Key Insights

FinTech Market Size, Share, Trends, Industry Analysis Report

: By Technology, Application, End Use (Banks, Financial Institutions, Insurance Companies, Others), and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM5658

- Base Year: 2024

- Historical Data: 2020-2023

FinTech Market Overview

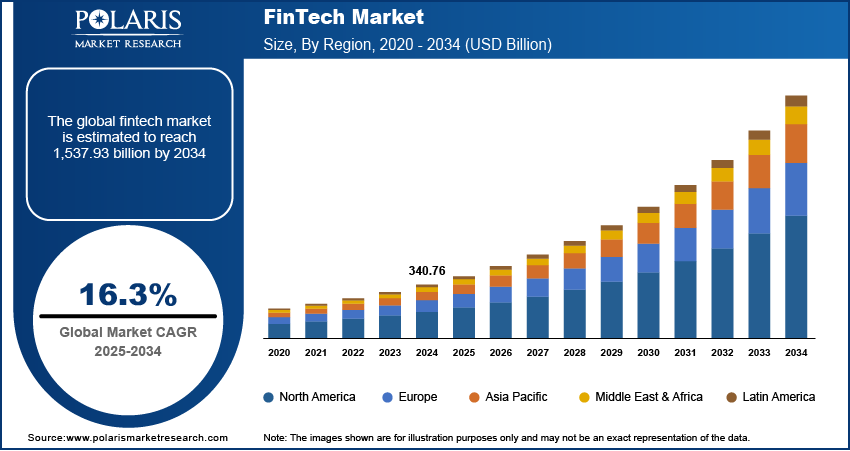

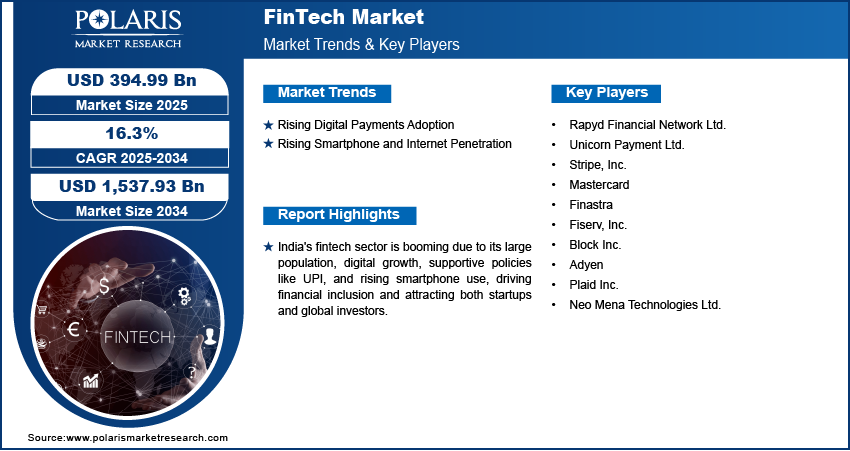

FinTech market size was valued at USD 340.76 billion in 2024. The fintech industry is projected to grow from USD 394.99 billion in 2025 to USD 1,537.93 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 16.3% during the forecast period. The FinTech market is driven by rapid digitalization, smartphone penetration, demand for seamless financial services, blockchain adoption, AI integration, regulatory support, financial inclusion goals, and growing investments.

- The AI segment is projected to witness the fastest growth during the forecast period, driven by its expanding use in enhancing customer service via chatbots, real-time fraud detection, and delivering personalized financial recommendations based on user behavior analytics.

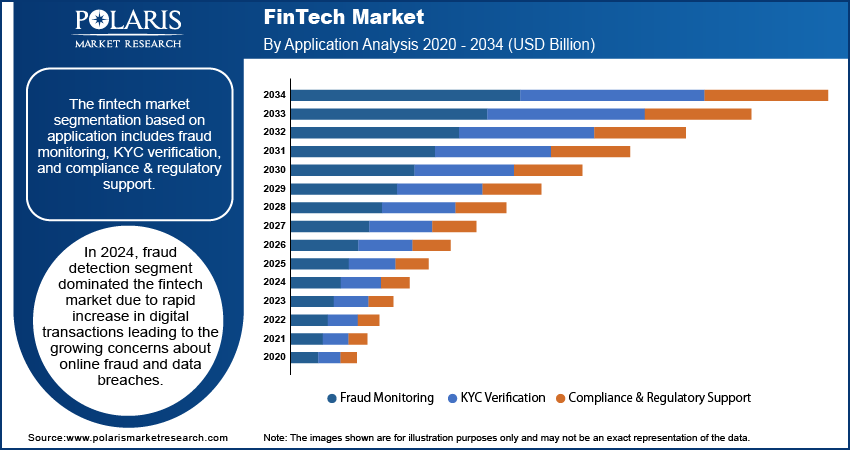

- The fraud monitoring segment led the market in 2024, fueled by the surge in digital transactions, rising cybersecurity threats, and the growing need for robust real-time risk detection and prevention systems across financial institutions and e-commerce platforms.

