India Crane Rental Market Size, Share, Trends, Industry Analysis Report

By Type (Mobile, Fixed), By Weight Lifting, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6237

- Base Year: 2024

- Historical Data: 2020-2023

Overview

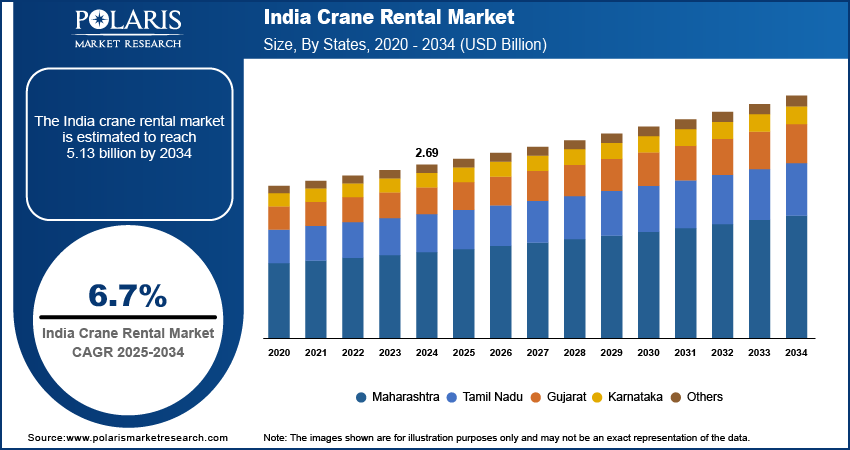

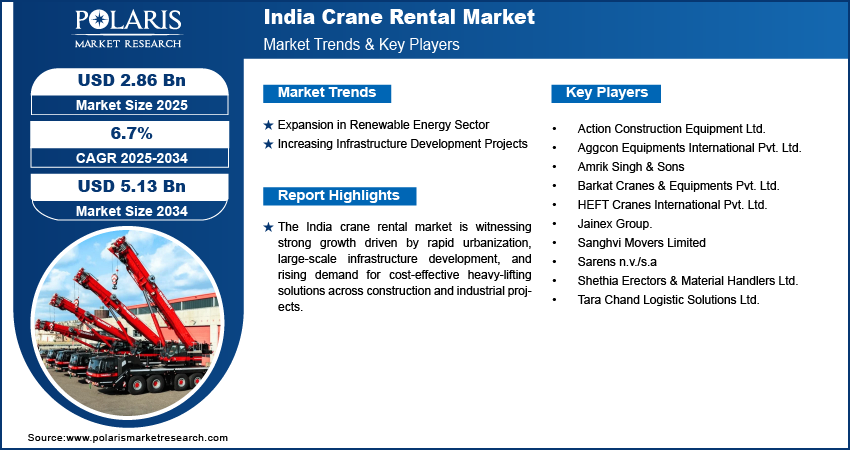

The India crane rental market size was valued at USD 2.69 billion in 2024, growing at a CAGR of 6.7% from 2025 to 2034. The market growth is being driven by rapid urbanization, large-scale infrastructure projects, and the government’s ongoing focus on improving transportation and industrial facilities. Simultaneously, the industry is transforming with the adoption of advanced technologies such as automated controls, higher lifting capacities, and enhanced safety systems.

Key Insights

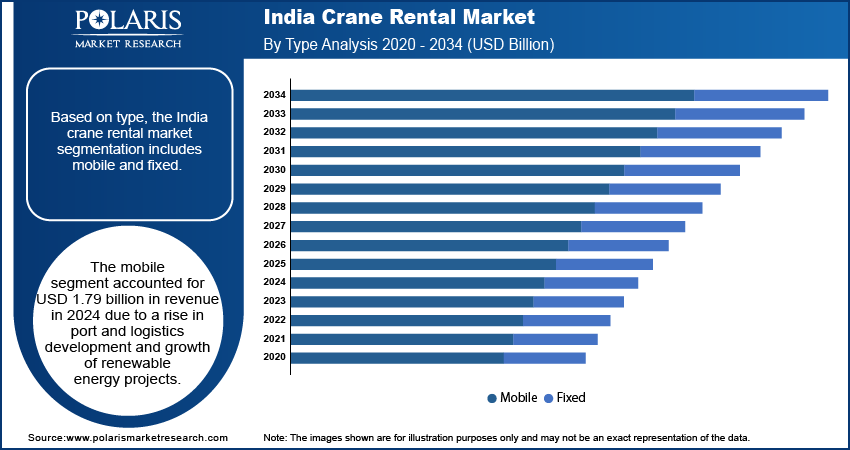

- The mobile segment accounted for USD 1.79 billion in revenue in 2024 due to a rise in port and logistics development and the growth of renewable energy projects.

