Animal Health Market Share, Size, Trends, Industry Analysis Report

By Animal Type (Production Animals, Companion Animals); By Product; By Distribution Channel; By End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4530

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

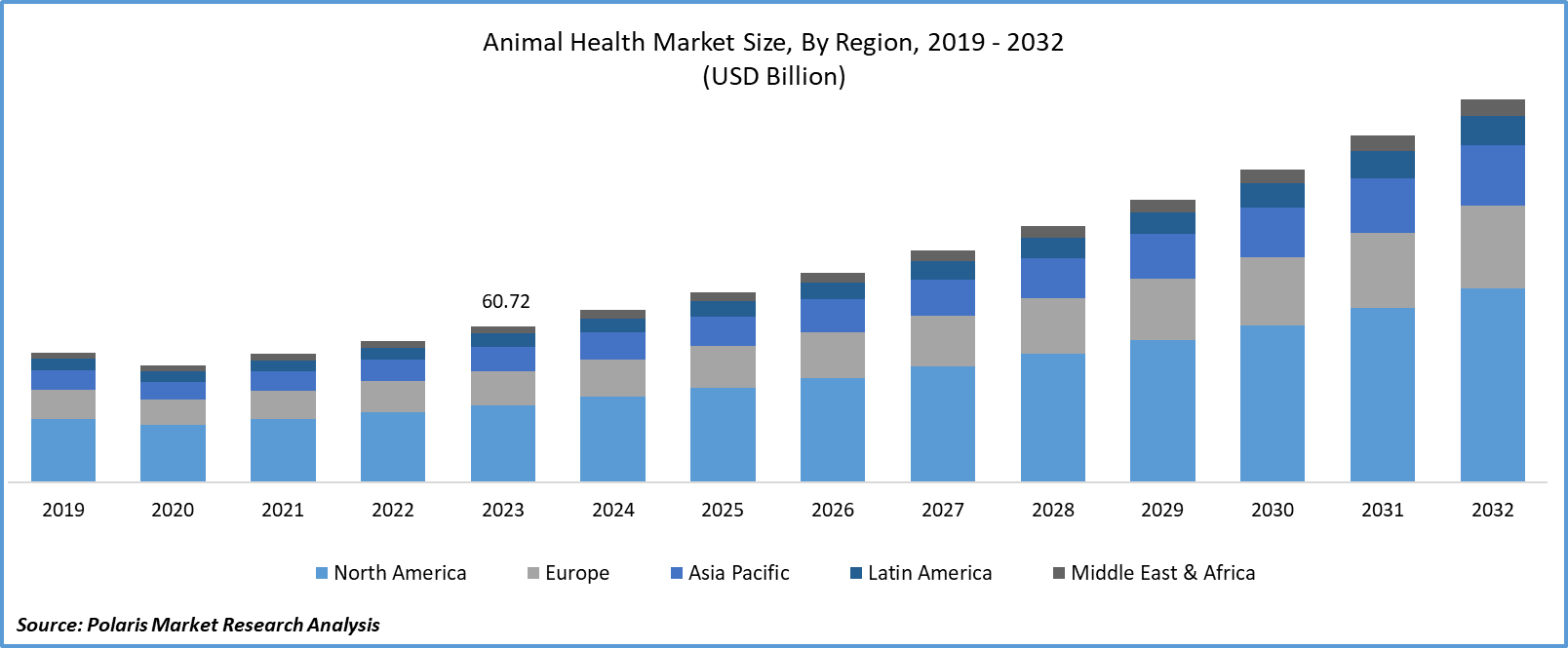

Animal health market size was valued at USD 60.72 billion in 2023. The market is anticipated to grow from USD 66.97 billion in 2024 to USD 149.02 by 2032, exhibiting the CAGR of 10.5% during the forecast period

Industry Trends

Animal health pertains to the condition of well-being and optimal functioning of animals, whether they are domesticated or wild. It encompasses the physical, mental, and behavioral dimensions of animals, emphasizing their overall health and quality of life. Safeguarding animal health requires the implementation of diverse measures, including preventive healthcare, timely vaccinations, suitable nutrition, and consistent veterinary attention. Effective management of animal health is crucial for the individual welfare of animals and for averting and managing the transmission of diseases that can affect both animal and human communities.