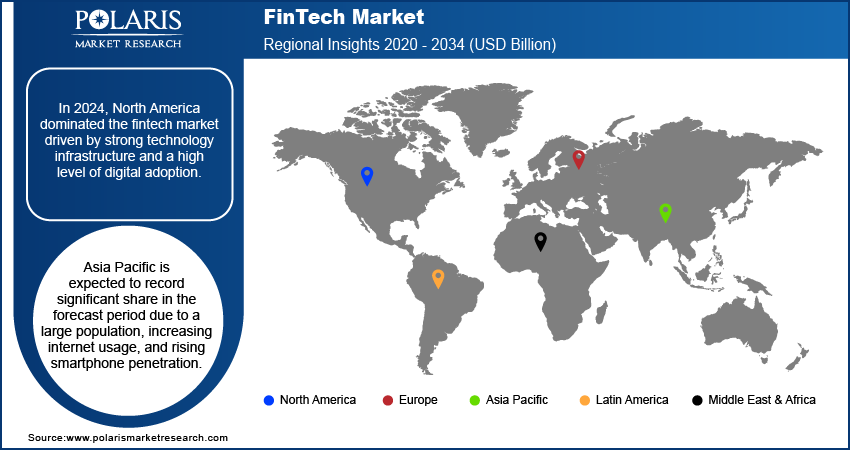

- North America dominated the market in 2024, supported by a well-established technological ecosystem, high consumer trust in digital platforms, widespread use of contactless payments, and proactive investments in fintech innovation and cybersecurity.

- Asia Pacific is expected to hold a significant market share during the forecast period, driven by rapid urbanization, growing internet penetration, a booming e-commerce sector, and rising adoption of smartphones across emerging economies.

- India is experiencing notable growth in the digital payments space, driven by its vast population, expanding fintech landscape, and government initiatives such as Digital India, UPI, and Aadhaar-linked services that promote financial inclusion and cashless transactions.

Industry Dynamics

- Growing demand for convenient, fast, and secure financial services is driving fintech market growth, as consumers and businesses seek innovative solutions that simplify payments, lending, and wealth management beyond traditional banking.

- Expanding adoption of digital wallets, peer-to-peer lending, and robo-advisory services is unlocking new opportunities, supported by rising smartphone penetration, increasing internet access, and evolving consumer preferences toward cashless and automated financial transactions.

- Regulatory complexities, cybersecurity risks, and limited financial literacy hinder wider fintech adoption, particularly in emerging markets with underdeveloped digital infrastructure and fragmented financial ecosystems.

- Advances in blockchain, AI, and mobile technologies are transforming the fintech landscape, enabling enhanced security, personalized financial products, and seamless user experiences tailored to a digitally savvy and globally connected customer base.

Market Statistics

- 2024 Market Size: USD 340.76 billion

- 2034 Projected Market Size: USD 1,537.93 billion

- CAGR (2025-2034): 16.53%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Fintech, short for financial technology, refers to the use of technology to improve and automate financial services and processes. It includes everything from mobile banking apps and digital wallets to blockchain technology, robo-advisors, and online lending platforms.

Governments and regulators around the world are supporting fintech growth by creating friendly rules and encouraging innovation. Open banking is one example where banks are required to share customer data with permission to third-party fintech companies through secure APIs. This allows new financial services to be built on top of existing bank infrastructure. Consequently, customers get more choices and better experiences. Supportive regulation also helps create a level playing field, encouraging startups to enter the market and compete with established banks. This collaboration between fintech, banks, and regulators is helping the industry grow in a safe and balanced way, thereby driving the growth of the market revenue.

Consumers today expect speed, convenience, and personalization in all aspects of their lives, including how they manage money. Younger generations, in particular, prefer using apps for banking, investing, and sending money rather than visiting physical branches. They also want services that are available anytime and tailored to their needs. This shift in behavior is pushing banks and financial companies to innovate and improve their digital offerings. Fintech firms, often more agile than traditional banks, are meeting these expectations with easy-to-use apps, better customer experiences, and faster service, thereby driving the growth of market demand.

