Continuous Glucose Monitoring Device Market Size, Share, Trends, Industry Analysis Report

: By Component Type (Transmitters & Receivers, Sensors, and Insulin Pumps), Connectivity, End Use, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM1608

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

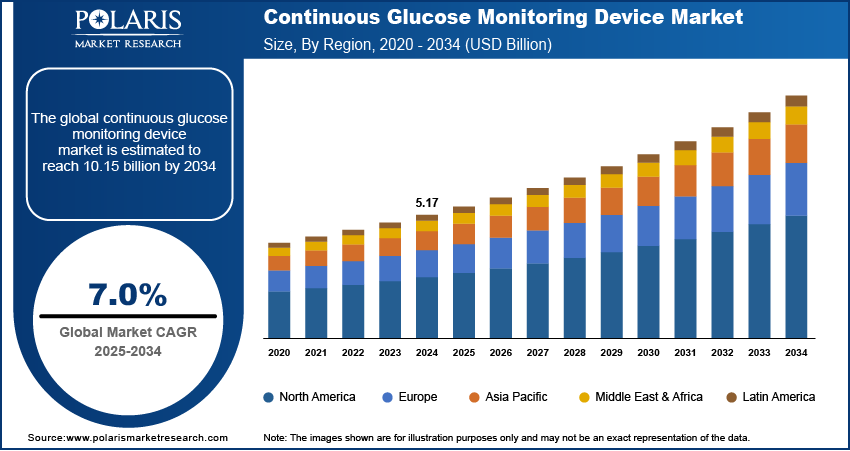

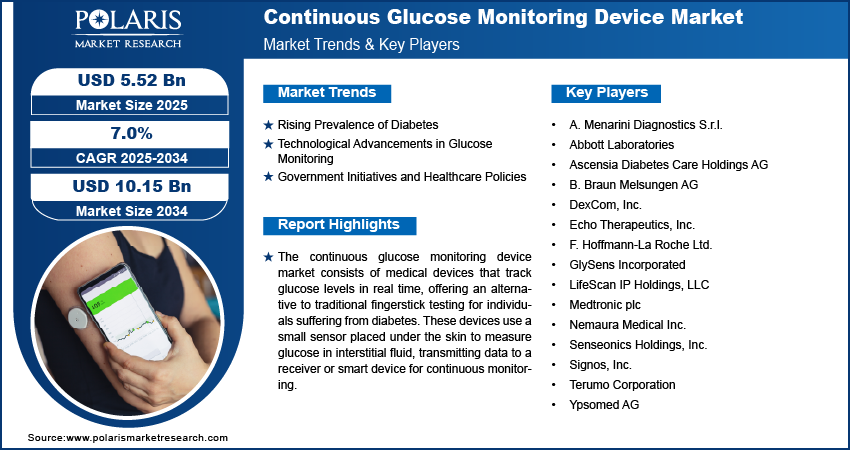

The continuous glucose monitoring device market size was valued at USD 5.17 billion in 2024. The market is projected to grow from USD 5.52 billion in 2025 to USD 10.15 billion by 2034, exhibiting a CAGR of 7.0% during 2025–2034. The continuous glucose monitoring device market is growing rapidly, driven by rising diabetes prevalence, technological advancements in sensor accuracy, supportive government policies, and increasing integration with digital health platforms, which enhance real-time monitoring, patient engagement, and overall disease management.

Key Insights

- The sensors segment leads market revenue, driven by improved accuracy, longer sensor life, and increasing adoption in diabetes management, which enhances continuous monitoring and patient convenience globally.

- The transmitters segment shows the fastest growth, fueled by advancements in wireless technology, miniaturization, and increased demand for real-time glucose data transmission to smartphones and insulin pumps.

- Bluetooth technology dominates revenue share, supported by widespread smartphone integration, seamless data syncing, and growing consumer preference for convenient, connected diabetes management solutions.

- The home care diagnostics segment generates the largest revenue, driven by rising patient preference for at-home monitoring, chronic disease management, and growing healthcare emphasis on personalized, remote care solutions.

- North America holds the largest market share due to high diabetes prevalence, advanced healthcare systems, and strong reimbursement frameworks that facilitate the broad adoption of continuous glucose monitoring devices.

