Liquid Sodium Silicate Market Size, Share, Trends, Industry Analysis Report

By Grade (LSS A, LSS B, LSS C, Other Grades), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6038

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

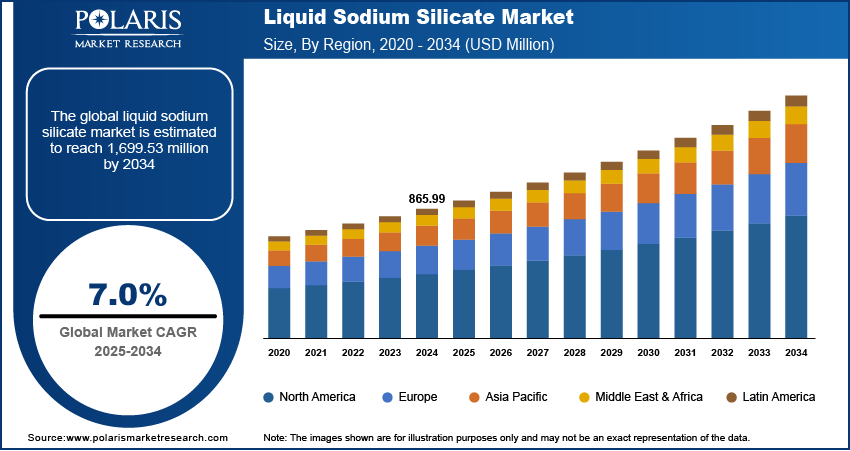

The global liquid sodium silicate market size was valued at USD 865.99 million in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The growing use of liquid sodium silicate in the detergent sector is a major driver, as it improves cleaning products.

Key Insights

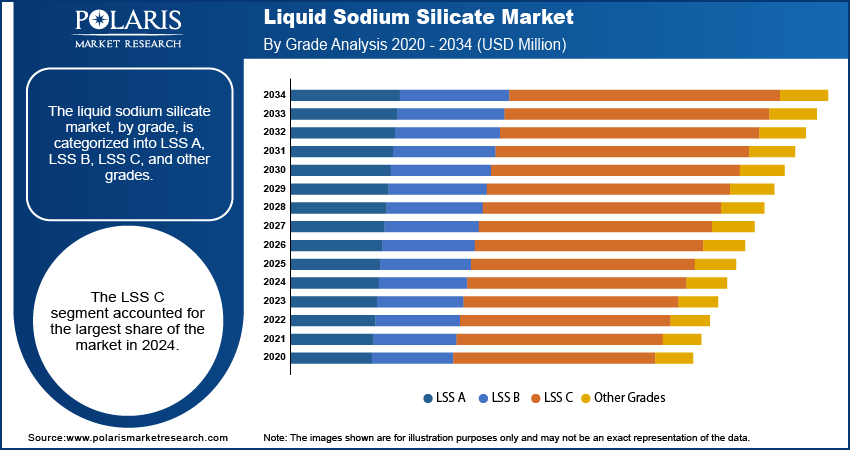

- By grade, the LSS C segment held the largest share in 2024 due to its strong alkaline properties. This makes it indispensable in heavy industries such as construction for specialized admixtures and in mining operations as a deflocculant, contributing to its consistent and widespread demand.

- By application, the detergents/cleaning compounds segment held the largest share in 2024, as liquid sodium silicate is a vital component in various cleaning formulations. Its ability to soften water, emulsify oils, and prevent corrosion makes it an essential ingredient for enhancing cleaning efficiency across residential, commercial, and industrial cleaning solvents and products.

