AI and Machine Learning Operationalization Software Market Size, Share, Industry Analysis Report

By Deployment (On-premises, Cloud-Based), By Functionality, By Application, By Enterprise Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5825

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

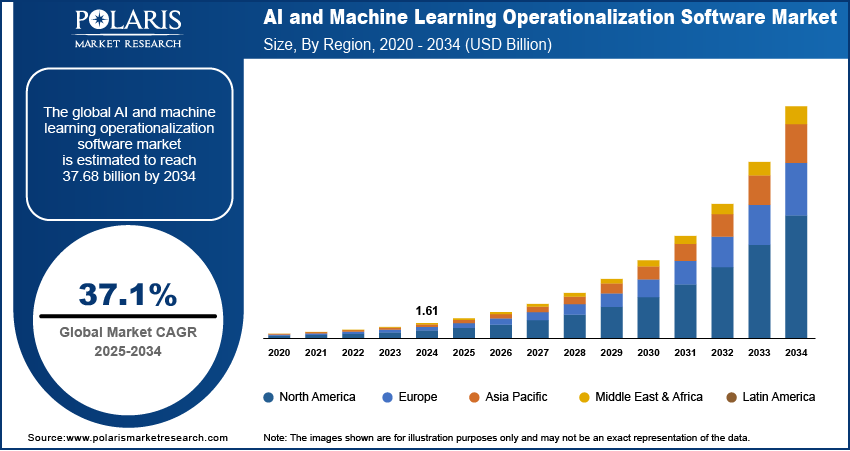

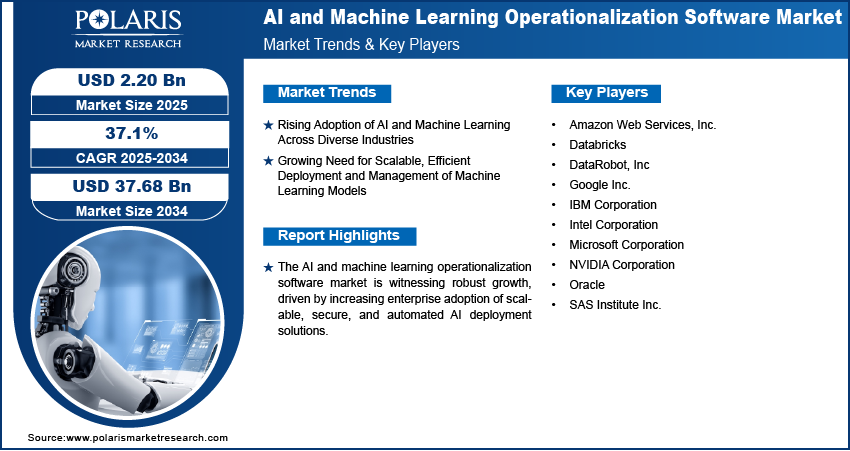

The global AI and machine learning operationalization software market size was valued at USD 1.61 billion in 2024, growing at a CAGR of 37.1% during 2025–2034. The market is driven by rising enterprise adoption of AI, demand for streamlined model deployment, and growing need for scalability, automation, and real-time decision-making.

AI and machine learning operationalization software refers to platforms and tools that enable the deployment, scaling, monitoring, and governance of AI/ML models in production environments. The rapid expansion of cloud infrastructure and the availability of improved computational power bolsters the growth of the data sector. According to an IBEF January 2025 report, cloud technology is projected to contribute 8% to India's GDP by 2026, potentially adding USD 310–380 billion to the economy. Cloud computing provides scalable environments that allow organizations to train and deploy complex models without investing in on-premise infrastructure. Additionally, increased access to GPUs and high-performance computing resources shortens model development cycles and accelerates operationalization timelines. This improved computational ecosystem ensures that AI models are trained efficiently and also deployed with agility, aligning well with enterprise scalability goals.

To Understand More About this Research: Request a Free Sample Report

Integration of AI and ML operationalization tools with DevOps and ModelOps frameworks to streamline development workflows further drives the growth of this sector. The convergence of MLOps with DevOps ensures a continuous integration and delivery pipeline for AI models as organizations increasingly adopt agile methodologies, improving collaboration between data scientists, IT teams, and developers. These integrations reduce operational bottlenecks, automate model lifecycle management, and facilitate rapid experimentation and deployment. Businesses can achieve faster time-to-value from their AI investments while ensuring governance and reproducibility across deployments by embedding operationalization tools within familiar DevOps workflows.

