Renewable Energy Market Size, Share, Trends, Industry Analysis Report

By Product (Solar Power, Hydropower, Bioenergy, Wind Power, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM2147

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

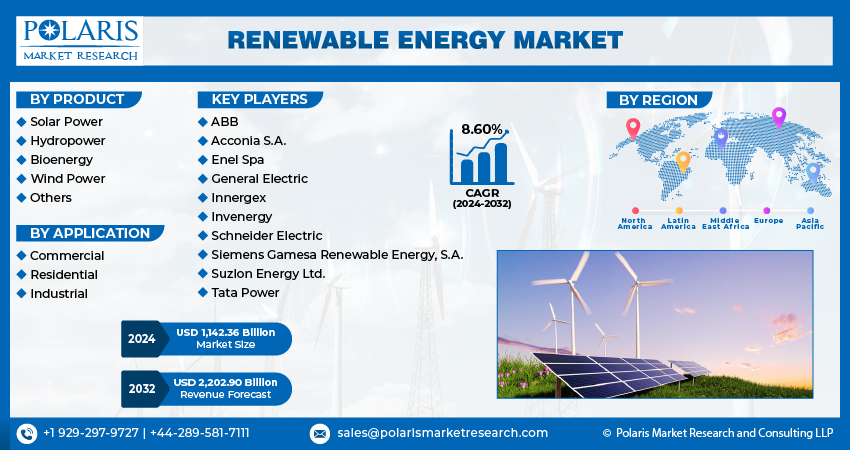

The global renewable energy market size was valued at USD 1,498.05 billion in 2024 and is anticipated to register a CAGR of 14.6% from 2025 to 2034. The landscape is primarily driven by supportive government policies and incentives aimed at promoting clean energy. A growing global focus on reducing greenhouse gas emissions and addressing climate change also plays a major role. Additionally, the continuous decline in the cost of renewable technologies such as solar and wind power is making them more competitive with traditional energy sources.

Key Insights

- By product, the solar power segment held the largest share in 2024. The declining cost of solar photovoltaic (PV) modules and large-scale capacity additions have driven the dominance of the solar power segment.

- The industrial segment, by application, dominated the revenue share in 2024. Rising energy demand from manufacturing and heavy industries, along with growing adoption of renewable energy to reduce operational costs and carbon emissions, has strengthened the industrial sector’s share.

- By region, Asia Pacific led the global revenue share in 2024. Government-backed renewable energy targets, significant investments in solar and wind projects, and rapid urbanization have supported Asia Pacific’s leadership in revenue share and growth.

Industry Dynamics

- The global drive to reduce greenhouse gas emissions and address climate change has led to an increased demand for cleaner alternatives. Consumers and corporations seek solutions to lower their carbon footprint and support a healthier planet for future generations.

- Supportive government policies and financial incentives also play a crucial role in boosting this sector's growth. Measures such as tax credits, subsidies, and favorable regulations encourage businesses and individuals to invest in new technologies and accelerate the shift toward sustainable energy sources.

- Technological advancements have made renewable energy more affordable and accessible than ever before. Innovations in manufacturing and economies of scale have led to a rapid decrease in the cost of solar panels and wind turbines, making them a more competitive option compared to traditional power generation methods.

Market Statistics

- 2024 Market Size: USD 1,498.05 billion

- 2034 Projected Market Size: USD 5,840.13 billion

- CAGR (2025–2034): 14.6%

- Asia Pacific: Largest market in 2024

AI Impact on Renewable Energy Market

- Artificial intelligence (AI) enables real-time grid management, which helps in balancing supply and demand with precision.

- AI-powered smart grids improve reliability and reduce energy losses during peak demand.

- AI tools analyze real-time meteorological inputs as well as historical weather data to predict solar and wind energy generation. This helps reduce reliance on fossil fuel backups, improve planning, and minimize energy waste.

- AI technology is used to monitor sensors on solar panels, wind turbines, and batteries to detect faults before breakdowns. This benefit assists in lowering maintenance costs, reducing downtime, and extending asset lifespan.