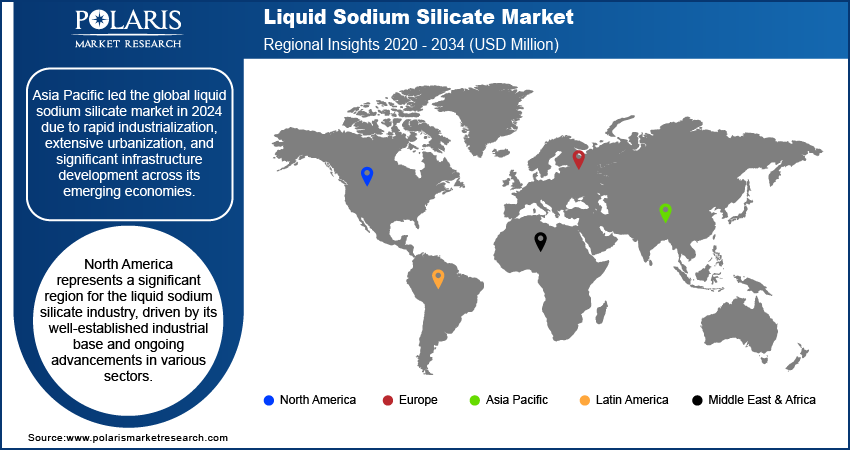

- By region, Asia Pacific held the largest share in 2024 due to rapid industrialization, extensive urbanization, and significant infrastructure development across its emerging economies. North America represents a significant region for the global liquid sodium silicate market, driven by its well-established industrial base and ongoing advancements in various sectors.

Industry Dynamics

- The increasing demand from the construction sector, where liquid sodium silicate serves as a vital binding agent and sealant, contributes significantly to its consumption. It improves the strength and durability of concrete and other building materials, which is crucial for modern infrastructure developments.

- A rising need for effective water treatment solutions drives the adoption of liquid sodium silicate. It is widely used for corrosion inhibition, coagulation, and flocculation in municipal and industrial water purification processes, helping to ensure the availability of clean water.

- The detergent manufacturing industry's continuous demand for liquid sodium silicate is a key growth factor. It functions as a builder in cleaning compounds, enhancing their effectiveness by softening water, emulsifying oils, and preventing the redeposition of dirt.

- Expanding applications within the pulp & paper sector are boosting the liquid sodium silicate market.

Market Statistics

- 2024 Market Size: USD 865.99 million

- 2034 Projected Market Size: USD 1,699.53 million

- CAGR (2025–2034): 7.0%

- Asia Pacific: Largest market in 2024

Liquid sodium silicate, often known as water glass, is a versatile chemical compound primarily made with sodium oxide and silicon dioxide. It comes as a clear to translucent viscous liquid and is widely used across various industries due to its unique properties, such as excellent binding, adhesive, and sealing capabilities.

The pulp & paper sector is a significant consumer of liquid sodium silicate, primarily for its role in bleaching and de-inking processes. It acts as a stabilizer for hydrogen peroxide in bleaching, preventing the rapid decomposition of the bleach and minimizing fiber degradation, which is crucial for achieving desired paper brightness and quality. Furthermore, in paper recycling, liquid sodium silicate aids in the effective removal of ink from recycled paper, contributing to the production of high-quality recycled paper products.

The growing textile industry is another key driver for the liquid sodium silicate market expansion, where it is utilized in various stages of fabric processing, including dyeing and printing. In dyeing, it acts as a buffering agent and a stabilizer, helping to achieve uniform color distribution and preventing color bleeding. It is also used as a scouring agent to remove impurities from fibers before dyeing, ensuring better dye absorption. As the textile area expands, particularly in emerging economies, and as the demand for diverse fabric types and processing methods grows, the need for chemicals such as liquid sodium silicate also increases.

Drivers and Opportunities

Growth in Construction Industry: The construction sector is a significant consumer of liquid sodium silicate, primarily due to its versatile properties as a binding agent, densifier, and sealant. It is widely used in concrete applications to improve strength, reduce permeability, and enhance overall durability. As infrastructure development and urbanization continue globally, the demand for high-performance building materials such as liquid sodium silicate is on the rise.

According to an article published in PMC in April 2021, titled "Positive Influence of Liquid Sodium Silicate on the Setting Time, Polymerization, and Strength Development Mechanism of MSWI Bottom Ash Alkali-Activated Mortars," the addition of liquid sodium silicate significantly influences the setting and hardening mechanisms, as well as the strength development, of alkali-activated materials used in construction. This showcases its crucial role in improving construction material performance. The ongoing global focus on resilient infrastructure and efficient building practices drives the increased use of liquid sodium silicate.

Rising Demand from Water Treatment Sector: Liquid sodium silicate plays a vital role in various water treatment processes, including corrosion inhibition, coagulation, and flocculation. It helps prevent scale formation in pipes and equipment, prolonging their lifespan and maintaining efficiency in water supply systems. With increasing concerns about water scarcity and the need for potable water, the demand for effective water treatment chemicals and solutions is steadily growing.

