Supply Chain Management Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By User Type, By Deployment Model, By End Use Industry, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2510

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global supply chain management market size was valued at USD 25.62 billion in 2024. The market is projected to grow at a CAGR of 11.10% during 2025 to 2034. Key factors driving demand for supply chain management include rapid technological advancements, the rise of e-commerce, and regulatory requirements.

Key Insights

- The software segment held the largest revenue share in 2024 due to its high usage in inventory management, vendor management, quality management, and logistics and distribution.

- In 2024, the large enterprises segment accounted for the largest market share owing to the greater need to build a strong network and brand identity.

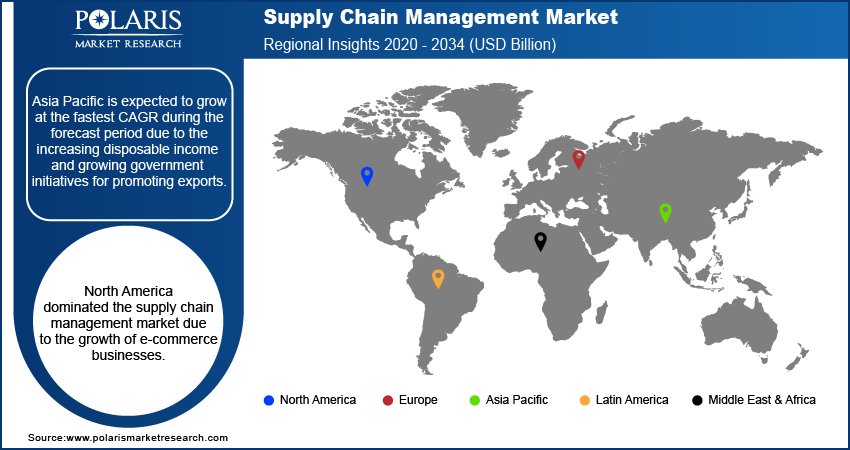

- North America dominated the supply chain management market due to the growth of e-commerce businesses.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the increasing disposable income and growing government initiatives for promoting exports.

Industry Dynamics

- The global supply chain management market is fueled by increasing demand for enhanced supply chain transparency.

- The growth in e-commerce across countries such as China, Japan, and India is also anticipated to increase demand for supply chain management.

- Growing industrialization, especially in emerging countries such as India, is creating a lucrative market opportunity.

- Growing security and privacy concerns among enterprises may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 25.62 Billion

- 2034 Projected Market Size: USD 73.28 Billion

- CAGR (2025-2034): 11.10%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Supply Chain Management Market

- Streamlines repetitive tasks while optimizing routes and overall logistics efficiency.

- Provides real-time visibility coupled with actionable predictive insights.

- Flags potential disruptions early, supporting proactive risk management.

SCM involves centralized management of the flow of goods and services including processes such as planning and forecasting, purchasing, product assembly, moving, storage, distribution, sales, and customer service. Supply chain management focuses on the development and delivery of goods with higher efficiency and greater speed. Industry players are developing digital SCM systems to improve efficiency in material handling and delivery. The use of supply chain software enables suppliers, manufacturers, logistics providers, and retailers to efficiently manage product creation, order fulfillment, and information tracking.

Integration of advanced technologies such as AI, machine learning, IoT, and automation into SCM enhances processes like manufacturing, maintenance, and distribution, resulting in greater efficiency. These technologies are capable of predicting failure before it happens to enable uninterrupted flow of the supply chain. These technologies are increasingly being adopted for enhanced transparency, visibility, connectivity, and SCM utilization. Supply chain management offers greater control over manufacturing processes for improved product quality, decreased risk of recalls, and stronger consumer brands. It also assists in maintaining control over shipping procedures to provide enhanced customer service and address shortages or inventory oversupply. Efficient supply chain management offers growth opportunities for companies to strengthen large and international operations.

Industry Dynamics

Growth Drivers

The global supply chain management market is fueled by increasing demand for enhanced supply chain transparency and greater demand for management solutions from large and medium-sized enterprises. The growth in e-commerce across countries such as China, Japan, and India, rising industrialization, and growing demand from the food and beverage sector supplement the market growth. Global players are expanding into these countries to tap supply chain management market potential. Technological advancements and increasing adoption of advanced technologies such as artificial intelligence and machine learning further support the supply chain management market growth. New product launches and acquisitions by leading players in the market, coupled with increasing use in the adoption of cloud-based SCM solutions, have resulted in greater demand for SCM across the globe.

