Monoclonal Antibodies Market Size, Share, Trends, & Industry Analysis Report

Source Type (Chimeric, Humanized), By Production Type, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM1104

- Base Year: 2024

- Historical Data: 2020 - 2023

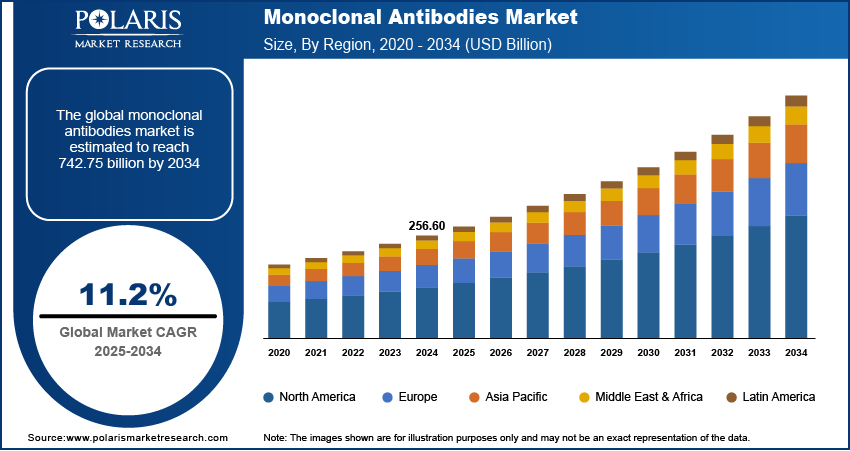

The global monoclonal antibodies market was valued at USD 256.60 billion in 2024 and is expected to grow at a CAGR of 11.2% during the forecast period. The market for monoclonal antibodies (mAbs) is driven by the rising prevalence of chronic diseases like cancer, cardiovascular disorders, and others. In addition, growing R&D activities in genomics, along with technological advancements such as next-generation sequencing, fuel the market growth. Various government support with strong investments done by many research organizations positively impacted the market growth.

Key Insights

- The human source segment accounted for the largest share in 2024 driven by rising number of drug launches and product approvals of human monoclonal antibodies.

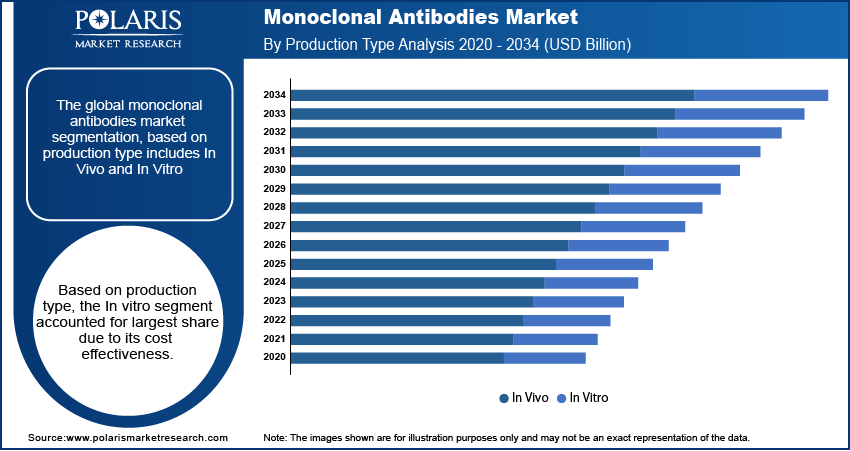

- Based on production type, the In vitro segment accounted for largest share due to its cost effectiveness.

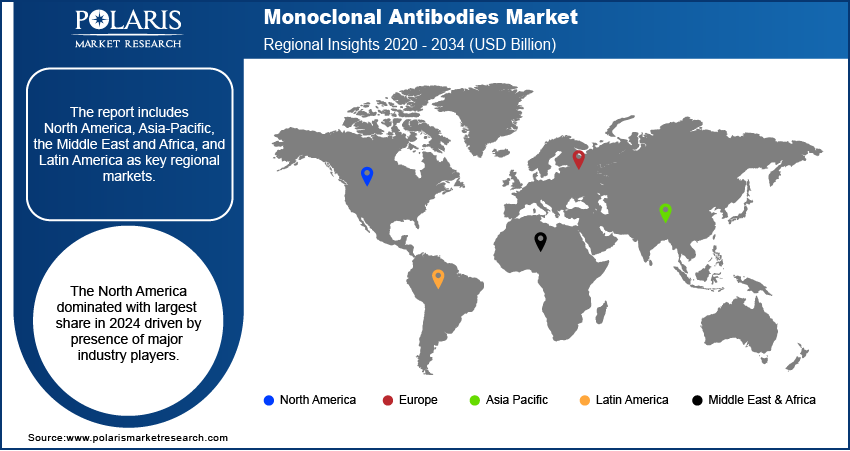

- The North America dominated with largest share in 2024 driven by presence of major industry players.

