Pet Therapeutic Diet Market Size, Share, Trends, Industry Analysis Report

By Product, By Animal Type, By Indication, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM6502

- Base Year: 2024

- Historical Data: 2020-2023

Overview

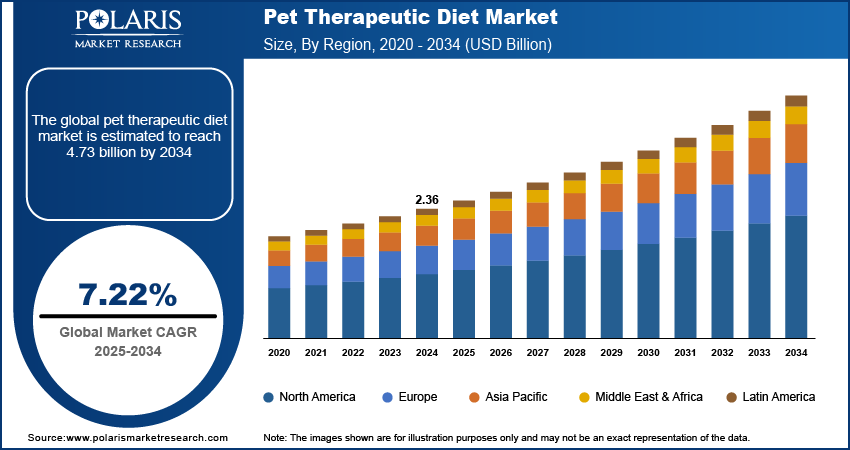

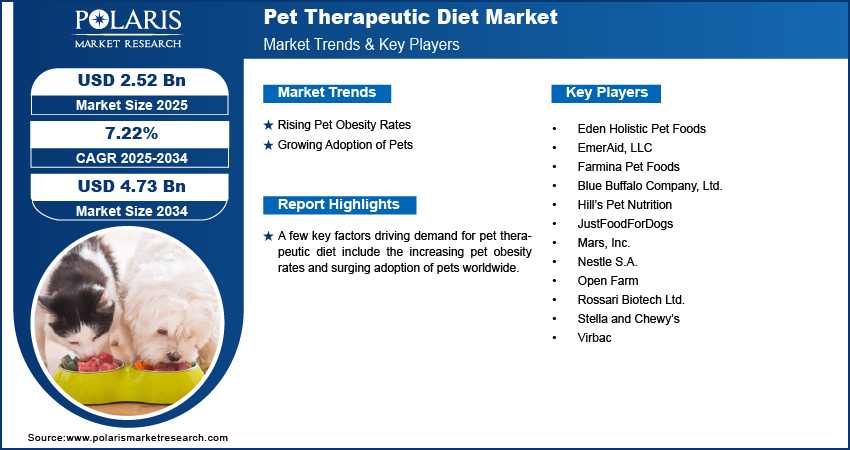

The global pet therapeutic diet market size was valued at USD 2.36 billion in 2024, growing at a CAGR of 7.22% from 2025 to 2034. Key factors driving demand for pet therapeutic diet include the increasing pet adoption worldwide coupled with rising cases of pet obesity around the globe.

Key Insights

- The dry food segment dominated the market share in 2024.

- The wet food category projected to grow at a fast rate as it improves digestibility and palatability for pet owners.

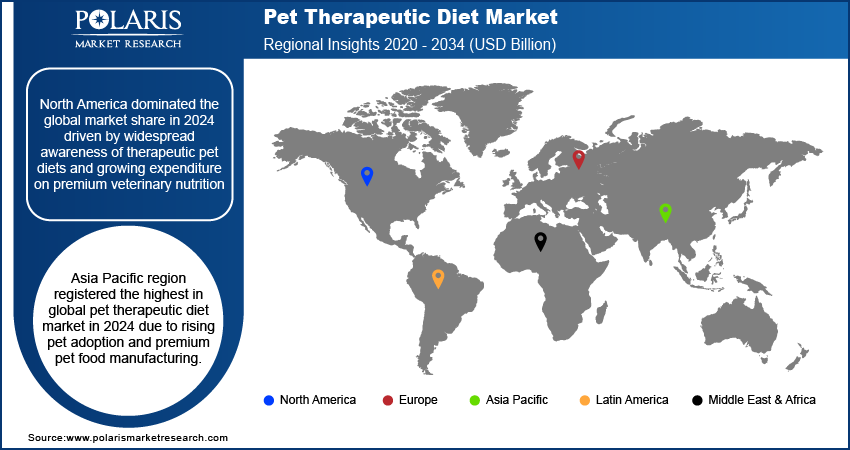

- North America pet therapeutic diet market dominated the market share in 2024.

- The U.S. pet therapeutic diet market is expanding due to increasing consumer emphasis on pet well-being and disease prevention solutions.

- Asia Pacific market is predicted to grow at highest CAGR between 2025-2034 driven by growing pet adoption and pet health consciousness.

- China and Japan led the regional growth with increasing demand for veterinary specialized diets.