Report Segmentation

The market is primarily segmented based on component, user type, deployment model, end use industry, and region.

|

By Component |

By User Type |

By Deployment Model |

By End Use Industry |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Software Segment Accounted for a Major Revenue Share in 2024

The software segment accounted for major revenue share in 2024, due to its high usage in vendor management, quality management, and logistics and distribution. Organizations involved in imports and exports of goods across the globe are increasingly adopting SCM software to avoid risks and failures. SCM software further offers benefits such as enhanced visibility, increased efficiency, analytics, reduced costs, greater agility, and increased compliance, which contributed to its high adoption in large enterprises. Moreover, it assists in automating major processes such as order processing, invoicing, and shipment tracking. This propelled medium and large eneterprises to invest in supply chain management software.

Small and Medium Size Enterprises is Expected Grow at a High CAGR During the Forecast Period

In 2024, the large enterprises segment accounted for the largest market share, owing to the need of large enterprises to to handle complex global networks. SCM helps large enterprises by providing real-time visibility, cost reductions, improved efficiency. The strong network and brand identity of large enterprises also propelled these enterprises to adopt SCM software. These enterprises are further depended on SCM software for procurement, inventory, logistics, and demand planning.

Small and medium-size segment is projected to grow at a robust pace in the coming years. This is due to high investment by small and medium-size businesses in SCM for efficient and secure operations, improved customer experience, and higher productivity. Small and medium-sized enterprises are further turning toward cloud-based SCM solutions owing to their flexibility and cost-effectiveness.

Cloud-based Segment is Expected to Witness Fastest Growth During the Forecast Period

The cloud-based segment is expected to witness a significant growth during the forecast period owing to its greater flexibility and adaptability to change. Cloud-based software can be easily modified to address fluctuating circumstances. These software can also be easily integrated with advanced technologies to cater to specific business needs, eliminating the need for a full-scale migration. The decreasing the cost of data storage coupled with the growing adoption of cloud computing is accelerating the growth of the segment. Enterprises across the globe are increasingly shifting towards cloud-based SCM software owing to their greater processing capabilities, storage, cost-effective pricing models, and reduction in operational overhead.

North America Held the Largest Revenue Share in 2024

North America accounted for the largest revenue share in 2024, due to growth in e-commerce and an increase in demand for transparency in processes across the supply chain. Established technological infrastructure in the region combined with the high adoption of advanced technologies surther fueled the growth of the market in the region. The various mergers and acquisitions taking place between major vendors in the region also contributed to the market dominance. The industry leaders are expanded their presence in the region, leading to supply chain management market dominance.

The market in the Asia Pacific is projected to grow at a robust pace in the coming years, owing to growing e-commerce sector and rising disposable income. The growth of quick delivery services in countries like India and Vietnam are also driving the market growth in the region. The growing population coupled with increasing online shopping is further leading to an increase in market revenue. Moreover, the expansion of operation by major companies in the region are propelling the market growth.

Competitive Insight

Major players in the supply chain management market are Blue Yonder, BluJay, Epicor Software Corporation, Coupa, GEP, IBM Corporation, Infor, Jaggaer, Kinaxis Inc., Körber, Logility, Manhattan Associates, Oracle Corporation, SAP, The Descartes Systems Group Inc., and Zycus among others. These companies are taking initiatives to strengthen their market presence by introducing advanced solutions for its customers. These players are also collaborating with other market leaders to expand their offerings and acquire new customers.

Recent Developments

In March 2022, Logility, Inc., introduced upgrades to its software for improved planning capabilities across the product lifecycle. The new upgrade offers visualization of the global relationships of users with their interconnected network through supply chain network maps. The software also exhibits new Product Lifecycle Management (PLM) dashboards for improved analysis of product performance and speed-to-market.

In April 2020, Körber collaborated with VARGO, which is a provider of warehouse execution software, material-handling systems integration, and equipment solutions for fulfilment and distribution centres. Through this collaboration, Körber provides VARGO’s offerings such as Continuous Order Fulfillment Engine, and warehouse execution system among others in North America. The collaboration also focuses on distribution of Körber’s warehouse management system by VARGO as part of its design solutions.

Supply Chain Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 25.62 billion |

| Market size value in 2025 | USD 28.41 billion |

|

Revenue forecast in 2034 |

USD 73.28 billion |

|

CAGR |

11.10% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2024 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Blue Yonder, BluJay, Epicor Software Corporation, Coupa, GEP, IBM Corporation, Infor, Jaggaer, Kinaxis Inc., Körber, Logility, Manhattan Associates, Oracle Corporation, SAP, The Descartes Systems Group Inc., and Zycus. |

FAQ's

• The global market size was valued at USD 25.62 billion in 2024 and is projected to grow to USD 73.28 billion by 2034.

• The global market is projected to register a CAGR of 11.10% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market include Blue Yonder, BluJay, Epicor Software Corporation, Coupa, GEP, IBM Corporation, Infor, Jaggaer, Kinaxis Inc., Körber, Logility, Manhattan Associates, Oracle Corporation, SAP, The Descartes Systems Group Inc., and Zycus.

• The software segment dominated the market revenue share in 2024.