U.S. Breast Conserving Surgery Market Size, Share, Trends, Industry Analysis Report

By Product Type (Lumpectomy Devices, Radiofrequency Ablation Devices), By Surgery Type, By End User, By Technology – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6014

- Base Year: 2024

- Historical Data: 2020-2023

Overview

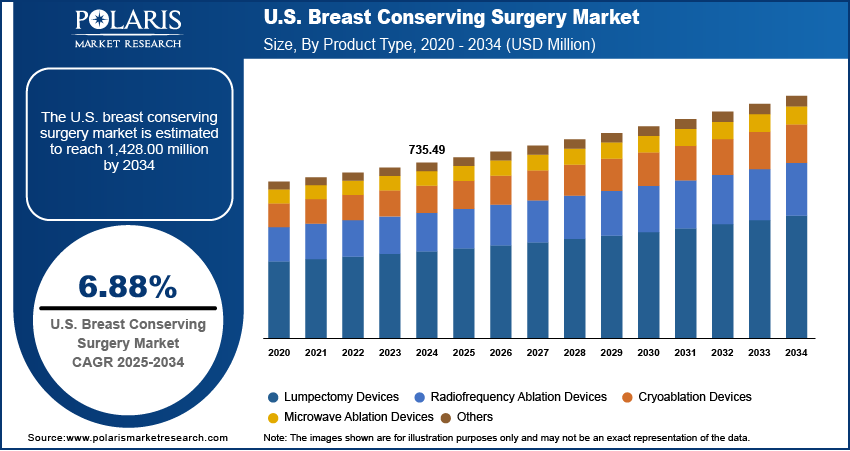

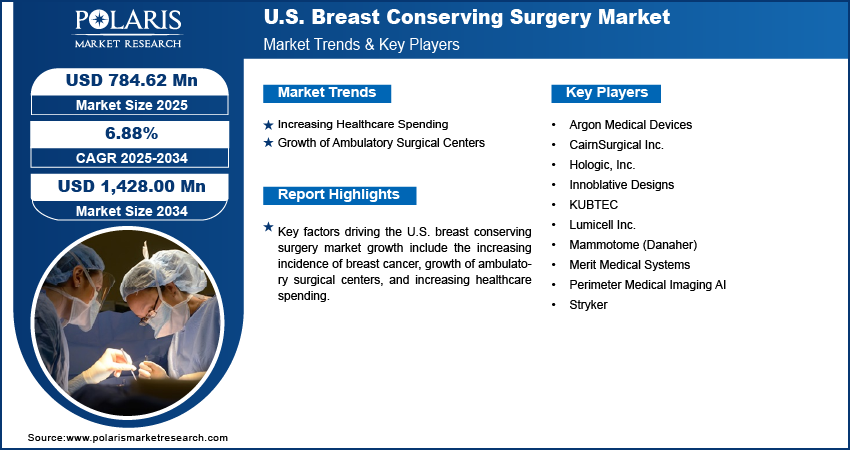

The U.S. breast conserving surgery (BCS) market size was valued at USD 735.49 million in 2024, growing at a CAGR of 6.88% from 2025 to 2034. Key factors driving demand for breast conserving surgeries in the country include the increasing incidence of breast cancer, growth of ambulatory surgical centers, and increasing healthcare spending.

Key Insights

- The lumpectomy devices segment accounted for a major revenue share in 2024.

- The hospitals segment dominated the revenue share in 2024.

- The traditional surgical techniques segment held a major market share in 2024.

- The image-guided surgery segment is projected to grow at a rapid pace during the forecast period.

Breast conserving surgery (BCS), also known as lumpectomy, partial mastectomy, or wide local excision, is a surgical procedure aimed at removing cancerous or abnormal tissue from the breast while preserving as much of the normal breast as possible. Unlike a mastectomy, where the entire breast is removed, BCS targets only the tumor and a small margin of surrounding healthy tissue to ensure complete excision of cancer cells. The primary goal is to achieve effective cancer control while maintaining the breast’s appearance and minimizing physical and psychological impacts. BCS is typically recommended for women with early-stage breast cancer or localized tumors that are small relative to the size of the breast. The procedure often includes the removal of some lymph nodes to check for cancer spread. After surgery, most patients undergo radiation therapy to destroy any remaining cancer cells and reduce the risk of recurrence.

