Wind Turbine Composites Market Size, Share, & Industry Analysis Report

: By Fiber Type (Glass Fiber, Carbon Fiber, and Others), By Application, By Manufacturing Process, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5942

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

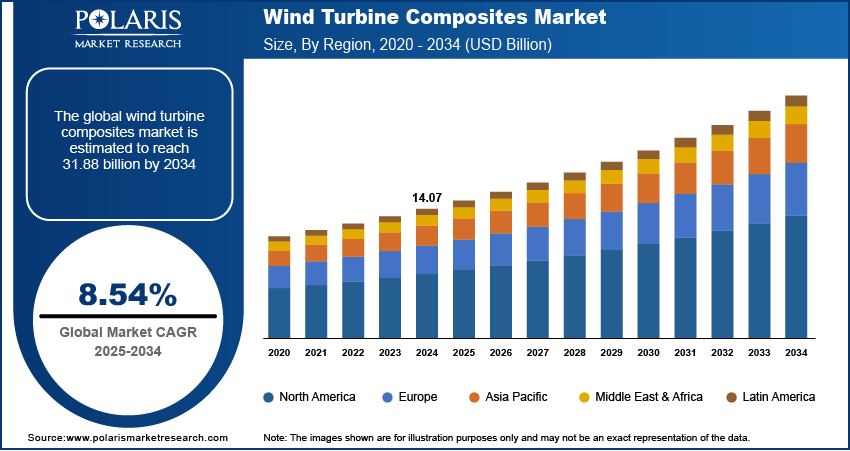

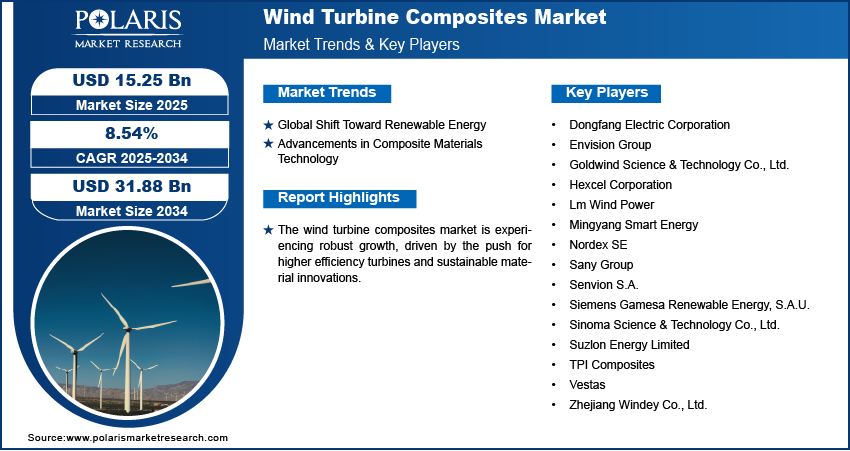

The global wind turbine composites market size was valued at USD 14.07 billion in 2024, growing at a CAGR of 8.54% during 2025–2034. The growth is driven by the increasing focus on fire resistance and thermal management.

Wind turbine composites are advanced materials, primarily composed of glass or carbon fibers mixed in a resin matrix, used in the manufacturing of wind turbine components such as blades, nacelles, and hubs. These composites offer superior strength-to-weight ratios, corrosion resistance, and design flexibility, making them integral to improving turbine efficiency and longevity. The growth of this market is attributed to the increasing focus of the government on renewable energy, backed by incentives and supportive regulatory frameworks. For instance, a February 2022 report by India's Ministry of New and Renewable Energy outlined major renewable energy incentives, such as 100% FDI allowance, waived transmission charges for solar/wind projects until June 2025, RPO targets, ultra-mega parks, and financial support for R&D initiatives. Favorable policies such as feed-in tariffs, tax credits, and renewable energy targets are also encouraging wind energy deployment, thereby boosting demand for durable and high-performance composite materials used in turbine construction.

To Understand More About this Research: Request a Free Sample Report

The rapid development of onshore and offshore wind installations is boosting the expansion opportunities as countries are moving toward sustainable energy sources. There has been a surge in wind farm deployments across diverse geographies, both on land and at sea. According to an IEA report from February 2025, onshore wind installations dominated global wind capacity in 2023, accounting for 93% (945 GW) of the total 1015 GW, while offshore systems represented just 7% (70 GW) of the installed base. The demand for lighter, more resilient materials that can withstand harsh environmental conditions, especially in offshore applications, is boosting the adoption of turbine composites. The scalability and improved mechanical properties of these composites make them ideal for large rotor blades, which are essential for capturing more wind energy and improving overall turbine output, further reflecting their relevance in modern wind energy infrastructure.

