Large Molecule Drug Substance CDMO Market Size, Share, Trends, Industry Analysis Report

By Product (Biologics and Biosimilar), By Service, By Source, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Nov-2025

- Pages: 125

- Format: PDF

- Report ID: PM6518

- Base Year: 2024

- Historical Data: 2020-2023

Overview

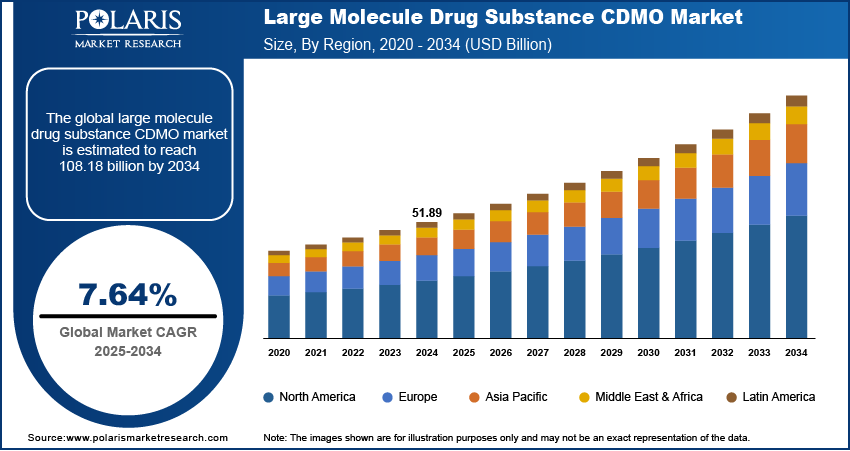

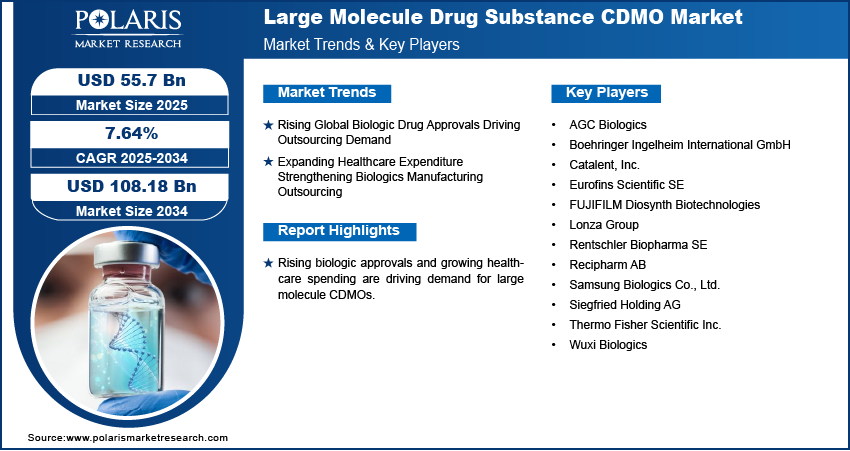

The global large molecule drug substance CDMO market size was valued at USD 51.89 billion in 2024, growing at a CAGR of 7.64% from 2025 to 2034. Rising global approvals of biologic drugs, coupled with increasing healthcare expenditure and a higher share of biologics in total pharmaceutical spending, are driving market growth.

Key Insights

- Biologics segment dominated the large molecule drug substance CDMO market in 2024.

- Biosimilar segment expected to grow fast due to cost-effective biologic demand.

- North America held largest share of the CDMO market in 2024.

- The U.S. market driven by established biopharma companies and advanced CDMO infrastructure.

- Asia Pacific market to grow 2025–2034 from rising biologics manufacturing investments.

- China and India lead expansion through increasing local and multinational CDMO activities.

Industry Dynamics

- Rising global approvals of biologic drugs are driving market growth as pharmaceutical companies expand large molecule production pipelines.

- Increasing healthcare expenditure and higher biologics share in total pharmaceutical spending are supporting greater outsourcing to CDMOs.