The renewable energy market focuses on technologies and services that generate electricity from natural sources that replenish themselves. These include solar, wind, hydro, geothermal, and bioenergy. The industry covers the entire process from manufacturing and installation to the maintenance and operation of these systems, providing a clean alternative to fossil fuels.

Many companies have ambitious targets to reduce their carbon footprint and move toward net-zero emissions. This is often driven by a need to improve brand reputation, meet stakeholder demands, and comply with emerging regulations, making the shift to renewable energy a key part of their business strategy. Another driver is the increasing public awareness and support for sustainable living, which pushes governments and companies to adopt greener practices.

The increasing focus on corporate sustainability goals has a significant impact on the market. As businesses commit to these targets, they seek ways to directly source clean power. One common way they achieve this is through power purchase agreements (PPAs), which are long-term contracts to buy electricity from a specific renewable energy project. For example, a report from the World Bank on public-private partnerships in the energy sector highlights how these agreements provide developers with a stable income, which helps secure funding for new projects and promotes market growth.

Drivers and Trends

Favorable Government Policies and Incentives: Governments worldwide are playing a major role in the growth by creating policies that promote the development and adoption of clean energy. These policies include tax credits, subsidies, and ambitious national targets for renewable energy capacity. Such measures provide a stable and predictable environment for investors and project developers, reducing financial risks and making it more appealing to invest in renewable energy infrastructure. The consistent policy support helps accelerate research and development, allowing new technologies to be brought to market more quickly.

The impact of these policies can be seen in recent data. According to the International Energy Agency (IEA) in its Renewables 2023 report, strong government policy support was a key reason for the growth of solar PV and onshore wind installations in key regions such as the U.S. and the European Union. The report forecasts that under existing policies, global renewable capacity is set to reach 7,300 GW by 2028. This rapid deployment shows how government policies directly boost the market by creating a favorable climate for growth and investment.

Falling Costs of Technology: The dramatic reduction in the cost of renewable energy technologies, especially solar photovoltaics (PV) and wind power, has been a major driver for expansion. Economies of scale, improved manufacturing processes, and increased competition have made renewable energy sources more cost-competitive with traditional fossil fuels. This makes it more economically viable for both large-scale utility projects and small-scale residential installations. As a result, the financial case for switching to clean energy has become stronger, leading to broader adoption across different sectors.

A report from the International Renewable Energy Agency (IRENA) titled Renewable Power Generation Costs and PPA Prices 2023 notes that the global weighted-average levelized cost of electricity (LCOE) for new utility-scale solar PV projects that started operating in 2023 fell by a significant amount compared to 2022. The report states that the cost of electricity from new renewable power projects has continued to decline, making them the most affordable source of new electricity in most parts of the world. This ongoing reduction in costs makes renewable energy a more attractive and affordable choice for consumers and businesses alike, driving continued expansion.

Segmental Insights

Product Analysis

Based on product, the segmentation includes solar power, hydropower, bioenergy, wind power, and others. The solar power segment held the largest share in 2024. This dominance is a result of an unprecedented rate of new capacity additions globally in recent years, which has surpassed all other renewable sources. The primary driver behind this expansion is the dramatic and continuous reduction in the cost of solar panels and related technologies, making it the most affordable source of new electricity in many parts of the world. Additionally, the versatility of solar power allows for its widespread adoption, from large utility-scale power plants and industrial applications to small-scale residential rooftops and off-grid solutions. This flexibility, combined with increasing government support and consumer demand for sustainable energy, has contributed to the dominance of the solar power segment.

The hydropower segment is anticipated to register the highest growth rate during the forecast period. Hydropower, also known as hydroelectric power, is a clean and renewable energy source that uses the natural force of moving water to generate electricity. This process typically involves a dam or diversion structure that creates a difference in water elevation. As water is released, it flows through a pipe, spinning a turbine that is connected to a generator. The generator then converts this kinetic energy into electricity. A key characteristic of hydropower is its reliability and flexibility, as plants can provide power on demand to support the grid, making it a valuable backup for intermittent sources such as solar and wind.