Industry Dynamics

Rising Adoption of AI and Machine Learning Across Diverse Industries

The rising adoption of AI and machine learning across diverse industries boosts the expansion opportunities. There is a growing need to move beyond experimentation and toward operationalizing these models as sectors such as healthcare, finance, manufacturing, and retail increasingly incorporate AI-driven solutions to improve decision-making, automate processes, and personalize customer experiences. In May 2024, mPulse reported strong Q1 2024 growth driven by automation and efficiency improvements. The company launched integrated predictive analytics and omni-channel engagement capabilities, improving personalized healthcare interventions. This development drives demand for robust platforms that can manage the complexities of deploying models into production environments, ensuring consistent performance, scalability, and governance. Organizations are prioritizing tools that facilitate the seamless integration of models into day-to-day operations as AI becomes more embedded in business strategies.

Growing Need for Scalable, Efficient Deployment and Management of Machine Learning Models

Traditional deployment methods often fall short in handling large volumes of models, frequent updates, and cross-functional collaboration. Operationalization software addresses these challenges by offering automation, monitoring, and version control capabilities that ensure models remain accurate, secure, and compliant throughout their lifecycle. In May 2024, GEP launched an AI-powered orchestration solution for procurement optimization for supply chains. The platform automates data flows and enhances decision-making through improved collaboration and visibility, marking a notable advancement in operational efficiency tools for large corporations. Therefore, as enterprises scale their Artificial initiatives, such platforms become essential for minimizing model drift, reducing deployment time, and ensuring consistent business value. This operational efficiency ultimately empowers organizations to harness AI more strategically and sustainably. Therefore, growing need for scalable and efficient deployment and management of machine learning platforms further fuels market growth.

Segmental Insights

Deployment Analysis

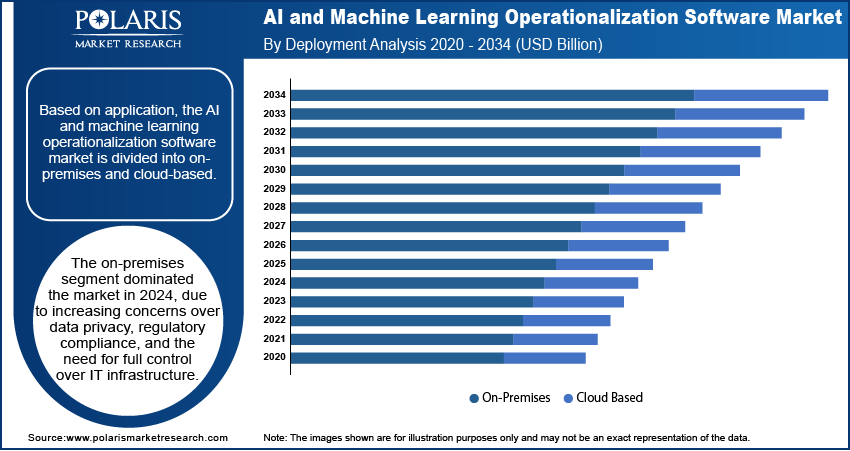

The segmentation, based on deployment, includes on-premises and cloud-based. The on-premises segment dominated the industry in 2024, due to increasing concerns over data privacy, regulatory compliance, and the need for full control over IT infrastructure. Enterprises operating in highly regulated industries, such as healthcare, banking, and government, favored on-premises solutions to maintain control over sensitive data and comply with internal governance policies. Additionally, on-premise deployment allows for customization and optimization of system performance based on specific organizational requirements. This model also minimizes dependency on external networks, making it a preferred choice for institutions with robust IT departments and security mandates.

Functionality Analysis

The segmentation, based on functionality, includes model deployment & management, data preprocessing & feature engineering, model monitoring & performance evaluation, and integration with existing systems. The model deployment & management segment held the largest share in 2024, as organizations increasingly focused on transitioning from experimentation to scalable production environments. This functionality has a role in operationalizing AI initiatives, ensuring seamless integration of trained models into business applications. It supports version control, rollback capabilities, and governance protocols, all of which are critical for maintaining model performance and compliance. Moreover, the growing complexity and frequency of model updates have highlighted the need for robust deployment pipelines and lifecycle management tools. Therefore, as enterprises scale their AI operations, the demand for reliable, efficient, and secure deployment systems has become paramount.

