Radiopharmaceuticals Market Size, Share, Trends, & Industry Analysis Report

By Radioisotope Type (Technetium-99, Fluorine-18), By Application, By Source, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6029

- Base Year: 2024

- Historical Data: 2020-2023

Overview

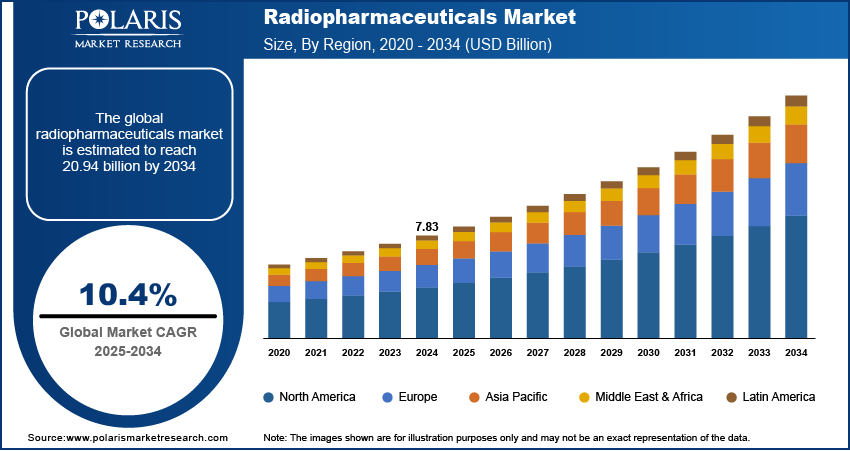

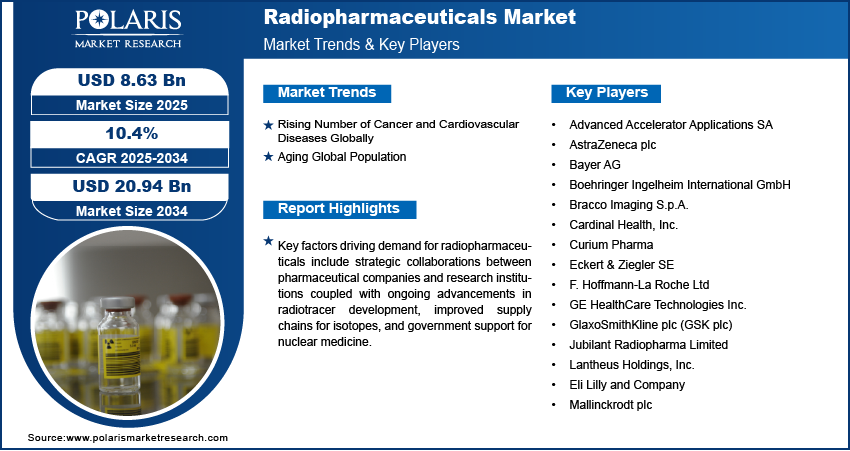

The global radiopharmaceuticals market size was valued at USD 7.83 billion in 2024, growing at a CAGR of 10.4% from 2025–2034. Rising number of cancer and cardiovascular diseases coupled with aging global population is driving the radiopharmaceuticals market growth.

Key Insights

- The technetium-99 segment accounted for largest market share in 2024.

- The neurology segment is projected to grow at the fastest rate over the forecast period, driven by rising prevalence of neurodegenerative diseases and demand for advanced imaging techniques.

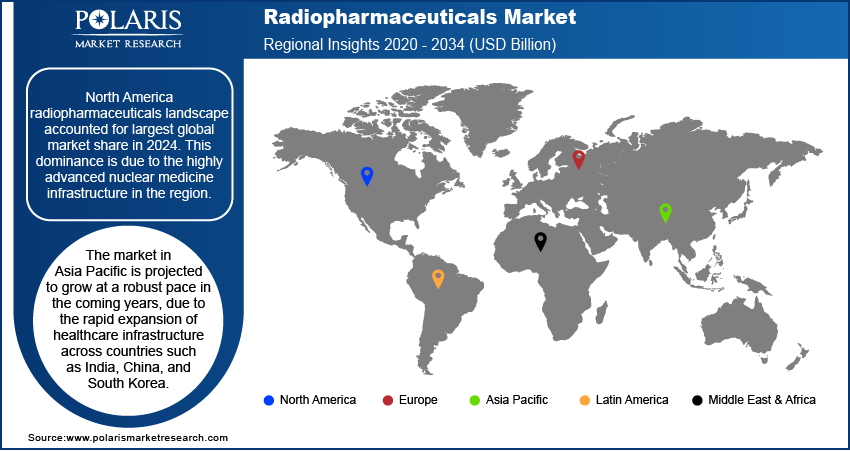

- The North America radiopharmaceuticals market accounted for largest global market share in 2024.