According to the World Health Organization (WHO) "Water, Sanitation and Hygiene (WASH)" overview, updated in January 2025, safe drinking water, sanitation, and hygiene are essential for human health and well-being. The WHO highlights that chemical contamination of water continues to pose a health burden, emphasizing the need for advanced treatment methods. This continuous global effort to ensure access to clean and safe water, as well as to treat wastewater, directly boosts the demand for chemicals such as liquid sodium silicate.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes LSS A, LSS B, LSS C, and other grades. The LSS C segment held the largest share in 2024. This grade, characterized by a lower silica-to-soda ratio, is highly alkaline and is widely used in various industrial applications. Its dominance can be attributed to its strong binding properties, which are particularly valuable in the construction chemicals sector for admixtures and grouts. Additionally, its role as a deflocculant in mining and drilling operations contributes to its strong position. The consistent demand from these established heavy industries, where the alkaline nature of LSS C is crucial for process efficiency and material performance, underpins its leading presence in the liquid sodium silicate landscape. This robust and steady demand from mature application areas ensures its continued strong market standing.

The LSS A segment is anticipated to register the highest growth rate during the forecast period. This segment represents liquid sodium silicates with a higher silica-to-soda ratio, often referred to as neutral or slightly acidic. The increasing adoption of LSS A is largely driven by its superior bonding and thermal resistance properties, making it highly suitable for specialized applications. These include passive fire protection systems, where its ability to form a heat-resistant barrier is vital, and in refractory materials used in high-temperature industrial processes. Furthermore, its growing utilization in precision casting for creating intricate and high-quality molds contributes to its accelerated growth. As industries increasingly seek advanced material solutions that offer enhanced performance and safety features, the demand for high-silica ratio liquid sodium silicates such as LSS A is expected to surge in the coming years, indicating a promising outlook for this grade.

Application Analysis

Based on application, the segmentation includes detergents/cleaning compounds, paper production, cements & binders, petroleum processing, ceramics, food & healthcare, metal treatment, and others. The detergents/cleaning compounds segment held the largest share in 2024. This is primarily due to the extensive use of liquid sodium silicate as a builder in laundry detergents, dishwashing soaps, and various industrial cleaning agents. Its unique properties, such as water softening, emulsification, and corrosion inhibition, make it an indispensable ingredient. It helps in effectively breaking down fats and oils, suspending dirt particles, and preventing the redeposition of soil onto fabrics or surfaces. The consistent and widespread demand for cleaning products across residential, commercial, and industrial sectors globally ensures the continued dominance of this application segment. The essential role of liquid sodium silicate in enhancing cleaning efficiency and stabilizing detergent formulations underpins its significant market presence.

The cements and binders application segment is anticipated to register the highest growth rate during the forecast period. This surge is driven by increasing infrastructure development projects and a growing emphasis on sustainable and high-performance construction materials. Liquid sodium silicate acts as an effective densifier and sealant for concrete, significantly improving its strength, durability, and resistance to chemical attacks and water penetration. It is also used as a binder in specialized cements, refractory materials, and protective coatings. As the construction sector increasingly adopts advanced solutions for stronger and more resilient structures, and as repairs and renovations become more frequent, the demand for liquid sodium silicate in these applications is witnessing a notable upward trend, positioning it for accelerated expansion.

Regional Analysis

The Asia Pacific liquid sodium silicate market accounted for the largest share in 2024, owing to rapid industrialization and urbanization, and a burgeoning manufacturing sector. Countries across this region are witnessing significant infrastructure development, which translates into high demand for liquid sodium silicate in construction applications such as cements and binders. Furthermore, the expanding household and personal care sector, particularly the production of detergents and cleaning agents for a large and growing population, is a major driver. The increasing need for water treatment solutions due to rising industrial activity and population growth also contributes significantly to demand.

China Liquid Sodium Silicate Market Overview

China plays a pivotal role in the Asia Pacific liquid sodium silicate landscape. Its vast manufacturing capabilities and ongoing large-scale infrastructure projects make it a major consumer. The country's robust construction sector heavily utilizes liquid sodium silicate in concrete and other building materials. Additionally, the massive and growing domestic market for detergents and cleaning products ensures a high and continuous demand. China's efforts in environmental protection and wastewater treatment also contribute to the increased adoption of liquid sodium silicate in purification processes.