The increasing need for animal protein and the rising prevalence of pet ownership are expected to drive market growth in the forecast period. Additionally, the heightened awareness of zoonotic diseases and the adoption of the One Health approach the significance of preventive care and disease management in animals. In response to industry trends, substantial investments in research and development (R&D) for innovative and enhanced animal health solutions are contributing positively to animal health market expansion.

However, the deliberate acquisition of businesses not only expanded the company's overall capacity but also introduced two decades of priceless experience into the animal health market. Key players in the animal health market often leverage innovative development strategies through partnerships and acquisitions to enhance their technological capabilities and supply cutting-edge solutions to meet the evolving needs of the industry.

- For instance, In December 2023, Zenex declared a complete acquisition of Ayurvet. Ayurvet, established by Pradip Burman, is a premier supplier of natural, herbal, and secure Ayurvedic medicines, topical treatments for companion and farm animals, and feed supplements. The company seamlessly integrates the ancient knowledge and wisdom of Ayurveda with cutting-edge technology.

To Understand More About this Research: Request a Free Sample Report

Additionally, animals play a crucial role as models in biological research, particularly in fields such as genetics and drug testing. The rising awareness of animal diseases, increasingly stringent regulations, and a growing emphasis on preventing diseases originating from animal epidemics are anticipated to drive the demand for animal healthcare products, resulting in rising market growth across all regions. The market is primarily propelled by a substantial increase in pet adoption, a rise in the incidence of zoonotic diseases and food-borne illnesses, as well as a growing global demand for protein-rich food. Furthermore, technological advancements in the market and the introduction of information systems are contributing to the growth of the animal health market.

The Animal Health Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Key Takeaway

- North America accounted for the largest market and contributed to more than 40% of share in 2023.

- Asia pacific region has expected to grow at fastest CAGR during the forecast period.

- By Product category, pharmaceutical segment held the largest market share in 2023.

- By End-use category, the veterinary hospitals & clinics segment expected to witness the fastest CAGR during the forecast period.

What are the market drivers driving the demand for the Animal Health Market?

The increasing prevalence of zoonotic diseases

The upsurge in zoonotic diseases is anticipated to propel the veterinary healthcare market. The rising trend of adopting pets for companionship is leading to increased exposure to diseases transmitted by animals worldwide. The heightened awareness of preventive measures and the expanding array of available treatment options are expected to boost the demand for animal care products in the forecast period.

According to the Centre for Disease Control (CDC), thousands of Americans fall ill each year due to diseases transmitted from animals. Animals play a crucial role in advancing healthcare product development by serving as test subjects for drug and medical device testing. The utilization of animals in drug discovery is essential, as research on numerous genetic and chronic human diseases cannot ethically be conducted directly on humans. In the United States alone, thousands of mice and monkeys are annually employed as test subjects in research laboratories.

Animal studies contribute significantly to the development of new surgical techniques, such as organ transplantations, as well as the safety testing of novel drugs and nutritional research. Animals prove particularly valuable in researching prolonged deteriorating diseases, as these conditions can be induced in animals with relative ease, thereby fostering the overall expansion of the market size.

Which factor is restraining the demand for Animal Health?

Government Regulations Over Approval for Animal Drugs

The market is influenced by a variety of regulations. The development and manufacturing of medicines undergo strict monitoring by government agencies such as the FDA, whereas regulations for veterinary diagnostic and other products are comparatively more lenient. The processes for regulatory approval can be complex and time-consuming, creating entry barriers for new companies. This often results in well-established players dominating a significant share of the animal health market, leveraging their resources and experience to navigate regulatory challenges effectively. Strict government regulations on the approval of animal drugs are expected to impede market growth.

Report Segmentation

The market is primarily segmented based on animal type, product, distribution channel, end-Use, and region.

|

By Animal type |

By Product |

By Distribution channel |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the basis of biologics, pharmaceuticals, diagnostics, medicinal feed additives, equipment & disposables, and others. The pharmaceuticals segment held the largest market share in 2023. Pharmaceutical is further classified into anti-inflammatory, anti-infective, parasiticides, analgesics, and others. Pharmaceuticals, including vaccines and medications, play a critical role in preventing and treating various diseases in animals. They are essential for maintaining the health and well-being of both companion and livestock animals.

