Wind Turbine Market Size, Share, Trends, Industry Analysis Report

By Axis (Vertical, Horizontal), By Installation, By Components, By Application, By Capacity, By Connectivity, By Rating, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6149

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

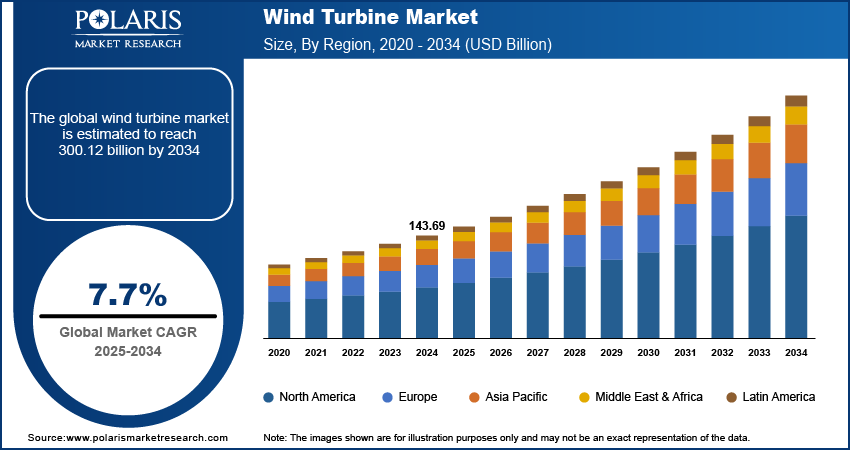

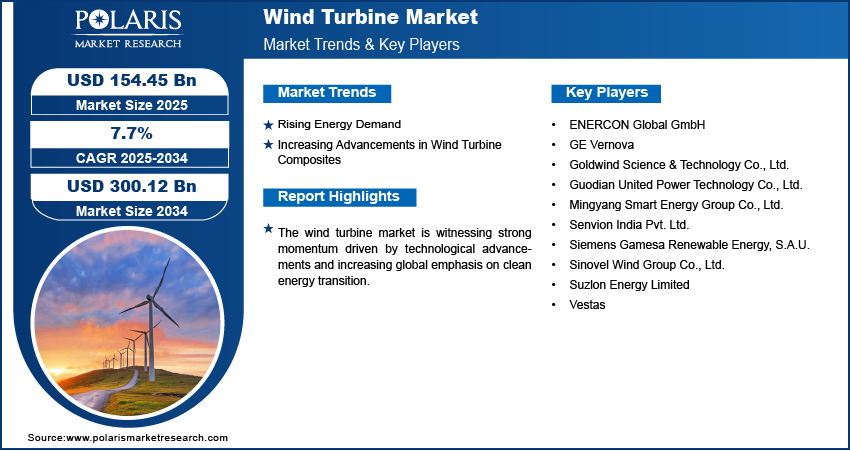

The global wind turbine market size was valued at USD 143.69 billion in 2024, growing at a CAGR of 7.7% from 2025 to 2034. Key factors driving demand for wind turbines include the rapid expansion of offshore wind development, rising global energy demand, increasing advancements in wind turbine composites.

