Cleaning and Hygiene Products Market Share, Size, Trends, & Industry Analysis Report

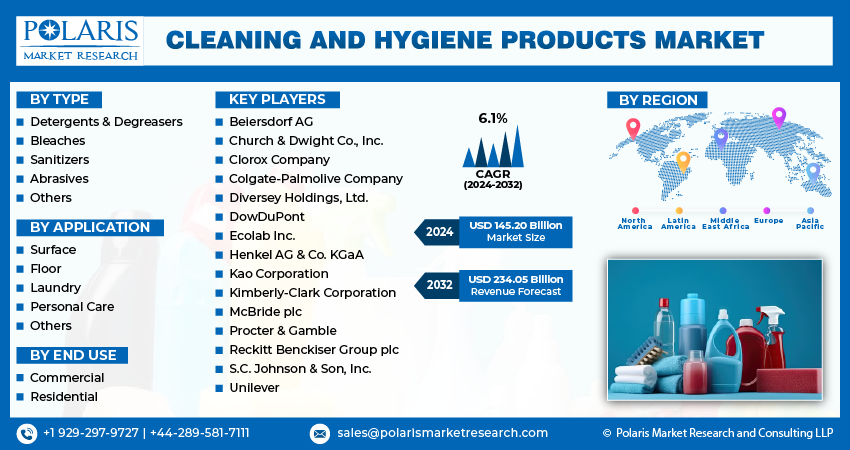

By Type (Detergents & Degreasers, Bleaches, Sanitizers, Abrasives, Others); By Application; By End Use; By Region; Segment Forecast, 2025- 2034

