AI in Radiology Market Size, Share, Trends, Industry Analysis Report

By Component, By Modality, By Deployment Mode, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Nov-2025

- Pages: 125

- Format: PDF

- Report ID: PM6517

- Base Year: 2024

- Historical Data: 2020-2023

Overview

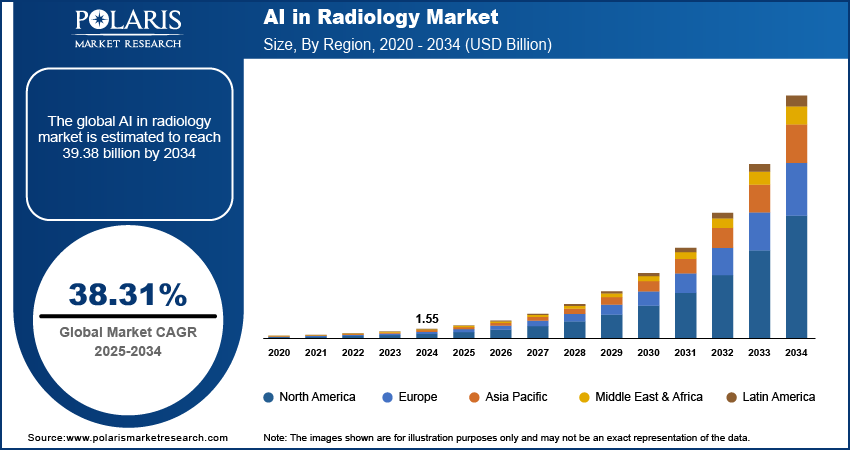

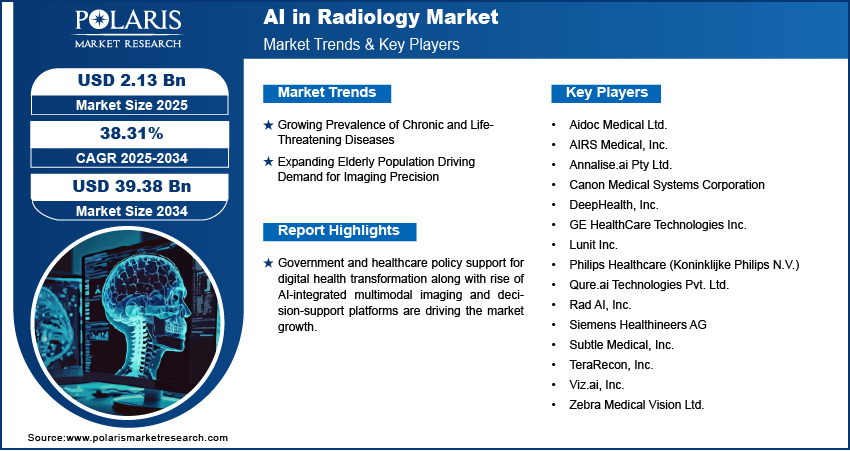

The global AI in radiology market size was valued at USD 1.55 billion in 2024, growing at a CAGR of 38.31% from 2025 to 2034. Growing prevalence of chronic and life-threatening diseases coupled with expanding elderly population driving demand for imaging precision is boosting the market growth.

Key Insights

- Based on component, the software segment dominated the market in 2024 owing to rising adoption of AI-based image interpretation solutions, workflow automation solutions, and clinical decision support systems in radiology departments.

- In terms of modality, ultrasound held fastest growing share due to rising requirements for AI-based, handheld, and point-of-care imaging devices.