Market Dynamics

Rising Digital Payments Adoption

People today want faster, safer, and more convenient ways to pay for goods and services. This shift from cash to digital payments is one of the factors fintech is growing rapidly. According to the National Payments Corporation of India, in January 2025, USD 951.91 million worth of transactions were made in India through Google Pay. Mobile wallets, QR code payments, contactless cards, and online transfers are becoming the norm. Businesses also prefer digital transactions because they are easier to track and reduce the risk of theft. Additionally, fintech companies are stepping up with user-friendly payment solutions that meet the needs of both individuals and businesses, thereby driving the market growth,

Rising Smartphone and Internet Penetration

More people around the world now have access to smartphones and the internet, making it easier to use digital financial services. According to the World Bank, in 2023, 65% of the world's population had access to the internet. In many regions, users prefer handling banking, shopping, and even investing through their phones. This expanding connectivity helps fintech companies reach millions of users quickly and affordably. It also allows individuals in remote or rural areas to access financial tools that were once limited to urban centers. The growing number of connected devices continues to open up new opportunities, thereby driving the growth of the market opportunity.

Segment Analysis

By Technology Outlook

The segmentation based on technology includes AI, blockchain, RPA, and others. The AI is expected to witness fastest growth in the forecast period as AI is being used to improve customer service through bots service, detect fraud in real time, and offer personalized financial advice based on user behavior. AI for customer service helps companies make smarter decisions by analyzing large amounts of data quickly and accurately. The demand for AI in fintech is rising as more businesses look for ways to automate and improve their services, thereby driving the segmental growth in the global market report.

By Application Outlook

The segmentation based on platform, includes fraud monitoring, KYC verification, and compliance & regulatory support. The fraud monitoring segment dominated in 2024 due to rapid increase in digital transactions leading to the growing concerns about online fraud and data breaches. Businesses and financial institutions place a strong emphasis on protecting user information and ensuring secure financial activities. Fraud monitoring tools, powered by technologies like AI and machine learning, helped detect suspicious behavior in real time, reducing losses and strengthening customer confidence, thereby driving the segmental growth in market statistics.

Regional Analysis

By region, the study provide insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated driven by strong technology infrastructure and a high level of digital adoption. According to the Federal Reserve, in the US, the use of digital wallets grew by 31% year over year, reaching 62% adoption in 2023. The United States, in particular, is home to many of the world’s top fintech companies and startups. Consumers in the region are quick to adopt digital banking, mobile payments, and investment platforms. Financial institutions are also heavily investing in technologies like AI, blockchain, and open banking. Supportive regulations and venture capital funding further encourage innovation, thereby driving the market expansion in North America.

Asia Pacific is expected to record significant share in the forecast period, due to a large population, increasing internet usage, and rising smartphone penetration. Countries like China, Singapore, and Australia are leading the way in digital payments, mobile wallets, and peer-to-peer lending. Many consumers in the region are turning from traditional banks altogether to fintech solutions for faster, easier access to financial services. The region also benefits from supportive government policies and strong interest from investors. This combination of factors is driving the market growth in Asia Pacific.

India is experiencing substantial growth due to its large population, growing digital infrastructure, and government-led initiatives like Digital India and UPI (Unified Payments Interface). Millions of people are now using mobile apps for payments, savings, insurance, and lending. Fintech is helping bridge the gap between urban and rural areas by offering affordable and easy-to-use financial services. The push for financial inclusion and the increasing use of smartphones is creating a strong foundation for fintech growth across the country, thereby driving the growth of the market demand in India.

FinTech Market Key Players & Competitive Analysis Report

The market statistics are undergoing significant transformation, driven by a diverse array of players who are consistently innovating to secure competitive advantages. Dominant global enterprises are at the forefront, leveraging substantial investments in research and development to improve operational efficiencies and expand market penetration. These organizations engage in strategic initiatives, including mergers and acquisitions, partnerships, and joint ventures, with the objective of diversifying their product lines and entering new market territories.

Emerging startups are exerting a considerable influence on the sector by introducing disruptive technologies designed to address the nuanced needs of specific niche markets. Analyzing the current market insight reveals that the competitive dynamics are further heightened by continuous advancements in product offerings, which drive differentiation and enhance responsiveness to evolving consumer preferences. Major players includes, Rapyd Financial Network Ltd.; Unicorn Payment Ltd.; Stripe, Inc.; Mastercard; Finastra; Fiserv, Inc.; Block Inc.; Adyen; Plaid Inc.; and Neo Mena Technologies Ltd.