Industry Dynamics

- Increasing obesity rates in pets worldwide is boosting market growth by driving demand for weight-control diets.

- Rising adoption of pets worldwide is driving the demand due to greater focus on pet health and nutrition.

- The rising innovation in functional ingredients is expected to create lucrative opportunities during the forecast period.

- The stringent regulatory guidelines associated with it is anticipated to restrain market growth.

Market Statistics

- 2024 Market Size: USD 2.36 Billion

- 2034 Projected Market Size: USD 4.73 Billion

- CAGR (2025–2034): 7.22%

- North America: Largest Market Share

Pet therapeutic diets are nutritionally formulated diet foods that are made to help manage particular health conditions in animals. The diets promote healthy weight, improve digestion, and help with organ function in pets with diseases such as allergies, diabetes, or kidney disease. Growing pet awareness and higher veterinarian recommendations are driving acceptance of specialty dietary solutions across the market.

Increase in pet health and nutrition spending is fueling strong demand for therapeutics diets. According to Bloomberg Intelligence's 2025 Pet Economy Report, the industry is expected to increase more than 45% in the next five years, exceeding USD 500 billion in 2030. This broadening market environment is driving adoption of dietary solutions for pets with distinct health requirements.

Emerging network of veterinary clinics and animal hospitals is creating demand for therapeutic diets as professionals recommend condition-specific diet. Growth of veterinary infrastructure is fueling the sales of therapeutic diet products and enhancing market growth.

Drivers & Opportunities

Increasing Rates of Pet Obesity: Growing rates of pet obesity are fueling demand for therapeutic foods as pet owner desire targeted nutrition to manage weight and associated disorders. The Association for Pet Obesity Prevention in 2024 reported that 35% of dog owners and 33% of cat owners claimed their pets to be overweight compared to 17% and 28% respectively in 2023. This rise in the rates of obesity is fueling demand for focused dietary solutions and driving industry development.

Increasing Pet Adoption: Rising perception of pets as family members is boosting owners to choose premium and specific nutrition for overall health and wellness. This growing human-animal bond is generating demand for therapeutic diets and aiding market expansion.

Segmental Insights

Product Analysis

By product, the market is segmented into wet food, dry food, and others. The dry food segment accounted for the largest share in 2024. This is due to its extended shelf life and nutrient balanced diet for regular feeding and it’s a common choice among pet owners considering cost-effectiveness and daily convenience.

The wet food segment is expected to record the fastest growth through 2034 as pet owners seek more moisture-based foods that improve digestion and palatability for age-vulnerable or health-aware pets.

Animal Type Analysis

Based on animal type, the market is segmented into dogs, cats and others. The dog segment dominated the market in 2024 due to increasing adoption rates and extensive availability of diet-specific formulas focusing on allergy, mobility, and heart health.

The cat segment is projected to expand at the fastest pace through 2034 due to increasing cat ownership and improved awareness of feline-related ailments such as urinary and renal conditions.

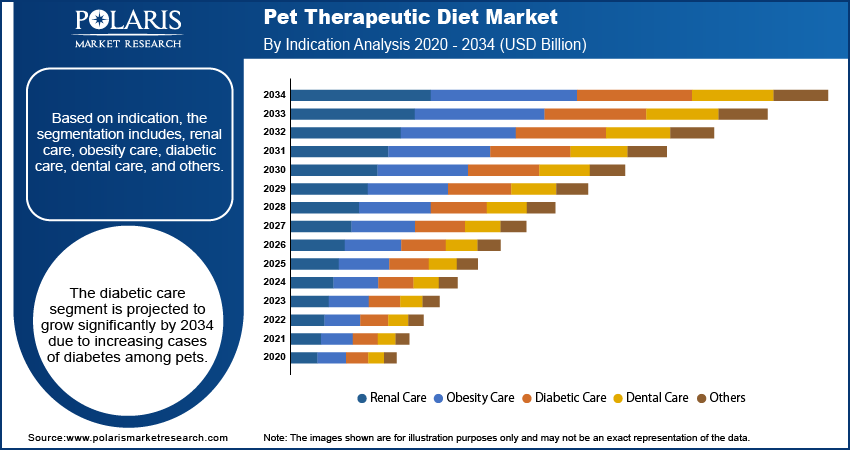

Indication Analysis

By indication, the market is divided into renal care, obesity care, diabetic care, dental care, and others. The obesity care segment led the market in 2024 as pet weight management awareness increasing among owners and veterinarians.

The diabetic care segment is expected to grow steadily by 2034 with the growing diagnosis of diabetes in pets and for low-glycemic, protein-fortified diets that regulate blood sugar levels.

Distribution Channel Analysis

By distribution channel, the market is segmented into e-commerce, veterinary hospitals & clinics, retail pharmacies, and others. The e-commerce segment held the largest share in 2024 due to rising online sales and home delivery options for specialized diets. For example, Purina Pro Plan Veterinary Diets are available for purchase on Amazon by U.S. pet owners, offering prescription-only science-based nutrition for various pet health needs.

