3D Weaving Market Size, Share, Trend, Industry Analysis Report

By Product Type (Glass Fiber, Composite Textile, Others), By Application, By End-Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6035

- Base Year: 2024

- Historical Data: 2020-2023

Overview

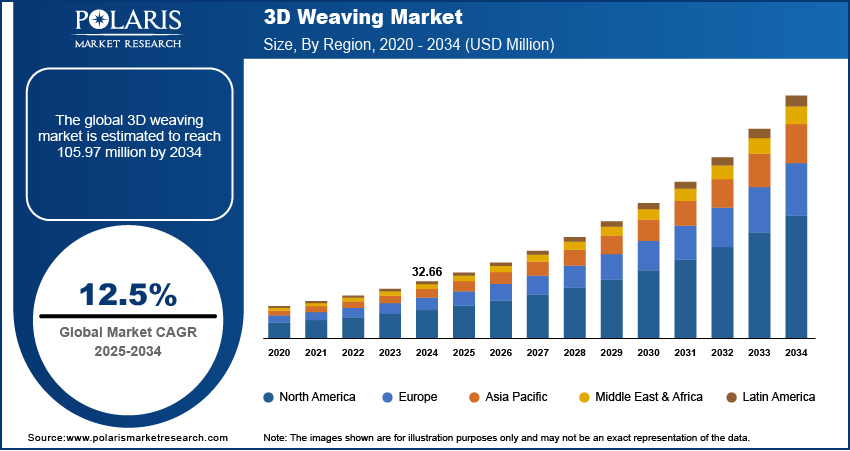

The global 3D weaving market size was valued at USD 32.66 million in 2024, growing at a CAGR of 12.5% from 2025 to 2034. Aircraft and defense components increasingly rely on 3D woven composites for their lightweight structure and superior mechanical strength. These materials improve fuel efficiency, resist delamination, and perform well under extreme stress, making them ideal for critical aerospace and military applications.

Key Insights

- The carbon weaving machines segment held the largest revenue share in 2024.

- The structural components segment dominated the market in 2024.

- The defense & aerospace segment accounted for the largest revenue share in 2024.

- North America 3D weaving market is expected to grow significantly from 2025 to 2034.

- In 2024, the U.S. accounted for a significant revenue share.

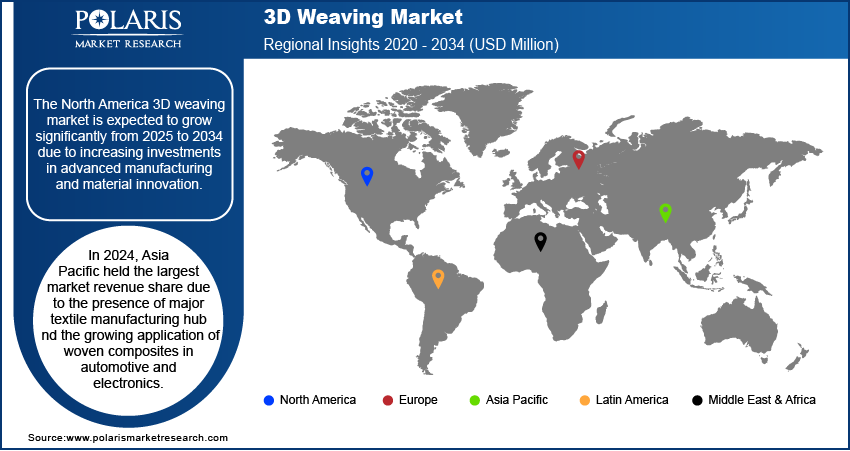

- In 2024, Asia Pacific held the largest revenue share.

- The market growth in Europe is attributed to the region’s strong emphasis on sustainable engineering and lightweight composite development.

The 3D weaving market refers to the industry involved in the production and application of three-dimensionally woven fabrics used in high-performance composites. These textiles offer enhanced structural integrity, impact resistance, and load-bearing capacity, making them valuable in the aerospace, automotive, defense, sports equipment, and construction materials. Automakers are adopting 3D woven fabrics in body panels, structural reinforcements, and interior components to reduce vehicle weight. This helps improve fuel economy and lower emissions while maintaining crash resistance and durability, especially in hybrid and electric vehicles.

3D woven textiles are being used in reinforced concrete structures, bridge components, and earthquake-resistant materials. Their high tensile strength and adaptability to complex geometries make them attractive for next-generation building and civil engineering applications. Moreover, 3D woven fabrics are used in helmets, body armor, and sports gear due to their ability to absorb impact and reduce weight. Rising focus on performance and safety in professional and consumer sports markets supports increased adoption of these advanced materials.