Key Insights

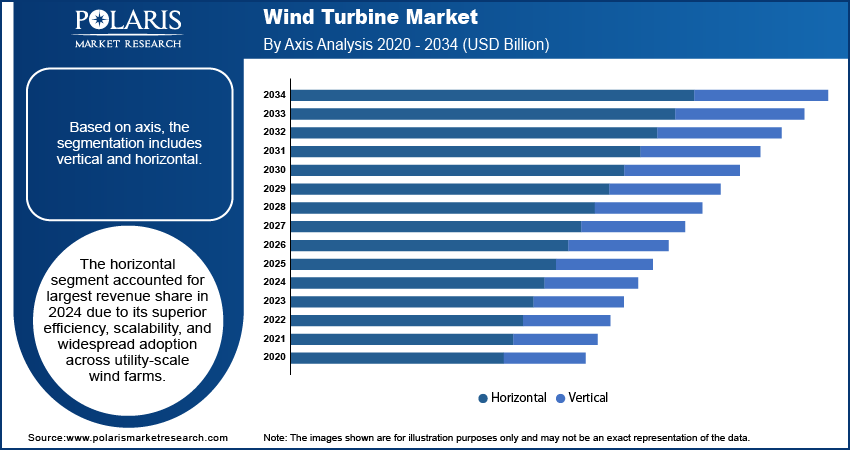

- The horizontal segment accounted for the largest revenue share in 2024 due to its superior efficiency, scalability, and widespread adoption across utility-scale wind farms.

- The offshore segment is expected to witness significant growth during the forecast period, driven by increasing investments in large-scale renewable energy projects and the availability of stronger, more consistent wind resources at sea.

- The rotator blade segment dominated the market in 2024 due to its crucial role in capturing energy and enhancing conversion efficiency within turbine systems.

- The utility segment dominated the market in 2024, driven by the need for large-scale energy production and the requirement for grid integration.

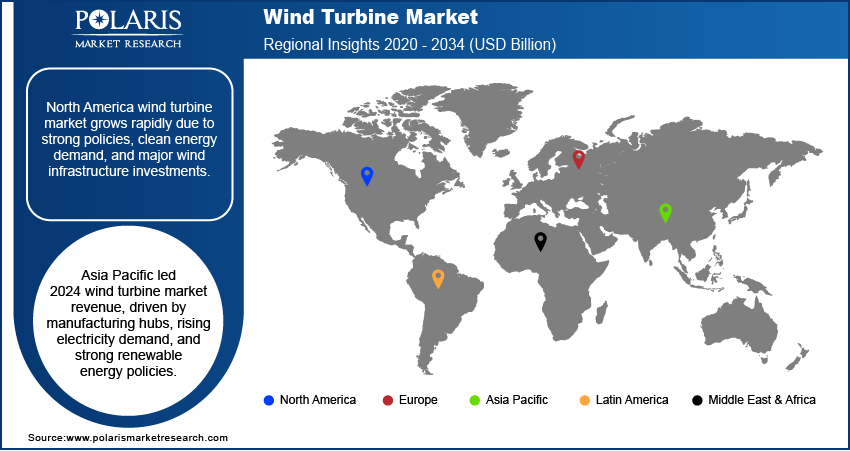

- The North America market is expected to witness the fastest growth during the forecast period due to robust policy frameworks supporting renewable energy, rising demand for clean power, and substantial investments in wind energy infrastructure.

- The U.S. held a significant market share in North America landscape in 2024 owing to its well-developed infrastructure, supportive regulatory environment, and strong federal and state-level renewable energy targets.

- Asia Pacific dominated the revenue share in 2024 primarily due to the presence of major manufacturing hubs, rising electricity demand, and strong government initiatives promoting the adoption of renewable energy.

- The market in China is expanding due to aggressive government policies aimed at reducing carbon emissions and increasing the share of renewables in the national energy mix.

Industry Dynamics

- Growing global energy demand, fueled by economic expansion and urbanization, is boosting adoption of wind turbines across residential, commercial, and industrial sectors.

- Advances in composite materials improve turbine blade efficiency and durability, supporting larger, more cost-effective wind energy systems.

- Offshore wind energy expansion offers significant growth potential, driven by higher wind speeds and reduced land constraints, enabling larger-scale renewable energy generation.

- High initial capital costs and complex logistics for installation and grid integration remain key barriers, particularly in emerging markets with limited infrastructure.