In the U.S., breast conserving surgery has become an important technique in the management of early-stage breast cancer, reflecting advances in surgical techniques and a growing emphasis on quality of life. Breast conserving surgery is the preferred option for many women with localized breast tumors, with national guidelines recommending it for most early-stage cases, provided clear surgical margins can be achieved. The U.S. healthcare system continues to focus on multidisciplinary care, patient education, and access to advanced surgical and radiological technologies, ensuring that breast conserving surgery remains a safe, effective, and patient-centered option for breast cancer treatment.

The U.S. breast conserving surgery market demand is driven by the increasing incidence of breast cancer. Breast Cancer Organization, in its report, stated that every year, breast cancer accounts for about 30% of all new cancer cases in U.S. women. This is driving breast cancer patients and healthcare providers to prefer breast conserving surgery as it preserves the natural appearance of the breast while offering comparable survival outcomes to mastectomy in early-stage cases. Hence, as breast cancer cases continue to rise, especially among younger women, the medical community in the U.S. increasingly adopts BCS as a standard approach, further fueling its demand.

Industry Dynamics

- Increasing healthcare spending is driving the U.S. breast conserving surgery market growth by reducing cost.

- Growth of ambulatory surgical centers is propelling the demand for breast conserving surgery by enhancing comfort and satisfaction.

- Technological advancements in wireless localization and AI-based margin assessment would create a lucrative market opportunity.

- The rising risk of local cancer recurrence compared to mastectomy treatment is hindering the industry's expansion.

Increasing Healthcare Spending: Increasing funding allows hospitals to invest in better technology, train more specialists, and raise awareness about surgical options, encouraging patients to choose breast conserving procedures over mastectomies. The American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion. Insurance coverage expansions under higher healthcare budgets are further reducing costs, making the surgery financially practical for more women. Public health campaigns, funded by increased spending, are educating patients about the benefits of breast-conserving surgery, further driving demand. Additionally, improved post-operative care and rehabilitation services, supported by higher budgets, are enhancing recovery outcomes, making the procedure more appealing.

Growth of Ambulatory Surgical Centers: The expansion of ambulatory surgical centers is driving demand for breast conserving surgery by offering a faster, more convenient, and cost-effective alternative to traditional hospital settings. These centers specialize in outpatient procedures, reducing wait times and allowing patients to recover at home, which appeals to those seeking minimally invasive options. Lower operational costs in ambulatory care services are making breast-conserving surgery more financially accessible. The streamlined, patient-focused environment in ambulatory surgical centers is also enhancing comfort and satisfaction, encouraging more women to choose BCS over mastectomies. Additionally, the expansion of ambulatory surgical facilities is increasing overall capacity, reducing scheduling delays and enabling more timely treatments, further driving demand for breast conserving surgeries across the U.S.

Segmental Insights

Product Type Analysis

Based on product type, the U.S. breast conserving surgery market segmentation includes lumpectomy devices, radiofrequency ablation devices, cryoablation devices, microwave ablation devices, and others. The lumpectomy devices segment accounted for a major market revenue share in 2024 due to their widespread adoption as the standard surgical approach for early-stage breast cancer. Surgeons favored these devices for their precision in excising tumors while preserving surrounding healthy breast tissue, which aligns with patients’ growing preference for cosmetically favorable outcomes. Technological advancements in surgical instrumentation, such as improved margin assessment tools and intraoperative imaging systems, have further enhanced lumpectomy outcomes, driving their continued dominance. Additionally, favorable reimbursement policies and strong clinical guidelines recommending breast-conserving therapy contributed to the segment’s expansion.