- Asia Pacific is expected to witness fastest growth during the forecast period driven by large patient population for mAb cancer therapies.

Industry Dynamics

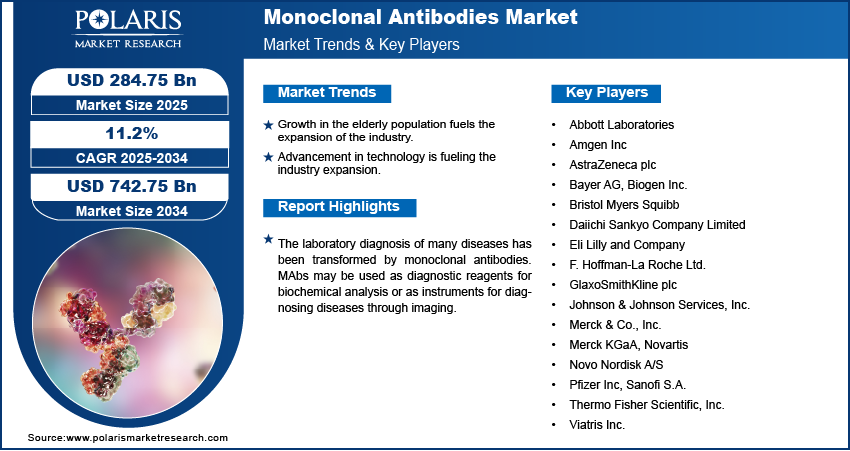

- Growth in the elderly population fuels the expansion of the industry.

- Rising prevalence of chronic disease such as cancer, cardiovascular disorders is fueling the industry growth.

- Advancement in technology is fueling the industry expansion.

- High development costs and complex manufacturing processes are limiting the growth.

Market Statistics

- 2024 Market Size: USD 256.60 Billion

- 2034 Projected Market Size: USD 742.75 Billion

- CAGR (2025-2034): 11.2%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Adoption of AI is expected to fuel the product development by enabling optimized antibody design, and improved target identification.

- Machine learning algorithms is anticipated to help analyze vast datasets to predict antibody behavior, which improves precision and efficiency in R&D.

- AI adoption is also expected to delay approvals due to challenges such as biased data outputs, limited explainability of algorithmic decisions, and regulatory concerns around AI-generated therapeutic candidates

The laboratory diagnosis of many diseases has been transformed by monoclonal antibodies. MAbs may be used as diagnostic reagents for biochemical analysis or as instruments for diagnosing diseases through imaging. Monoclonal antibodies support the body's immune system in the fight against cancer. These drugs could be combined with other cancer treatments.

Monoclonal antibodies are used most effectively as drugs to cure diseases, which is one of their main applications. Because these antibodies may bind to particular antigen epitopes, they can target diseased or damaged cells and are less expensive to produce than conventional medicines.

Due to their site-specificity, monoclonal antibodies are also an essential tool for material detection or purification. In end-use sectors, including molecular biology, medicine, and biochemistry, they are, therefore, extensively used.

In recent years, there have been attempts to use MAbs to identify the infection sites. By targeting MAb against bacterial antigens, this is made achievable. Additionally, to precisely identify localized infections, monoclonal antibodies against inflammatory leucocytes that gather at the infectious site are helpful.

Nearly all manufacturers are involved in license agreement renewal, cooperation initiatives, and merger and acquisition strategies to boost profits and establish a strong competitive position in the global market. Additionally, many companies are spending a lot of money developing better antibodies in an effort to beat their competitors in the market's overall competition.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The worldwide monoclonal antibodies market is expected to experience considerable growth due to technological developments in the R&D of diseases at the molecular level and the expansion of monoclonal antibody applications.

Additionally, the growing elderly population and their susceptibility to various chronic illnesses, particularly cancer, are projected to increase the demand for different antibodies, supporting the expansion of the total market.

Similar to this, more mAb therapies are being used for targeted therapies. Patients and doctors are becoming more aware of these therapies, which is predicted to contribute considerably to the market's growth.

The potential for the market to grow will be driven by a strong focus on the research and development of novel monoclonal antibody therapeutics to provide highly targeted treatment for complex and severe diseases. Players in the industry will primarily benefit from government support and regulatory authorization to build the monoclonal antibody market.

Additionally, many active clinical trials to explore innovative medication therapies and various products approved for COVID-19 emergency treatment have fueled market expansion during the pandemic. mAbs are an effective and secure alternative for reducing COVID-19, and several of these antibodies have been granted emergency use authorizations (EUA) by the FDA.

Report Segmentation

The market is primarily segmented based on source type, production type, application, end-use, and region.

|

By Source Type |

By Production Type |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Human Source Segment Accounted for the Largest Share

The rising number of drug launches and also product approvals of human monoclonal antibodies lead to drive the segment growth. Due to the inclusion of human monoclonal antibodies in the treatment of various infectious disorders, the market for this segment is also anticipated to rise. Additionally, several industry players are concentrating on developing human monoclonal antibodies to treat COVID-19 patients. Segmental growth will be promoted as a result during the forthcoming period. Introducing advanced technologies has sped up product development creation and discovery. This will cause even more attention to turn toward using human mAbs for immunotherapeutic purposes.

