U.S. Remote Patient Monitoring System Market Size, Share, Trends, Industry Analysis Report

By Product (Vital Sign Monitors, Special Monitors), By End Use, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6207

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

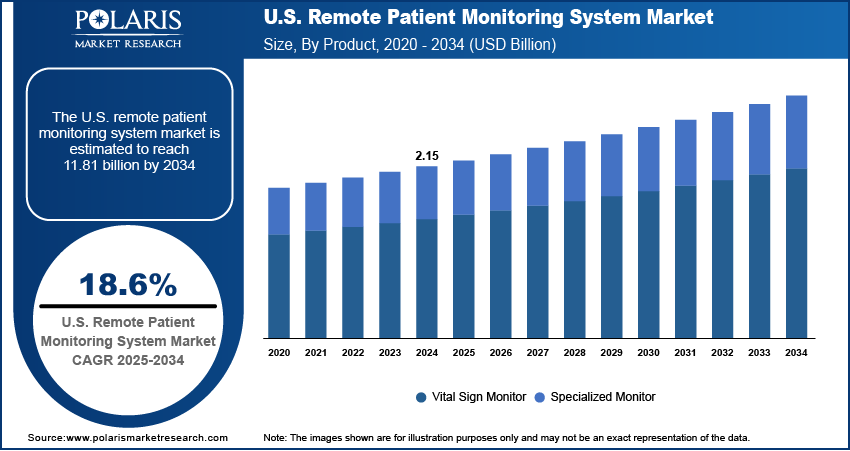

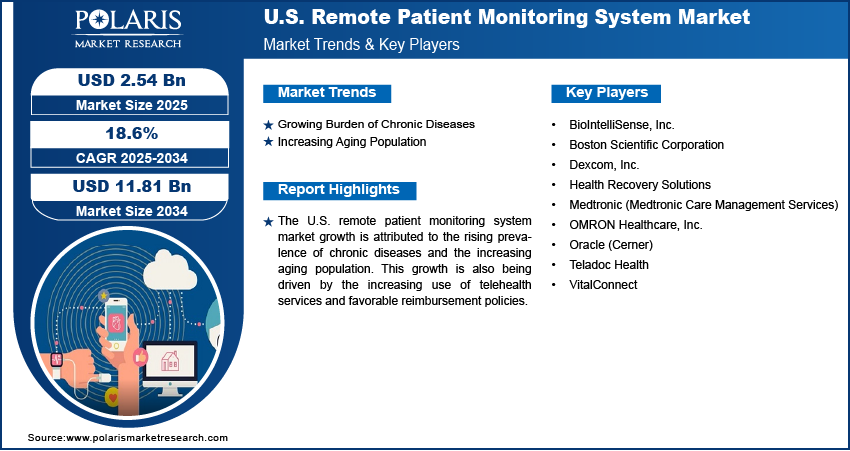

The U.S. remote patient monitoring (RPM) system market size was valued at USD 2.15 billion in 2024 and is anticipated to register a CAGR of 18.6% from 2025 to 2034. The increasing incidence of chronic diseases and the rising aging population are key market growth drivers. There is also a growing demand for healthcare services that can be provided at home. This trend is further supported by the increased adoption of telehealth and favorable reimbursement policies.

Key Insights

- By product, the special monitors segment held the largest share in 2024, due to the wide variety of devices that track complex and specific health conditions, which is essential for managing chronic diseases and preventing complications.

- By end use, the hospital-based patients segment held the largest share in 2024. Hospitals use these monitoring devices to manage a large number of patients, both in-patient and out-patient, which helps make faster decisions and prevent re-admissions.

- By application, the diabetes segment held the largest share in 2024. The high prevalence of this chronic condition in the U.S. requires constant monitoring of blood glucose levels, making remote patient monitoring a vital tool for patients and doctors.

Industry Dynamics

- The rising number of people affected by chronic conditions, such as heart disease and diabetes, is a major growth factor. These conditions need continuous management and observation, which can be done effectively with monitoring devices. This helps reduce hospital visits and improves long-term health outcomes.

- The growing number of older adults is a significant driver. As the population ages, there is an increased need for continuous care and long-term management of age-related health issues. Remote monitoring provides a way to deliver this care from the comfort of a person's home.

- Technological advancements and the increasing use of telehealth are fueling the demand. The development of more portable devices, wireless connectivity, and user-friendly mobile apps makes it easier for patients and doctors to manage health data remotely, making healthcare more accessible.

Market Statistics

- 2024 Market Size: USD 2.15 billion

- 2034 Projected Market Size: USD 11.81 billion

- CAGR (2025–2034): 18.6%

AI Impact on U.S. Remote Patient Monitoring System Market

- AI-powered remote patient monitoring systems work with various devices such as ECG monitors, smartwatches, and glucose tracking devices.

- Automated alerts notify healthcare experts of critical changes, which improves response time.

- AI integration helps minimize human errors in critical processes such as data interpretation and clinical decision making.

- AI-based RPM apps and systems enhance patient engagement through feedback loops and interactive platforms.

- Concerns regarding data security and privacy due to sensitive health information can restrain the adoption of AI integration in RPM systems.

