Tower Crane Market Size, Share, Trends, Industry Analysis Report

: By Product (Fast Erecting Cranes, Hammerhead Cranes, Luffing Jib Cranes, and Mobile Cranes), Capacity, Application, Design, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3111

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

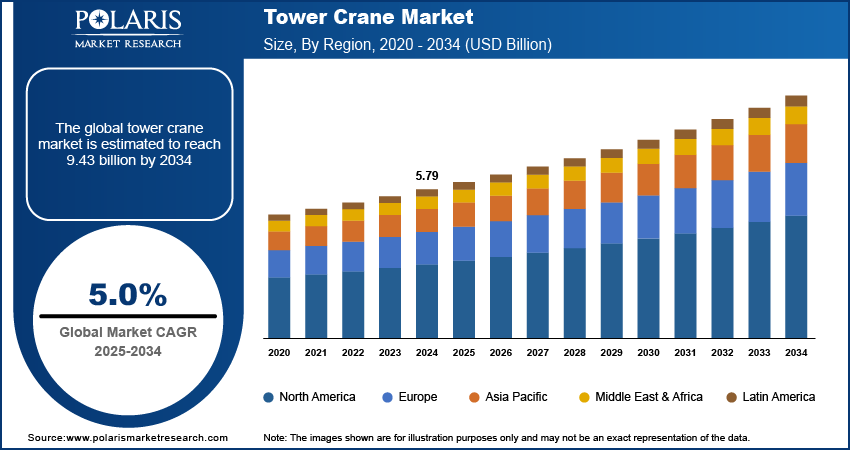

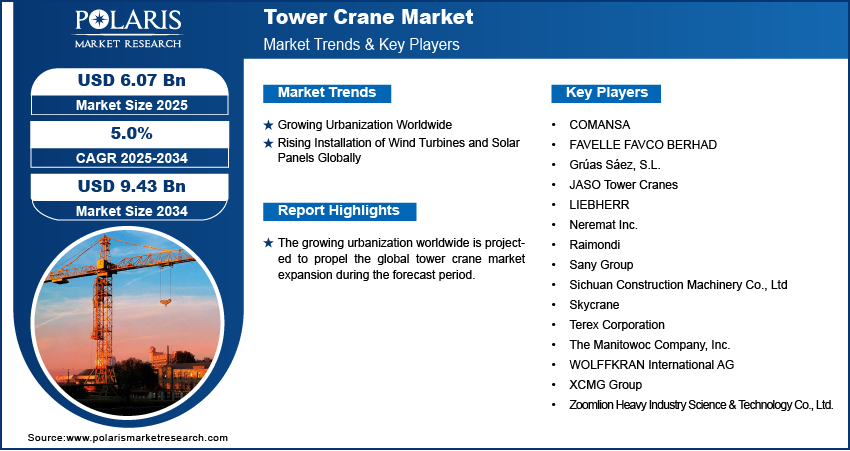

The global tower crane market size was valued at USD 5.79 billion in 2024, exhibiting a CAGR of 5.0% during 2025–2034. The rising focus on port development globally and the expansion of the mining industry are the key factors propelling market development.

Key Insights

- The hammerhead cranes segment led the market in 2024, driven by their cost-effectiveness and widespread adoption in various construction projects.

- The construction segment accounted for the largest market share in 2024, primarily due to continuous demand for commercial complexes, high-rise buildings, and infrastructure development.