Industry Dynamics

Global Shift Toward Renewable Energy

Countries across the world are strengthening efforts to reduce carbon emissions and decrease reliance on fossil fuels. Wind energy, being one of the most scalable and cost-effective renewable sources, has witnessed accelerated adoption worldwide. According to a February 2025 IEA report, renewables are projected to grow from 30% of global energy generation in 2023 to 46% by 2030, with solar and wind power driving nearly all of this expansion. This transition has directly increased the demand for wind turbines, particularly those that are lighter, more durable, and capable of operating efficiently in varied conditions. Composites, with their excellent mechanical properties and resistance to fatigue, are essential in manufacturing high-performance turbine blades and structural components, thereby aligning with the global renewable energy agenda. Hence, the global shift toward renewable energy is driving the market demand.

Advancements in Composite Materials Technology

Advancements in composite materials technology are boosting the market by allowing the production of larger, more efficient, and longer-lasting wind turbine castings. In September 2021, Siemens Gamesa launched the world's first commercially viable recyclable wind turbine blades (RecyclableBlade), marking a major sustainability milestone. Initial installations were planned with RWE, EDF Renewables, and WPD, supporting the goal of fully recyclable turbines. Innovations in resin systems, fiber reinforcement, and manufacturing techniques have improved the structural integrity and aerodynamic performance of turbine blades. These technological improvements improve energy capture and also contribute to reducing overall maintenance and operational costs. The role of advanced composites becomes increasingly essential in supporting next-generation wind energy systems as the industry pushes toward optimizing turbine output and lowering the levelized cost of energy (LCOE).

Segmental Insights

By Type Analysis

The global wind turbine composites market segmentation, based on type, includes blades, nacelles, and others. The nacelle segment is anticipated to register the fastest growth in the wind turbine composite market during the forecast period, owing to its vital function in housing and protecting key turbine components such as the gearbox, generator, and brake system. The structural requirements of nacelles have become more demanding with the ongoing development of larger and more powerful turbines, necessitating the use of advanced composite materials that provide both durability and weight reduction. Improved design standards and increased energy efficiency targets are further driving the use of high-performance composites in nacelle structures. The demand for lightweight and corrosion-resistant composite nacelles is expected to accelerate as the wind energy sector shifts toward more complex and higher-capacity installations.

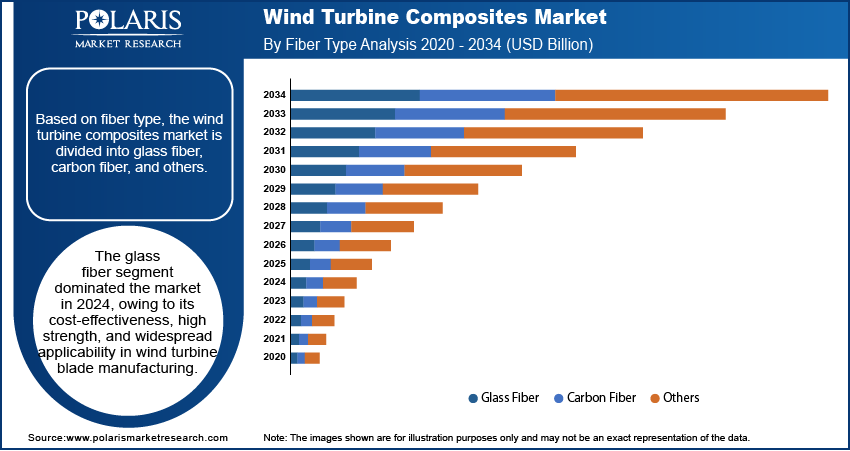

By Fiber Type Analysis

The global market segmentation, based on fiber type, includes glass fiber, carbon fiber, and others. The glass fiber segment dominated the market in 2024 owing to its cost-effectiveness, high strength, and widespread applicability in wind turbine blade manufacturing. Glass fiber composites offer a strong balance between performance and affordability, making them the preferred material in large-scale onshore wind installations. Additionally, their ease of processing and compatibility with various resin systems improve production efficiency. The mature supply chain and long-standing use of glass fiber have further supported its dominance, particularly in regions prioritizing cost-efficient wind energy solutions.