- Published Date:Sep-2025

- Pages: 130

- Format: PDF

- Report ID: PM4337

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Introduction

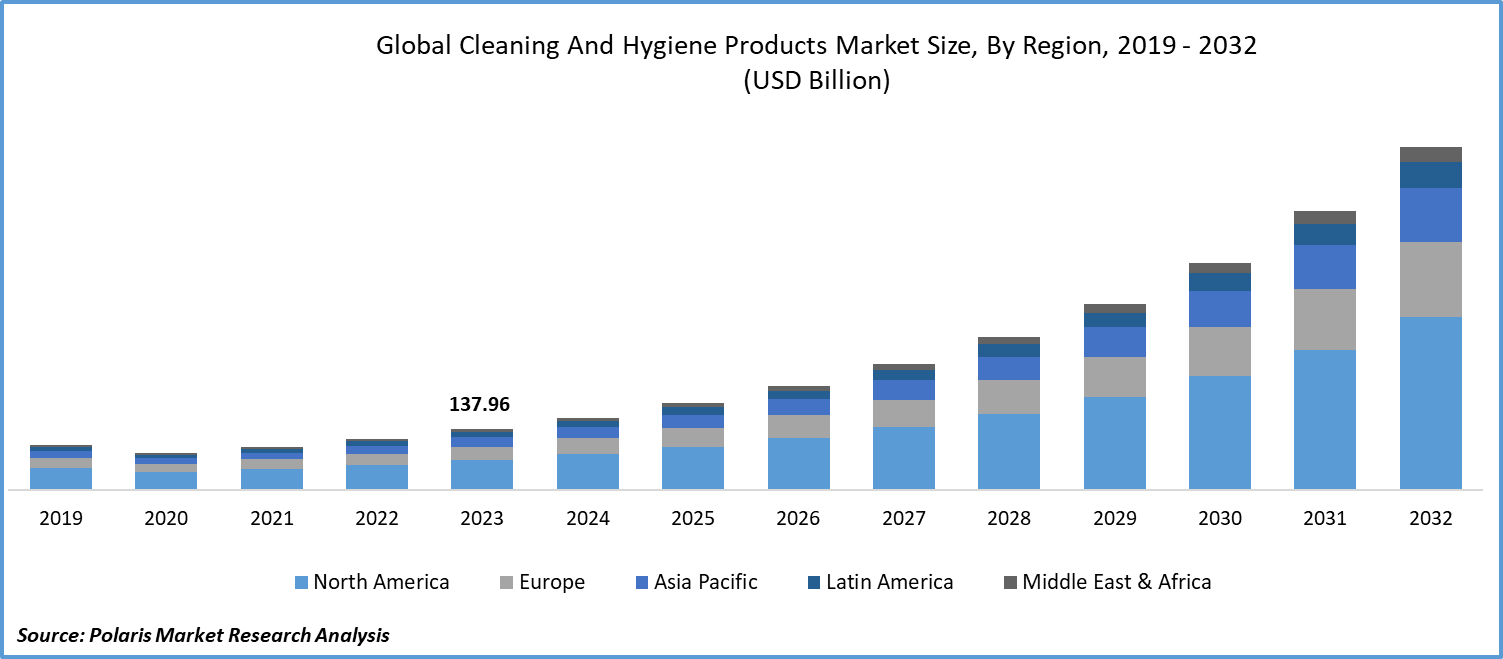

The Cleaning and Hygiene Products Market will be worth USD 151.4 billion in 2024, with a CAGR of 6.25% through 2034. Heightened awareness of sanitation, increased spending on personal and institutional hygiene, and post-pandemic hygiene standards are supporting market growth.

Key Insights

- In 2024, detergents and degreasers became the largest segment, serving as vital cleansing products used to remove oil, dirt, and grime from surfaces.

- The laundry segment led the market in 2024 through its provision of essential and innovative products that clean, protect, and disinfect clothing, thereby responding to the increasing demand for eco-friendly and high-performance alternatives.

- The residential segment contributed the majority of revenues in 2024, which were driven by rising demand for effective, eco-friendly cleaning and hygiene solutions that offer healthy living benefits and provide easy-to-use daily home care convenience.

- Asia Pacific led the world market in 2024, driven by growing hygiene awareness, urbanization, and the demand for more innovative, environmentally friendly cleaning products that cater to diverse regional preferences.

- North America is undergoing a profound shift, driven by escalating health issues, shifting consumer trends, and the need to comply with increasingly stringent regulatory requirements.

Industry Dynamics

- The market is rapidly changing, with increasingly stringent environmental concerns driving the need for sustainable solutions that strike a balance between strong cleaning and reduced ecological footprints.

- Urban lifestyles and urbanization are driving demand for convenient, multi-benefit cleaning products in the expanding hygiene market.

- The growing health consciousness following recent global crises is driving healthy growth in the cleaning sector, as consumers seek efficient and innovative products for both household and business applications.

- The market for cleaning and hygiene products is hindered by stringent and complex regulations that raise prices, delay product development, and divert significant resources, potentially hindering innovation and impacting product prices.

Market Statistics

2024 Market Size: USD 151.4 billion

2034 Projected Market Size: USD 268.5 billion

CAGR (2025-2034): 6.25%

Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

The cleaning and hygiene products market experiences robust growth driven by escalating global health concerns. Recent health crises have highlighted the importance of maintaining cleanliness and hygiene worldwide. This heightened awareness prompts a surge in demand for dependable and effective hygiene products across households, commercial spaces, and public areas.

In addition, companies operating in the market are concentrating on developing new solutions to cater to the growing market demand. For instance, in November 2022, Reckitt and Essity jointly unveiled a line of co-branded disinfection products tailored for professional hygiene customers. This collaboration leverages the strengths of their Dettol, Sagrotan, and Tork brands and is set to be introduced across four European countries: the United Kingdom, Ireland, Germany, and Austria. The co-branded product range includes an antibacterial multipurpose cleaner spray, antimicrobial foam soap, and a hand sanitizer gel designed for use with Tork dispensers.

The cleaning and hygiene products market is undergoing a significant transformation driven by a growing focus on sustainability. A rising environmental consciousness prompts consumers to prefer eco-friendly cleaning solutions, compelling manufacturers to create products with reduced ecological impact. This shift involves incorporating biodegradable components and recyclable packaging. Companies are reformulating their products to meet the demand for responsible consumption. Sustainable advancements in cleaning appeal to an environmentally aware market, balancing effectiveness with ecological responsibility.