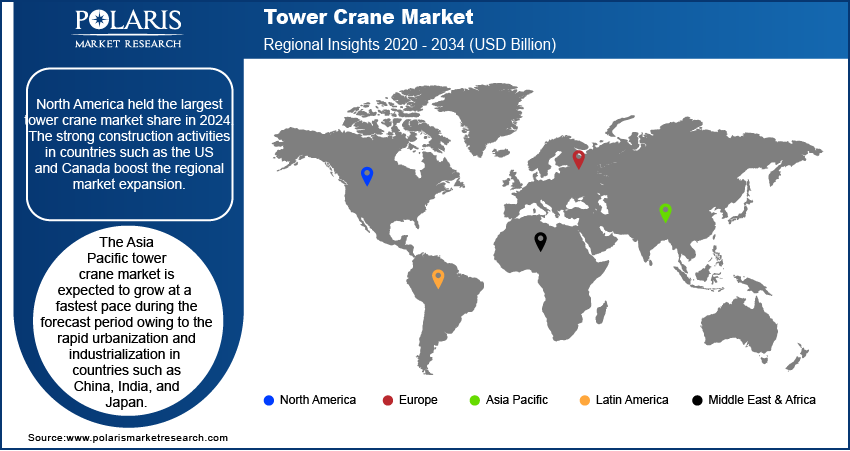

- North America accounted for the largest market share in 2024. The regional market dominance is fueled by robust construction activity in major economies like the US and Canada.

- Asia Pacific is anticipated to register the fastest growth during the projection period, owing to rapid industrialization and urbanization in major economies like India, China, and Japan.

Industry Dynamics

- The rising construction of commercial complexes and high-rise residential buildings, driven by rapid urbanization, is fueling the need for tower cranes that can lift and place heavy materials.

- The growing installation of solar panels and wind turbines, which need the precise lifting of large components, drives market demand.

- The growing focus on sustainable construction practices is creating market opportunities.

- High initial investment and operational costs may present challenges for market growth.

Key Statistics

2024 Market Size: USD 5.79 billion

2034 Projected Market Size: USD 9.43 billion

CAGR (2025-2034): 5.0%

North America: Largest Market in 2024

Tower crane is a tall, fixed structure used in construction to lift and move heavy materials. Its design features a vertical tower that provides height and stability, supporting a horizontal arm or jib that rotates 360 degrees. This allows the crane to reach different areas of a construction site without needing to move its base. These cranes are essential for building skyscrapers and large structures, as they lift heavy loads, such as steel beams and concrete blocks, to great heights.

The increasing focus on the development of ports around the globe is propelling the global tower crane market growth. According to the World Banks Container Port Performance Index (CPPI), there were 57 new ports in 2023. Tower cranes are essential equipment at ports for lifting and transporting heavy materials such as high-strength steel and concrete from vessels to the shore and vice versa. Therefore, as the development of ports increases globally, the need for tower cranes spurs.

The expanding mining industry drives the tower crane market demand. Mining projects involve the construction of extensive infrastructure, such as processing plants, storage facilities, and transport systems, which require efficient lifting solutions. Tower cranes are ideal for handling heavy loads, including steel components, machinery, and raw materials, with precision and stability. Additionally, as mining operations extend to deeper and more challenging terrains, the reliance on advanced tower cranes with greater reach and load capacities grows.

Tower Crane Market Dynamics

Growing Urbanization Worldwide

The growing urbanization worldwide is projected to propel the global tower crane market expansion during the forecast period. As per the data published by the United Nations, more than half of the global population lives in urban areas, and is expected to continue to rise in the coming years. Urbanization leads to the development of high-rise residential buildings, commercial complexes, and infrastructure such as bridges and metro systems. This requires the lifting and placement of heavy materials at significant heights, creating a demand for tower cranes as these cranes lift and position heavy materials with precision at great heights. Additionally, the limited space in urban areas necessitates vertical construction, further amplifying the adoption of tower cranes.

Rising Installation of Wind Turbines and Solar Panels Globally

The rising installation of wind turbines and solar panels globally is estimated to fuel the global tower crane market revenue in the coming years. Wind turbine installations require the precise lifting of massive components, such as nacelles, blades, and towers, at significant heights, making tower cranes crucial for these tasks. Similarly, large-scale solar farms demand tower cranes for the efficient transport and placement of heavy solar panel structures and supporting equipment. Therefore, as the global push toward renewable energy accelerates, the construction of wind and solar infrastructure expands, driving the demand for tower cranes.