Application Analysis

The segmentation, based on application, includes predictive analytics, fraud detection and risk management, customer experience management, natural language processing (NLP) and text analytics, and others. The customer experience management segment is expected to grow at a significant CAGR during the forecast period as enterprises increasingly leverage AI and machine learning to personalize interactions, predict customer needs, and enhance engagement across channels. Businesses across sectors are prioritizing data-driven strategies to gain deeper insights into customer behavior and deliver tailored experiences in real time. AI operationalization tools enable the dynamic deployment of models that analyze customer sentiment, journey patterns, and preferences at scale. This capability supports more informed and proactive customer engagement strategies, ultimately fostering brand loyalty and customer retention. The growing focus on improving customer satisfaction is likely to boost the expansion of this application area.

Enterprise Size Analysis

The segmentation, based on enterprise size, includes small & medium enterprises and large enterprises. The small & medium enterprises segment growth is driven by its scalability, accessibility, and the rising availability of cloud-based and modular solutions. These businesses are recognizing the value of embedding AI in their core operations to drive efficiency, gain competitive advantages, and make data-driven decisions without incurring heavy infrastructure costs. Additionally, advancements in no-code and low-code platforms are lowering entry barriers for SMEs, enabling them to operationalize models with minimal technical expertise. The flexibility and affordability of these tools make them particularly attractive to smaller firms aiming to accelerate digital transformation and achieve operational agility.

Regional Analysis

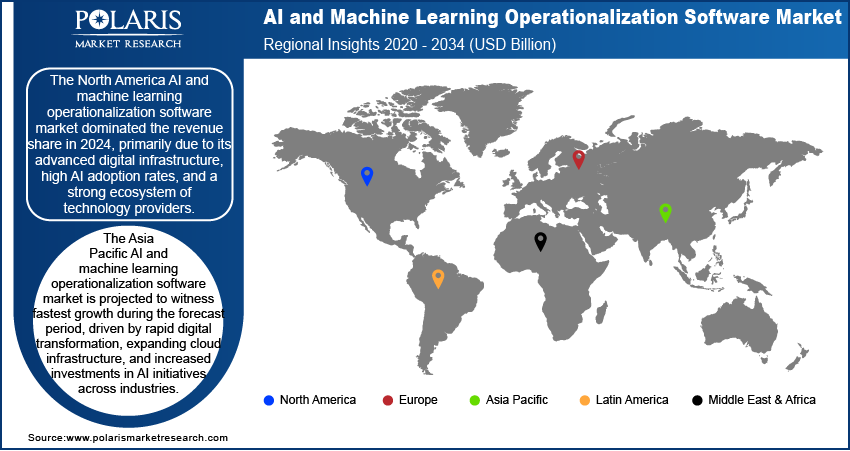

The report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America AI and machine learning operationalization software market dominated the revenue share in 2024, primarily due to its advanced digital infrastructure, high AI adoption rates, and a strong ecosystem of technology providers. Enterprises in the region have been early adopters of AI and ML technologies, investing heavily in operationalization solutions to scale AI initiatives across functions. Seeq and AVEVA formed a strategic partnership to integrate their industrial analytics platforms. The collaboration enhances operational data accessibility for chemical, energy, and mining sectors, aiming to optimize production outcomes through improved contextual analytics. The presence of established cloud service providers, research institutions, and a skilled workforce has further contributed to the region’s leadership. Moreover, the region’s regulatory emphasis on data governance and responsible AI has accelerated the demand for software that supports model transparency, auditability, and compliance in deployment.

US AI and Machine Learning Operationalization Software Market Trends

The US market held the largest share in 2024, due to its early enterprise adoption of AI and a well-established base of cloud infrastructure providers and AI startups. Organizations across sectors have integrated AI into core operations, necessitating robust operationalization tools to manage large-scale deployments and ensure compliance. Furthermore, substantial investments in R&D and strong collaboration between academia and industry continue to accelerate innovation in model lifecycle management.

Asia Pacific AI and Machine Learning Operationalization Software Market Outlook

The Asia Pacific market is projected to witness the fastest growth during the forecast period, driven by rapid digital transformation, expanding cloud infrastructure, and increased investments in AI initiatives across industries. Countries in this region are embracing AI to optimize business operations, enhance customer experiences, and support smart city development. As organizations mature in their AI adoption, there is a growing emphasis on moving models from pilot to production, boosting demand for operationalization software. Additionally, the rise of tech-savvy startups and government-backed innovation programs is fostering an ecosystem conducive to AI deployment and lifecycle management solutions. According to a March 2025 report from India's Ministry of Electronics & IT, the government allocated USD 1.24 billion over five years to improve AI infrastructure, including a computing facility with 18,693 GPUs. This positions India among global leaders in public AI computing capacity.