- The low to medium segment is projected to register a CAGR of 7.2% during the forecast period, driven by the rising demand for affordable lifting solutions in urban construction, small-scale industrial projects, and infrastructure maintenance.

- The buildings & constructions segment accounted for USD 1.03 billion revenue share in 2024, attributed to the surge in residential and commercial developments and the growing preference for renting cranes to reduce project costs.

Industry Dynamics

- India’s rapid infrastructure development is a key force driving the expansion of the India crane rental market. Major government initiatives such as Bharatmala, Sagarmala, metro rail expansions, and smart city missions are boosting large-scale construction activities across the country.

- India’s growing focus on renewable energy development is significantly contributing to the expansion of the crane rental industry.

- The high initial investment and maintenance costs for modern crane equipment are a major restraint in the Indian rental crane market.

- Rising demand for large-scale infrastructure and smart city projects, supported by integrated smart city platforms, is expected to create opportunities for crane rental companies to offer scalable, cost-effective solutions with advanced, high-capacity equipment.

Market Statistics

- 2024 Market Size: USD 2.69 billion

- 2034 Projected Market Size: USD 5.13 billion

- CAGR (2025–2034): 6.7%

AI Impact on India Crane Rental Market

- The adoption of artificial intelligence (AI) is rapidly transforming the India crane rental market by boosting operational efficiency, safety, and client experience.

- AI-enabled platforms analyze various signals such as temperature, vibration, and hydraulic pressure, which help anticipate issues before they result in costly downtime.

- Crane rental providers and AI companies are collaborating to explore AI applications to enhance recommendation and selection models. The AI tools are expected to identify the most suitable lifting equipment and rental providers.

Growing investments in roads, bridges, metro rail, and smart city projects are driving demand for cranes on lease. According to the India Brand Equity Foundation, in March 2024, Prime Minister Narendra Modi inaugurated a series of connectivity projects in Kolkata, with a cumulative investment of approximately USD 1.8 billion. Rental solutions support cost control and equipment flexibility across project phases, making them an attractive option for infrastructure contractors managing tight timelines and budgets. The India crane rental market involves the leasing of various types of cranes for construction, infrastructure, mining, and industrial applications. It offers businesses cost-effective access to lifting equipment without long-term ownership. Rental services typically include setup, operation, maintenance, and dismantling support, making them ideal for short-term or project-based needs. Large-scale wind and solar power installations require cranes for tower assembly, turbine placement, and panel mounting. Increasing adoption of renewable energy sources across states is pushing crane rental firms to scale fleets suited for remote and high-altitude project sites.

Mining operations require cranes for overburden removal, equipment relocation, and maintenance. Crane rental services offer specialized lifting solutions suited for rough terrain and heavy-duty tasks, allowing mine operators to scale capacity without long-term capital investment. According to the Indian Bureau of Mines 2024 annual report, India’s mineral production value reached USD 16.17 billion in FY 2023–2024, reflecting a 9.2% increase from the previous year. The government's push for sustainable mining and auction of new mineral blocks is driving growth across the sector. Additionally, smart city initiatives involve large-scale construction, utilities deployment, and public infrastructure upgrades. Crane rental companies are benefitting from this push as local authorities and contractors prefer on-demand crane access for complex urban construction zones.

Drivers & Opportunities

Increasing Infrastructure Development Projects: Major government initiatives such as Bharatmala, Sagarmala, metro rail expansions, and smart city missions are triggering large-scale construction activities across the country. As of May 2025, metro rail services are operational or under construction in 23 cities, with the network expanding to 1,013 kilometers. These projects demand heavy lifting equipment for the assembly of structural components such as flyovers, pillars, bridges, and high-rise buildings.