The radiofrequency ablation devices segment is projected to grow at a robust pace in the coming years, driven by its minimally invasive nature and increasing use among patients who are ineligible for traditional surgery. RFA enables localized tumor destruction with minimal scarring, reduced operative time, and quicker recovery, making it particularly attractive for elderly patients and those with comorbidities. The integration of RFA with real-time imaging technologies has also improved targeting accuracy, leading to better oncological outcomes. Ongoing clinical trials and FDA approvals for new indications continue to expand its clinical utility, which supports its projected growth in the future.

Surgery Type Analysis

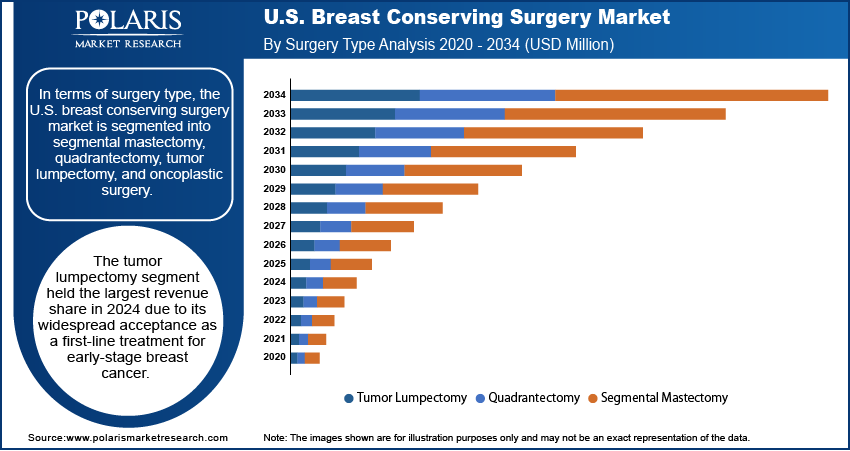

In terms of surgery type, the U.S. breast conserving surgery market segmentation includes segmental mastectomy, quadrantectomy, tumor lumpectomy, and oncoplastic surgery. The tumor lumpectomy segment held the largest market revenue share in 2024 due to its widespread acceptance as a first-line treatment for early-stage breast cancer. Physicians prefer this approach as it effectively removes malignant tissue while preserving the majority of the breast, resulting in better cosmetic outcomes and reduced psychological impact for patients. Advances in surgical techniques and imaging-guided margin assessments have improved the precision of tumor excision, which has led to lower recurrence rates and increased patient confidence in the procedure. Furthermore, national screening programs and rising awareness have contributed to earlier diagnosis, which favors tumor lumpectomy over other radical procedures.

End User Analysis

In terms of end user, the segmentation includes hospitals, ambulatory surgical centers (ASCs), specialty clinics, and cancer research institutes. The hospitals segment dominated the revenue share in 2024 due to their advanced infrastructure, multidisciplinary care teams, and access to comprehensive diagnostic and therapeutic resources. These facilities routinely handle complex breast cancer cases and offer integrated services such as radiology, pathology, digital pathology, teleradiology, and reconstructive surgery under one roof, making them the preferred choice for both patients and physicians. Hospitals also benefit from a higher concentration of board-certified oncologic surgeons and breast care specialists, which contributes to better clinical outcomes. Additionally, the availability of inpatient care, advanced imaging technologies, and intraoperative monitoring has strengthened the segment's dominance.

Technology Analysis

In terms of technology, the U.S. breast conserving surgery market segmentation includes traditional surgical techniques, image-guided surgery, robotic-assisted surgery, and minimally invasive techniques. The traditional surgical techniques segment accounted for a major market share in 2024 due to their long-standing use, widespread surgeon familiarity, and proven clinical outcomes. Most surgeons continue to rely on conventional lumpectomy methods, especially in community and academic settings where access to high-cost advanced systems may be limited. These techniques offer predictable procedural workflows and remain the standard in many treatment guidelines for early-stage breast cancer. The continued availability of skilled surgical personnel trained in these approaches, along with the presence of supportive reimbursement frameworks, has reinforced their position as the dominant technology in clinical practice.

