DevOps Market Share, Size, Trends, Industry Analysis Report

By Organizational Size (Small and Medium Enterprises, Large Enterprises); By Industry; By Deployment; By Offering; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 132

- Format: PDF

- Report ID: PM3958

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

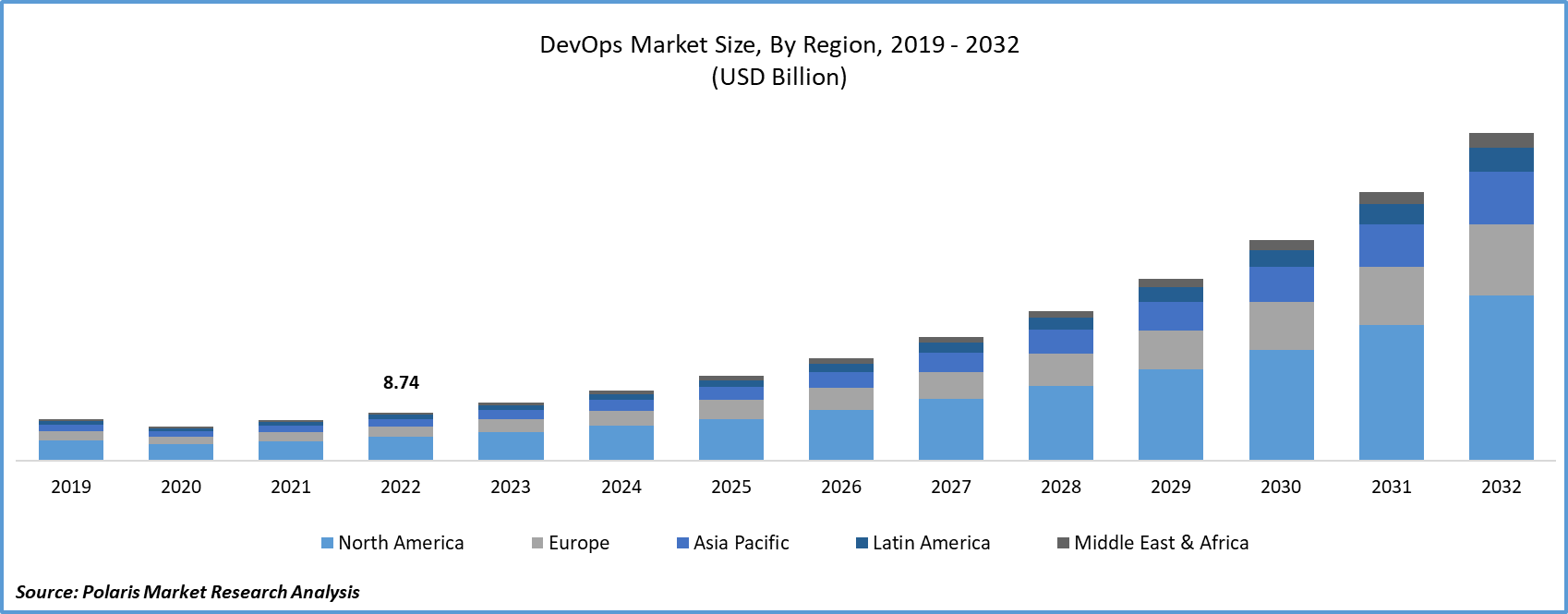

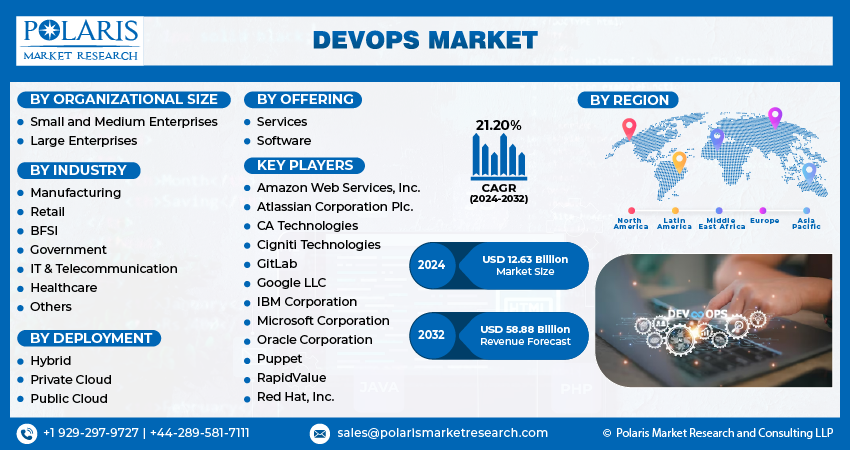

The global devops market was valued at USD 12.6 billion in 2024 and is expected to grow at a CAGR of 21.20% during the forecast period. Key factors driving the demand includes increasing adoption of DevOps tools and continued transition to hybrid cloud and enhanced operational efficiency.

Key Insights

- In 2024, the public cloud segment dominated the market, driven by the increasing adoption of artificial intelligence (AI) and machine learning (ML), which are providing a significant boost to the market.

- The IT & Telecommunication segment accounted for the largest market. This is due to the expansion of industries such as healthcare, manufacturing, banking, insurance, and finance, which are transitioning towards automated software deployment.

- North America held the largest revenue share in 2024, attributed to its widespread adoption globally across multiple industries, including IT & telecommunications, retail, and BFSI.

- The Asia-Pacific DevOps market is anticipated to experience the most substantial growth due to the increasing number of SMEs that necessitate the adoption of DevOps tools to enhance the agility and efficiency of their business operations.

Industry Dynamics

- The surging popularity of DevOps tools is due to their ability to streamline development within collaborative teams, while minimizing errors, thereby driving demand.

- The growing demand for heightened operational flexibility, enhanced client satisfaction, and the integration of the Internet of Things (IoT) is driving market expansion.

- Cultural change and breaking down silos of organizational resistance create challenges among development and operations teams.

- The expansion of cloud and hybrid technology creates new opportunities.

Market Statistics

- 2024 Market Size: USD 12.66 billion

- 2034 Projected Market Size: USD 86.16 billion

- CAGR (2025-2034): 21.20%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Industry

- Enhance developer speed and efficiency by automating repetitive tasks, such as testing and code integration.

- System data analysis for the prevention of outages enables proactive issue resolution.

- Continuous scanning for vulnerabilities and anomalies enhances security within the software pipeline.