In Vitro Production Type Accounted for the Biggest Market Share

Vitro production type held the biggest market share in 2024. The presence of serum-free culture media and semi-permeable membrane-based systems has increased the utility of biomanufacturing operations and is likely to accelerate segment growth. Due to its cost-effectiveness compared to in vitro approaches and capacity to generate mAbs in high concentrations, in vivo production type is anticipated to expand at a significant rate throughout the forthcoming period.

The Oncology Segment Dominated the Highest Revenue Share

The oncology segment’s dominance in the global market results from increased healthcare costs and growing public knowledge of mAbs and their efficacy in treating cancer. The expanding demand for monoclonal antibodies in the treatment of various cancer, including lung cancer, breast cancer, colorectal cancer, and prostate cancer, is responsible for the cancer segment's dominating expansion.

One of the main reasons for the rising demand for monoclonal antibodies among cancer patients is their greater effectiveness in treating cancer with minimal to no adverse effects.

The Hospital End-Use Segment Held the Biggest Market Share in 2024

The hospital segment had the largest share due to the rising number of patients and chronic conditions; Patient preferences have been driven by advanced drug therapies' availability in institutions. The demand for products in hospitals will be driven by highly skilled professionals offering specialized treatments for conditions including cancer and autoimmune illnesses. Specialty centers held a significant market share in 2021 due to the rising government financing in recent years.

The North American Region Holds the Largest Market Share Globally

Most of the market share was held by the North American monoclonal antibody market, which can be attributed to the significant presence of major industry players and the number of product approvals. In addition, rising R&D spending by businesses and government funding for cancer research has facilitated the development of innovative monoclonal antibody treatments. Also, demand for monoclonal antibodies in the regional market will be driven by increased product usage for efficient disease treatment. A strong healthcare system has made treatments more accessible to the people, which has increased demand for the products.

The expansion of the Asia Pacific monoclonal antibodies market is anticipated to be fueled by increased disposable income, a huge patient population for mAb cancer therapies, and rising government spending on developing modern healthcare infrastructure and expanding access to superior healthcare facilities.

Competitive Insight

Some of the major players operating in the global market include Abbott Laboratories, Amgen Inc, AstraZeneca plc, Bayer AG, Biogen Inc., Bristol Myers Squibb, Daiichi Sankyo Company Limited, Eli Lilly and Company, F. Hoffman-La Roche Ltd., GlaxoSmithKline plc, Johnson & Johnson Services, Inc., Merck & Co., Inc., Merck KGaA, Novo Nordisk A/S, Novartis, Pfizer Inc, Sanofi S.A., Thermo Fisher Scientific, Inc., and Viatris Inc.

Recent Developments

- July 2025, Sanofi announced that its investigational monoclonal antibody SAR446523 received orphan drug designation from the U.S. FDA for treating relapsed or refractory multiple myeloma, marking a key milestone in its efforts to develop targeted therapies for rare cancers.

- July 2025, Eyam Health and Medicines for Malaria Venture launched a strategic partnership to develop affordable, long-acting monoclonal antibody-based malaria treatments, using Eyam’s AI-driven Jennerator and Gemini platforms to deliver multi-therapy, sub-$1 preventive shots targeting drug-resistant malaria.

Monoclonal Antibodies Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 256.60 billion |

| Market size value in 2025 | USD 284.75 billion |

|

Revenue forecast in 2034 |

USD 742.75 billion |

|

CAGR |

11.2 % from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Source Type, By Production Type, By Application, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Abbott Laboratories, Amgen Inc, AstraZeneca plc, Bayer AG, Biogen Inc., Bristol Myers Squibb, Daiichi Sankyo Company Limited, Eli Lilly and Company, F. Hoffman-La Roche Ltd., GlaxoSmithKline plc, Johnson & Johnson Services, Inc., Merck & Co., Inc., Merck KGaA, Novo Nordisk A/S, Novartis, Pfizer Inc, Sanofi S.A., Thermo Fisher Scientific, Inc., and Viatris Inc. |

FAQ's

• The market size was valued at USD 256.60 billion in 2024 and is projected to grow to USD 742.75 billion by 2034.

• The market is projected to register a CAGR of 11.2% during the forecast period.

• A few of the key players in the market are Abbott Laboratories, Amgen Inc, AstraZeneca plc, Bayer AG, Biogen Inc., Bristol Myers Squibb, Daiichi Sankyo Company Limited, Eli Lilly and Company, F. Hoffman-La Roche Ltd., GlaxoSmithKline plc, Johnson & Johnson Services, Inc., Merck & Co., Inc., Merck KGaA, Novo Nordisk A/S, Novartis, Pfizer Inc, Sanofi S.A., Thermo Fisher Scientific, Inc., and Viatris Inc

• The human segment dominated the market revenue share in 2024.