Veterinary Eye Care Services Market Size, Share, Trends, Industry Analysis Report

By Animal, By Product, By Indication, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6489

- Base Year: 2024

- Historical Data: 2020-2023

What is veterinary eye care services market size?

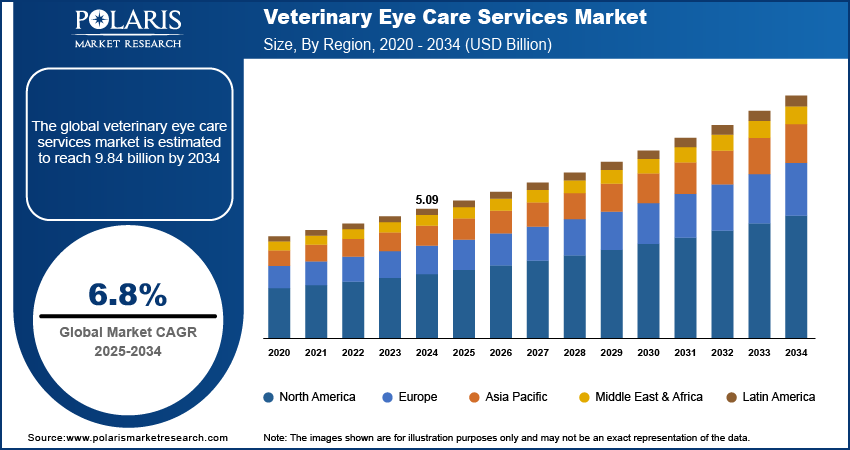

The global veterinary eye care services market size was valued at USD 5.09 billion in 2024, growing at a CAGR of 6.8% from 2025 to 2034. Rising pet ownership along with increasing prevalence of ocular disorders in companion animals driving the market growth.

Key Insights

- Canine segment led the market in 2024, driven by the high incidence of eye disorders such as cataracts, glaucoma, and conjunctivitis among dogs.

- Medications segment accounted for a significant market share, supported by the expanding availability of prescription drugs, ointments, and anti-inflammatory formulations for various ocular diseases.

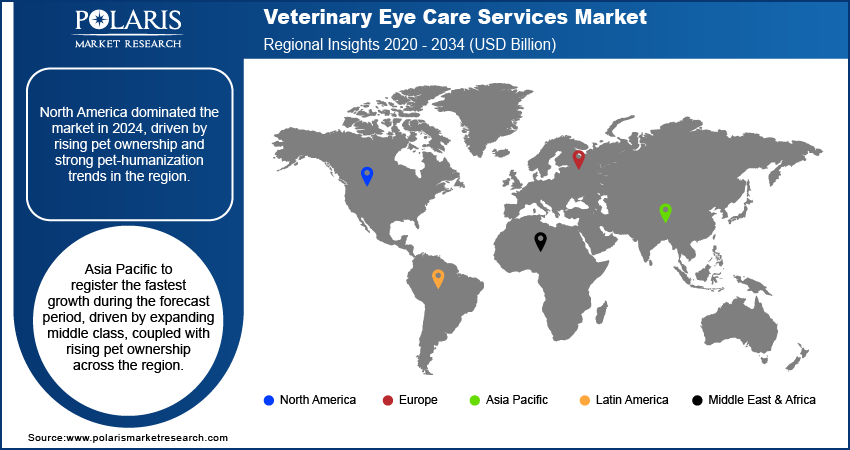

- North America was the largest market in 2024, due to increasing pet ownership and widespread pet-humanization trends within the region.

- The U.S. led the North America market, driven by increased pet owner willingness to spend on premium and preventive veterinary care.

- Asia Pacific is expected to record the highest growth, fueled by increasing middle-class populations and consistent increase in pet ownership within growing economies.

- Australia made significant contributions to regional growth, led by rising investment in veterinary infrastructure and specialist training programs that increase access to specialist eye care.

- Key players operating in the market include AAccutome, Inc., An-Vision GmbH, Bausch & Lomb Incorporated, Boehringer Ingelheim International GmbH, Ceva Sante Animale S.A., Dechra Pharmaceuticals PLC, I-Med Animal Health, Iridex Corporation, Jorgensen Laboratories, LLC, LKC Technologies Inc., Merck & Co., Inc., OptoMed Oy, Reichert, Inc., Sandoz AG, and Zoetis Services LLC.