Tower Crane Market Segment Analysis

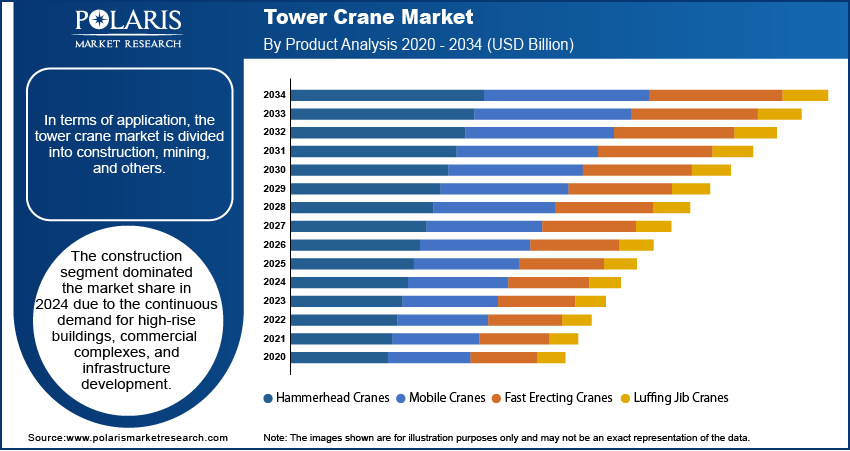

Assessment by Product

Based on product, the tower crane market is categorized into fast erecting cranes, hammerhead cranes, luffing jib cranes, and mobile cranes. The hammerhead cranes segment accounted for a major tower crane market share in 2024 due to their widespread application in various construction projects and their cost-effectiveness. These cranes are highly versatile and can handle heavy loads with precision, making them a preferred choice for high-rise construction equipment, large-scale industrial projects, and infrastructure development. The robust design and ability of hammerhead cranes to rotate 360 degrees provide exceptional stability and efficiency, especially in urban construction environments where space is limited. The growing demand for high-capacity cranes in rapidly urbanizing regions further contributed to their dominance, as they efficiently meet the requirements of large and complex construction projects.

The mobile cranes segment is expected to grow at a robust pace in the coming years owing to their mobility and ease of transportation, which make them ideal for projects requiring frequent relocation, such as road construction, bridge building, and wind turbine installation. Additionally, technological advancements, such as telescopic booms and enhanced lifting capacities, further expand their appeal and adoption.

Evaluation by Application

In terms of application, the tower crane market is divided into construction, mining, and others. The construction segment dominated the market share in 2024 due to the continuous demand for high-rise buildings, commercial complexes, and infrastructure development. The growing urbanization and the need for modern residential and commercial spaces in developed and emerging economies significantly contributed to the segment's dominance. Additionally, large-scale construction projects, such as skyscrapers, airports, and bridges, created the need for tower cranes to handle heavy materials and equipment at great heights.

Regional Analysis

By region, the study provides the tower crane market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest tower crane market share in 2024 due to strong construction activity in countries such as the US and Canada. Major cities across the US, such as New York, Chicago, and Los Angeles, have seen significant urban expansion and the construction of skyscrapers and office complexes, which increases the adoption of tower cranes. The US government’s investments in infrastructure projects, including transportation, energy, and housing, have also contributed to the rising need for efficient lifting solutions such as tower cranes. The presence of large-scale construction companies and advancements in construction technology further boosted the demand for tower cranes in the region.

The Asia Pacific tower crane market is expected to grow at a fastest pace during the forecast period owing to the rapid urbanization and industrialization in countries such as China, India, and Japan. China, in particular, plays a crucial role in the market growth due to its ongoing infrastructure development, massive construction projects, and expanding renewable energy installations. The construction of residential complexes, commercial spaces, and transport infrastructure, especially in India and Southeast Asia, further amplifies the need for efficient tower cranes. Additionally, the push for smart buildings across Asia Pacific led to a continued increase in construction activities, ensuring that tower cranes remain vital in handling large-scale projects.

Key Players and Competitive Analysis Report

Major market players are making substantial investments in research and development to broaden their product portfolios, further driving the tower crane market expansion. These companies are also engaging in diverse strategic initiatives to strengthen their global presence. Key activities include the launch of innovative products, international partnerships, increased capital investments, and mergers and acquisitions. A few of the major companies operating in the tower crane market include Raimondi; Sichuan Construction Machinery Co., Ltd; Terex Corporation; The Manitowoc Company, Inc.; WOLFFKRAN International AG; XCMG Group; Zoomlion Heavy Industry Science & Technology Co., Ltd.; COMANSA; FAVELLE FAVCO BERHAD; Grúas Sáez, S.L.; JASO Tower Cranes; Sany Group; Neremat Inc.; Skycrane; and LIEBHERR.