- The US radiopharmaceuticals market held largest regional share of the Asia Pacific market in 2024, due to the high prevalence of cancer and cardiovascular diseases.

- The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, due to the rapid expansion of healthcare infrastructure across countries such as India, China, and South Korea.

- The market in the China is expanding due to supportive government initiatives in nuclear technology and cancer control programs.

Industry Dynamics

- Rising number of cancer and cardiovascular diseases globally is boosting the demand for diagnostic and therapeutic radiopharmaceuticals, as healthcare systems rapidly adopting nuclear medicine for early detection, treatment planning and monitoring of chronic conditions.

- Aging global population is contributing to a surge in age-related disorders such as cancer, neurodegenerative and cardiovascular diseases. This in turn drives the demand for advanced radiopharmaceuticals to support geriatric diagnostics and personalized therapy.

- High production costs and complex regulatory approvals are limiting the widespread availability of radiopharmaceuticals, in low-resource regions with underdeveloped nuclear medicine infrastructure.

- Integration with nuclear imaging platforms is creating future opportunities for market growth. This enables faster and accurate detection of abnormalities to support clinical decision-making in complex oncology and neurological cases.

Market Statistics

- 2024 Market Size: USD 7.83 billion

- 2034 Projected Market Size: USD 8.63 billion

- CAGR (2025-2034): 10.4%

- North America: Largest market in 2024

Radiopharmaceuticals compounds are commonly used in diagnostic imaging procedures such as PET and SPECT scans, as well as in therapeutic applications for treating specific cancers. The introduction of new radioisotopes and radiolabeled compounds offer better tissue targeting and reduced side effects, enhancing treatment effectiveness and driving procedural volumes. Therefore, healthcare providers are expanding nuclear medicine capabilities and upgrading imaging systems to accommodate advanced tracer technologies. This is increasing patient base benefiting from nuclear medicine applications across hospitals and imaging centers.

The rising collaborations between pharmaceutical companies and research institutions are contributing to the advancement and commercialization of radiopharmaceuticals. For instance, in April 2025, Debiopharm collaborated with Oncodesign Services to develop antibody–chelator conjugates for preclinical radiopharmaceutical research in radioimmunotherapy targeting HER2⁺ tumors. It enables the development of next-generation radiolabeled therapies and imaging agents with improved targeting capabilities and reduced toxicity. This collaborative approach is enhancing the availability of cutting-edge radiopharmaceuticals and boosting its adoption across global healthcare markets.

In addition, ongoing advancements in radiotracer development, improved supply chains for isotopes and government support for nuclear medicine research are further boosting the market growth. For instance, in July 2025, The University of Alberta developed a new radiotracer that improves breast cancer detection by enabling faster, more accurate scans, with early studies showing high diagnostic precision. These developments are accelerating clinical outcomes, expand diagnostic capabilities and boosting the adoption of advanced radiopharmaceutical solutions across healthcare systems.

Drivers, Trends/Opportunities

Rising Number of Cancer and Cardiovascular Diseases Globally: The increasing prevalence of cancer and cardiovascular conditions is significantly fueling the growth of the radiopharmaceuticals market. According to the World Health Organization (WHO), chronic conditions including cardiovascular diseases, cancer, diabetes, and respiratory illnesses are expected cause 86% of the projected 90 million annual deaths by 2050. Cancer detection and cardiac imaging increasingly rely on nuclear medicine techniques. This is increasing the need for radiopharmaceuticals for accurate disease staging, treatment monitoring and risk assessment, thus fueling the market growth.

Aging Global Population: The growing number of elderly populations globally is propelling the market growth. According to the World Health Organization, 1 in 6 people globally will be aged 60 or older by 2030. The population in this age group is expected to double, reaching 2.1 billion people worldwide by 2050. Older adults are more susceptible to chronic diseases, including neurodegenerative disorders, cancer, and cardiovascular ailments, which require continuous monitoring and early intervention. Radiopharmaceuticals enable clinicians to assess disease progression and tailor treatment strategies effectively in this age group. This is boosting higher procedural volumes across diagnostic and therapeutic applications therefore increasing the demand for radiopharmaceutical compounds.

Segmental Insights

Radioisotope Type Analysis

Based on radioisotope type, the segmentation includes technetium-99, fluorine-18, iodine-131, lutetium-177, yttrium-90, gallium-68, gallium-67, rubidium-82, iodine-123, iodine-125, indium-111, and others. The technetium-99 segment accounted for largest revenue share in 2024, due to its widespread application in SPECT imaging for conditions related to bone, cardiac, and oncology diagnostics. Its favorable characteristics, including short half-life, cost efficiency, and optimal gamma emission energy, make it highly suitable for clinical use.