Industry Dynamics

- Growing pet ownership and the continued humanization of pets are driving demand for specialized veterinary ophthalmic care very strongly.

- Growing incidence of ocular disease in companion animals, such as conjunctivitis, uveitis, and corneal ulcers, is driving demand for early diagnosis and treatment.

- The high cost of treatment and equipment is limiting market growth, particularly in developing markets with limited access to specialist veterinary ophthalmology.

- Artificial intelligence-assisted diagnostic equipment and digital imaging systems are creating growth opportunities by enhancing accuracy, therapeutic outcomes, and workflow effectiveness in veterinary clinics.

Market Statistics

- 2024 Market Size: USD 5.09 Billion

- 2034 Projected Market Size: USD 9.84 Billion

- CAGR (2025–2034): 6.8%

- North America: Largest Market Share

What is veterinary eye care services?

Veterinary eye care services market includes specialized treatment and diagnostic solutions aimed at treating ocular diseases in animals. These services are extensively employed in veterinary hospitals, animal health centers, and veterinary clinics to treat diseases like cataracts, glaucoma, corneal ulcers, and retinal disease. Improvements in ophthalmic devices, imaging tools, and surgical methods are enhancing diagnostic precision and treatment efficacy.

Accelerating technological advancements in veterinary diagnostic and treatment technology are revolutionizing eye care for animals. The combination of AI-imaging and hematology technology allows for quicker and more precise identification of ocular and systemic ailments associated with eye wellness. In September 2025, Zoetis a prominent veterinary diagnostics company extended availability of an AI-driven cartridge-based hematology analyzer to major European nations such as France, Germany, Italy, and Spain. This is part of an increasing trend towards sophisticated, data-driven diagnostic platforms that improve accuracy and clinical efficacy in veterinary ophthalmology.

The continuous progress in veterinary clinics, specialty care hospitals, and diagnostic labs is enhancing access to sophisticated eye care services for animals. Growing investments in equipment, training, and specialist presence are making more veterinarians capable of correctly diagnosing and treating sophisticated ophthalmic conditions. This growing infrastructure is also enhancing awareness among pet owners regarding preventive and corrective eye care.

Drivers & Opportunities

What are the factors driving the veterinary eye care services market growth?

Rising Pet Ownership: The continuous rise in pet adoption and increasing emotional bond between owners and pets are pushing more spending on specialized animal care. As per the American Pet Products Association (APPA) 2025 Industry Report, approximately 94 million households in the U.S. accounting for 71% of all households keep at least one pet. This persistent trend of humanization is increasing the demand for good healthcare, including specialized ophthalmic services, for their pets.

Increasing Prevalence of Ocular Disorders in Companion Animals: The increasing incidence of ocular diseases like cataracts, glaucoma, and corneal ulcers in dogs and cats is driving demand for dedicated eye care services. Age-related, genetic, and diabetes-associated conditions are on the rise, leading to increasing demand for early diagnosis and corrective treatment. As reported in a May 2025 report by the National Library of Medicine, ocular diseases were noted in 9.07% of the examined dogs, with 208 out of 2,293 cases identified as having eye disorders. Conjunctivitis (27.9%) and eyelid abnormalities (24%) were the most common conditions.

Segmental Insights

By Animal

Based on animal type, the veterinary eye care services market is segmented into canine, feline, equine, bovine, and others. The canine segment held leading market share in 2024 due to the prevalence of eye disorders like cataract, glaucoma, and conjunctivitis among dogs. The increasing pet ownership and higher spending on companion animal healthcare are also contributing to segment growth.

The feline market is anticipated to record rapid growth, driven by increasing awareness for feline ocular health and the availability of advanced ophthalmic treatments for conditions such as corneal ulcers and uveitis.

By Product

On the basis of product, the market is classified into devices & instruments and medications. Devices & instruments dominated the market in 2024, driven by increasing use of diagnostic devices like slit lamps, ophthalmoscopes, and tonometers in veterinary clinics.