Market Statistics

- 2024 Market Size: USD 143.69 billion

- 2034 Projected Market Size: USD 300.12 billion

- CAGR (2025–2034): 7.7%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A wind turbine is a device that converts the kinetic energy of wind into mechanical energy, which is then transformed into electricity through a generator. The rapid expansion of offshore wind development is creating new opportunities for growth. Offshore wind farms offer higher and more consistent wind speeds compared to onshore installations, resulting in greater electricity output and increased efficiency. According to a February 2025 International Energy Agency report, global wind electricity generation increased by 10% (216 TWh) in 2023, surpassing a total output of 2,330 TWh from last year. This trend is being supported by advancements in turbine technology, foundation structures, and grid connectivity, which have made offshore projects more economically viable. The strategic deployment of offshore wind farms has become a critical component in achieving large-scale renewable energy targets as countries aim to diversify their energy mix.

The global push toward decarbonization and sustainability goals supports the growth opportunities. Wind turbines play a vital role in reducing dependence on fossil fuels by offering a clean, renewable energy, and scalable energy source. Governments and private stakeholders are aligning their energy policies and investments with climate commitments, which has significantly boosted demand for wind energy infrastructure. In June 2024, India's Union Cabinet approved a USD 890 million Viability Gap Funding (VGF) scheme for offshore wind, including USD 820 million for 1 GW projects (500 MW each in Gujarat & Tamil Nadu) and USD 72 million for port upgrades to support logistics. This transition is further reinforced by increasing regulatory support, carbon pricing mechanisms, and growing corporate commitments to net-zero emissions, collectively driving the adoption as a sustainable energy solution.

Drivers & Opportunities

Rising Energy Demand: Rising global energy demand is driving the expansion opportunities, as economies continue to expand and urbanization accelerates, leading to increased electricity consumption across residential, commercial, and industrial sectors. According to a March 2025 IEA report, global energy demand increased by 2.2% in 2024, a substantial rise compared to the historical annual growth rate. Governments and energy providers are turning to wind power as a reliable and renewable alternative to conventional fossil fuels to meet this surge in demand in a sustainable manner. Wind turbines provide a scalable and low-emission solution that supports both base-load and peak energy requirements. The deployment of these turbines is gaining momentum as part of integrated power generation strategies, as energy security and long-term supply stability become critical concerns.

Increasing Advancements in Wind Turbine Composites: Increasing advancements in wind turbine composites are enhancing the performance and efficiency of wind energy systems, driving further market growth. Innovations in composite materials used for turbine blades, such as carbon fiber and advanced resin systems, have significantly enhanced the strength-to-weight ratio, enabling longer and more durable blades without compromising structural integrity. In February 2025, ACCIONA's Turbine Made initiative began repurposing decommissioned wind turbine blades in Australia, starting with a blade from the Waubra Wind Farm for sustainable manufacturing purposes. These technological improvements contribute to higher energy output and lower maintenance costs over a turbine’s lifecycle. The adoption of advanced composites is becoming a crucial enabler in expanding the feasibility and competitiveness of wind power as manufacturers prioritize lightweight and high-performance materials to optimize turbine design and efficiency.

Segmental Insights

Axis Analysis

Based on axis, the segmentation includes vertical and horizontal. The horizontal segment accounted for a larger revenue share in 2024 due to its superior efficiency, scalability, and widespread adoption across utility-scale wind farms. Horizontal-axis wind turbines (HAWTs) are favored for their ability to generate higher power outputs, especially in regions with consistent wind flows. Their aerodynamic design enables optimal energy capture and facilitates easier integration with existing grid infrastructure. Additionally, the maturity of technology, lower cost per megawatt, and ease of maintenance contribute to their dominant position.

Installation Analysis

In terms of installation, the segmentation includes offshore and onshore. The offshore segment is expected to witness significant growth during the forecast period, driven by increasing investments in large-scale renewable energy projects and the availability of stronger, more consistent wind resources at sea. Offshore wind turbines operate at higher capacities without land constraints, making them an attractive option for nations with limited onshore space. Technological advancements in floating foundations and subsea cabling are also enhancing the feasibility of offshore projects, supporting the segment’s rapid expansion.