Industry Dynamics

- Automotive manufacturers are focusing on reducing vehicle weight to meet stringent fuel efficiency and emission regulations.

- Wind energy projects demand materials that endure constant stress, vibration, and exposure to extreme weather.

- Growing demand for lightweight, high-strength composites in aerospace and defense is creating new opportunities for 3D weaving technologies in advanced material manufacturing.

- High capital investment and limited technical expertise hinder the adoption of 3D weaving systems, especially in small and medium-scale manufacturing units.

Increasing Adoption in Automotive Lightweighting: Automotive manufacturers are focusing on reducing vehicle weight to meet stringent fuel efficiency and emission regulations. 3D woven fabrics are gaining traction as they provide structural strength while significantly cutting down mass. These materials are being used in body panels, underbody structures, crash reinforcements, and even interior trims. Their ability to absorb impact without delaminating ensures vehicle safety standards are upheld. In electric and hybrid vehicles, where reducing weight is essential to extend battery life and driving range, 3D woven composites offer a compelling solution. The durability, dimensional stability, and design flexibility they offer are encouraging OEMs to integrate them into next-generation vehicle platforms on a broader scale.

Expansion of Wind Energy Sector: Wind energy projects demand materials that can endure constant stress, vibration, and exposure to extreme weather. According to the Ministry of New and Renewable Energy, India’s renewable energy capacity grew 17.13% year-on-year to 226.74 GW in 2025. 3D woven composites are being used in the manufacturing of wind turbine blades, nacelle covers, and structural parts due to their superior fatigue resistance and strength-to-weight ratio. These materials help in maintaining blade shape under load and resisting long-term wear, thereby improving overall turbine performance and lifespan. Their use enables engineers to design lighter blades without compromising structural integrity, allowing for taller towers and larger rotors. Growing investments in offshore and onshore wind energy installations are driving demand for advanced composite materials such as 3D woven fabrics across global renewable infrastructure projects.

Segmental Insights

Product Type Analysis

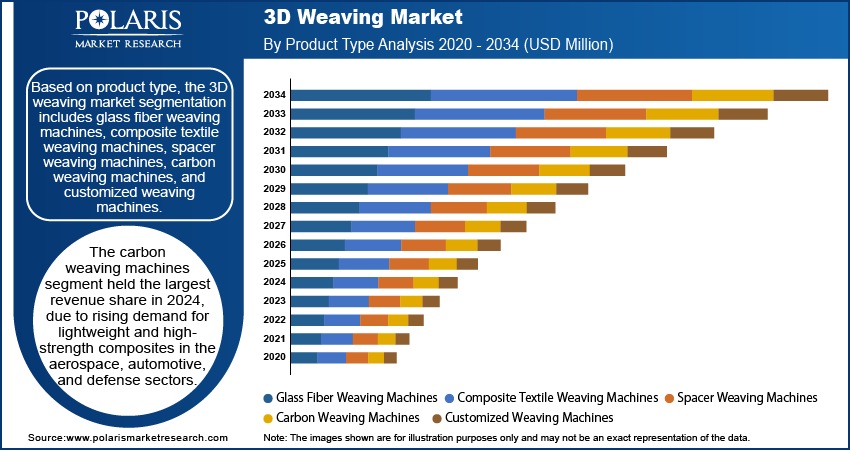

Based on product type, the segmentation includes glass fiber weaving machines, composite textile weaving machines, spacer weaving machines, carbon weaving machines, and customized weaving machines. The carbon weaving machines segment held the largest revenue share in 2024, due to rising demand for lightweight, high-strength composites in the aerospace, automotive, and defense sectors. These machines are optimized to produce complex 3D carbon fiber structures that deliver superior performance under stress, making them ideal for critical load-bearing applications. Their ability to weave multi-axial fabrics helps manufacturers achieve better mechanical properties, reducing the need for secondary processes. Increased production of aircraft components, vehicle reinforcements, and ballistic-grade materials continues to boost the use of carbon fiber weaving systems in both high-performance and volume-based manufacturing environments.

The spacer weaving machines segment is projected to register a significant CAGR during the forecast period, due to their increasing use in producing lightweight, breathable, and impact-absorbing fabrics. These machines are widely used for manufacturing protective sportswear, automotive seating, and medical textiles. Their unique ability to weave three-dimensional spacer fabrics with consistent thickness and structural resilience makes them suitable for cushioning and insulation purposes. The healthcare industry, in particular, is exploring these fabrics for advanced orthopedic supports and pressure-relief applications. Growing interest in ergonomically designed, high-comfort textile components is expected to drive the adoption of spacer weaving technology across multiple end-use sectors.

