Construction Chemicals Market Share, Size, Trends, Industry Analysis Report

By Product (Concrete Admixture, Construction Adhesives, Construction Sealant, Protective Coatings) By Application (Residential, Non-Residential) And Segment Forecast, 2025-2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM3911

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

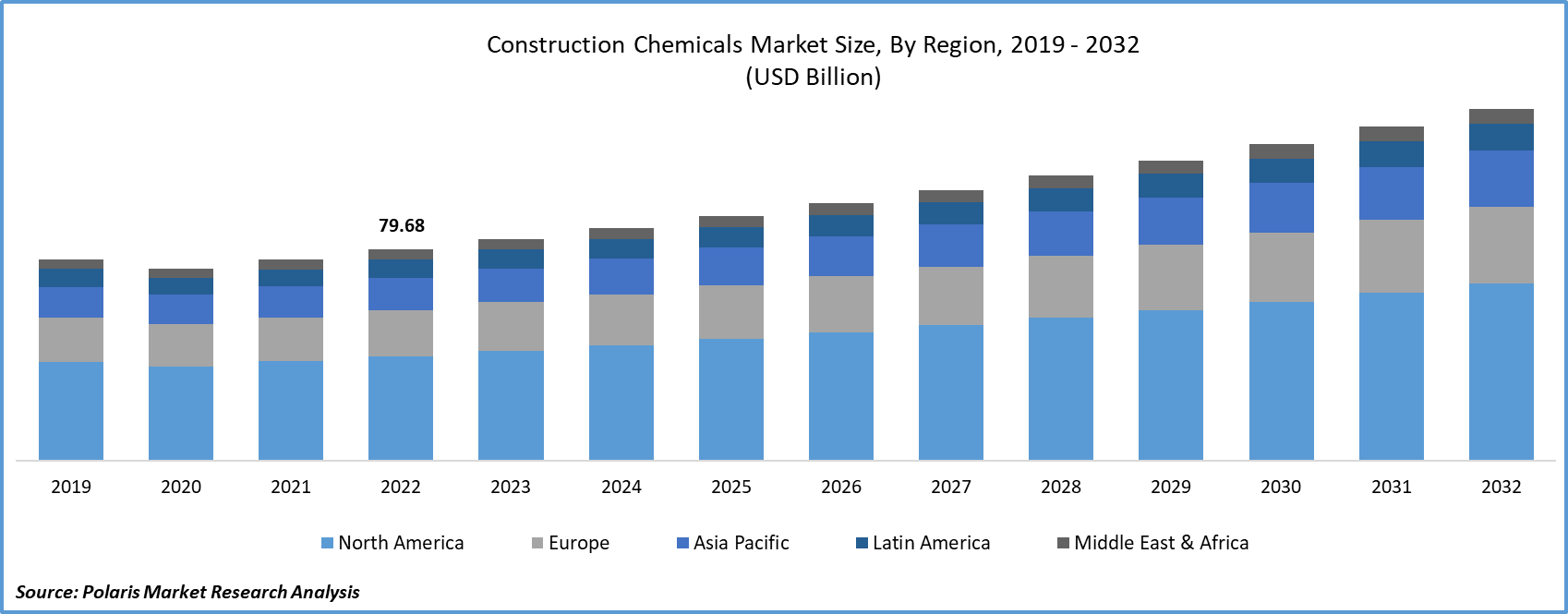

The global construction chemicals market share was valued at USD 83.79 billion in 2024 and is expected to grow with a CAGR of 5.30% during the forecast period. Key factors driving the demand includes rising new building projects, innovations in product development, and the rapid urbanization observed in many developing regions.

Key Insights

- The concrete ad-mixture segment accounted for the largest market share in 2024 due to its role as the primary binding material.

- The non-residential segment held the majority market share in 2024. This is due to the critical role in protecting buildings against moisture, dust, and heat.

- APAC held the largest share in 2024 due to significant investments in infrastructure development, combined with rising disposable income levels among consumers in the region.

- Europe is expected to witness the fastest growth due to the expansion of the construction industry.

Industry Dynamics

- The growth in demand for construction products has led to increased cement usage, which in turn drives up the need for various building chemicals.

- The market is also driven by the introduction of advanced product offerings designed to enhance performance.

- Strict regulations and changing raw material prices creates challenge for profit margins.

- Green construction creates demand for high-performance and eco-friendly products.