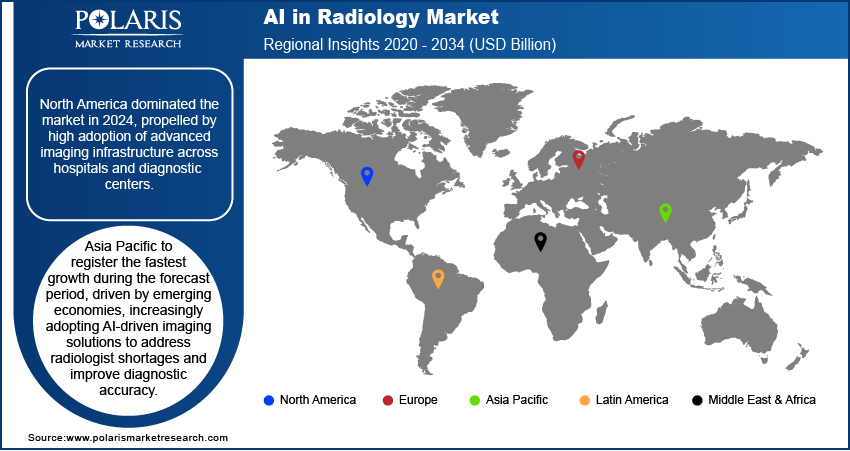

- North America led the market share in the global market in 2024 due to high use of advanced imaging infrastructure in hospitals and diagnostic centers.

- The U.S. dominated the regional market due to massive investments in AI-driven healthcare innovation supported by federal and private funding.

- Asia Pacific projected to grow at a high rate over the forecast period, led by emerging economies implementing AI-based imaging solutions to combat radiologist shortages and enhance diagnostic accuracy.

- India led the market in the region, fueled by accelerated growth of healthcare infrastructure and diagnostic imaging facilities.

Industry Dynamics

- Emerging prevalence of life-threatening and chronic diseases is fueling adoption of AI in radiology for fast and more accurate diagnostics.

- Growing population of elderly is escalating demand for precise imaging solutions and predictive analytics.

- High implementation and integration charges continue to remain restraining factor for small hospitals and imaging facilities.

- Advancements in convolutional neural networks (CNNs) and deep learning are offering opportunities for high-precision automatic image analysis.

Market Statistics

- 2024 Market Size: USD 1.55 Billion

- 2034 Projected Market Size: USD 39.38 Billion

- CAGR (2025–2034): 38.31%

- North America: Largest Market Share

The radiology AI market offers sophisticated software tools aimed at improving disease detection, automating image analysis, and informing clinical decisions within hospitals, diagnostic service centers, and research centers. Growth is driven by the increasing incidence of long-term conditions, growing imaging volumes, and the need for quicker and more precise diagnostic processes.

Supportive policy environment and reimbursement incentives by healthcare regulators are driving the demand for AI-based diagnostic platforms throughout hospitals and imaging centers. Governments are encouraging AI adoption in order to increase efficiency, decrease the turnaround time for diagnostics, and boost accuracy in clinical decision-making. This is strengthening the confidence of healthcare providers towards AI-driven radiology processes.

Rising innovation in AI integrated medical imaging solutions with electronic medical records (EMR), lab findings, and pathology inputs are driving the market growth. In October 2025, Viz.ai launched Viz Assist a collection of autonomous AI agents aimed at bringing together imaging, EHRs, and ambient listening to assist clinicians in real-time. These developments are making faster, more accurate, and context-aware diagnostics.

Drivers & Opportunities

Growing prevalence of chronic and life-threatening diseases: Rapid global surge in chronic illnesses like cancer, cardiovascular diseases, diabetes, and neurological disorders is boosting the demand for sophisticated diagnostic imaging solutions. According to the World Health Organization, if current trends persist, chronic diseases are expected to cause 86% of the 90 million yearly deaths by 2050. This is generating the need for AI-facilitated early detection and risk stratification solutions.

Expanding elderly population driving demand for imaging precision: Rising number of aging population is increasing imaging volumes for age-related disorders such as dementia, stroke, and orthopedic degeneration. One in six individuals across the globe are estimated to be over 60 years of age by 2030, up from 1 billion in 2020 to 1.4 billion, and projected to reach 2.1 billion by 2050. This increasing demographic trend is driving demand for AI technologies enhancing diagnostic confidence and alleviating clinician workload.

Segmental Insights

By Component

On a component basis, the market is divided into software, services, and hardware. The market is dominated by the software segment due to rising adoption of AI-based image interpretation solutions, workflow automation platforms, and clinical decision support systems within radiology departments.

Services are expected to register high growth driven by rising installation of AI model deployment, training, and maintenance support in order to facilitate hassle-free system integration.

By Modality

On the basis of modality, the market is segmented into computed tomography (CT), magnetic resonance imaging (MRI), X-ray, ultrasound, positron emission tomography (PET), mammography, and others. The computed tomography (CT) segment held the largest share, due to extensive imaging volume and high applicability of AI in quick abnormality detection and reconstruction of scans.