North America Liquid Sodium Silicate Market Insights

North America represents a significant region for the liquid sodium silicate landscape, driven by its well-established industrial base and ongoing advancements in various sectors. The robust demand from the construction sector, particularly for concrete admixtures and sealants, contributes substantially to the region's consumption. Furthermore, the growing focus on water treatment solutions, both municipal and industrial, continues to fuel the use of liquid sodium silicate for its effective coagulation and corrosion inhibition properties. The mature detergent and cleaning compounds sector also consistently fuels demand, as the compound remains a key ingredient for its cleaning efficacy.

U.S. Liquid Sodium Silicate Market Trends

In North America, the U.S. is a leading consumer of liquid sodium silicate, primarily due to its diversified industrial landscape and continuous infrastructure development. The country's strong manufacturing sector, coupled with steady demand from the construction and detergents industries, underpins its prominent position. There is also an increasing emphasis on sustainable practices and eco-friendly solutions across various applications, which further encourages the adoption of liquid sodium silicate.

Europe Liquid Sodium Silicate Market Outlook

Europe is a key region in the liquid sodium silicate landscape, characterized by advanced industrial economies and a strong focus on environmental regulations and sustainable practices. The demand for liquid sodium silicate in Europe is consistently driven by its widespread use in the detergents sector, where it contributes to efficient and environmentally friendlier cleaning formulations. The pulp & paper sector in the region represents a significant application area, with liquid sodium silicate being crucial for de-inking and other paper processing needs. Additionally, the region's stringent water treatment standards necessitate the ongoing use of sodium silicate for water purification and waste management.

The Germany liquid sodium silicate market stands out as a major contributor to the European market. The country's strong industrial base, particularly in manufacturing, chemicals, and automotive sectors, creates a steady demand for this compound. Its use in various applications, including high-performance detergents, water treatment processes, and construction materials, is propelled by Germany's emphasis on technological innovation and environmental responsibility. The demand for sustainable and eco-friendly products across Germany's industries is a significant factor driving regional growth, especially in urban areas with expanding infrastructure projects.

Key Players and Competitive Insights

The liquid sodium silicate sector features a competitive landscape with several major players vying for market share. These companies, including PQ Corporation, Oriental Silicas Corporation, Evonik Industries AG, Nippon Chemical Industrial Co., Ltd., and Tokuyama Corporation, are actively involved in the production and distribution of various grades of liquid sodium silicate. The competitive environment is shaped by factors such as product innovation, strategic partnerships, and global presence. Companies often differentiate themselves through product quality, technical support, and the ability to cater to diverse industrial applications. The market sees a mix of established global chemical manufacturers and regional specialists, all working to meet the evolving demand across key end-use sectors such as construction, detergents, and water treatment.

A few prominent companies in the landscape include PQ Corporation, Oriental Silicas Corporation, Evonik Industries AG, Nippon Chemical Industrial Co., Ltd., Tokuyama Corporation, W. R. Grace & Co., Solvay S.A., Dr. Paul Lohmann GmbH KG, and VanBaerle Group.

Key Players

- Dr. Paul Lohmann GmbH KG

- Evonik Industries AG (Evonik)

- Nippon Chemical Industrial Co., Ltd.

- Oriental Silicas Corporation

- PQ Corporation

- Solvay S.A. (Solvay)

- Tokuyama Corporation

- VanBaerle Group

- W. R. Grace & Co.

Liquid Sodium Silicate Industry Development

March 2024: Evonik announced a significant expansion at its Charleston site in South Carolina, USA, boosting the production capacity of precipitated silica by 50%.

Liquid Sodium Silicate Market Segmentation

By Grade Outlook (Revenue – USD Million, 2020–2034)

- LSS A

- LSS B

- LSS C

- Other Grades

By Application Outlook (Revenue – USD Million, 2020–2034)

- Detergents/Cleaning Compounds

- Paper Production

- Cements & Binders

- Petroleum Processing

- Ceramics

- Food & Healthcare

- Metal Treatment

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Liquid Sodium Silicate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 865.99 million |

|

Market Size in 2025 |

USD 924.44 million |

|

Revenue Forecast by 2034 |

USD 1,699.53 million |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 865.99 million in 2024 and is projected to grow to USD 1,699.53 million by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include PQ Corporation, Oriental Silicas Corporation, Evonik Industries AG, Nippon Chemical Industrial Co., Ltd., Tokuyama Corporation, W. R. Grace & Co., Solvay S.A., Dr. Paul Lohmann GmbH KG, VanBaerle Group, and Klaus Chemical.

The LSS C segment accounted for the largest share of the market in 2024.

The cements and binders segment is expected to witness the fastest growth during the forecast period.