- Advancements in single-use and continuous bioprocessing technologies are expected to create new opportunities during the forecast period.

- High operational and setup expenses of biologic manufacturing plants restraint small and mid-sized CDMOs from participating.

Market Statistics

- 2024 Market Size: USD 51.89 Billion

- 2034 Projected Market Size: USD 108.18 Billion

- CAGR (2025–2034): 7.64%

- North America: Largest Market Share

The large molecule drug substance CDMO market encompasses the outsourcing of biologic manufacturing operations, such as cell line development, upstream and downstream processing, and analytical testing. CDMOs offer advanced infrastructure and expertise to pharmaceutical and biotechnology firms to produce complex biologics like monoclonal antibodies, recombinant proteins, and vaccines. This outsourcing model enables firms to curtail capital investment and shorten time-to-market for large molecule drugs.

Increasing worldwide approvals of biologic medicines and growing healthcare spending are fueling market growth as pharmaceutical firms increasingly turn to biologics to treat chronic and rare diseases. The World Health Organization stated that, if current trends continue, chronic diseases such as heart disease, cancer, diabetes, and respiratory illnesses could cause 86% of the 90 million deaths each year by 2050. Increasing biologics' portion of overall pharmaceutical spending showcases rising demand for quality large molecule manufacturing capabilities, which further solidifies the position of CDMOs in the worldwide biopharmaceutical supply chain.

Ongoing advances in continuous and single-use bioprocessing technology are increasing production scalability and efficiency, opening up new possibilities for CDMOs. However, the high cost of setup as well as operations for biologic manufacturing facilities remains to restrict the involvement of small and mid-size contract manufacturers in this business.

Drivers & Opportunities

Rising Global Biologic Drug Approvals Driving Outsourcing Demand: The global rise in biologic drug approvals is fueling the need for large molecule drug substance CDMOs as pharmaceutical firms increase their pipeline of biologics. Increasing regulatory support for innovative biologic therapies and the growing number of approvals for monoclonal antibodies, recombinant proteins, and gene therapy are boosting outsourcing needs for advanced manufacturing and process development capabilities.

Expanding Healthcare Expenditure Strengthening Biologics Manufacturing Outsourcing: Expanding healthcare expenditure and the rising share of biologics in total pharmaceutical spending are supporting consistent growth of the CDMO market. According to U.S. Centers for Medicare and Medicaid Services (CMS) projections, health spending is expected to hit USD 5.6 trillion in 2025, with hospitals taking the lead at USD 1.8 trillion, and climb to USD 8.6 trillion in 2033. Higher budgets are spent by governments and private healthcare systems on biologic therapies for chronic and rare conditions, which is stimulating pharma companies to collaborate with CDMOs for cost-effective and scalable biologic manufacturing.

Segmental Insights

Product Analysis

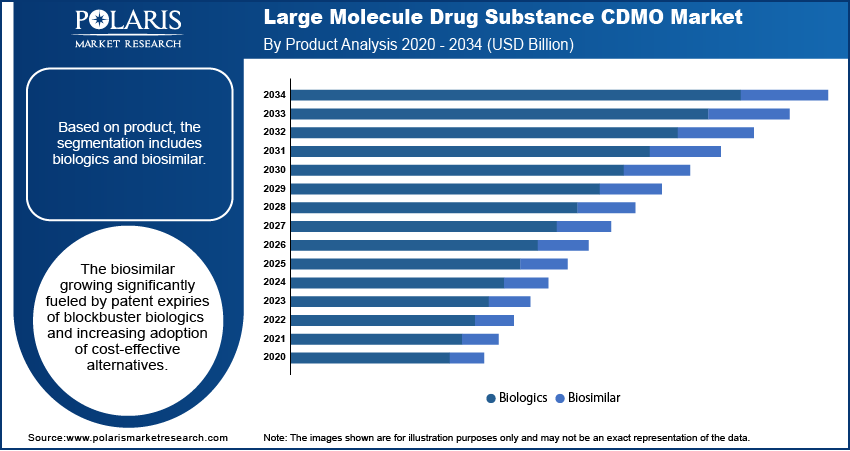

By product, the market is divided into biologics and biosimilar. The biologics segment led the market in 2024, fueled by huge demand for monoclonal antibodies and recombinant proteins. Additionally, growing approvals of new biologics and expanding therapeutic uses are driving continued outsourcing to CDMOs worldwide.