Application Analysis

Based on application, the segmentation includes commercial, residential, and industrial. The industrial segment held the largest share in 2024. This segment’s dominance is primarily driven by the high energy consumption of manufacturing facilities, factories, and other large-scale operations. Industrial users require a massive and consistent supply of power to run their machinery and processes, and adopting renewable energy solutions, such as large-scale wind and solar farms, helps them meet these needs while reducing operational costs over the long term. Additionally, many industrial companies are under increasing pressure from regulators and consumers to meet corporate sustainability goals and reduce their carbon footprint. This has led to a significant shift toward cleaner energy sources, making the industrial application segment the largest consumer and driver of demand in the renewable energy.

The commercial segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is a result of businesses of all sizes, from retail stores and offices to hospitality and data centers, increasingly adopting renewable energy. These companies are motivated by a combination of factors, including the desire to lower their electricity bills, enhance their brand image, and comply with environmental, social, and governance (ESG) criteria. The development of more flexible and cost-effective solar installations, along with other on-site energy solutions, has made it easier for commercial entities to generate their own clean power. This trend is further supported by government incentives and policies designed to promote renewable energy adoption in the business sector, positioning the commercial segment for continued strong growth.

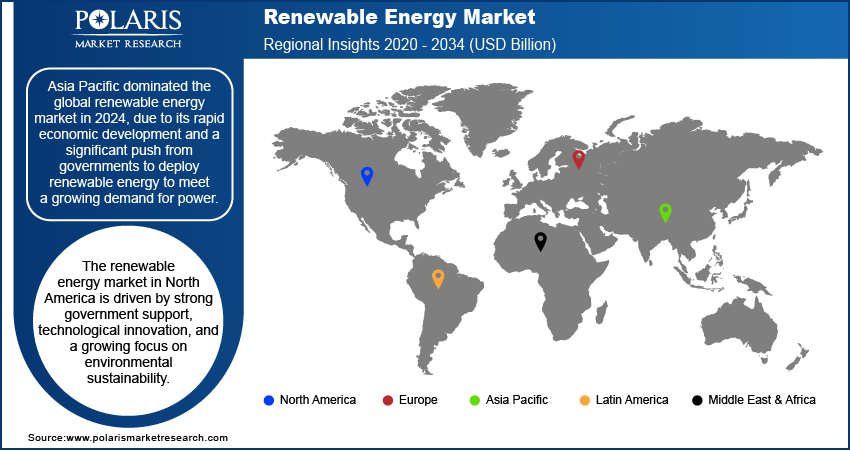

Regional Analysis

The Asia Pacific renewable energy market accounted for the largest share in 2024. Asia Pacific is a global powerhouse, characterized by rapid growth driven by rising energy demand, urbanization, and industrialization in emerging economies. The region is home to some of the world's most aggressive renewable energy deployments, with a focus on both large-scale power projects and distributed generation. Governments across the region are implementing strong policies and incentives to address energy security and environmental concerns, which are significant in a region with a large population and high economic activity. While the region is making great strides, challenges remain in financing and integrating these new technologies into existing, and sometimes outdated, grid infrastructure.

China Renewable Energy Market Insights

China is a major contributor to the industry growth in Asia Pacific. The country has become a global leader in renewable energy generation and technology. It is deploying solar and wind capacity at an unprecedented rate, supported by massive government investment and ambitious national goals. China is a major consumer of renewable energy as well as a leading manufacturer of solar panels and wind turbines, which has helped drive down costs globally. However, the country still faces challenges in transmitting power from its often remote renewable energy sites to its densely populated urban centers, which necessitates further investments in its grid infrastructure to fully realize its clean energy potential.

North America Renewable Energy Market Trends

The renewable energy in North America is driven by a combination of strong government support, technological innovation, and a growing focus on environmental sustainability. Countries across the region are investing heavily in new clean energy projects, particularly in wind and solar power, including home solar systems. The region's vast geographical landscape allows for the development of large-scale renewable projects, while an increasing number of companies are setting decarbonization goals that boost demand. The integration of modern grid technologies and energy storage solutions also helps manage the variable nature of renewable power sources, which supports the continued expansion.