Mastercard Inc. offers a range of financial services with headquarters in New York, U.S., since 1956. Its main business is processing payments between the banks of retailers and the banks or credit unions that issue the debit, credit, or prepaid cards that are used to make purchases around the world under the Mastercard name. Mastercard became a public company in 2006. In response to Bank of America named BankAmerica, which ultimately evolved into Visa, a group of banks and regional bankcard organizations founded Mastercard. Mastercard Worldwide was a cooperative owned by more than 25,000 financial institutions prior to its initial public offering. Moreover, Mastercard partners with member financial institutions all over the world to offer Mastercard-branded network payment cards. With operations in the Americas, Africa, the Middle East, Europe, and Asia-Pacific, Mastercard provides services to corporations, individuals, digital partners, financial institutions, merchants, governments, and other organizations. Mastercard Data & Services partners with fintech globally, offering end-to-end support, advanced analytics, and SaaS solutions to accelerate payment innovation, customer acquisition, and scalable business growth

Stripe, Inc. is a financial technology company founded in 2010. It is headquartered in South San Francisco, California, and Dublin, Ireland. The company provides payment processing software and application programming interfaces (APIs) that enable businesses to accept payments online and in person. Stripe serves a wide range of customers, including startups, small and medium-sized businesses, and large enterprises. As of 2024, Stripe processes over USD 1.4 trillion in payments annually. Stripe’s main product is its payment processing platform, which supports credit and debit cards, digital wallets, and other payment methods. The company offers several other products to address different business needs. Stripe Connect allows marketplaces and platforms to manage payments between multiple parties. Stripe Billing provides tools for subscription management and invoicing. Stripe Terminal supports physical point-of-sale transactions. Stripe Atlas helps entrepreneurs incorporate companies in the United States and access banking services. Additionally, Stripe Capital offers financing options for businesses, while Stripe Issuing enables the creation and management of physical and virtual cards. Stripe Tax automates tax calculation and collection, and Stripe Identity provides identity verification services. The company also offers tools like Stripe Climate and Frontier to facilitate contributions toward carbon removal projects. Stripe operates in 46 countries, with offices in cities such as San Francisco, Dublin, London, Paris, Singapore, Tokyo, Melbourne, and Bengaluru. Its payment infrastructure allows businesses to accept payments from customers in over 185 countries.

Key Companies in the FinTech Market include:

- Adyen

- Block Inc.

- Finastra

- Fiserv, Inc.

- Mastercard

- Neo Mena Technologies Ltd.

- Plaid Inc.

- Rapyd Financial Network Ltd.

- Stripe, Inc.

- Unicorn Payment Ltd.

FinTech Market Development

In September 2024, MercadoLibre secured $250M in financing from JPMorgan to expand its fintech arm Mercado Pago's credit services in Mexico. The deal supports SMBs and strengthens the company's Mexican operations, allowing it to finance more businesses and individuals.

In June 2024, The Texas Stock Exchange (TXSE) was announced by TXSE Group following a USD 120 million capital raise, backed by major investors, to challenge New York-centric exchanges and expand equity market access.

In May 2024, French fintech Lydia was restructured with its services split into two apps, and a new digital banking brand, Sumeria, was launched with USD 113.171 million investment and 400 hires planned.

FinTech Market Segmentation:

By Technology Outlook (Revenue USD Billion, 2020–2034)

- AI

- Blockchain

- RPA

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Fraud Monitoring

- KYC Verification

- Compliance & Regulatory Support

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Banks

- Financial Institutions

- Insurance Companies

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

FinTech Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 340.76 billion |

|

Market size value in 2025 |

USD 394.99 billion |

|

Revenue Forecast in 2034 |

USD 1,537.93 billion |

|

CAGR |

16.3% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The fintech market size was valued at USD 340.76 billion in 2024 and is projected to grow to USD 1,537.93 billion by 2034.

The global market is projected to grow at a CAGR of 16.3% during the forecast period, 2025-2034.

Asia Pacific had the largest share in the global market in 2024.

The key players in the market are Rapyd Financial Network Ltd.; Unicorn Payment Ltd.; Stripe, Inc.; Mastercard; Finastra; Fiserv, Inc.; Block Inc.; Adyen; Plaid Inc.; Neo Mena Technologies Ltd.

The fraud detection segment dominated in 2024 due to rapid increase in digital transactions leading to the growing concerns about online fraud and data breaches.

The AI is expected to witness fastest growth in the forecast period due to increasing usage of AI in customer service and to analyze customer behavior.