Pet Food Ingredients Market Share, Size, Trends, Industry Analysis Report

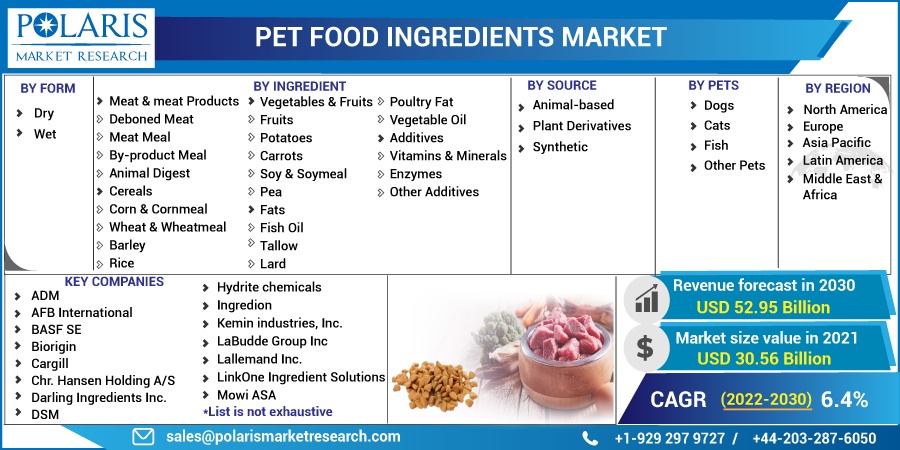

By Form (Dry, Wet); By Ingredient; By Source (Animal-based, Plant Derivatives, Synthetic); By Pets (Dogs, Cats, Fish); By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM2720

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

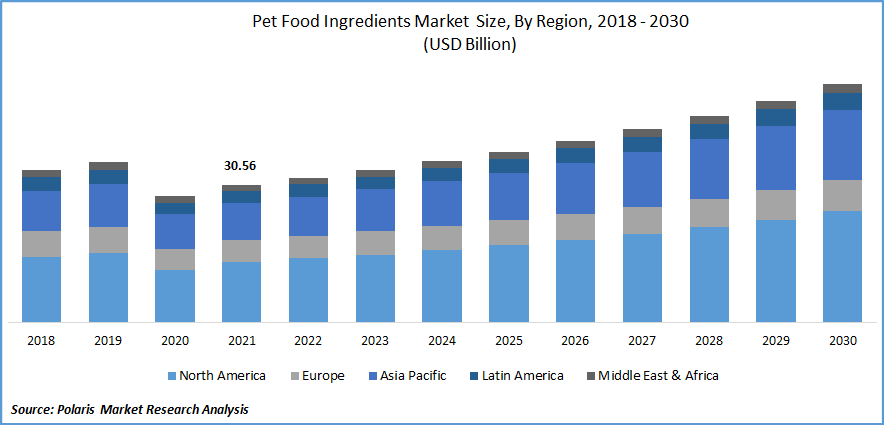

The global pet food ingredients market was valued at USD 30.56 billion in 2021 and is expected to grow at a CAGR of 6.4% during the forecast period. The growing demand for pet food ingredients is expected to be driven by the rapid adoption of pets and rising and emerging consciousness regarding their health and well-being.

Know more about this report: Request for sample pages

The market for pet food ingredients is primarily driven by the rising awareness of the nutritional advantages of minerals, dietary fiber, omega-3 fatty acids, and carotenoids necessary for pet nutrition. In addition, these ingredients improve digestive health, support weight management, and enhance the immune system; such factors support market growth.

The COVID-19 pandemic had a negative impact on the pet food ingredients market. The economic slowdown and negligible operations have disrupted the supply of ingredients required to make pet food, eventually reducing the sale of pet food. Furthermore, lack of labor and restricted mobility owing to the stringent government norms hampered market production.

Many pet food manufacturers provide food items with several alternatives designed to fulfill the needs of different pets and breeds. However, manufacturing this ingredient requires a huge investment to install various machinery and equipment. In addition, these types of machinery need timely maintenance, which is quite expensive. The manufacturers incur all these additional costs, one of the major factors restraining the market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global pet food ingredients market is likely to be driven by pet humanization and premiumization of pet care across developed and developing nations. In addition, changing lifestyle has resulted in a customer shift toward organic and non-GMO ingredients with natural flavors and colors, which is expected to drive market growth.

Moreover, homemade pet food and treats that are affordable and require less preparation time are expected to boost the market growth.

Technological advancement to produce novel ingredients to improve pets’ skeletal formation, muscle contraction and nerve impulse transmission is expected to drive the growth of the pet food ingredients market. In addition, snack bars and meal toppers with cannabidiol, hemp oil, and krill oil are some of the innovative supplements which are fueling the market growth.