By Manufacturing Process Analysis

The global market segmentation, based on manufacturing process, includes vacuum injection molding, prepreg, and hand lay-up. The prepreg segment is expected to witness substantial growth during the forecast period, driven by its superior material properties, such as uniform resin distribution, high fiber content, and reduced void formation. Prepreg composites allow manufacturers to achieve consistent quality and improved mechanical performance in critical wind turbine components such as blades and nacelles. The need for materials that offer both precision and structural integrity becomes more pressing as turbine sizes increase and operational demands intensify. The shift toward automated and advanced manufacturing processes is also expected to support the wider adoption of prepreg technology.

Regional Analysis

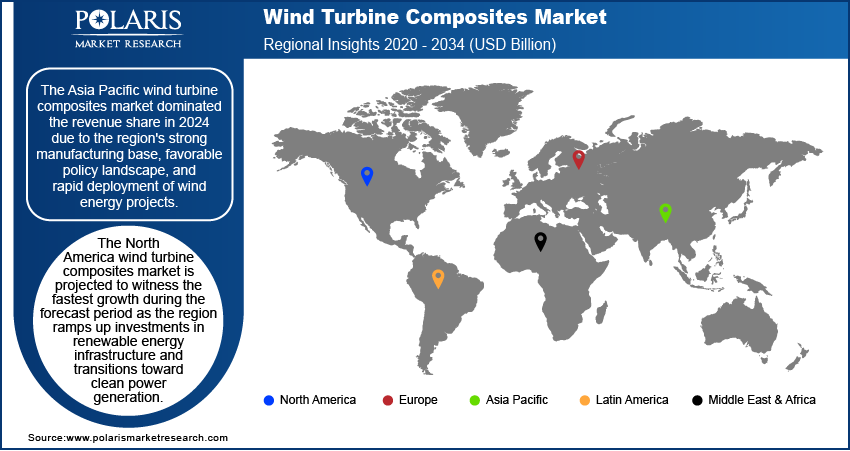

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific wind turbine composites market dominated the revenue share in 2024 due to the region's strong manufacturing base, favorable policy landscape, and rapid deployment of wind energy projects. A December 2024 MNRE report revealed that India achieved 200 GW of installed renewable energy capacity by September 2024, rising to 214 GW by November, a 14% yearly increase. The April-November 2024 period saw 15 GW added, doubling the previous year's growth rate. Countries such as China, India, Japan, and South Korea are investing particularly in wind power infrastructure, supported by national renewable energy targets and increasing demand for clean electricity. The availability of raw materials, low production costs, and expanding domestic turbine manufacturing capabilities have also contributed to the region’s leadership. Asia Pacific continues to be a strategic hub for both onshore and offshore wind development.

The North America wind turbine composites market is projected to witness the fastest growth during the forecast period as the region ramps up investments in renewable energy infrastructure and transitions toward clean power generation. According to a 2024 IEA report, the US Infrastructure Investment and Jobs Act allocated USD 75 billion to clean energy, including USD 21.3 billion for grid upgrades, USD 21.5 billion for demonstrations, USD 6.5 billion for efficiency, and USD 8.6 billion for manufacturing and workforce development. The US and Canada are focusing on expanding both onshore and offshore wind capacities, with growing demand for high-performance materials to support large-scale turbine installations. Government incentives and technological innovation are encouraging the adoption of composite solutions tailored for harsh operating environments. North America’s strong engineering capabilities and increasing private sector participation are expected to drive growth opportunities in the coming years.

The Europe wind turbine composites market is projected to witness substantial growth during the forecast period due to the region’s leadership in offshore wind deployment and strong regulatory support for renewable energy. Countries such as Germany, the UK, France, and Denmark have long-standing commitments to decarbonization, which includes scaling up wind energy capacities. The region’s focus on sustainability, innovation in composite technologies, and collaboration between governments and private companies is enabling a favorable environment for expansion opportunities. Europe’s mature infrastructure and robust R&D investments will continue to shape the evolution of advanced composites.

Key Players and Competitive Analysis

The wind turbine composites sector is witnessing transformative growth driven by technological advancements in lightweight materials and sustainable value chains. Major players are capitalizing on expansion opportunities in both developed markets such as North America and emerging markets across Asia, where wind energy adoption accelerates. Strategic investments in R&D that focus on improving blade durability and efficiency are rising, while economic and geopolitical shifts influence raw material sourcing. Vendor strategies highlight product offerings optimized for larger turbine designs, with leading competitive intelligence guiding mergers such as LM Wind Power's integration into GE Renewable Energy. Small and medium-sized businesses innovate with recyclable resins to address supply chain disruptions, while multinationals leverage regional footprints to meet localized demand. Expert insights highlight latent demand for offshore wind solutions, with competitive positioning increasingly tied to carbon-neutral products production methods. The future of ecosystems relies on partnerships spanning material science firms to renewable energy developers as disruptive technologies such as 3D-printed molds emerge. A few key players are Dongfang Electric Corporation; Envision Group; Goldwind Science & Technology Co., Ltd.; Hexcel Corporation; LM Wind Power; Mingyang Smart Energy; Nordex SE; Sany Group; Senvion S.A.; Siemens Gamesa Renewable Energy, S.A.U.; Sinoma Science & Technology Co., Ltd.; Suzlon Energy Limited; TPI Composites; Vestas; and Zhejiang Windey Co., Ltd.