U.S. Renewable Energy Market Outlook

In the U.S., there is a rising adoption of renewable energy due to the introduction of both federal and state-level policies. The country has a diverse portfolio of renewable sources, with wind energy being a major contributor, especially in the central states, while solar power is rapidly expanding nationwide, both in large utility-scale projects and in residential rooftop installations. A shift in corporate and consumer preferences toward clean energy is also a powerful driver. However, the landscape faces challenges related to grid modernization and connection delays for new projects, as the existing infrastructure struggles to keep pace with the rapid deployment of new renewable capacity.

Europe Renewable Energy Market Trends

Europe is a mature and highly developed market for renewable energy, with a long history of ambitious climate targets and supportive policies. The region has consistently been a leader in the transition to clean energy, driven by strong commitments to reduce greenhouse gas emissions and enhance energy security. European countries are making significant investments in offshore wind and solar power, and there is a growing focus on the electrification of transport and heating to further decarbonize the economy. A major push to phase out fossil fuels and a widespread public awareness of climate change are also strong underlying factors that support the ongoing development across the region.

The Germany renewable energy market, in particular, has been at the forefront of Europe’s transition for decades. The country’s policies have created a strong framework for the expansion of renewables, particularly solar and wind, and it has invested heavily in both onshore and offshore wind farms. Germany’s commitment to phasing out nuclear power has further accelerated the need for clean energy alternatives. The focus is now shifting toward managing the intermittency of these sources, with significant investments in battery storage and smart grid technology to ensure a stable and reliable power supply as the share of renewables continues to grow.

Key Players and Competitive Insights

The competitive landscape of the renewable energy industry is vast and dynamic, with key players such as NextEra Energy, Vestas Wind Systems, Ørsted, JinkoSolar, and Iberdrola leading the way. The competition is intense, driven by a global push for decarbonization and the increasing cost-effectiveness of clean energy technologies. Companies are trying to gain share through a combination of large-scale project development, technological innovation, and strategic partnerships. The landscape is not just defined by utility-scale operators but also by equipment manufacturers and service providers who are crucial to the value chain.

A few prominent companies in the industry include NextEra Energy, Inc.; Vestas Wind Systems A/S; Iberdrola, S.A.; Brookfield Renewable Corporation; Adani Green Energy Limited; Siemens Gamesa Renewable Energy, S.A.; First Solar, Inc.; inkoSolar Holding Co., Ltd.; Canadian Solar Inc.; and ReNew Energy Global PLC.

Key Players

- Adani Green Energy Limited

- Brookfield Renewable Corporation

- Canadian Solar Inc.

- First Solar, Inc.

- Iberdrola, S.A.

- JinkoSolar Holding Co., Ltd.

- NextEra Energy, Inc.

- Ørsted A/S

- ReNew Energy Global PLC

- Siemens Gamesa Renewable Energy, S.A.

- Vestas Wind Systems A/S

Renewable Energy Industry Developments

September 2025: Iberdrola España announced the commissioning of its photovoltaic plant in Ciudad Rodrigo. The company stated that the plant has a capacity of 316 MW. It will produce clean energy that can be supplied to over 155,000 homes. The plant will reduce carbon dioxide by 75,000 tonnes per year.

December 2024: ABB announced the signing of an agreement for the acquisition of the power electronics business of Gamesa Electric. With the acquisition, ABB aims to improve its positioning in the rapidly growing market for renewable power conversion technology.

December 2024: NSCH, headquartered in Massachusetts, signed a two-year agreement with ENGIE Resources to cover 100% of its energy consumption with Renewable Energy Credits (RECs). This initiative aligns with NSCH’s sustainability objectives by ensuring its energy use is fully offset through renewable generation.

April 2023: 3Degrees, Inc. partnered with the International Organization for Migration (IOM) and Energy Peace Partners (EPP) to support a second Peace Renewable Energy Credit (P-REC) transaction. This initiative financed the solar electrification of Malakal Teaching Hospital and Bor State Hospital in South Sudan.