What Does the Current Market Landscape Look for DevOps Landscape?

DevOps tools offer a multitude of advantages, including enhancing agility, fostering quality innovation, and minimizing production disruptions. Some key categories of DevOps tools encompass configuration management tools, API tools, application and infrastructure monitoring tools, collaboration and organizational tools, and build automation tools. DevOps is envisioned as the future of automating the application lifecycle. Automating repetitive tasks accelerates and streamlines operations, allowing teams and organizations to enhance work quality, iteration speed, and consistency. Moreover, it frees up time that would otherwise be spent on low-value tasks. With escalating levels of automation, industry leaders provide technical teams with the freedom to focus on innovative initiatives that deliver added value to organizations.

At the outset of the DevOps journey, core elements such as deployment automation, continuous integration, version control, and infrastructure automation are typically acknowledged. As development and operations teams develop a stronger appreciation for the benefits of cooperation and knowledge sharing, they rapidly embrace various technologies and processes. This accelerates the exchange of insights, ideas, metrics, methodologies, and enabling tools. Moreover, the implementation of DevOps encounters specific challenges, including the absence of a universally agreed-upon definition, a lack of standardization in adopting development and operations practices, and the need to tailor each implementation to its unique context. An increasingly intricate IT infrastructure, combining physical, virtual, and cloud environments, has heightened the complexity of IT processes. In response, DevOps steps in, relieving humans of substantial management tasks through automation. This is one of the reasons why organizations are striving for extensive DevOps automation and advanced container orchestration while selecting cloud hosting for their workloads. The collaboration between development and operations accelerates an organization's ability to deliver applications and enhance customer services. Software Deployment Operations (SDO) performance plays a pivotal role, setting teams and organizations apart in various industries, as it enables the optimization of software applications for superior outcomes. Integrating DevOps practices and capabilities during technological transformation yields dividends in terms of organizational performance and the quality of results.