Rising investments in port infrastructure are boosting the need for heavy lifting solutions. Crane rentals are becoming essential for container handling, shipyard operations, and large-scale logistics construction activities. According to the International Trade Administration (ITA), India's port infrastructure market is projected to reach USD 8.99 billion by 2030, with the government planning to invest USD 82 billion by 2035. The target is to increase port capacity from 2,600 MTPA to 10,000 MTPA by 2047. Contractors prefer renting cranes instead of purchasing them, primarily due to the high capital involved in acquiring advanced lifting machinery. Renting cranes offers flexibility in equipment type and capacity, allowing project managers to match the right machine to specific construction stages. This approach also reduces idle machinery time between projects, thereby improving cost-efficiency. Hence, the rapid infrastructure development across India propels the India crane rental market expansion.

Expansion in Renewable Energy Sector: India’s growing focus on renewable energy development is significantly contributing to the expansion of the crane rental industry. According to a 2024 report by Institute for Energy Economics & Financial Analysis, India’s renewable energy capacity reached 135 GW, with solar and wind accounting for over 90% of new installations. The country has set ambitious targets for increasing solar and wind energy capacities, with major projects underway in Rajasthan, Gujarat, Maharashtra, Tamil Nadu, and Karnataka. Wind turbine installations and solar farms require high-capacity cranes for the erection of tall wind towers, lifting heavy nacelles, rotor blades, and assembling large solar panel structures. For instance, as reported by the India Brand Equity Foundation, India significantly enhanced its wind energy infrastructure in 2024, with an addition of 3.4 GW in new capacity. The states of Gujarat (1,250 MW), Karnataka (1,135 MW), and Tamil Nadu (980 MW) were at the forefront of these developments, collectively contributing to 98% of the total new installations. These tasks involve complex logistics and lifting operations, particularly in remote, uneven, or elevated terrains where crane deployment must be precise and reliable. Investing in such specialized equipment may not be feasible for renewable energy developers, especially when equipment use is project-specific and seasonal.

Segmental Insights

Type Analysis

Based on type, the segmentation includes mobile and fixed. The mobile segment held the largest share in 2024. Mobile cranes are versatile, self-propelled lifting machines used extensively in construction, infrastructure, and industrial projects across India. These cranes are mounted on wheeled vehicles, offering high mobility and flexibility, making them ideal for projects requiring frequent relocation. In the Indian crane rental market, mobile cranes are preferred due to their ability to handle heavy loads, ease of transportation, and adaptability to diverse terrains. Common types include all-terrain cranes, rough-terrain cranes, and truck-mounted cranes, each serving specific project needs. The rapid expansion of infrastructure projects under government initiatives such as Smart Cities Mission, Bharatmala Pariyojana, and Atal Mission for Rejuvenation and Urban Transformation (AMRUT) has increased the need for efficient lifting solutions, including mobile cranes. The surge in industrial and commercial construction, including warehouses, factories, and high-rise buildings, necessitates mobile cranes for material handling and assembly.

The fixed segment is projected to grow at a substantial pace in the coming years, although its demand in the India rental market remains limited compared to mobile cranes due to permanent installation requirements and higher setup costs. The demand for fixed cranes in India rental market is growing due to several key factors. The surge in high-rise urban construction, driven by rapid urbanization and real estate development, has increased the need for tower cranes, which offer the required height and lifting capacity. Government-led infrastructure projects, including metro rail networks, highways, and bridges, also require fixed cranes for their stability and precision in handling heavy materials.

Weight Lifting Analysis

In terms of weight lifting, the segmentation includes low, low to medium, heavy, and extreme heavy. The low segment held 40.3% share of the market in 2024 due to their compact and versatile lifting nature that is designed for light to moderate load-handling tasks. These cranes include mobile cranes, overhead cranes, jib cranes, and mini crawler cranes, which are widely used in construction, warehouses, workshops, and industrial facilities. The key advantages of low-weight lifting capacity cranes include easy maneuverability, lower operational costs, and suitability for confined spaces, making them ideal for small-scale projects, maintenance work, and material handling in urban and semi-urban areas. In the India crane rental market, these cranes are in high demand due to their affordability, flexibility, and efficiency in handling lighter loads without the need for heavy infrastructure.

The low to medium segment is projected to register a CAGR of 7.2% during the forecast period, driven by balanced performance characteristics, substantial lifting power combined with relatively compact dimensions, and operational flexibility. In India's evolving infrastructure landscape, these cranes serve diverse sectors from urban construction to manufacturing plants, providing cost-effective solutions for projects requiring moderate lifting capacity without the expense of larger equipment.