- Europe’s market expands with increasing diabetes cases, supportive reimbursement policies, and continuous healthcare infrastructure improvements, which collectively encourage CGM device usage and better disease management outcomes.

Industry Dynamics

- Rising demand for continuous glucose monitoring devices is driven by increasing diabetes prevalence, technological advancements, and the need for real-time, convenient glucose management in healthcare and home settings.

- Expanding use in hospitals, clinics, and home care boosts growth, supported by patient preference for accurate, minimally invasive, and continuous glucose tracking to improve disease management.

- Challenges such as high device costs, data privacy concerns, and reimbursement barriers may hinder market growth, emphasizing the need for affordable, secure, and accessible CGM solutions.

- Innovations in sensor technology, wireless connectivity, and integration with digital health platforms are accelerating adoption, enhancing user experience, remote monitoring capabilities, and improving overall diabetes care globally.

Market Statistics

- 2024 Market Size: USD 5.17 billion

- 2034 Projected Market Size: USD 10.15 billion

- CAGR (2025-2034): 7.0%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The continuous glucose monitoring device market growth is attributed to the rising prevalence of diabetes and increasing awareness about real-time glucose monitoring. Key drivers include the growing adoption of wearable health technologies, advancements in sensor accuracy, and the demand for non-invasive monitoring solutions. The market is further supported by government initiatives promoting diabetes management and the integration of continuous glucose monitoring devices with digital health platforms. Trends such as artificial intelligence-driven analytics, interoperability with insulin delivery systems, and the development of long-duration sensors are shaping the market. Additionally, the expanding geriatric population and the rising focus on personalized healthcare contribute to market expansion.

Market Dynamics

Rising Prevalence of Diabetes

The increasing global prevalence of diabetes significantly propels the demand for continuous glucose monitoring devices. According to the International Diabetes Federation, in 2021, approximately 537 million adults aged 20 to 79 were affected by diabetes worldwide, a figure projected to rise to 643 million by 2030. This surge highlights the critical need for effective glucose monitoring solutions to manage and mitigate diabetes-related health complications.

Technological Advancements in Glucose Monitoring

Advancements in continuous glucose monitoring technology have enhanced device accuracy, user convenience, and integration capabilities, thereby driving continuous glucose monitoring device market growth. Modern devices offer real-time data transmission to smartphones and other digital platforms, facilitating proactive diabetes management. Innovations such as longer-lasting sensors and non-invasive monitoring options are further contributing to the increased adoption of these devices.

Government Initiatives and Healthcare Policies

Supportive government initiatives and healthcare policies play a crucial role in expanding access to continuous glucose monitoring devices. In 2024, Diabetes Australia advocated for a $200 million federal investment to subsidize continuous glucose monitors and insulin pumps, aiming to provide access to approximately 400,000 individuals. Such initiatives are instrumental in making these essential devices more affordable and accessible, thereby encouraging widespread adoption.

Segment Insights

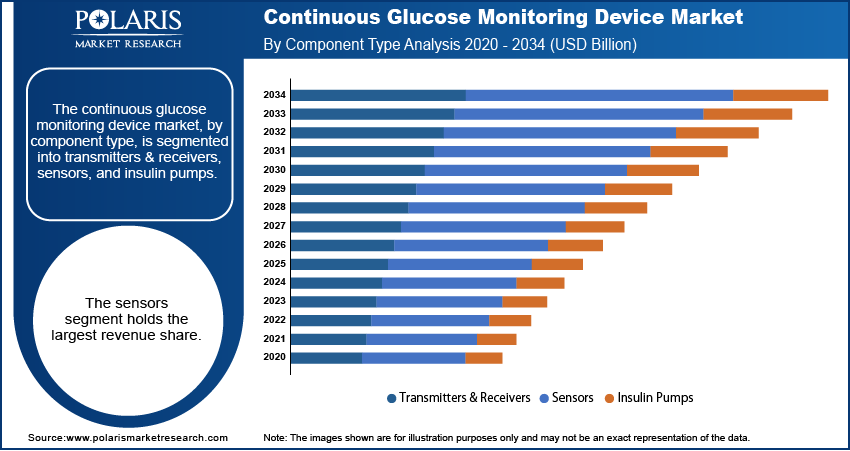

Component Type-Based Insights

The continuous glucose monitoring device market, by component type, is segmented into transmitters & receivers, sensors, and insulin pumps. The sensors segment holds the largest market revenue share. This dominance is attributed to technological advancements that have led to the development of smaller, more accurate, and longer-lasting sensors, enhancing user comfort and convenience. These improvements have made sensors integral to continuous glucose monitoring systems, as they provide real-time data on glucose levels, facilitating better diabetes management.