The medication segment is expected to grow at a fast pace, driven by the increasing availability of prescription medications, ointments, and anti-inflammatory drugs for the treatment of a variety of eye diseases.

By Indication

Based on indication, the market is divided into eyelid abnormalities, cataract, glaucoma, retinal complications, uveitis, conjunctivitis, corneal complications, and other indications. Cataract held a major share in 2024, owing to the growing number of aging pets and predispositions, leading to the demand for corrective treatments and surgical procedures.

Glaucoma complications are anticipated to experience robust growth, fueled by improved early diagnosis and the adoption of laser-based surgical methods.

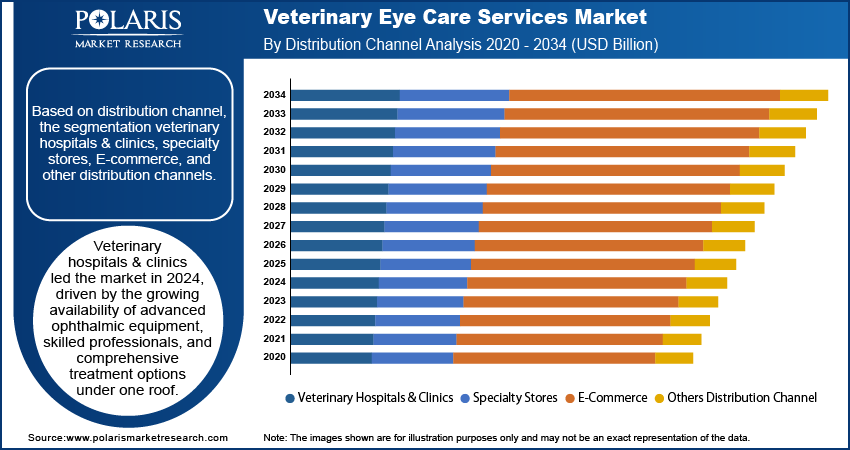

By Distribution Channel

By distribution channel, the market is segmented into veterinary hospitals & clinics, specialty stores, e-commerce, and other distribution channels. Veterinary hospitals & clinics held the highest market share in 2024, driven by the increasing number of sophisticated ophthalmic equipment, trained professionals, and integrated treatment solutions within one location.

E-commerce is expected to register strong growth, as internet sites increasingly provide simple access to ophthalmic medications, eye drops, and diagnostic equipment.

Regional Analysis

North America led the market share in 2024, fueled by increasing pet ownership and robust pet-humanization trends throughout the region. Established networks of veterinary referrals, along with a growing number of specialty clinics, are making sophisticated ophthalmic diagnostics, surgery, and post-surgical care more accessible. This increasing accessibility of specialized care is boosting steady expansion of the market and driving adoption of advanced therapeutic opportunities.

The U.S. Veterinary Eye Care Services Market Overview

The U.S. accounted for the largest market share in North America, driven by increasing pet owner willingness to pay for premium and preventive care for their pets. Overall U.S. pet industry expenditures reached USD 152 billion in 2024, reflecting steady growth and market resilience, as reported by the American Pet Products Association (APPA). Increasing attention to preventive care and animal quality of life is also driving demand for sophisticated eye care diagnostics and treatments.

Asia Pacific Veterinary Eye Care Services Market Insights

Asia Pacific is expected to grow with a high rate in the forecast period driven by the growing middle class, combined with increasing pet ownership in urban regions, with strong demand for veterinary specialty care for high-end ophthalmic diagnostics and surgeries. Growing disposable income, increasing pet health awareness, and higher inclination towards specialized treatment are pushing pet owners towards availing quality eye care solutions for pets and hence fueling regional market growth.

Australia Veterinary Eye Care Services Market Analysis

Australia market is witnessing robust growth within Asia pacific due to the increasing investment in veterinary infrastructure and specialist training programs that are enhancing local access to ophthalmic advanced care. In September 2025, CVS Australia acquired six Sydney Animal Hospital locations in Newtown, Inner West, Norwest, Kellyville, Newport, and Avalon. This strategic growth enhances the specialty network of services and improves access to high-quality eye care for animals, enabling long-term growth in the Australian veterinary eye care market.