Application Analysis

In terms of application, the segmentation includes structural components, protective materials, reinforcements, insulation, load bearing composites, decorative/ design, and thermal protection. The structural components segment dominated the market in 2024 due to their critical role in improving the strength and stiffness of composite materials across various industries. These woven structures provide robust support in aerospace panels, vehicle chassis, bridge reinforcements, and marine structures. Their ability to integrate multi-directional fiber orientation enhances load distribution and impact resistance, reducing the likelihood of material failure. Manufacturers prefer 3D woven structures for structural parts because they offer dimensional stability, minimal delamination, and reliable performance over time. This growing reliance on durable, high-integrity composite structures have kept structural components at the forefront of demand.

The thermal protection segment is expected to register the highest CAGR during the forecast period due to the growing use of heat-resistant woven composites in aerospace, energy, and defense industries. These fabrics are designed to endure extreme temperatures, making them suitable for engine insulation, space vehicle shielding, and high-temperature industrial equipment. Their ability to maintain integrity under thermal stress enhances safety and operational efficiency in critical applications. The use of materials such as carbon and silica fibers in 3D woven form allows for precision thermal management without adding unnecessary weight. Rising demand for heat-tolerant, lightweight solutions is set to accelerate the growth of this segment.

End-Use Industry Analysis

In terms of end-use industry, the segmentation includes automotive, construction and infrastructure, consumer electronics, defense & aerospace, energy and goods, healthcare, and others. The defense & aerospace segment accounted for the largest revenue share in 2024 due to increasing demand for lightweight, high-performance materials used in aircraft, satellites, and military-grade protective gear. 3D woven fabrics offer enhanced durability, resistance to extreme conditions, and better energy absorption compared to traditional laminated composites. They are being used in fuselage structures, wing skins, rotor blades, and body armor, where weight savings and structural strength are equally important. Government spending on next-generation military platforms and expanding space exploration programs is driving the adoption of these advanced textile-based composites across global defense and aerospace sectors.

The healthcare segment is projected to register the highest growth rate over the forecast period, driven by innovations in 3D woven medical textiles. Applications such as orthopedic implants, surgical meshes, and tissue engineering scaffolds benefit from the customizable geometry and porosity of 3D woven fabrics. These materials enable tailored mechanical performance and improved biocompatibility, supporting faster healing and patient comfort. Increased demand for minimally invasive surgical solutions and advanced prosthetics is encouraging the integration of 3D weaving into medical product development. Rising healthcare investment and personalized treatment trends are also helping expand the application of woven composites in clinical environments.

Regional Analysis

The North America 3D weaving market is expected to grow significantly from 2025 to 2034 due to increasing investments in advanced manufacturing and material innovation. The aerospace & defense sector is expanding and using 3D woven composites for structural components, driven by the need for lighter, more durable materials. For instance, according to the Aerospace Industries Association (AIA), the U.S. aerospace & defense sector is experiencing significant growth, contributing approximately USD 1 trillion in economic activity. Automotive OEMs are integrating woven fabrics into vehicle interiors and safety systems to meet performance and regulatory targets. Rising adoption of industrial automation and continued R&D into multi-functional composite solutions are strengthening demand. Collaborative efforts between research institutions and private firms are also accelerating the development of tailored 3D woven materials across engineering and medical applications.

U.S. 3D Weaving Market Insights

In 2024, the U.S. accounted for the significant revenue share due to strong activity in aerospace, defense, and technical textiles manufacturing. Leading aerospace manufacturers are increasingly integrating 3D woven composites in fuselage and wing structures to reduce weight without compromising strength. Government-funded defense modernization programs are supporting the production of advanced protective gear using 3D fabrics. Medical device companies are also exploring woven scaffolds and implants due to their precision and customization capabilities. Strong domestic supply chains, university-led research, and early adoption of digital weaving technologies are enabling U.S.-based manufacturers to stay competitive and meet growing multi-industry demands.

Asia Pacific 3D Weaving Market Overview

In 2024, Asia Pacific accounted for the largest revenue share due to the presence of major textile manufacturing hubs and growing application of woven composites in automotive and electronics. Countries in the region are increasing investments in smart manufacturing and composite infrastructure to meet demand for lightweight, high-performance materials. Automotive manufacturers in Japan, South Korea, and India are integrating 3D woven components to improve fuel efficiency and safety standards. Electronics and telecom industries are also using these fabrics for thermal protection and internal supports. Scalable production capabilities and strong government support are contributing to Asia Pacific’s leadership in the market.