Market Statistics

- 2024 Market Size: USD 83.79 billion

- 2034 Projected Market Size: USD 140.20 billion

- CAGR (2025-2034): 5.3%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

What Does the Current Market Landscape Look for Construction Chemicals?

The construction chemicals sector is poised for substantial growth, primarily driven by the upsurge in building, construction, and infrastructure projects. This trend is further accelerated by the rapid urbanization observed in many developing regions, contributing to an expanded market landscape over the forecast period. Given the industry's susceptibility to various regulatory factors, major companies are channeling their efforts into research and development initiatives aimed at creating innovative bio-based products. These endeavors align with the need to comply with evolving regulations and cater to a growing demand for environmentally friendly solutions.

Construction chemicals have always been playing crucial role in practically all kinds of construction endeavours be it industrial, residential, commercial and so on. These chemicals are frequently utilized in several sections of projects so as to obtain several significant qualities such as functionality and longevity. Construction chemicals prevail in several configurations from an extensive number of manufacturers globally. They are chemical formulations utilized with masonry substances, cement, concrete and alternate construction substances at the moment of construction to carry the construction substances cohesively.

Some of the advantages of the construction chemicals are that they enhance functionality. They can be utilized to lessen mixing schedule, generate simple to mix function to elevated operational concrete. Chemical admixtuers are predominantly utilized to enhance concrete portrayal. The construction chemicals market sales are soaring as they also assist to escalate the momentum of construction work. Another advantage is that they escalate productivity and effectiveness in which they lessen water intake of concrete, tumble loss, depletion, bleeding and sorting out and regulate alkali cluster reaction.

Construction chemicals used in building projects can release toxic volatile organic compounds (VOCs) during construction activities. These VOCs have been associated with health issues such as asthma, skin irritation, migraines, disorientation, and eye irritation. Government regulations aimed at limiting the use of these construction chemicals due to their VOC emissions have somewhat constrained the market's growth potential. These regulations are in place to mitigate the potential health and environmental impacts associated with VOC exposure, reflecting a balance between construction industry needs and public health concerns.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces construction chemicals market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

The increasing adoption of construction chemicals, particularly in building operations, is propelled by a growing recognition of the environmental challenges associated with conventional structures. Furthermore, governments worldwide are implementing regulations to address climate change concerns. Major players in the construction sector are directing their attention toward enhancing the safety of underground structures while incorporating sustainable and eco-friendly elements. This includes the use of polycarboxylate ether-based green additives and measures aimed at overall building protection. Additionally, cool roof treatments are being employed to contribute to sustainability efforts, reflecting a broader commitment to environmental responsibility within the industry.

The Construction Chemicals Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

What are the Factors Driving the Market Growth?

Rising New Building Projects

The construction products industry in emerging nations is set to thrive due to the growth in new building projects and maintenance and rehabilitation sectors. Even with India, China, & South Korea experiencing substantial population growth, there is a significant demand for both residential and non-residential structures. This robust demand has led to increased cement usage, consequently driving up the need for various building chemicals like cement additives, admixtures, sealants, & adhesives.

Moreover, the global construction chemicals market is poised for expansion, primarily driven by the introduction of advanced product offerings designed to enhance performance. Notable examples include specialty cement additives like silicone caulks & mortars. These construction chemicals boost performance but also confer technological advantages by enhancing structural integrity and durability, often featuring anti-corrosive properties.

Report Key Segmentation

The market is primarily segmented based on product, by end-use, and region.

|

By Product |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Segment Insights

Product Analysis

Which Segment by Product Held the Largest Share?

The concrete ad-mixture segment accounted for the largest market share in 2024. Cement serves as the primary binding material, and concrete is produced by mixing cement with crushed rocks (aggregate), sand, & water. To enhance the finish and strength of concrete, ad-mixtures are introduced during the mixing process. These admixtures serve various purposes, including reducing water content in the concrete and improving its durability.

There are several types of ad-mixtures employed in construction, including ligno-based ad-mixtures, Sulfonated Naphthalene Formaldehyde (SNF), and sulfonated Melamine Formaldehyde. Among these, ligno-based admixtures were the first to be utilized in concrete.

The construction adhesives segment will grow at a steady pace. These adhesives are crafted from premium-quality materials, effectively boosting the longevity and bonding capabilities of adhesives. Adhesives are formulated using various materials, including cement, epoxy, & polymers. Cement-based adhesives find extensive use in affixing floor & wall tiles. They typically consist of water-resistant cement & polymer-modified cement, making them suitable for both internal and external applications. On the other hand, epoxy adhesives are notable for their cold-curing properties and resistance to a wide range of substances, including water, oil, alkalis, and various solvents.