Industry Growth Drivers

-

Urbanization and the changing lifestyles of consumers are projected to spur product demand

The cleaning and hygiene products market growth is propelled by urbanization and shifting lifestyles. The rise in urban populations, marked by compact living and busy schedules, generates a heightened demand for convenient and versatile household cleaning products. The acceleration of fast-paced lifestyles accentuates the need for accessible and efficient hygiene products. Manufacturers respond with inventive solutions designed for urban living, significantly impacting the market's upward trend. This underscores the vital role these products play in adapting to modern living environments shaped by changing demographics and urban dynamics.

-

Growing awareness regarding health and sanitation is expected to drive cleaning and hygiene products market growth

A growing awareness of health and sanitation propels the cleaning and hygiene products market. Fueled by global health concerns, consumers prioritize cleanliness, resulting in an increased demand for hygiene products. This heightened emphasis on personal and environmental health, particularly in the wake of recent pandemics, spurs market growth. Innovations targeting evolving health concerns, both in households and commercial spaces, contribute to the rising demand for effective cleaning solutions, solidifying the market's expansion.

Industry Challenges

-

Regulatory complexities and compliance standards are likely to impede market growth

The cleaning and hygiene products market faces significant challenges stemming from regulatory complexities and compliance standards. Stringent regulations demand meticulous adherence, driving up production costs for manufacturers. Compliance hurdles often require extensive testing and documentation, slowing down product development cycles. Stricter guidelines surrounding ingredient disclosure and safety further contribute to market limitations. Navigating varied regional standards complicates the global supply chain, impacting the industry's operational efficiency. As regulatory landscapes evolve, companies must allocate substantial resources to stay abreast of changing requirements, constraining innovation and potentially affecting the affordability of cleaning and hygiene products for consumers.

Report Segmentation

The cleaning and hygiene products market analysis is primarily segmented based on type, application, end use, and region.

|

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Detergents & Degreasers emerged as the largest segment in 2024

The detergents & degreasers emerged as the largest segment in 2023. Detergents and degreasers are essential cleaning products that are intended to remove oil, filth, and dirt from various surfaces. While degreasers concentrate on slicing through and eliminating greasy residues, detergents use surfactants to dissolve and lift away grime. These cleaning products are essential for a variety of tasks in the home, workplace, vehicle repair, and commercial settings. Used for floor care, dishwashing, or strong industrial degreasing, these products are carefully blended to provide effective and powerful cleaning solutions, greatly assisting in maintaining hygienic conditions in a variety of environments.

By Application Analysis

The laundry segment accounted for a significant market share in 2024

The laundry segment accounted for a significant market share in 2024. In order to properly care for clothing and maintain its freshness and cleanliness, laundry supplies are necessary. Color-safe bleach, fabric softeners, spot removers, and detergents are essential for preserving the quality of garments. Advanced formulas focus on fabric preservation, odor reduction, and stain removal. Specialized disinfectants and laundry sanitizers provide improved hygiene and solve modern health issues. In response, the market innovates, bringing in eco-friendly products to satisfy customers who care about the environment. The laundry product market is changing to accommodate a wide range of preferences. It offers fabric boosters and high-performance detergents, which simplify the laundry process and encourage cleanliness, long-lasting clothing, and environmental sustainability.

By End Use Analysis

The residential segment held a significant market revenue share in 2024

The residential segment held a significant revenue share in 2024. Products for hygiene and cleaning the home are necessary to create a healthy atmosphere. These household cleaning products, which include laundry detergents, disinfectants, multi-surface cleansers, and personal care items, are essential for daily household maintenance. Customers are looking for more efficient solutions that provide cleanliness while also taking the environment into account. In response, the market adopts creative strategies, launching environmentally friendly formulas and recyclable packaging. Demand for flexible, user-friendly solutions that improve overall well-being and streamline tasks is driven by changing lifestyles. Home cleaning and hygiene supplies are essential for maintaining a hospitable and clean environment, whether they are used for surface maintenance, guaranteeing laundry freshness, or encouraging personal hygiene.