Moreover, manufacturers are focusing on developing products based on different pets, their life stages, breeds, and medical problems, contributing to the market growth.

Report Segmentation

The market is primarily segmented based on form, ingredients, source, pets, nature, and region.

|

By Form |

By Ingredient |

By Source |

By Pets |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Dry Pet Food Segment Accounted for the Largest Share in 2021

The dry pet food segment accounted for the highest revenue share in 2021, owing to its higher convenience and better storage & shelf life. In addition, the increasing demand for the dry form of pet food is rising due to their affordability and low moisture content, which facilitates easy handling during processing and storage. Furthermore, dry food has a firm texture which maintains the dental hygiene of pets, which is expected to drive the segment growth.

The wet form of pet food is the second-largest segment expected to grow over the forecast period. Wet pet food ingredients improve the palatability of pet food products, which leads to a high acceptance rate, which is one of the significant reasons for the positive impact of the market growth.

In addition, wet food aids in the movement of nutrients in and out of cells, cushions joints, and helps in the easy elimination of feces which is expected to support segment growth.

Vegetable and Fruits are Expected to Witness Faster Growth

The demand for vegetables and fruits is expected to see a significant surge over the forecast period. Vegetables and fruits are great sources of dietary fiber, proteins, and vitamins, which help to strengthen their skin, fur, bones, and teeth and have the ability to resist disease, which is expected to drive market growth. Moreover, pet owners’ shifts towards vegan and plant-based food products to meet the nutritional requirement of pets is also a considerable factor fueling the market growth.

Meat and meat products are also expected to grow over the forecast period due to the rising number of pet owners owning dogs, cats, and others who prefer meat treats. The by-product meal is expected to contribute to the market revenue as it includes organ meat and edible parts of the animal, such as bones and tissue, which are rich in proteins and nutrients.

Many pets prefer by-product meal because they are better in taste and has a higher nutritional value which is expected to have a positive impact on the market growth over the forecast period.

Animal-Based Source is Expected to Spearhead the Market Growth

The animal-based segment is expected to dominate the market over the forecast period owing to several meals, including meat which is the by-product of animal sources. The growing demand of pet owners who prefer food that is high in protein, iron, fatty acid, and vitamins for their pets. In addition, liver, udders, and chicken feet are a source of various amino acids and nutrients that fulfill the requirements of pets; these food products are expected to drive segment growth.

Furthermore, meat makes pet food more appetizing which in turn helps pets to digest it more quickly, which is likely to complement market growth.

Cat Segment is Expected to Account Fastest Growth During the Forecast Period

Cat segment is expected to witness the fastest growth because of its greater nutritional need. Cats have a high vitamin required to fulfill their diet as their bodies cannot generate the required vitamins. In addition, cats thrive on animal proteins as they provide essential amino acids to fulfill their daily nutritional need, which is expected to support the segment's growth.

Moreover, manufacturers are focusing on developing innovative food supplements rich in vitamin D, which are not secreted by the cat body, which is likely to have a positive impact on revenue growth over the forecast period.

Asia Pacific is Expected to Dominate and Witness the Fastest Growth over the Forecast Period

The Asia Pacific is the largest region for the market. It is expected to witness faster growth over the forecast period owing to the considerable pet population, high adoption rates, and growing awareness of pet nutrition and health.

In addition, many developing countries such as India and China have a large number of stray animals, which can expand the market for pet food ingredients market. Moreover, the middle-income population also focuses on luxury pet food products because of high disposable income, which is expected to drive demand over the forecast period.

Competitive Insight

Some of the major players operating in the global market include Cargill Inc., DSM Nutritional Products AG, ADM, Kemin Industries, BASF Nutrition, AFB International, DuPont Nutrition, Lallemand; Inc., and others.

Recent Developments

In September 2022, Royal DSM acquired Prodap, which will work on precision and personalization with the power of digital solutions, which will strengthen animal nutrition knowledge.

In February 2021, Cargill launched a new brand of butcher-quality dog treats named chompery, which are natural and a single-ingredient product that is easy to digest. The product line consists of bones, ribs, windpipes, and jerky.

Pet Food Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 32.12 billion |

|

Revenue forecast in 2030 |

USD 52.95 billion |

|

CAGR |

6.4% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Form, By Ingredient, By Source, By Pets, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Some of the major players operating in the global market include Cargill Inc., DSM Nutritional Products AG, ADM, Kemin Industries, BASF Nutrition, AFB International, DuPont Nutrition, Lallemand; Inc., and others. |