China 3D Weaving Market Outlook

The market in China is witnessing strong growth driven by rapid industrialization and a national push toward advanced materials innovation. Local manufacturers are investing in automated weaving technologies to produce high-strength fabrics for aerospace, EVs, and infrastructure. Demand for lightweight composites in high-speed rail, drones, and defense equipment is accelerating adoption. Research institutions are collaborating with industry players to develop tailored 3D woven structures that meet performance benchmarks in complex applications. Export opportunities and increasing competitiveness in the global textile technology landscape are positioning China as a key growth hub for innovative 3D woven solutions.

Europe 3D Weaving Market Trends

The Europe 3D weaving market growth is attributed to the region’s strong emphasis on sustainable engineering and lightweight composite development. The aerospace and automotive sectors are adopting 3D woven fabrics to reduce emissions while enhancing performance and safety. Research-driven innovation is enabling manufacturers to develop recyclable and bio-based woven composites that align with circular economy goals. Leading universities and research centers are advancing fiber architecture and process technologies that support complex applications. Demand from renewable energy, rail, and construction is also contributing to market growth. Regulatory support and funding for green materials and smart textiles are further reinforcing Europe’s competitive position.

Key Players and Competitive Analysis Report

The competitive landscape of the 3D weaving market is shaped by rapid advancements in textile engineering, demand for high-performance composites, and expanding application areas. Industry analysis highlights increasing investments in market expansion strategies, particularly across aerospace, automotive, and defense sectors. Companies are actively pursuing mergers and acquisitions to gain technological capabilities and integrate vertically across the value chain. Strategic alliances and joint ventures are fostering co-development of customized 3D woven architectures tailored for load-bearing and impact-resistant applications. Technology advancements in automated looms, digital design software, and fiber placement precision are enabling scalable and cost-effective production of complex structures. Post-merger integration efforts focus on streamlining manufacturing, improving turnaround times, and expanding R&D scope. Competitive intensity is rising as players invest in proprietary weaving techniques, thermal-resistant fiber compositions, and multi-layer reinforcement designs. The shift toward lightweight, recyclable, and multifunctional materials continues to influence innovation strategies, positioning 3D weaving as a cornerstone of advanced composite manufacturing.

Key Players

- Dashmesh Jacquard and Powerloom Pvt. Ltd.

- Hefei Fanyuan Instrument Co., Ltd

- Kale Texnique

- Lindauer DORNIER GmbH

- Marjan Polymer Industries

- Optima3D Ltd.

- Sino Textile Machinery

- Staubli International AG

- UNSPUN

- VUTS, a.s.

3D Weaving Industry Development

October 2024: UNSPUN and Decathlon partnered to implement its Vega 3D weaving technology in Europe, providing on-demand, low-waste sportswear.

3D Weaving Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Glass Fiber Weaving Machines

- Composite Textile Weaving Machines

- Spacer Weaving Machines

- Carbon Weaving Machines

- Customized Weaving Machines

By Application Outlook (Revenue, USD Million, 2020–2034)

- Structural Components

- Protective Materials

- Reinforcements

- Insulation

- Load Bearing Composites

- Decorative/Design

- Thermal Protection

By End-Use Industry Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Construction and Infrastructure

- Consumer Electronics

- Defense & Aerospace

- Energy and Goods

- Healthcare

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

3D Weaving Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 32.66 million |

|

Market Size in 2025 |

USD 36.71 million |

|

Revenue Forecast by 2034 |

USD 105.97 million |

|

CAGR |

12.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 32.66 million in 2024 and is projected to grow to USD 105.97 million by 2034.

The global market is projected to register a CAGR of 12.5% during the forecast period.

In 2024, Asia Pacific accounted for the largest revenue share due to the presence of major textile manufacturing hubs and the growing application of woven composites in automotive and electronics.

A few of the key players in the market are Dashmesh Jacquard and Powerloom Pvt. Ltd.; Hefei Fanyuan Instrument Co., Ltd; Kale Texnique; Lindauer DORNIER GmbH; Marjan Polymer Industries; Optima3D Ltd.; Sino Textile Machinery; Staubli International AG; UNSPUN; and VUTS, a.s.

The carbon weaving machines segment held the largest revenue share in 2024, due to rising demand for lightweight, high-strength composites in aerospace, automotive, and defense sectors.

The structural components segment dominated the 3D weaving market in 2024 due to their critical role in improving the strength and stiffness of composite materials across various industries.