The biosimilar segment is expected to grow at the highest CAGR throughout the forecast period, as a result of patent expirations of blockbuster biologics and greater adoption of lower-cost biosimilars.

Service Analysis

By service, the market is categorized into contract manufacturing and contract development. The contract manufacturing segment dominated the market in 2024, supported by large-scale production requirements of biologics and robust infrastructure in established CDMOs. Moreover, pharmaceutical companies prefer outsourcing manufacturing to reduce capital investment and operational risks.

The contract development segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand for early-stage process development and analytical support. In addition, small and mid-sized biotech firms rely on CDMOs for development services.

Source Analysis

Based on source, the market is segmented into mammalian, microbial and others. The mammalian segment led the market in 2024 due to its adaptability towards developing complicated biologics like monoclonal antibodies and recombinant proteins.

The microbial segment is expected to have the highest CAGR growth during the forecast period, as it is cost-effective and has quicker production cycles for enzymes and recombinant proteins.

End User Analysis

Based on end user, the market is segmented into biopharmaceutical companies, biotechnology companies and academic and research institutes. The biopharmaceutical companies segment dominated the market in 2024, owing to large-scale biologics production and strong pipeline development. Moreover, pharmaceutical companies prefer outsourcing manufacturing to reduce capital investment and operational risks.

The biotechnology companies segment is anticipated to expand with the highest CAGR through the forecast period, fueled by higher biologics and biosimulation development by new biotech companies. In addition, collaboration with CDMOs accelerates time-to-market.

Regional Analysis

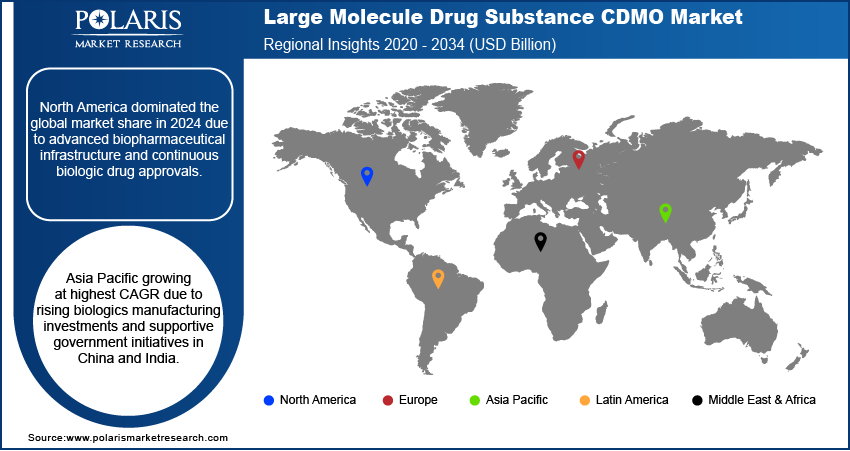

North America led the market for large molecule drug substance CDMO in 2024, due to the strong presence of established biopharmaceutical companies and advanced CDMO infrastructure. Moreover, high R&D investment and regulatory support for biologics further drive market growth.

The U.S. Large Molecule Drug Substance CDMO Market Insights

The U.S. led the North America market with its high density of leading biopharmaceutical firms and advanced CDMO facilities. For example, Hans Scientific in September 2025 announced to invest USD 2 billion to enhance U.S. biologics CDMO capacity, such as injectable and lyophilization plants, for reshoring and local drug production.