Remote patient monitoring, also known as RPM, is a type of healthcare technology that uses various devices to collect and transmit a patient's health data from a remote location. This allows healthcare professionals to monitor a patient's vital signs and other health information without them needing to be in a hospital or clinic. This system is especially helpful for people with long-term illnesses or those who need care at home.

The shortage of healthcare workers boosts the U.S. remote patient monitoring system market growth. As the number of doctors, nurses, and other professionals declines, there is a greater need for solutions that can help manage a growing patient population more efficiently. RPM technology helps healthcare providers handle more patients at once by automating data collection. This allows them to focus on patients who need direct attention and to provide timely care from a distance.

Another factor fueling the U.S. remote patient monitoring system market expansion is the increasing focus on preventive care and patient engagement. RPM devices encourage patients to take an active part in managing their own health by giving them real-time data and feedback. This helps them better understand their conditions and can lead to healthier choices. For example, a person with diabetes can use a continuous glucose monitor to track their blood sugar levels throughout the day, which helps them make informed decisions about their diet and activity. This focus on prevention and engagement is a key trend in modern healthcare that is driving the demand for RPM systems across the U.S.

Drivers and Trends

Growing Burden of Chronic Diseases: Various chronic conditions such as heart disease, diabetes, and hypertension require continuous management and regular check-ups, which can be difficult for patients to keep up with in traditional clinical settings. RPM technology offers a solution by allowing doctors to track a patient's vital signs and other health metrics from a distance. This helps ensure that patients are adhering to their treatment plans and allows for the early detection of any potential complications.

A study published in the journal Preventing Chronic Disease in 2020 titled "Prevalence of Multiple Chronic Conditions Among US Adults, 2018" by the CDC found that over half of all U.S. adults had at least one chronic condition, with more than a quarter of adults having multiple conditions. The need for constant monitoring of these widespread conditions makes remote patient monitoring a useful tool for both patients and healthcare providers. Therefore, rising prevalence of chronic diseases is a strong driver of the U.S. remote patient monitoring system market.

Increasing Aging Population: As people live longer, there is a greater need for ongoing healthcare and long-term care services to manage age-related health issues. Many older adults also prefer to receive care in their homes to maintain their independence and quality of life. This demographic shift is creating a significant demand for healthcare solutions that can be delivered outside of hospitals and clinics.

According to a U.S. Census Bureau report from May 2023, "The Older Population: 2020," the number of Americans aged 65 and above grew at the fastest rate in a century between 2010 and 2020. This report highlighted that the population over 65 reached 55.8 million, a 38.6% increase in just ten years. The rapid growth of the older adult population is driving the need for scalable and accessible healthcare options such as remote patient monitoring systems.

Segmental Insights

Product Analysis

Based on product, the U.S. remote patient monitoring system market segmentation includes vital sign monitors and special monitors. The special monitors segment held the largest share in 2024. This is due to a wide range of devices that track specific and complex health conditions. These monitors are essential for managing diseases that require continuous and detailed data, such as cardiac rhythm and blood glucose levels. The ability to monitor these crucial parameters from a patient's home helps in early diagnosis and prevents complications, making these devices highly valuable for both patients and healthcare professionals. The demand is also fueled by the increasing use of these monitors in managing long-term illnesses, which are becoming more common in the country's aging population. As special monitors are important for specialized care, these devices have become a central part of remote healthcare solutions.

The vital sign monitors segment is anticipated to register the highest growth rate during the forecast period. This is because these devices track basic but critical physiological metrics such as blood pressure, heart rate, and temperature. The widespread use and affordability of these devices, especially after the COVID-19 pandemic, have increased their adoption. Devices such as pulse oximeters, which measure oxygen levels, have become particularly popular for home use. The growing emphasis on preventive healthcare and the ability for patients to actively participate in their own health management through easy-to-use devices are driving this trend. This growth is also supported by the fact that many chronic conditions first present with changes in vital signs, making these monitors the first line of defense in remote care. The quick development of wireless and portable versions of these devices is making them even more accessible to a wider audience, contributing to their rapid growth.