The transmitters segment is experiencing the highest growth rate within the market. Transmitters play a crucial role in continuous glucose monitoring devices by wirelessly communicating data from the sensor to external devices such as receivers or smartphones. The increasing demand for real-time glucose monitoring and the integration of continuous glucose monitoring data with digital health platforms contribute to the rapid growth of the transmitters segment.

Connectivity-Based Insights

The continuous glucose monitoring device market, by connectivity, is segmented into Bluetooth and 4G. The Bluetooth segment holds the largest revenue share. This prominence is attributed to Bluetooth's widespread compatibility and user-friendly nature, enabling seamless integration with smartphones and other devices. For instance, the Dexcom G6 CGM system utilizes Bluetooth to transmit glucose data to compatible devices every five minutes, providing users with real-time monitoring capabilities.

The 4G connectivity segment is experiencing the fastest growth rate within the market. Sensors equipped with 4G connectivity facilitate real-time data transmission to healthcare providers, allowing for prompt feedback on glucose levels. This advancement enables patients to make necessary adjustments to their insulin dosage or diet plan based on the received information, thereby enhancing diabetes management.

End Use-Based Insights

The continuous glucose monitoring device market, by end use, is segmented into hospitals, homecare diagnostics, and others. The homecare diagnostics segment holds the largest revenue share. This prominence is attributed to the increasing preference for personal health management and the convenience of monitoring glucose levels outside clinical settings. Continuous glucose monitoring devices designed for home use empower patients to manage their diabetes more effectively, leading to improved adherence to treatment plans and better health outcomes. The accessibility and user-friendly nature of these devices have significantly contributed to their widespread adoption in homecare settings.

The hospital segment is experiencing the highest growth rate within the market. This surge is driven by the rising number of hospital visits for diabetes management and the increasing utilization of continuous glucose monitoring devices in inpatient care. Hospitals are integrating these devices into their treatment protocols to provide real-time glucose monitoring, which aids in timely decision-making and enhances patient care. The ability of continuous glucose monitoring devices to deliver continuous data on glucose levels is particularly beneficial in critical care settings, contributing to their growing adoption in hospitals.

Regional Insights

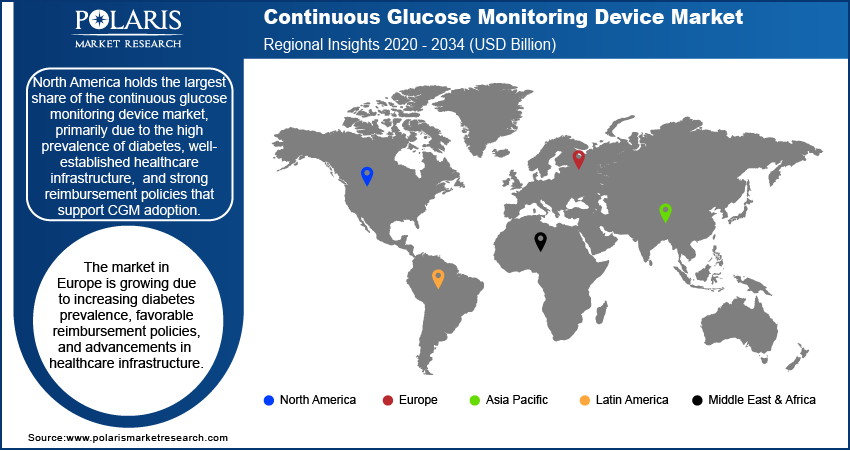

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the continuous glucose monitoring device market revenue, primarily due to the high prevalence of diabetes, well-established healthcare infrastructure, and strong reimbursement policies that support CGM adoption. The region benefits from significant investments in technological advancements, early regulatory approvals, and a strong presence of key market players driving innovation. Additionally, growing awareness among individuals regarding proactive diabetes management and increasing integration of CGM devices with digital health platforms further support market growth. While North America leads, other regions such as Asia Pacific are experiencing rapid expansion due to rising diabetes cases, improving healthcare accessibility, and growing adoption of advanced glucose monitoring solutions.