Europe Large Molecule Drug Substance CDMO Market Assessments

Europe is held the substantial market share by 2034, owing to strong biosimilar adoption and well-established biopharma hubs in the UK and Germany. Additionally, robust regulatory environments promote CDMO collaborations. In addition, Germany remains the key contributor with advanced biologics manufacturing capabilities in this region.

Asia Pacific Large Molecule Drug Substance CDMO Market Trends

Asia Pacific is expected to demonstrate the highest growth rate owing to increasing biologics manufacturing investments in China and India. In March 2025, Shilpa Medicare introduced a hybrid CDMO at DCAT 2025, offering full outsourcing along with pre-formulated ready-to-use formulations for oncology, biologics, and peptide development. Furthermore, government support policies for pharmaceutical outsourcing facilitate increasing adoption of CDMO.

China Large Molecule Drug Substance CDMO Market Overview

China is the leading contributor in Asia Pacific, driven by increasing investments in biologics production and growth of local CDMOs. Additionally, government policies favoring pharmaceutical outsourcing boost market adoption. Furthermore, rising domestic biologics pipeline development accelerates demand for contract manufacturing and development services.

Key Players & Competitive Analysis

The large molecule drug substance CDMO market is competitive as companies develop biologics and biosimilar manufacturing capacity, providing pharmaceutical and biotechnology companies with contract development and manufacturing services. Moreover, partnerships with international biopharma companies and research institutes drive market growth and adoption globally.

Some of the key companies in the large molecule drug substance CDMO market include Thermo Fisher Scientific Inc., Eurofins Scientific SE, Wuxi Biologics, Samsung Biologics Co., Ltd., Catalent, Inc., AGC Biologics, Boehringer Ingelheim International GmbH, FUJIFILM Diosynth Biotechnologies, Lonza Group, Recipharm AB, Siegfried Holding AG, and Rentschler Biopharma SE.

Key Players

- AGC Biologics

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- Eurofins Scientific SE

- FUJIFILM Diosynth Biotechnologies

- Lonza Group

- Rentschler Biopharma SE

- Recipharm AB

- Samsung Biologics Co., Ltd.

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

- Wuxi Biologics

Large Molecule Drug Substance CDMO Industry Developments

October 2025: Cambrex is investing USD 120 million to expand its U.S. manufacturing capacity, strengthening large-scale production of APIs and peptide therapeutics and supporting a more resilient domestic drug supply chain.

September 2025: Rezon Bio has launched two European facilities to provide end-to-end biologics CDMO services, from cell line development to commercial-scale manufacturing using advanced single-use and bioreactor technologies.

Large Molecule Drug Substance CDMO Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Biologics

- Biosimilar

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Contract Manufacturing

- Clinical

- Commercial

- Contract Development

- Cell Line Development

- Process Development

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Mammalian

- Microbial

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Companies

- Biotechnology Companies

- Academic and Research Institutes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Large Molecule Drug Substance CDMO Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 51.89 Billion |

|

Market Size in 2025 |

USD 55.77 Billion |

|

Revenue Forecast by 2034 |

USD 108.18 Billion |

|

CAGR |

7.64% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 51.89 billion in 2024 and is projected to grow to USD 108.18 billion by 2034.

The global market is projected to register a CAGR of 7.64% during the forecast period.

North America held largest market in 2024 driven by the strong presence of established biopharmaceutical companies and advanced CDMO infrastructure.

A few of the key players in the market are Thermo Fisher Scientific Inc., Eurofins Scientific SE, Wuxi Biologics, Samsung Biologics Co., Ltd., Catalent, Inc., AGC Biologics, Boehringer Ingelheim International GmbH, FUJIFILM Diosynth Biotechnologies, Lonza Group, Recipharm AB, Siegfried Holding AG, and Rentschler Biopharma SE.

The biologics led market in 2024 due to high demand for monoclonal antibodies, recombinant proteins, and other complex biologics.

The biotechnology companies growing steadily led by increasing biologics and biosimilar development by emerging biotech firms.