China AI and Machine Learning Operationalization Software Market Assessment

The market in China is experiencing growth, driven by national AI development strategies, increasing enterprise digitization, and the proliferation of AI-focused tech companies. The country’s focus on self-reliant AI capabilities has boosted demand for platforms that can operationalize models securely and at scale. Additionally, the rise of AI applications in smart cities, healthcare, and manufacturing is driving organizations to adopt deployment and monitoring tools that assure efficient integration of models into critical systems.

Europe AI and Machine Learning Operationalization Software Market Insights

The Europe market is projected to witness substantial growth during the forecast period, supported by the region’s strict data protection regulations and growing focus on ethical AI deployment. Enterprises are increasingly adopting software solutions that align with GDPR requirements and support responsible, explainable AI practices. Additionally, industries such as manufacturing, automotive, and financial services are integrating AI at a strategic level, necessitating robust deployment and monitoring systems. The region’s emphasis on innovation, supported by public-private partnerships and cross-border digital strategies, is further boosting the adoption of operationalization tools that ensure scalable, compliant, and sustainable AI integration.

UK AI and Machine Learning Operationalization Software Market

The UK market growth is driven by the strong demand for explainable and ethical AI, especially in highly regulated sectors such as finance, insurance, and public services. Enterprises are prioritizing tools that enable transparent model deployment, performance monitoring, and compliance with data protection laws. Moreover, government support for AI innovation and initiatives to upskill the workforce are fostering a favorable environment for expanding operational AI capabilities across industries.

Key Players and Competitive Analysis

The field of AI and ML operationalization software is witnessing intense competition as vendors are focusing on capitalizing on revenue opportunities in both developed markets and emerging markets. Major players are leveraging competitive intelligence and strategy to differentiate their offerings, with strategic investments in automation and MLOps capabilities driving revenue growth. Small and medium-sized businesses are increasingly adopting these solutions, creating new expansion opportunities for vendors. Industry trends show a shift toward cloud-native platforms, while economic and geopolitical shifts are influencing regional adoption patterns. Leading providers are focusing on sustainable value chains and future development strategies to maintain their edge. Disruptions and trends in AI governance and ethical AI are reshaping competitive dynamics, with vendors prioritizing expert insights to align with evolving customer needs. The market’s latent demand and opportunities remain strong, particularly in sectors such as healthcare and finance, where technological advancements are accelerating adoption.

A few key players are Amazon Web Services, Inc.; Databricks; DataRobot, Inc.; Google Inc.; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation; Oracle; and SAS Institute Inc.

Key Players

- Amazon Web Services, Inc.

- Databricks

- DataRobot, Inc

- Google Inc.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- Oracle

- SAS Institute Inc.

Industry Developments

May 2025: Databricks launched Data Intelligence for Marketing, integrating its platform with marketing solutions to unify customer and campaign data in real time. The tool enables self-service analytics for marketers to optimize campaign efficiency and relevance at scale.

March 2025: DataRobot launched AI application suites for finance and supply chain operations with SAP, enabling faster AI implementation and secure data integration for business processes.

AI and Machine Learning Operationalization Software Market Segmentation

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-premises

- Cloud-Based

By Functionality Outlook (Revenue, USD Billion, 2020–2034)

- Model Deployment & Management

- Data Preprocessing & Feature Engineering

- Model Monitoring & Performance Evaluation

- Integration with Existing Systems

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Predictive Analytics

- Fraud Detection and Risk Management

- Customer Experience Management

- Natural language processing (NLP) and text analytics

- Others

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Small & Medium Enterprises

- Large Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunications

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI and Machine Learning Operationalization Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.61 billion |

|

Market Size in 2025 |

USD 2.20 billion |

|

Revenue Forecast by 2034 |

USD 37.68 billion |

|

CAGR |

37.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.61 billion in 2024 and is projected to grow to USD 37.68 billion by 2034.

The global market is projected to register a CAGR of 37.1% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Amazon Web Services, Inc.; Databricks; DataRobot, Inc.; Google Inc.; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation; Oracle; and SAS Institute Inc.

The on-premises segment dominated the market in 2024.

The customer experience management segment is expected to register a significant CAGR during the forecast period.