The Europe continuous glucose monitoring device market is growing due to increasing diabetes prevalence, favorable reimbursement policies, and advancements in healthcare infrastructure. Countries such as Germany, the UK, and France are key contributors, driven by high adoption rates of CGM devices and strong government initiatives supporting diabetes management. The region benefits from a well-regulated medical device sector, ensuring the availability of innovative CGM solutions. Additionally, collaborations between healthcare providers and technology companies are enhancing remote monitoring and digital health integration, further boosting market expansion.

The Asia Pacific continuous glucose monitoring device market is experiencing rapid growth due to rising diabetes cases, increasing healthcare expenditure, and improving awareness of advanced glucose monitoring solutions. Countries such as China, India, and Japan are leading this growth, supported by expanding healthcare infrastructure and government initiatives promoting diabetes care. The demand for non-invasive and cost-effective CGM devices is increasing as affordability and accessibility improve. Additionally, the region is witnessing a surge in telemedicine and digital health adoption, further accelerating CGM adoption in both urban and rural areas.

Key Players and Competitive Insights

Several market players are actively contributing to advancements in diabetes management. Dexcom, Inc. is renowned for its innovative CGM systems, offering real-time glucose monitoring solutions. Abbott Laboratories has developed the FreeStyle Libre system, providing users with a sensor-based approach to glucose tracking. Medtronic plc integrates CGM technology with insulin pump systems, enhancing comprehensive diabetes care. Senseonics Holdings, Inc. offers the Eversense CGM system, featuring an implantable sensor for extended monitoring periods. Ypsomed AG specializes in insulin delivery systems and has expanded into CGM technologies. A. Menarini Diagnostics S.r.l. provides a range of diagnostic solutions, including CGM devices. Signos, Inc. focuses on personalized health insights through continuous glucose monitoring. GlySens Incorporated is developing implantable CGM systems aimed at long-term monitoring. F. Hoffmann-La Roche Ltd. offers integrated diabetes management solutions, encompassing CGM devices.

In the competitive landscape, companies are striving to enhance the accuracy, convenience, and affordability of CGM devices. Dexcom and Abbott have recently introduced over-the-counter CGM systems, aiming to broaden access beyond insulin-dependent individuals. Medtronic continues to innovate by integrating CGM technology with insulin delivery systems, providing comprehensive solutions for diabetes management. Senseonics' implantable sensor offers an alternative for users seeking longer sensor wear duration. Emerging players such as Signos and Nemaura Medical are focusing on personalized health insights and non-invasive monitoring technologies, respectively, contributing to the diversification of available CGM solutions.

DexCom, Inc. is a prominent company specializing in continuous glucose monitoring (CGM) systems for diabetes management. Founded in 1999 and headquartered in San Diego, California, DexCom has developed innovative CGM technologies that provide real-time glucose data to individuals with diabetes, aiding in effective disease management. The company's product portfolio includes devices like the Dexcom G6 and the recently launched Dexcom G7, which offer features such as customizable alerts and integration with smart devices.

Medtronic plc is engaged in the continuous glucose monitoring (CGM) market. The company’s CGM systems, such as the Guardian and MiniMed series, utilize sensors to measure interstitial glucose levels every few minutes, providing real-time data on glucose trends. These systems are designed to enhance diabetes management by integrating with insulin pumps or functioning independently. Features like predictive alerts and automated insulin adjustments help users manage glucose fluctuations effectively, reducing risks of hyperglycemia and hypoglycemia.

List of Key Companies:

- A. Menarini Diagnostics S.r.l.

- Abbott Laboratories

- Ascensia Diabetes Care Holdings AG

- B. Braun Melsungen AG

- DexCom, Inc.

- Echo Therapeutics, Inc.

- F. Hoffmann-La Roche Ltd.

- GlySens Incorporated

- LifeScan IP Holdings, LLC

- Medtronic plc

- Nemaura Medical Inc.

- Senseonics Holdings, Inc.

- Signos, Inc.