Components Analysis

The segmentation, based on components, includes rotator blade, generator, gearbox, and nacelle. The rotator blade segment dominated the market in 2024 due to its crucial role in capturing energy and enhancing conversion efficiency within these turbine systems. Rotor blades directly influence the performance, output, and operational lifespan of turbines. Manufacturers are prioritizing the development of lightweight, durable blades made from advanced composite materials as demand for larger and more powerful turbines continues to increase. The continuous innovation in blade design, aimed at reducing aerodynamic drag and increasing surface area, further reinforces the segment’s leadership.

Application Analysis

In terms of application, the segmentation includes, residential, utility, industrial, and commercial. The utility segment dominated the market in 2024, driven by the need for large-scale energy production and the requirement for grid integration. Utility companies are investing in wind energy infrastructure to diversify power sources and meet decarbonization mandates. The scale and output of utility-scale wind projects make them highly cost-effective and impactful in addressing national and regional energy demands. Moreover, favorable regulatory policies and access to financing are enabling consistent expansion in this application segment.

Regional Analysis

The North America wind turbine market is expected to witness fastest growth during the forecast period. This is attributed to robust policy frameworks supporting renewable energy, rising demand for clean power, and substantial investments in wind energy infrastructure. Technological advancements, combined with favorable land availability and strong interconnection systems, are accelerating project development across the region. Additionally, increased collaboration between the private and public sectors is promoting a dynamic environment for the deployment of wind energy.

U.S. Wind Turbine Market Insights

The U.S. held a significant revenue share in North America wind turbine landscape in 2024, owing to its well-developed infrastructure, supportive regulatory environment, and strong federal and state-level renewable energy targets. The country’s vast land availability and favorable wind conditions, particularly in the Midwest and coastal regions, have enabled the development of large-scale wind farms. Additionally, robust investments in grid modernization and technological advancements in turbine design continue to support expansion opportunities.

Asia Pacific Wind Turbine Market Trends

Asia Pacific dominated the global wind turbine market revenue share in 2024, primarily due to the presence of major manufacturing hubs, rising electricity demand, and strong government initiatives promoting the adoption of renewable energy. For instance, a May 2024 U.S. EIA report noted Japan's goal for carbon neutrality by 2050, targeting a non-fossil fuel power share of 59% by 2030 (up from 31% in 2022), with renewables at 36–38% and nuclear power at 20–22%. Countries across the region are aggressively scaling up wind power capacity to reduce reliance on fossil fuels and meet carbon neutrality goals. The region also benefits from cost-effective labor, favorable climatic conditions, and a growing domestic supply chain, supporting the rapid deployment of both onshore and offshore wind projects.

China Wind Turbine Market Overview

The market in China is expanding due to aggressive government policies aimed at reducing carbon emissions and increasing the share of renewables in the national energy mix. China’s extensive manufacturing capabilities and cost-effective supply chain have made it a global hub for wind turbine production. The country's focus on both onshore and offshore project development, supported by substantial infrastructure investments, is accelerating deployment and driving growth.

Europe Wind Turbine Market Assessment

The wind turbine landscape in Europe is projected to hold a substantial share by 2034 due to the region’s long-standing commitment to sustainability, strict emissions regulations, and well-established wind energy infrastructure. European nations are continuously investing in offshore wind capacity and cross-border energy interconnectivity to enhance energy security and meet climate targets. The presence of major industry players, advanced research and development capabilities, and supportive policy mechanisms further positions Europe as a stronghold in the future of wind energy deployment.

UK Wind Turbine Market Analysis

The growth of the UK sector is driven by the country’s leadership in offshore wind development and its long-term commitment to achieving net-zero emissions. The UK has leveraged its favorable coastal geography to establish high-capacity offshore projects, supported by a mature regulatory framework and a competitive auction system. Innovation in floating wind technology, combined with consistent government support, is further boosting the sector’s expansion.