The image-guided surgery segment is projected to grow at a rapid pace during the forecast period, owing to its ability to offer precision and real-time visualization in achieving clear margins and minimizing re-excisions. This approach integrates intraoperative imaging modalities such as 3D ultrasound, ultrasound, MRI, or optical coherence tomography, which enhance tumor localization and allow surgeons to differentiate malignant from healthy tissue with greater accuracy. The rising demand for techniques that improve oncologic and cosmetic outcomes is driving the adoption of image-guided solutions, particularly in centers aiming to reduce local recurrence rates. Technological advancements, coupled with growing surgeon training and evidence supporting superior outcomes, continue to push the segment growth.

Key Players and Competitive Analysis

The U.S. breast conserving surgery market is highly competitive, with key players offering innovative technologies to improve surgical precision, margin assessment, and patient outcomes. Hologic, Inc. and Mammotome (Danaher) dominate the market with advanced biopsy and localization solutions, such as Hologic’s ATEC system and Mammotome’s Breast Lesion Excision System (BLES), which streamline tumor removal while minimizing tissue damage. Stryker competes strongly with its SAVI SCOUT radar-based localization system, reducing reliance on wire-guided procedures and improving surgical workflow. Meanwhile, Merit Medical Systems and Argon Medical Devices provide cost-effective biopsy and localization tools, catering to cost-sensitive healthcare providers. Emerging players such as Lumicell Inc. and Perimeter Medical Imaging AI are disrupting the market with real-time intraoperative imaging.

A few major companies operating in the U.S. breast conserving surgery market include Argon Medical Devices; CairnSurgical Inc.; Hologic, Inc; Innoblative Designs; KUBTEC; Lumicell Inc; Mammotome (Danaher); Merit Medical Systems; Perimeter Medical Imaging AI; and Stryker.

Key Players

- Argon Medical Devices

- CairnSurgical Inc.

- Hologic, Inc.

- Innoblative Designs

- KUBTEC

- Lumicell Inc.

- Mammotome (Danaher)

- Merit Medical Systems

- Perimeter Medical Imaging AI

- Stryker

Industry Developments

January 2025: Lumicell, Inc., a company involved in developing innovative fluorescence-guided imaging technologies for cancer detection, announced the commercial availability and first commercial use of LumiSystem, a technology designed to enhance breast cancer surgery, in the U.S.

April 2025: Innoblative Designs, Inc., announced that the U.S. Food and Drug Administration has approved its Investigational Device Exemption (IDE) application, paving the way for the company to initiate its U.S. feasibility study. The study will evaluate the safety and effectiveness of the company's SIRA RFA Electrosurgical Device in patients undergoing breast-conservation surgery (BCS).

U.S. Breast Conserving Surgery Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Lumpectomy Devices

- Radiofrequency Ablation Devices

- Cryoablation Devices

- Microwave Ablation Devices

- Others

By Surgery Type Outlook (Revenue, USD Million, 2020–2034)

- Segmental Mastectomy

- Quadrantectomy

- Tumor Lumpectomy

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Cancer Research Institutes

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Traditional Surgical Techniques

- Image-Guided Surgery

- Robotic-Assisted Surgery

- Minimally Invasive Techniques

U.S. Breast Conserving Surgery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 735.49 Million |

|

Market Size in 2025 |

USD 784.62 Million |

|

Revenue Forecast by 2034 |

USD 1,428.00 Million |

|

CAGR |

6.88% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 735.49 million in 2024 and is projected to grow to USD 1,428.00 million by 2034.

The market is projected to register a CAGR of 6.88% during the forecast period.

A few of the key players in the market are Argon Medical Devices; CairnSurgical Inc.; Hologic, Inc; Innoblative Designs; KUBTEC; Lumicell Inc; Mammotome (Danaher); Merit Medical Systems; Perimeter Medical Imaging AI; and Stryker.

The lumpectomy devices segment dominated the market share in 2024.

The image-guided surgery segment is expected to witness the fastest growth during the forecast period.