DevOps is a combination of the terms "development" and "operations" that’s meant to unite people, processes, and technology. It aims to improve the speed, security, and efficiency of software development and delivery compared to traditional processes. Coming from an agile approach to software development, DevOps builds upon the cross-functional approach of deploying applications in a fast and iterative manner. It aims to shorten the system development lifecycle and offer continuous delivery with high-quality software.

The core DevOps principles encompass the automation of the software development lifecycle, as well as collaboration and effective communication. Additionally, it places a major emphasis on continuous improvement and minimization of water usage, with a strong focus on user requirements and short feedback loops. DevOps is applied across various sectors, including manufacturing, retail, BFSI, government, IT & communication, and healthcare. The ability of DevOps tools to streamline development within collaborative environments has increased their popularity, thereby driving growth in the DevOps market.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Expansion of DevOps Market?

The surging popularity of DevOps tools stems from their ability to streamline development within collaborative teams while minimizing errors. These tools play a crucial role in enhancing the security and stability of the software deployment process. Key trends in the development and operations software market include the prominence of Platform-as-a-Service and containerization. The virtualization of these services is emerging as a significant trend, simplifying the implementation of DevOps.

The market is also experiencing growing demand for heightened operational flexibility, enhanced client satisfaction, and the integration of the Internet of Things (IoT). DevOps serves as a distinct approach to enterprise software development, emphasizing the necessity of cooperation, automation, and communication between software developers and IT operations teams. It is an amalgamation of two well-established methods: Agile Development and Agile System Administration. DevOps tools significantly facilitate the development process, elevating its quality, reducing errors, and enhancing security and operational procedure maintenance.

Report Segmentation

The market is primarily segmented based on organizational size, industry, deployment, offering, and region.

|

By Organizational Size |

By Industry |

By Deployment |

By Offering |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Segmental Insights

Deployment Analysis

Which Segment by Deployment Dominated the Market in 2024?

Public cloud segment dominated the market in 2024. The is due to the increasing adoption of cloud technologies and frameworks, alongside the digital transformation of enterprises aimed at automating business processes and unlocking significant operational potential. Emerging tech trends like artificial intelligence (AI) and machine learning (ML) are providing a significant boost to the market. AI and ML algorithms excel in processing vast datasets, handling routine tasks, allowing professionals to focus on targeted work, discern patterns, identify issues, and propose solutions.

The dominance of the public cloud segment, is attributed to the surging demand for cloud-based solutions in system architectures and web servers across various industries. Public cloud offerings include accessibility, remote access, rapid deployment, and a range of enterprise advantages such as scalability and flexibility, all contributing to its widespread adoption.

Industrial Analysis

Why IT & Telecommunication Segment Accounted for the largest Share of the Market?

The IT & Telecommunication segment accounted for the largest market share during the forecast period. This is due to the expansion of industries such as healthcare, manufacturing, banking, insurance, and finance are transitioning towards automated software deployment to achieve greater precision, efficiency, and reduced maintenance expenses. The IT & telecommunication sector has claimed the lion's share of the market in recent years. It is projected to maintain its leading position over the next five years, driven by the escalating demand for swift delivery services. Currently, industries like IT & telecom, BFSI, and retail stand as the foremost end-users of DevOps tools. The market is poised for growth in these segments, fueled by the uptick in online and mobile transactions and the increasing need for an enhanced customer experience.

Organizational Size Analysis

Which Segment by Operational Size Captured the Highest Share?