Ultrasound is projected to grow at a fast pace driven by the rising need for AI-driven, point-of-care, and handheld imaging modalities.

By Deployment Mode

On the basis of deployment mode, the market is divided into on-premise, cloud-based, and hybrid. Cloud-based solutions dominated the market propelled by the rising trend towards scalable AI infrastructure among hospitals and imaging centers for quicker deployment and remote access.

Hybrid deployment is expected to grow rapidly during the forecast period due to its combine data control with flexibility features.

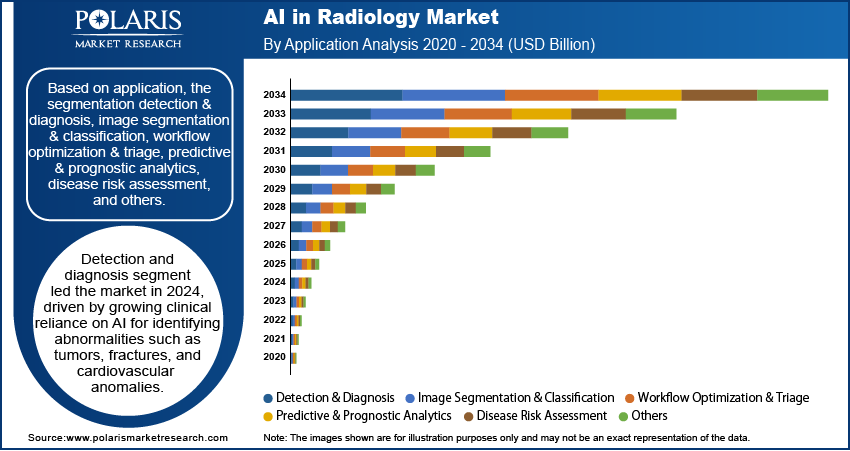

By Application

Based on application the market is segmented into detection & diagnosis, image segmentation & classification, workflow optimization & triage, predictive & prognostic analytics, disease risk assessment, others. Detection and diagnosis segment is leading the market share, driven by increasing clinical dependence on AI for the detection of abnormalities like tumors, fractures, and cardiovascular anomalies.

Workflow optimization and triage are growing at a very fast rate, fueled by growing demand to make urgent cases a priority and streamline radiologist workloads.

By End User

In terms of end user the market is classified into hospitals & clinics, research & academic institutes, ambulatory surgical centers, diagnostic imaging centers, and others. The largest end-user segment is hospitals and clinics due to the huge number of diagnostic procedures and heavy investments in AI-powered digital transformation.

Diagnostic imaging centers are anticipated to expand at a high rate, owing to the increasing use of AI to improve reporting time and diagnostic accuracy.

Regional Analysis

North America led the market share in the AI in radiology market driven by high demand for sophisticated imaging infrastructure in hospitals and diagnostic facilities. Increasing incidence of chronic diseases is fueling the demand for quick, accurate diagnostic interpretation and enhanced workflow efficiency.

The U.S. AI in Radiology Market Overview

The U.S. led the North America region, due to major investments in AI-based healthcare innovation, backed by federal and private capital. In October 2025, Hyro, a U.S.-based healthcare AI firm, raised USD 45 million in capital led by Healthier Capital, with Norwest, Define Ventures, and strategic investors such as Bon Secours Mercy Health and ServiceNow Ventures joining in, boosting robust growth in Artificial Intelligence-based radiology solutions.

Asia Pacific AI in Radiology Market Insights

Asia Pacific is projected to grow at a rapid pace during the forecast period, due to emerging economies increasingly adopting AI-based imaging solutions to meet radiologist shortages and enhance diagnostic accuracy. Government-supported initiatives for digital healthcare transformation and integration of AI are fueling market growth.

India AI in Radiology Market Analysis

India is the market leader in Asia Pacific, propelled by swift growth in healthcare infrastructure and diagnostic imaging centers. During the Union Budget 2025-26, the government committed investment of USD 11.50 billion for healthcare development, maintenance, and improvement, up by 9.78% compared to the last year. This growth in investment highlights the robust policy support for digital and AI-based healthcare initiatives.