The veterinary clinics & hospitals segment is projected to record the highest growth up to 2034 as pet owners depend on professional guidance and in-clinic purchasing of therapeutic diets.

Regional Analysis

North America led the pet therapeutic diets market in 2024, fueled by high pet health awareness and growing spending on high-quality veterinary nutrition. Expanding adoption of specialized diets for weight management, renal care, and digestive health is shaping steady market expansion across the region.

U.S. Pet Therapeutic Diet Market Insights

Introduction of microbiome-centered therapeutic diets in the U.S. is boosting demand for specialized pet nutrition to manage digestive, kidney, and multi-health issues. At VMX 2025, Hill’s Pet Nutrition launched ActivBiome+ blends targeting dogs and cats with complex or multiple health conditions. Such innovations are enhancing pet health management and boosting growth of the therapeutic diets market.

Europe Pet Therapeutic Diet Market Assessments

Europe accounted for the significant market share owing to rising prescription-based and functional diets formulated for chronic conditions in companion animals. Higher pet humanization trends and increasing presence of established veterinary networks continue to drive persistent product adoption.

Asia Pacific Pet Therapeutic Diet Market Trends

Asia Pacific is expected to register the fastest growth, driven by growing pet care industry and increasing emphasis on preventive animal health in urban regions. Increasing investments in veterinary infrastructure and high-end pet food ingredients production are further boosting regional market growth.

India Pet Therapeutic Diet Market Overview

Rising Indian pet care market is driving demand for therapeutic diets as pet owners are investing more in pet nutrition and health. Industry value, as per IBEF, is estimated at USD 3.6 billion in 2024 and is seen to reach USD 24.8 billion by 2032. The growing market potential is increasing use of specialized diets for pets with specific health requirements.

Key Players & Competitive Analysis

The pet therapeutic diets market is moderately competitive, with key players such as Mars, Incorporated, Nestle S.A., Hill’s Pet Nutrition Inc., Farmina Pet Foods and Husse. They compete on product quality, clinical endorsement, and coverage through distribution in veterinary as well as retail channels. Strategic collaborations and product innovation in condition-oriented diets is transforming competition in this area.

A few major companies operating in the pet therapeutic diet industry include Mars, Inc., Nestle S.A., Hill’s Pet Nutrition, Rossari Biotech Ltd., Farmina Pet Foods, Blue Buffalo Company, Ltd., JustFoodForDogs, EmerAid, LLC, Virbac, Eden Holistic Pet Foods, Open Farm, and Stella and Chewy’s.

Key Players

- Eden Holistic Pet Foods

- EmerAid, LLC

- Farmina Pet Foods

- Blue Buffalo Company, Ltd.

- Hill’s Pet Nutrition

- JustFoodForDogs

- Mars, Inc.

- Nestle S.A.

- Open Farm

- Rossari Biotech Ltd.

- Stella and Chewy’s

- Virbac

Pet Therapeutic Diet Industry Developments

July 2025: Farmina Pet Foods partnered with MWI Animal Health to provide its VetLife therapeutic diets to all areas of the country. The line addresses dermatological, kidney, gastrointestinal, urinary, and metabolic disorders with high-quality, natural ingredients.

August 2024: Rossari unveiled Vetsense, a range of prescription innovative diets for the gastrointestinal, weight, skin and weaning requirements in animals, at IVACON 2024. The products support recovery, normal digestion, skin, and safe weight management in dogs and cats.

April 2024: Royal Canin subsidiary of Mars, Inc., added five new science-formulated diets for cats and dogs to its veterinary gastrointestinal line. The formula is designed to promote digestive health and deliver personalized nutrition for various gastrointestinal conditions.

Pet Therapeutic Diet Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Wet Food

- Dry Food

- Others

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Dogs

- Cats

- Others

By Indication (Revenue, USD Billion, 2020–2034)

- Renal Care

- Obesity Care

- Diabetic Care

- Dental Care

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- E-commerce

- Veterinary hospitals & clinics

- Retail Pharmacies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pet Therapeutic Diet Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.36 Billion |

|

Market Size in 2025 |

USD 2.52 Billion |

|

Revenue Forecast by 2034 |

USD 4.73 Billion |

|

CAGR |

7.22% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.36 billion in 2024 and is projected to grow to USD 4.73 billion by 2034.

The global market is projected to register a CAGR of 7.22% during the forecast period.

North America dominated the market in 2024 driven by strong spending on premium pet nutrition and advanced veterinary care.

A few of the key players in the market are Mars, Inc., Nestle S.A., Hill’s Pet Nutrition, Rossari Biotech Ltd., Farmina Pet Foods, Blue Buffalo Company, Ltd., JustFoodForDogs, EmerAid, LLC, Virbac, Eden Holistic Pet Foods, Open Farm, and Stella and Chewy’s.

The dog segment dominated the market revenue share in 2024 due to high pet ownership and growing demand for condition-specific diets.

The veterinary hospitals & clinics segment is projected to witness the fastest growth during the forecast period due to greater reliance on expert-prescribed diets.