Pharmaceutical companies often provide comprehensive healthcare solutions, including vaccines, antibiotics, and other therapeutic medications. This comprehensive approach appeals to veterinarians, livestock farmers, and pet owners, consolidating the market share of pharmaceuticals.

By End Use Insights

Based on End-use industry analysis, the market has been segmented on the basis of point-of-care testing/in-house testing, veterinary reference laboratories, veterinary hospitals & clinics, and others. The veterinary hospitals & clinics segment is expected to witness the fastest CAGR during the forecast period. The rising trend of pet ownership has led to a surge in demand for veterinary services. Pet owners are increasingly seeking healthcare services for their animals, including routine check-ups, vaccinations, and treatment of illnesses. It heightened awareness of pet health contributes to the growth of veterinary hospitals and clinics. Ongoing advancements in veterinary medicine and technology have expanded the range of services offered by veterinary hospitals and clinics.

Regional Insights

North America

North America accounted for the largest animal health market share in 2023. North America exhibits high rates of pet ownership, with a large population of households keeping companion animals such as dogs, cats, and other pets. This robust pet ownership culture drives demand for various animal health products and services, including veterinary care, medications, and pet wellness products. Pet owners are more likely to seek veterinary care, preventive measures, and quality nutrition for their animals, contributing to the growth of the animal health market.

The animal health industry in North America adheres to rigorous regulatory standards set by agencies like the U.S. Food and Drug Administration (FDA). Compliance with these standards ensures the safety and efficacy of animal health products, fostering trust among consumers and supporting market dominance.

Asia Pacific

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. Within Asia Pacific, nations like China, Japan, and India exhibit varied levels of economic development, due to an increased presence of biopharmaceutical companies dedicated to advancing animal health and modernizing the drug discovery process. The growing population has led to the consumption of dairy products, meat, eggs, and other products. It shows the increasing demand for animals and their production. The secondary increase in companion animals has also increased individual love towards pets, showing a rapid increase in the animal health market growth during the projected period.

Competitive Landscape

The competitive landscape of the animal health market study is dynamic and multifaceted, characterized by a diverse array of players ranging from multinational pharmaceutical companies to smaller biotech firms and veterinary service providers. As the global demand for animal health products and services continues to rise, driven by factors such as increasing pet ownership, growing livestock production, and rising awareness about animal welfare, competition within the industry has intensified.

Some of the major market players operating in the global market include:

- Boehringer Ingelheim Gmbh

- Ceva Santé Animale

- Dechra Pharmaceuticals Plc

- Elanco

- Idexx Laboratories, Inc.

- Mars Inc.

- Merck & Co., Inc.

- Vetoquinol S.A.

- Virbac

- Zoetis

Recent Developments

- In November 2023, Boehringer Ingelheim secured approval from the European Commission for SENVELGO, its initial oral liquid medication formulated for cats with diabetes.

- In September 2023, Mars Inc. completed the acquisition of SYNLAB Vet, a European Veterinary Reference Laboratory, from SYNLAB Group. This move enhances its Petcare division's current presence in the comprehensive veterinary diagnostics business across Europe.

Report Coverage

The animal health market report emphasizes on key regions across the globe to provide better understanding of the product to the Uses. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, animal type, product, distribution channel, end-use, and their futuristic growth opportunities.

Animal Health Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 66.97 billion |

|

Revenue forecast in 2032 |

USD 149.02 billion |

|

CAGR |

10.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Animal Type, By Product, By Distribution Channel, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Navigate through the intricacies of the 2032 Animal Health Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Alexipharmic Drugs Market Size, Share 2024 Research Report

Cleaning and Hygiene Products Market Size, Share 2024 Research Report

AI Data Management Market Size, Share 2024 Research Report

FAQ's

key companies in Animal Health Market are Boehringer Ingelheim Gmbh, Ceva Santé Animale, Dechra Pharmaceuticals Plc

Animal health market exhibiting the CAGR of 10.5% during the forecast period

The Animal Health Market report covering key segments are animal type, product, distribution channel, end-Use, and region.

key driving factors in Animal Health Market are increasing prevalence of zoonotic diseases

The global Animal Health Market size is expected to reach USD 149.02 billion by 2032