Europe Veterinary Eye Care Services Market Assessment

Europe held significant market share driven by strict regulatory demand and high focus on animal welfare, fostering adoption of professional eye care standards. The European Food Safety Authority (EFSA) published scientific opinions in 2022 and 2023 to support updating EU legislation on animal welfare, providing technical advice concerning housing, transport, and species-specific care. Existing veterinary infrastructure, including university teaching hospitals and specialist referral centers, also continues to expand service capacity for advanced ophthalmology care.

Key Players & Competitive Analysis

The global veterinary eye care services market is characterized by increasing competition and constant developments in diagnostic and treatment technologies. Market leaders are looking to extend their veterinary ophthalmology portfolios through breakthroughs in imaging systems, surgical instruments, and drug formulations for pets and livestock. Increasing incidence of ocular ailments including cataracts, glaucoma, and conjunctivitis in pets and rising awareness regarding animal well-being are pushing service providers to implement sophisticated diagnostic and therapeutic technologies.

Who are the key players in veterinary eye care services market?

Key players in the global veterinary eye care services market include Accutome, Inc., An-Vision GmbH, Bausch & Lomb Incorporated, Boehringer Ingelheim International GmbH, Ceva Sante Animale S.A., Dechra Pharmaceuticals PLC, I-Med Animal Health, Iridex Corporation, Jorgensen Laboratories, LLC, LKC Technologies Inc., Merck & Co., Inc., OptoMed Oy, Reichert, Inc., Sandoz AG, and Zoetis Services LLC.

Key Players

- Accutome, Inc.

- An-Vision GmbH

- Bausch & Lomb Incorporated

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale S.A.

- Dechra Pharmaceuticals PLC

- I-Med Animal Health

- Iridex Corporation

- Jorgensen Laboratories, LLC

- LKC Technologies Inc.

- Merck & Co., Inc.

- OptoMed Oy

- Reichert, Inc.

- Sandoz AG

- Zoetis Services LLC

Veterinary Eye Care Services Industry Developments

In July 2025, Dômes Pharma partnered with Fear Free to unveil stress-free veterinary eye care, which includes products like Oculenis, Ocunovis Procare, and Fluodrop. This campaign brings cutting-edge solutions together with empathetic care for both veterinarians and pets.

In June 2023, Sentrx and Kiora Pharmaceuticals updated their licensing agreement to promote developments in veterinary ophthalmology. The agreement centers on the use of KIO-201 technology for healing corneal wounds, which combines hyaluronic acid with antibiotics to deliver advanced eye care for companion animals.

Veterinary Eye Care Services Market Segmentation

By Animal Outlook (Revenue, USD Billion, 2020–2034)

- Canine

- Feline

- Equine

- Bovine

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Devices & Instruments

- Diagnostic Devices

- Treatment Devices

- Medications

- Antibiotics

- NSAIDs

- Corticosteroids

- Lubricants / Artificial Tears

- Analgesics / Pain Relievers

- Other Medications

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Eyelid Abnormalities

- Cataract

- Glaucoma

- Retinal Complications

- Uveitis

- Conjunctivitis

- Corneal Complications

- Other Indications

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Veterinary Hospitals & Clinics

- Specialty Stores

- E-Commerce

- Other Distribution Channels

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Veterinary Eye Care Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.09 Billion |

|

Market Size in 2025 |

USD 5.43 Billion |

|

Revenue Forecast by 2034 |

USD 9.84 Billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.09 billion in 2024 and is projected to grow to USD 9.84 billion by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Accutome, Inc., An-Vision GmbH, Bausch & Lomb Incorporated, Boehringer Ingelheim International GmbH, Ceva Sante Animale S.A., Dechra Pharmaceuticals PLC, I-Med Animal Health, Iridex Corporation, Jorgensen Laboratories, LLC, LKC Technologies Inc., Merck & Co., Inc., OptoMed Oy, Reichert, Inc., Sandoz AG, and Zoetis Services LLC.

The canine segment dominated the market revenue share in 2024.

The medications segment is projected to witness the fastest growth during the forecast period.