Key Players & Competitive Analysis

The wind turbine industry is witnessing intense competition driven by strategic investments, technological advancements, and emerging market segments. Major players are leveraging competitive intelligence to capitalize on revenue opportunities, particularly in developed sectors, while exploring expansion opportunities in high-growth regions. Disruptions and trends, such as blade recycling initiatives and floating offshore turbines, are reshaping sustainable value chains. Economic and geopolitical shifts are influencing vendor strategies, with companies focusing on growth projections and region-wise market size to optimize their regional footprint. Small and medium-sized businesses are entering the space through innovative future development strategies, while established firms prioritize revenue growth analysis and mitigation of supply chain disruptions. Expert insights highlight latent demand for hybrid energy solutions and grid integration technologies. Industry leaders are adopting sustainability strategies, diversifying their product offerings, and forming joint ventures to maintain a competitive position. Macroeconomic trends, including decarbonization policies, further accelerate business transformation, creating a dynamic landscape where revenue share hinges on technological assessment and pricing insights.

A few major companies operating in the industry include ENERCON Global GmbH; GE Vernova; Goldwind Science & Technology Co., Ltd.; Guodian United Power Technology Co., Ltd.; Mingyang Smart Energy Group Co., Ltd.; Senvion India Pvt. Ltd.; Siemens Gamesa Renewable Energy, S.A.U.; Sinovel Wind Group Co., Ltd.; Suzlon Energy Limited; and Vestas.

Key Players

- ENERCON Global GmbH

- GE Vernova

- Goldwind Science & Technology Co., Ltd.

- Guodian United Power Technology Co., Ltd.

- Mingyang Smart Energy Group Co., Ltd.

- Senvion India Pvt. Ltd.

- Siemens Gamesa Renewable Energy, S.A.U.

- Sinovel Wind Group Co., Ltd.

- Suzlon Energy Limited

- Vestas

Wind Turbine Industry Developments

- December 2024: Envision Energy secured a contract to supply 344.5 MW wind turbines for ACEN’s Quezon North Wind project, the Philippines’ largest single wind deal. This follows their collaboration on the 600 MW Monsoon Wind in Laos, Southeast Asia’s first cross-border wind initiative.

- September 2024: Senvion India launched its 4.2M160 wind turbine, a 4 MW WTG with a 160m rotor, designed for low-wind conditions. Featuring adaptive controls, DFIG technology, and compliance with IEC/IECRE standards, it is optimized for reliability in diverse climates, including high temperatures and dusty environments.

Wind Turbine Market Segmentation

By Axis Outlook (Revenue, USD Billion, 2020–2034)

- Vertical

- Horizontal

By Installation Outlook (Revenue, USD Billion, 2020–2034)

- Offshore

- Onshore

By Components Outlook (Revenue, USD Billion, 2020–2034)

- Rotator blade

- Generator

- Gearbox

- Nacelle

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Utility

- Industrial

- Commercial

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Small

- Medium

- Large

By Connectivity Outlook (Revenue, USD Billion, 2020–2034)

- Grid Connected

- Stand Alone

By Rating Outlook (Revenue, USD Billion, 2020–2034)

- < 100 kW

- 100 kW to 250 kW

- > 250 kW to 500 kW

- > 500 kW to 1 MW

- 1 MW to 2 MW

- >2 MW

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wind Turbine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 143.69 Billion |

|

Market Size in 2025 |

USD 154.45 Billion |

|

Revenue Forecast by 2034 |

USD 300.12 Billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 143.69 billion in 2024 and is projected to grow to USD 300.12 billion by 2034.

The global market is projected to register a CAGR of 7.7% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are ENERCON Global GmbH; GE Vernova; Goldwind Science & Technology Co., Ltd.; Guodian United Power Technology Co., Ltd.; Mingyang Smart Energy Group Co., Ltd.; Senvion India Pvt. Ltd.; Siemens Gamesa Renewable Energy, S.A.U.; Sinovel Wind Group Co., Ltd.; Suzlon Energy Limited; and Vestas.

The horizontal segment accounted for largest revenue share in 2024.

The offshore segment is expected to witness significant growth during the forecast period.