End Use Analysis

The segmentation, based on end use includes, into buildings & constructions, infrastructure, transportation, oil & gas, mining & excavation, marine & offshore, and others. The buildings & constructions segment accounted for USD 1.03 billion revenue share in 2024. Rental cranes play a crucial role in the building and construction industry by providing heavy lifting and material handling solutions for projects of varying scales. These cranes are essential for tasks such as lifting steel beams, concrete panels, machinery, and other heavy materials to great heights or across large distances, ensuring efficiency and safety on construction sites. Rental cranes are particularly beneficial for short-term projects, peak demand periods, or when specialized equipment is required for specific tasks.

The infrastructure segment is projected to capture 27.65% share of the market by 2034 due to rapid government-led investments in highways, metro projects, and smart city developments driving high demand for heavy-lifting equipment. For instance, in July 2025, the Indian government announced a ₹10,000 crore rail infrastructure investment in Bihar, aiming to transform the state’s railway network through modernization and expansion. The growing adoption of modular and prefabricated construction techniques in infrastructure, such as bridge components and pre-cast concrete segments, necessitates the use of cranes for assembly, boosting rental demand. The need for compliance with stringent safety and environmental regulations in infrastructure development is also driving rental cranes demand, as rental companies provide well-maintained, certified equipment that meets industry standards.

Key Players & Competitive Analysis

The India crane rental sector is witnessing intense competition, driven by the rapid growth in infrastructure, construction, energy, and industrial sectors. These companies adopt various strategies including strategic partnerships, investment in advanced lifting equipment, technology integration, and geographic expansion to strengthen their market presence. Emphasis is placed on fleet modernization, safety compliance, real-time tracking systems, and tailored rental solutions to meet evolving project requirements. Companies are also focusing on specialized services for sectors like metro rail, power, petrochemicals, ports, and real estate as demand increases for high-capacity, efficient, and multi-terrain cranes, The growing presence of regional players and tech-driven entrants is intensifying competition, pushing established firms to continuously innovate in service delivery and pricing models. This competitive landscape fosters the need for operational excellence, customer-centric offerings, and strategic scalability to maintain leadership and capture emerging growth opportunities in the crane rental sector.

A few key players such as Action Construction Equipment Ltd.; Sanghvi Movers Limited; Sarens n.v./s.a; Shethia Erectors & Material Handlers Ltd.; Barkat Cranes & Equipments Pvt. Ltd.; Tara Chand Logistic Solutions Ltd.; Amrik Singh & Sons; HEFT Cranes International Pvt. Ltd.; Aggcon Equipments International Pvt. Ltd.; and Jainex Group dominate the market through their extensive fleets and nationwide service networks.

Key Players

- Action Construction Equipment Ltd.

- Aggcon Equipments International Pvt. Ltd.

- Amrik Singh & Sons

- Barkat Cranes & Equipments Pvt. Ltd.

- HEFT Cranes International Pvt. Ltd.

- Jainex Group

- Sanghvi Movers Limited

- Sarens n.v./s.a

- Shethia Erectors & Material Handlers Ltd.

- Tara Chand Logistic Solutions Ltd.

India Crane Rental Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Mobile

- Fixed

By Weight Lifting Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Low

- Low to Medium

- Heavy

- Extreme Heavy

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Buildings & Constructions

- Infrastructure

- Transportation

- Oil & Gas

- Mining & Excavation

- Marine & Offshore

- Others

India Crane Rental Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.69 Billion |

|

Market Size in 2025 |

USD 2.86 Billion |

|

Revenue Forecast by 2034 |

USD 5.13 Billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.69 billion in 2024 and is projected to grow to USD 5.13 billion by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

A few of the key players in the market are Action Construction Equipment Ltd.; Sanghvi Movers Limited; Sarens n.v./s.a; Shethia Erectors & Material Handlers Ltd.; Barkat Cranes & Equipments Pvt. Ltd.; Tara Chand Logistic Solutions Ltd.; Amrik Singh & Sons; HEFT Cranes International Pvt. Ltd.; Aggcon Equipments International Pvt. Ltd.; and Jainex Group.

The mobile segment accounted for USD 1.79 billion in revenue in 2024.

The low to medium segment is projected to register a CAGR of 7.2% during the forecast period.