to conduct in-depth checks on high-risk customers, which is further driving the demand for the enhanced due diligence in the region, thereby driving the growth in the region.

What are the Reasons for Asia Pacific’s Significant Growth Rate?

The market in Aisa Pacific is expected to register a CAGR of 11.5% during the forecast period due to increase in the use of digital banking, advance fintech sector and government regulations. Major countries in the region such as India, China, and Japan are adopting digital banking for transactions which is driving the demand for the EDD tools. Moreover, rising export of trade and services in the region is fueling the number of international transactions, which is further driving the need for tools to verify client base, further driving the demand for the enhanced due diligence tools, thereby driving the region growth.

Key Players & Competitive Analysis

Some of the major players operating in the global market for e-KYC include 63 Moons Technologies Ltd., Acuant, Au10tix, EverCompliant, Financial Software & Systems Pvt. Ltd., GB Group, GIEOM Business Solutions, IDnow GmbH, Jumio Corporation, Onfido, Panamax Inc., Pegasystems Inc., Tata Consultancy Services (TCS), Trulioo, Trust Stamp, Wipro Technologies among others. The market is characterized by intense competition with the presence of a few major global players holding a significant market share. Key players emphasize new product developments and alliances as options for higher profitability through improved client interactions.

Key Players

- 63 Moons Technologies Ltd.

- Acuant

- Au10tix

- EverCompliant

- Financial Software & Systems Pvt. Ltd.

- GB Group

- GIEOM Business Solutions

- IDnow GmbH

- Jumio Corporation

- Onfido

- Panamax Inc.

- Pegasystems Inc.

- Tata Consultancy Services (TCS)

- Trulioo

- Trust Stamp

- Wipro Technologies

Industry Developments

October 2025, Crowe LLP and SecurityScorecard announced a collaboration that combined Crowe’s cyber and third-party risk expertise with SecurityScorecard’s intelligence platform to help organizations reduce risk faster, improve compliance, and strengthen resilience across their third-party ecosystems

September 2025, DeepDive launched its AI-powered platform to enhance Enhanced Due Diligence (EDD) and accelerate financial crime investigations, enabling compliance teams to access multilingual, global data sources and generate deeper intelligence with greater speed and accuracy using generative AI.

July 2025, WorkFusion launched its AI agent, Edward, to automate enhanced due diligence for financial institutions. Edward streamlined data collection from KYC and monitoring systems, generating structured reports that enabled compliance teams to assess high-risk customers more efficiently and accurately

Enhanced Due Diligence Market Segmentation

By Vertical Outlook (Revenue, USD Billion, 2021–2034)

- Banking, Financial Services & Insurance (BFSI)

- Government & Public Sector

- IT & Telecommunications

- Healthcare & Life Sciences

- Energy & Utilities

- Retail & E-commerce

- Real Estate

- Transportation & Logistics

- Legal & Professional Services

- Gaming & Gambling

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Enhanced Due Diligence Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.20 Billion |

|

Market Size in 2025 |

USD 3.81 Billion |

|

Revenue Forecast by 2034 |

USD 10.08 Billion |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.20 billion in 2024 and is projected to grow to USD 10.08 billion by 2034.

The global market is projected to register a CAGR of 11.2% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are 63 Moons Technologies Ltd.; Acuant; Au10tix; EverCompliant; Financial Software & Systems Pvt. Ltd.; GB Group; GIEOM Business Solutions; IDnow GmbH; Jumio Corporation; Onfido; Panamax Inc.; Pegasystems Inc.; Tata Consultancy Services (TCS); Trulioo; Trust Stamp; Wipro Technologies.

The BFSI segment dominated the market revenue share in 2024.

The IT & telecommunication segment is projected to witness the fastest growth during the forecast period.