Protective coatings play a crucial role in both new construction projects and repair endeavors. They provide essential protection against a range of substances, such as oil, acids, solvents, and various fuels. Among the key chemicals employed in protective coatings, notable ones include epoxy, urethane, polyester, & polyurea.

End-Use Analysis

Why Non-Residential Segment Held Majority Share?

The non-residential segment held the majority market share in 2024. Within these sectors, construction chemicals are commonly utilized for sealing purposes, particularly in joints and cracks. Moreover, sealants serve a critical role in protecting buildings against moisture, dust, and heat, making them a versatile solution for various commercial and residential applications. Anticipated projects like the Panama Canal expansion are expected to stimulate growth within this segment over the forecast period significantly. Furthermore, the expansion of modern office spaces, urbanization, and evolving lifestyles have all played pivotal roles in driving market growth.

The housing sectors in emerging markets such as China, India, South Africa, & Turkey are poised for a promising future. This optimistic outlook is projected to be a significant driver of market growth in the coming years. The increasing demand for single-family housing projects aligns with the growing financial capacity of consumers in these developing markets.

Regional Insights

What are the Regional Insights?

APAC held the largest share. This growth is due to the significant investments in infrastructure development, combined with the ascending levels of disposable income among consumers in the region. Indonesia, the Philippines, & Malaysia are currently undergoing rapid economic expansion. This economic growth is expected to exert a favorable influence on the construction sector. Notably, these countries are experiencing a substantial uptick in demand for infrastructure projects, leading to an increased need for construction chemicals in the region.

With the escalating Indian population, the country’s urbanization rate is also growing rapidly. As per United Nations Development Programme (“UNDP”) projections, by 2046, nearly 50 percent of the country’s population will reside in urban areas. However, this urbanization will drive the demand for housing, offices, & other real estate asset classes in the medium to the long term. UNDP anticipated that there will be eight cities with a population of 10 Mn & above by 2035 in the country, thereby meeting unmet housing demand.

Europe is expected to witness steady growth. The expansion of the construction industry primarily influences the market. In Western European nations like the U.K., Germany, the Netherlands, France, and others, there is an anticipation of moderate growth throughout the forecast period. Economic and political policies within these countries are also expected to exert a substantial influence on the development of the market.

Key Industry Players & Competitive Analysis

The market is characterized by intense competition, with a small number of dominant companies controlling a significant portion of the market share. In response to strict environmental regulations, these industry leaders are prioritizing the research and development of innovative alternatives, particularly in the realm of bio-based construction chemicals.

Some of the top companies operating in the global market are:

- Sika AG

- Chembond Chemicals Ltd.

- RPM International Inc

- Cera-Chem Private Limited.

- MAPEI Corporation

- Fosroc International Ltd.

- Bostik, Inc.

- H.B. Fuller

- Henkel AG & Company

- BASF SE

- The Dow Chemical Company

- Pidilite industries

Industry Recent Developments

-

April 2024: Mapei launched the Mapeflex MS 55, a hybrid adhesive and sealant with a high modulus of elasticity, ideal for everyday use in both professional and domestic contexts.

- June 2023: Fosroc entered a partnership with Chemtech, a prominent player in the construction chemicals industry. This collaboration has facilitated the production and distribution of Fosroc's diverse portfolio of construction chemicals.

- February 2023: Sika successfully completed the acquisition of MBBC Group. This strategic move has not only bolstered Sika's global product offerings and services but has also expedited the construction industry's shift toward sustainability.

Construction Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 83.79 billion |

| Market size value in 2025 | USD 88.12 billion |

|

Revenue Forecast in 2034 |

USD 140.20 billion |

|

CAGR |

5.30% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By Consumer, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 Construction Chemicals Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

• The global market size was valued at USD 83.79 billion in 2024 and is projected to grow to USD 140.20 billion by 2034.

• The global market is projected to register a CAGR of 5.3% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market are Sika AG; Chembond Chemicals Ltd.; RPM International Inc; Cera-Chem Private Limited; MAPEI Corporation; Fosroc International Ltd.; Bostik, Inc.; H.B. Fuller; Henkel AG & Company, KGaA; BASF SE; The Dow Chemical Company; Pidilite Industries Ltd.

• The concrete ad-mixture segment accounted for the largest market share in 2024.

• The non-residential segment held the majority market share in 2024.