Regional Insights

Asia-Pacific region dominated the global market in 2024

In 2024, the Asia-Pacific region dominated the global market. The cleaning and hygiene products market in Asia-Pacific is burgeoning, fueled by heightened awareness of hygiene standards, urbanization, and a focus on health. This growth has intensified competition, prompting key industry players to innovate with eco-friendly solutions and cater to diverse regional preferences. Multifunctional, efficient, and sustainable products are gaining traction. Strategic collaborations, partnerships, and continuous research and development efforts are central to companies seeking to gain a competitive edge.

Noteworthy transformations are underway in the North American cleaning and hygiene products market, propelled by an escalating focus on health and sanitation. Companies are compelled not just to meet but exceed stringent government regulations and standards. The market in North America is dynamic, shaped by evolving consumer preferences and a firm commitment to meeting rigorous regulatory criteria.

Key Market Players & Competitive Insights

The cleaning and hygiene products market is characterized by a varied and dynamic landscape, anticipating increased competition with the entry of multiple new participants. Prominent industry players continuously improve their technologies to sustain a competitive edge, giving priority to efficiency, reliability, and safety. These entities underscore strategic initiatives like forming partnerships, refining products, and engaging in collaborative ventures to outperform their peers. Their objective is to secure a significant cleaning and hygiene products market share.

Some of the major players operating in the global cleaning and hygiene products market include:

- Beiersdorf AG

- Church & Dwight Co., Inc.

- Clorox Company

- Colgate-Palmolive Company

- Diversey Holdings, Ltd.

- DowDuPont

- Ecolab Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Kimberly-Clark Corporation

- McBride plc

- Procter & Gamble

- Reckitt Benckiser Group plc

- S.C. Johnson & Son, Inc.

- Unilever

Recent Developments

- In April 2025 – Unilever launches “Cif Infinite Clean” probiotic spray

- In March 2023, Reliance Industries declared the introduction of a series of home and personal care items, encompassing laundry detergents, bathing and washing soaps, and toilet and floor cleaners. This nationwide rollout is being conducted by its subsidiary, Reliance Consumer Products, utilizing omnichannel distribution across India.

- In August 2022, Unilever Professional India (UPro) expanded its range within the CIF, Domex, Surf, and Comfort brands to encompass a variety of new products. This extension includes items such as degreasers, food-contact-safe surface sanitizers, glass cleaners, air fresheners, kitchen sanitizers, dishwasher chemicals, laundry care detergent, and fabric conditioners tailored for commercial use. These products are specifically crafted to address the everyday requirements of cleaning professionals, delivering optimal performance at an affordable price point.

- In February 2022, SC Johnson Professional unveiled its latest Quaternary Disinfectant Cleaner, available in a convenient squeeze-and-pour bottle that facilitates easy measurement. This versatile product effectively cleans, disinfects, and deodorizes in a single, time-saving step. The innovative packaging design streamlines the dilution process, whether for use in a bucket, automatic scrubber or spray bottle.

Report Coverage

The cleaning and hygiene products market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, applications, end uses, and their futuristic growth opportunities.

Cleaning and Hygiene Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 159.8 billion |

|

Revenue forecast in 2034 |

USD 268.5 billion |

|

CAGR |

6.25% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the 2025 market share, size, and revenue growth rate statistics in the field of Cleaning and Hygiene Products Market, meticulously compiled by Polaris Market Research Industry Reports. This comprehensive analysis encompasses a market forecast outlook extending to 2034, along with an insightful historical overview. Experience the depth of this industry analysis by obtaining a complimentary PDF download of the sample report.

Browse Our Bestselling Reports:

Lithium Titanate Oxide (LTO) Battery Market Size, Share Research Report

Mobility as a Service Market Size, Share Research Report

Oncology companion diagnostic market Size, Share Research Report

FAQ's

The global Cleaning and Hygiene Products market size is expected to reach USD 268.5 billion by 2034

Key players in the market are Clorox Company, Colgate-Palmolive Company, McBride plc, Procter & Gamble, Reckitt Benckiser Group plc

Asia-Pacific contribute notably towards the global Cleaning and Hygiene Products Market

Cleaning and Hygiene Products Market exhibiting the CAGR of 6.25% during the forecast period.

The Cleaning and Hygiene Products Market report covering key segments are type, application, end use, and region.