End Use Analysis

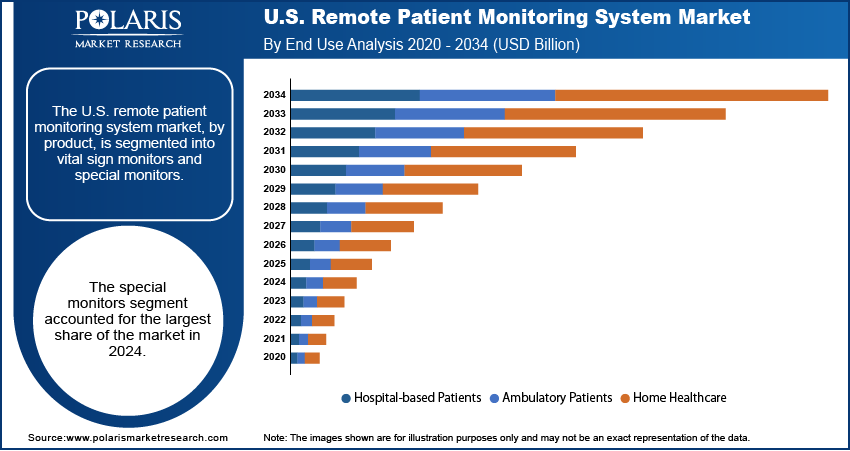

Based on end use, the U.S. remote patient monitoring system market segmentation includes hospitals based patients, ambulatory patients, and home healthcare. The hospitals based patients segment held the largest share in 2024. This is because hospitals are often the main point of contact for patients having serious or long-term health issues that need constant supervision. By using remote monitoring systems, hospitals can manage many patients at once, both in-patient and out-patient, without sacrificing the quality of care. The technology allows hospital staff to get real-time health data, which helps them make faster decisions about patient care and treatment plans. This is especially useful for post-surgery patients or those with critical conditions, as it helps prevent complications and re-admissions, which saves money and resources for the hospitals.

The home healthcare segment is anticipated to register the highest growth rate during the forecast period. This trend is driven by a desire for more convenient and affordable care options that let people stay in their homes. Many older adults and people with long-term illnesses prefer to manage their health from home to maintain their independence. Advances in technology, such as wireless devices, digital patient monitoring, and mobile apps, have made this possible and simple for them to do. As more people become comfortable with managing their own health and as reimbursement policies for home-based care improve, this segment will continue to grow. This shift also helps reduce the strain on hospitals, allowing them to focus on more critical cases.

Application Analysis

Based on application, the segmentation includes cancer, cardiovascular diseases, diabetes, sleep disorders, weight management & fitness monitoring, bronchitis, infections, virus, dehydration, and hypertension. The diabetes segment held the largest share in 2024. This is because diabetes is a common chronic disease in the U.S. that needs regular monitoring of blood glucose levels. Remote patient monitoring devices such as continuous glucose monitors have become important for managing this condition, allowing patients to track their levels at home and make timely adjustments to their diet and medication. These devices help diabetes patients avoid serious complications and improve their quality of life. The increasing number of people with this condition and the need for constant management have made this a dominant application in the market.

The cardiovascular diseases segment is anticipated to register the highest growth rate during the forecast period. The rising number of people suffering from heart conditions, including high blood pressure and arrhythmias, is driving this growth. Remote patient monitoring systems allow doctors to get real-time data on a patient's heart rate, blood pressure, and other vital signs from a distance. This is especially helpful for people who are recovering from a heart attack or have chronic heart failure. By using these devices, healthcare providers can spot warning signs early and intervene before a minor issue becomes a major medical event. The development of advanced cardiac monitors and the increasing use of telehealth for managing heart health are key factors behind the rapid expansion of this segment.

Key Players and Competitive Insights

The competitive landscape for the U.S. remote patient monitoring market is a mix of large, multinational corporations and specialized technology startups. Major players such as Medtronic, Philips, GE Healthcare, Boston Scientific, and OMRON Healthcare are actively competing in this space. These companies often leverage their extensive product portfolios and global presence to offer complete solutions that include both hardware and software. They focus on strategic partnerships and acquisitions to enhance their capabilities and expand into new areas. Smaller, more agile firms often specialize in specific applications, such as diabetes management or cardiac monitoring, and drive innovation with new technologies such as AI and machine learning.

A few prominent companies in the industry include BioIntelliSense, Inc.; Boston Scientific Corporation; Dexcom, Inc.; Health Recovery Solutions; Medtronic (Medtronic Care Management Services); OMRON Healthcare, Inc.; Oracle (Cerner); Teladoc Health; and VitalConnect.

Key Players

- BioIntelliSense, Inc.

- Boston Scientific Corporation

- Dexcom, Inc.

- Health Recovery Solutions

- Medtronic (Medtronic Care Management Services)

- OMRON Healthcare, Inc.

- Oracle (Cerner)

- Teladoc Health

- VitalConnect

Industry Developments

April 2025: Medtronic announced that the U.S. Food and Drug Administration (FDA) approved its Simplera Sync sensor for the MiniMed 780G System.

January 2024: Boston Scientific announced that the U.S. FDA approved the FARAPULSE Pulsed Field Ablation System.

U.S. Remote Patient Monitoring System Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Vital Sign Monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special Monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals Based Patients

- Ambulatory Patients

- Home Healthcare

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management & Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Hypertension

U.S. Remote Patient Monitoring System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.15 billion |

|

Market Size in 2025 |

USD 2.54 billion |

|

Revenue Forecast by 2034 |

USD 11.81 billion |

|

CAGR |

18.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.15 billion in 2024 and is projected to grow to USD 11.81 billion by 2034.

The market is projected to register a CAGR of 18.6% during the forecast period.

A few key players in the market include BioIntelliSense, Inc.; Boston Scientific Corporation; Dexcom, Inc.; Health Recovery Solutions; Medtronic (Medtronic Care Management Services); OMRON Healthcare, Inc.; Oracle (Cerner); Teladoc Health; and VitalConnect.

The special monitors segment accounted for the largest share of the market in 2024.

The diseases segment is expected to witness the fastest growth during the forecast period.