- Terumo Corporation

- Ypsomed AG

Industry Developments

- December 2024: DexCom and Abbott Laboratories reached a settlement to resolve all ongoing patent disputes related to continuous glucose monitoring devices. The agreement included the dismissal of all pending legal cases globally and a provision preventing legal action between the companies for patent and appearance disputes for the next decade.

- August 2024: DexCom launched over-the-counter continuous glucose monitor, Stelo, in the US. The device is intended for individuals aged 18 and above who do not use insulin. Stelo utilizes a wearable sensor paired with an application on the user's smartphone or other smart devices to continuously measure blood glucose levels.

Market Segmentation

By Component Type Outlook (Revenue – USD Billion, 2020–2034)

- Transmitters & Receivers

- Sensors

- Insulin Pumps

By Connectivity Outlook (Revenue – USD Billion, 2020–2034)

- Bluetooth

- 4G

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Homecare Diagnostics

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.17 billion |

|

Market Size Value in 2025 |

USD 5.52 billion |

|

Revenue Forecast by 2034 |

USD 10.15 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The continuous glucose monitoring device market has been segmented into detailed segments of component type, connectivity, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the continuous glucose monitoring device market focus on expanding accessibility, technological advancements, and strategic partnerships to drive growth. Many manufacturers are investing in research and development to enhance sensor accuracy, extend wear duration, and integrate CGM systems with digital health platforms. Market players are also emphasizing direct-to-consumer sales and over-the-counter product launches to reach a broader audience. Collaborations with healthcare providers and insurance companies help improve adoption rates by ensuring better reimbursement options. Additionally, geographic expansion into emerging markets and regulatory approvals for new devices contribute to market growth.

FAQ's

The continuous glucose monitoring device market size was valued at USD 5.17 billion in 2024 and is projected to grow to USD 10.15 billion by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period.

North America held the largest share of the market in 2024 due to the high prevalence of diabetes, well-established healthcare infrastructure, and strong reimbursement policies that support CGM adoption.

Several companies are actively contributing to advancements in diabetes management. Dexcom, Inc. is renowned for its innovative CGM systems, offering real-time glucose monitoring solutions. Abbott Laboratories has developed the FreeStyle Libre system, providing users with a sensor-based approach to glucose tracking. Medtronic plc integrates CGM technology with insulin pump systems, enhancing comprehensive diabetes care.

The sensors segment accounted for the largest share of the market in 2024 due to technological advancements that have led to the development of smaller, more accurate, and longer-lasting sensors, enhancing user comfort and convenience.

The Bluetooth segment accounted for a larger share of the market in 2024 due to Bluetooth's widespread compatibility and user-friendly nature, enabling seamless integration with smartphones and other devices.

A continuous glucose monitoring (CGM) device is a medical device that tracks blood glucose levels in real time throughout the day and night. It consists of a small sensor placed under the skin, which measures glucose levels in interstitial fluid and transmits the data to a receiver, smartphone, or insulin pump. Unlike traditional fingerstick tests, CGM devices provide continuous data, allowing users to monitor glucose trends and fluctuations more effectively. These devices are widely used for diabetes management, helping individuals make informed decisions about diet, medication, and lifestyle adjustments.

A few key trends in the market are described below: Integration with Digital Health Platforms – CGM devices are increasingly being integrated with mobile apps, smartwatches, and cloud-based platforms for real-time monitoring and data sharing with healthcare providers. Over-the-Counter (OTC) CGM Devices – Companies are launching non-prescription CGM devices to expand accessibility, particularly for individuals without insulin dependence. Advancements in Sensor Technology – Newer CGM sensors offer extended wear duration, improved accuracy, and reduced calibration requirements, enhancing user convenience. Rising Adoption of AI and Predictive Analytics – AI-powered algorithms are being integrated into CGM systems to analyze glucose trends and provide predictive insights for better diabetes management.

A new company entering the continuous glucose monitoring device market can focus on non-invasive CGM technology to differentiate itself from existing players and improve patient comfort. Investing in AI-driven predictive analytics can enhance glucose monitoring accuracy and provide proactive health insights. Developing affordable, over-the-counter CGM devices can expand market accessibility, especially in emerging economies. Integration with digital health platforms, including smartwatches and telemedicine services, can improve user engagement and remote monitoring. Additionally, forming partnerships with healthcare providers and insurers can facilitate wider adoption by ensuring reimbursement coverage and clinical validation.