Renewable Energy Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Solar Power

- Hydropower

- Bioenergy

- Wind Power

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Residential

- Industrial

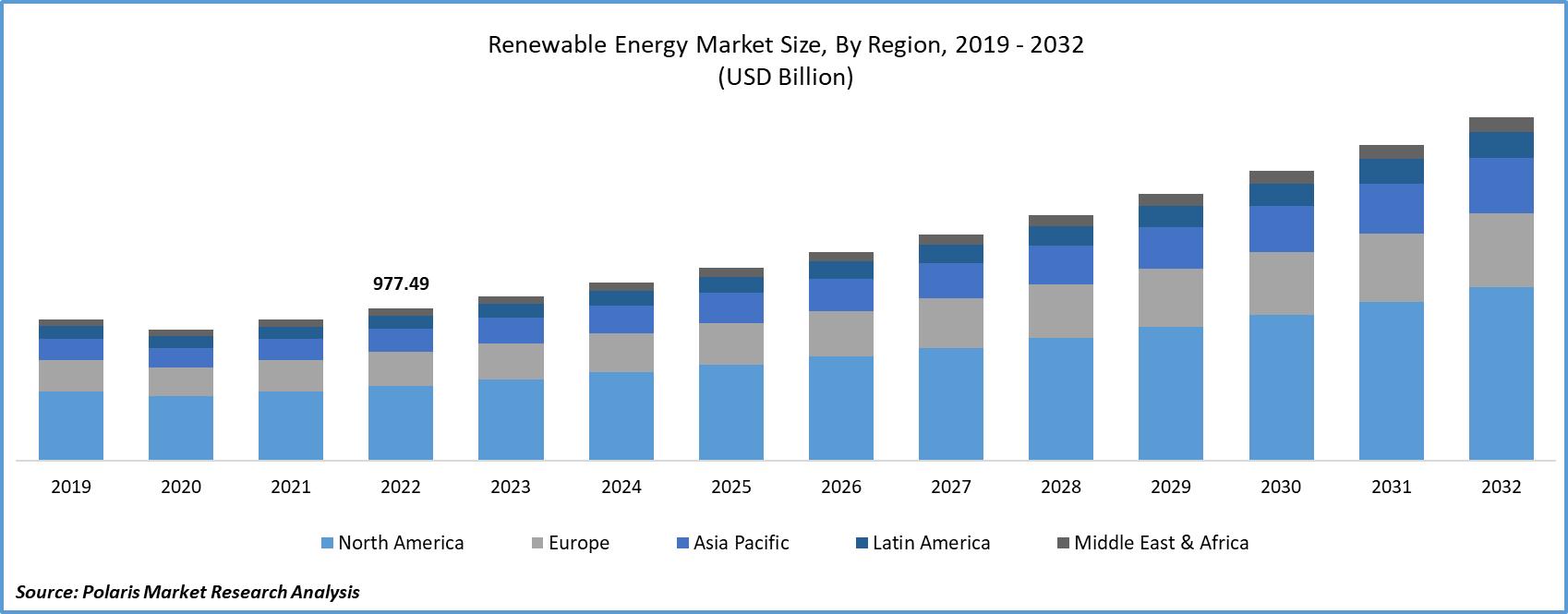

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Renewable Energy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,498.05 billion |

|

Market Size in 2025 |

USD 1,713.02 billion |

|

Revenue Forecast by 2034 |

USD 5,840.13 billion |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,498.05 billion in 2024 and is projected to grow to USD 5,840.13 billion by 2034.

The global market is projected to register a CAGR of 14.6% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include NextEra Energy, Inc.; Vestas Wind Systems A/S; Iberdrola, S.A.; Brookfield Renewable Corporation; Adani Green Energy Limited; Siemens Gamesa Renewable Energy, S.A.; First Solar, Inc.; inkoSolar Holding Co., Ltd.; Canadian Solar Inc.; and ReNew Energy Global PLC.

The solar power segment accounted for the largest share in 2024.

The commercial segment is expected to witness the fastest growth during the forecast period.