The Large Enterprises segment captured highest share of the market in 2024. This is due to the primary adoption of DevOps by large enterprises, which have shown a greater propensity for deploying DevOps solutions to manage their critical business operations. Large enterprises have been at the forefront of embracing DevOps to elevate quality and efficiency, streamline processes, expedite time-to-market, and trim down costs associated with IT operations, including software development, delivery, and maintenance. However, in the case of small and medium-sized enterprises (SMEs), several challenges, such as a shortage of skilled workforce, a preference for traditional methods, and the requirement for standardized DevOps tools, have impeded the widespread adoption of DevOps practices.

Regional Insights

What are the Factors for the Regional Growth?

North America held the largest revenue share in 2024. This is attributed to a large adoption of it globally across multiple industries, such as IT & telecommunication, retail, and BFSI. Organizations within these industries are constantly challenged to deliver software at greater speed, reliability, and operational efficiency, thereby making DevOps a key strategic initiative rather than just an option. The high concentration of the largest cloud companies and innovative technology organizations has adopted a culture of continuous integration and delivery in the North American workspace. Furthermore, the availability of talent working in agile environments and those with automation competency has been a significant enabler.

In Europe, numerous banks have incorporated DevOps into their software processes, resulting in a 25% improvement in the efficiency of updating applications like internet banking. This shift has lightened the workload for IT operations teams, enabling them to concentrate on delivering added value to the company's business operations. Projections indicate that the Latin America (LATAM) and Middle East & Africa (MEA) markets are poised for substantial growth.

The Asia-Pacific DevOps market is anticipated to experience the most substantial Compound Annual Growth Rate (CAGR) in the forecast period, driven by the increasing need for automated software solutions in Small and Medium Enterprises (SMEs) across countries like Singapore, Japan, and China. This region has witnessed a notable increase in the number of SMEs necessitating the adoption of DevOps tools to enhance the agility and efficiency of their business operations. Additionally, the ongoing development of advanced infrastructure and the growing prevalence of smart devices, smartphones, and digital services in emerging APAC nations are expected to propel market expansion.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Amazon Web Services, Inc.

- Atlassian Corporation Plc.

- CA Technologies

- Cigniti Technologies

- GitLab

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Puppet

- RapidValue

- Red Hat, Inc.

Recent Developments

- July 2025: IBM and DBmaestro collaborated to make DBmaestro’s advanced database DevSecOps and observability suite available through IBM’s solutions portfolio, empowering customers to achieve end-to-end DevOps automation, real-time database visibility, and unmatched agility, security, and innovation.

- December 2022; Copado, a provider of Continuous Delivery (CD) and Continuous Integration (CI) services, has introduced the DevOps Exchange tailored for enterprise Software as a Service (SaaS) solutions. This Exchange showcases pre-built solutions contributed by the Copado community, augmenting the features and functionalities of Copado's DevOps platform for Salesforce.

- May 2022: IT service management firm Claranet has successfully acquired Geko Cloud in Spain, bolstering its cloud and DevOps offerings within the region. This acquisition enables Claranet to provide advanced cloud consulting services, container as a service, digital modernization, cloud infrastructure management, and microservices to its clientele.

DevOps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.66 billion |

| Market size value in 2025 | USD 15.27 billion |

|

Revenue forecast in 2034 |

USD 86.16 billion |

|

CAGR |

21.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Organizational size, By Industry, By Deployment, By Offering, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Gain profound insights into the 2025 DevOps market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2034. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Legal Services Market Size, Share 2024 Research Report

Paper Straw Market Size, Share 2024 Research Report

SMS Firewall Market Size, Share 2024 Research Report

Virtual Sports Market Size, Share 2024 Research Report

Consumer Genomics Market Size, Share 2024 Research Report

FAQ's

• The global market size was valued at USD 12.66 billion in 2024 and is projected to grow to USD 86.16 billion by 2034.

• The global market is projected to register a CAGR of 21.20% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are Amazon Web Services, Inc.; Atlassian Corporation Plc.; CA Technologies; Cigniti Technologies; GitLab; Google LLC; IBM Corporation; Microsoft Corporation; Oracle Corporation; Puppet; RapidValue; and Red Hat, Inc.

• In 2024, the public cloud segment dominated the market

• The IT & Telecommunication segment accounted for the largest market.