TPI Composites, Inc. is an independent manufacturer of composite wind blades headquartered in Scottsdale, Arizona, with a global footprint spanning factories in the US, Mexico, Türkiye, and India, as well as engineering development centers in Denmark and Germany. Founded in 1968, TPI has specialized in composite wind blades since 2001, leveraging decades of expertise in advanced carbon materials and manufacturing processes to serve the rapidly growing wind energy sector. The company is a strategic partner to many of the world’s top wind turbine OEMs, allowing them to outsource blade production and expand their global capacity efficiently. TPI’s wind blades are engineered to customer specifications and manufactured in strategically located facilities to minimize costs and support local markets. The company also provides comprehensive field services, such as inspection, repair, and preventative maintenance, further supporting the lifecycle of wind turbine components. TPI’s products contribute greatly to global decarbonization efforts.

Hexcel Corporation has been in advanced composite materials, playing a major role in this market for over 25 years. Hexcel supplies a broad range of high-performance materials, such as glass and carbon fibers, non-crimp fabrics, prepregs, laminates, and pultruded elements tailored specifically for wind turbine blade manufacturers with dedicated manufacturing facilities in Asia, Europe, and the USA. Their products, such as the HexPly prepregs and HiMax multiaxial fabrics, are engineered to deliver exceptional strength, fatigue resistance, and lightweight durability, allowing the production of longer, more efficient wind blades that exceed 80 meters in length. Hexcel’s expertise extends to process innovation, offering solutions for various manufacturing routes such as prepreg, infusion, and co-infusion technologies and providing technical performance for semi-automatic processes. The company’s materials are critical in addressing the evolving needs of the wind energy sector, supporting the shift toward larger turbines and more sustainable, recyclable composite solutions.

Key Players

- Dongfang Electric Corporation

- Envision Group

- Goldwind Science & Technology Co., Ltd.

- Hexcel Corporation

- Lm Wind Power

- Mingyang Smart Energy

- Nordex SE

- Sany Group

- Senvion S.A.

- Siemens Gamesa Renewable Energy, S.A.U.

- Sinoma Science & Technology Co., Ltd.

- Suzlon Energy Limited

- TPI Composites

- Vestas

- Zhejiang Windey Co., Ltd.

Industry Developments

In February 2025, Exel Composites, Owens Corning, and Urban Canopee partnered to develop circular, biobased composite materials for urban cooling solutions. The collaboration utilizes recycled glass fiber and bio-resins in pull-winding production for Urban Canopee’s Corolle plant canopy systems.

In October 2024, ZEBRA project, led by IRT Jules Verne with industry partners, achieved full recyclability of thermoplastic wind turbine blades using Elium resin and recycled glass fiber. The initiative demonstrated closed-loop recycling with validated environmental and economic benefits.

Wind Turbine Composites Market Segmentation

By Fiber Type Outlook (Revenue, USD Billion, 2020–2034)

- Glass Fiber

- Carbon Fiber

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Blades

- Nacelles

- Others

By Manufacturing Process Outlook (Revenue, USD Billion, 2020–2034)

- Vacuum Injection Molding

- Prepreg

- Hand Lay-up

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Wind Turbine Composites Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.07 billion |

|

Market Size Value in 2025 |

USD 15.25 billion |

|

Revenue Forecast by 2034 |

USD 31.88 billion |

|

CAGR |

8.54% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 14.07 billion in 2024 and is projected to grow to USD 31.88 billion by 2034.

The global market is projected to register a CAGR of 8.54% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Dongfang Electric Corporation; Envision Group; Goldwind Science & Technology Co., Ltd.; Hexcel Corporation; LM Wind Power; Mingyang Smart Energy; Nordex SE; Sany Group; Senvion S.A.; Siemens Gamesa Renewable Energy, S.A.U.; Sinoma Science & Technology Co., Ltd.; Suzlon Energy Limited; TPI Composites; Vestas; and Zhejiang Windey Co., Ltd.

The glass fiber segment dominated the market in 2024.

The nacelle segment is expected to witness the fastest growth during the forecast period.