Europe AI in Radiology Market Assessment

Europe accounted for significant market share in AI in Radiology market, led by government programs and policies to encourage healthcare digitalization, AI implementation, and precision medicine. High investments into academic-medical-healthtech partnerships also ensure further research and implementation of AI. The European Commission, in October 2025, initiated the SmartCHANGE programme under the Horizon Europe umbrella, financing USD 8.7 million to create AI solutions for early prevention and detection of long-term diseases in children between 5–19 years of age, leveraging a mobile app based on gamification and privacy-protecting AI platforms in pilot countries in Europe and Asia.

Key Players & Competitive Analysis

The global AI in radiology market is competitive with players emphasizing advanced algorithms to improve diagnostic accuracy, minimize reporting time, and aid clinical decision-making across modalities like CT, MRI, X-ray, ultrasound, and mammography. The demand for workflow automation, real-time triaging, early detection of diseases, and hassle-free integration with PACS/RIS systems drives innovation. Strategic partnerships with hospitals, imaging facilities, and cloud computing vendors are driving adoption, whereas regulatory clearances, explainable AI, and FDA-approved products are emerging as key drivers of market leadership.

Key companies operating in the global AI in radiology market include Aidoc Medical Ltd., AIRS Medical, Inc., Annalise.ai Pty Ltd., Canon Medical Systems Corporation, DeepHealth, Inc., GE HealthCare Technologies Inc., Lunit Inc., Philips Healthcare (Koninklijke Philips N.V.), Qure.ai Technologies Pvt. Ltd., Rad AI, Inc., Siemens Healthineers AG, Subtle Medical, Inc., TeraRecon, Inc., Viz.ai, Inc., and Zebra Medical Vision Ltd.

Key Players

- Aidoc Medical Ltd.

- AIRS Medical, Inc.

- Annalise.ai Pty Ltd.

- Canon Medical Systems Corporation

- DeepHealth, Inc.

- GE HealthCare Technologies Inc.

- Lunit Inc.

- Philips Healthcare (Koninklijke Philips N.V.)

- Qure.ai Technologies Pvt. Ltd.

- Rad AI, Inc.

- Siemens Healthineers AG

- Subtle Medical, Inc.

- TeraRecon, Inc.

- Viz.ai, Inc.

- Zebra Medical Vision Ltd.

AI in Radiology Industry Developments

In February 2025, DeepHealth unveiled its next-generation AI-powered radiology informatics and population screening solutions. Central to these innovations was the introduction of Diagnostic Suite, a cloud-native operating system designed to redefine traditional Picture Archiving and Communication Systems (PACS).

In June 2024, Qure.ai and Strategic Radiology have partnered to enhance radiology workflows through AI-powered imaging solutions. This collaboration aims to improve clinical accuracy and operational efficiency by providing over 1,700 radiologists with access to advanced medical imaging AI technology.

AI in Radiology Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

- Hardware

By Modality Outlook (Revenue, USD Billion, 2020–2034)

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- X-ray

- Ultrasound

- Positron Emission Tomography (PET)

- Mammography

- Others

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- On-premise

- Cloud-based

- Hybrid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Detection & Diagnosis

- Image Segmentation & Classification

- Workflow Optimization & Triage

- Predictive & Prognostic Analytics

- Disease Risk Assessment

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Diagnostic Imaging Centers

- Research & Academic Institutes

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI in Radiology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.55 Billion |

|

Market Size in 2025 |

USD 2.13 Billion |

|

Revenue Forecast by 2034 |

USD 39.38 Billion |

|

CAGR |

38.31% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.55 billion in 2024 and is projected to grow to USD 39.38 billion by 2034.

The global market is projected to register a CAGR of 38.31% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Aidoc Medical Ltd., AIRS Medical, Inc., Annalise.ai Pty Ltd., Canon Medical Systems Corporation, DeepHealth, Inc., GE HealthCare Technologies Inc., Lunit Inc., Philips Healthcare (Koninklijke Philips N.V.), Qure.ai Technologies Pvt. Ltd., Rad AI, Inc., Siemens Healthineers AG, Subtle Medical, Inc., TeraRecon, Inc., Viz.ai, Inc., and Zebra Medical Vision Ltd.

The software segment dominated the market revenue share in 2024.

The ultrasound segment is projected to witness the fastest growth during the forecast period.