LIEBHERR is a global manufacturer of tower cranes, renowned for its innovative designs and advanced technology that cater to various construction needs. Established over 70 years ago, the company has developed a diverse range of tower cranes, including top-slewing cranes, fast-erecting cranes, and luffing jib cranes, which are utilized in residential, industrial, and infrastructure projects worldwide. Liebherr’s tower cranes are characterized by their impressive lifting capacities, which range from 13 to 5,000 metric tons, and their ability to reach heights of up to 120 meters. This versatility allows them to handle a wide array of construction tasks, from small residential buildings to large-scale commercial projects. The company’s product portfolio includes Liebherr 280 EC-H, which offers a maximum lifting capacity of 12 metric tons and a horizontal jib length of up to 75 meters. This crane is designed for medium to large construction projects and features multiple configurations to accommodate different site requirements.

XCMG Group, officially known as Xuzhou Construction Machinery Group Co., Ltd., is a prominent China-based multinational company specializing in the manufacturing of heavy machinery, including a diverse range of tower cranes. Founded in 1943, XCMG has grown to become a leader in the construction machinery industry. The company has a rich history of innovation, beginning with the production of its first tower crane in 1957, which laid the groundwork for its extensive portfolio of lifting equipment. The company offers several models of tower cranes, including the QTZ250 (TC7021), which provides a maximum lifting capacity of 12 tons and a maximum boom length of 70 meters.

List of Key Companies

- COMANSA

- FAVELLE FAVCO BERHAD

- Grúas Sáez, S.L.

- JASO Tower Cranes

- LIEBHERR

- Neremat Inc.

- Raimondi

- Sany Group

- Sichuan Construction Machinery Co., Ltd

- Skycrane

- Terex Corporation

- The Manitowoc Company, Inc.

- WOLFFKRAN International AG

- XCMG Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Tower Crane Industry Developments

September 2024: China State Construction Engineering Corporation (CSCEC) introduced its self-developed, unmanned tower crane at the construction site of Huangdao Hospital of Traditional Chinese Medicine in Qingdao.

March 2024: Comansa, a multinational company that designs, manufactures, supplies, and supports tower cranes for construction projects, showcased its most recent model of luffing crane, the CML800, in China

February 2024: Terex Corporation, a global leader in the manufacturing of construction equipment and materials, announced the launch of its CTT 152-6 Flat Top Crane.

Tower Crane Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Fast Erecting Cranes

- Hammerhead Cranes

- Luffing Jib Cranes

- Mobile Cranes

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Below 5 Metric Tons

- 6 to 80 Metric Tons

- Above 80 Metric Tons

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Mining

- Others

By Design Outlook (Revenue, USD Billion, 2020–2034)

- Top Slewing

- Bottom Slewing

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Tower Crane Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.79 billion |

|

Market Size Value in 2025 |

USD 6.07 billion |

|

Revenue Forecast by 2034 |

USD 9.43 billion |

|

CAGR |

5.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global tower crane market size was valued at USD 5.79 billion in 2024 and is projected to grow to USD 9.43 billion by 2034.

The global market is projected to register a CAGR of 5.0% during the forecast period.

North America had the largest share of the global market in 2024

A few of the key players in the market are Raimondi; Sichuan Construction Machinery Co., Ltd; Terex Corporation; The Manitowoc Company, Inc.; WOLFFKRAN International AG; XCMG Group; Zoomlion Heavy Industry Science & Technology Co., Ltd.; COMANSA; FAVELLE FAVCO BERHAD; Grúas Sáez, S.L.; JASO Tower Cranes; Sany Group; Neremat Inc.; Skycrane; and LIEBHERR.

The mobile cranes segment is projected for a significant growth rate in the global market during 2025–2034.

The construction segment dominated the market in 2024.