The fluorine-18 segment is expected to grow at the fastest CAGR during the forecast period, fueled by increasing demand for PET imaging across oncology, neurology, and cardiology. Fluorine-18 is extensively used in radiolabeling glucose analogs such as FDG (fluorodeoxyglucose), allowing clinicians to detect metabolic activity in tissues with high precision. The compound’s short half-life, high image resolution, and ability to bind to various biomarkers make it suitable for early detection and disease monitoring.

Application Analysis

By application, the market includes oncology, cardiology, gastroenterology, neuroendocrinology, neurology, nephrology, and others. The oncology segment held the largest revenue share in 2024, owing to the growing adoption of radiopharmaceuticals in cancer diagnosis, staging, and treatment planning. These compounds enable clinicians to detect tumors, assess treatment response, and deliver targeted radiation therapy with improved precision. The growing global burden of cancer and rising adoption of personalized treatment approaches are fueling usage in diagnostic imaging services and radiotherapeutic procedures.

The neurology segment is projected to register the fastest growth rate from 2025 to 2034, driven by rising prevalence of neurodegenerative diseases and demand for advanced imaging techniques. Radiotracers are increasingly used in the early diagnosis and monitoring of Alzheimer’s disease, Parkinson’s disease treatment, and other neurological conditions. PET and SPECT technologies, coupled with radioisotopes targeting specific brain receptors and metabolic pathways, are enabling accurate and non-invasive assessments of brain function.

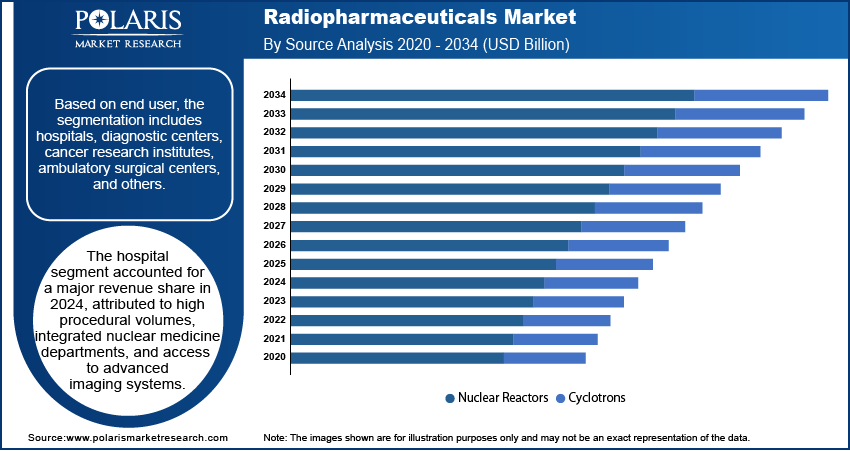

Source Outlook Analysis

By source outlook, the market includes nuclear reactors and cyclotrons. The nuclear reactors segment held the largest revenue share in 2024, due to widespread use of isotopes such as molybdenum-99, which decays into technetium-99m essential for most diagnostic imaging procedures. Countries with established nuclear programs continue to dominate supply, supporting consistent availability of diagnostic isotopes globally.

The cyclotrons segment is expected to grow at the fastest rate over the forecast period. Cyclotron-based production is expanding due to its cost efficiency, ability to generate isotopes with shorter half-lives, and reduced dependence on reactor-based infrastructure. The rising number of hospital-based cyclotrons is enhancing local access to PET tracers and contributing to increased procedural volumes in outpatient imaging centers.

End User Analysis

By end user, the market includes hospitals, diagnostic centers, cancer research institutes, ambulatory surgical centers, and others. The hospitals residential segment held the largest revenue share in 2024, attributed to high procedural volumes, integrated nuclear medicine departments, and access to advanced imaging systems. Hospitals remain the primary setting for diagnostic imaging and therapeutic nuclear medicine services, supporting widespread use of radiopharmaceuticals for cancer, heart disease, and neurological disorders.

The diagnostic centers segment is projected to witness the fastest growth during the forecast period. The increasing number of outpatient imaging facilities and standalone nuclear medicine clinics is expanding access to radiotracer-based diagnostics. For instance, in April 2025, US Radiology Specialists opened a new imaging center in Waco, Texas, its fourth new facility of the year and eighth since October 2024. The company aims to open 12 new centers in 2025, including five through joint ventures, expanding its network of 183 imaging centers across 13 states. These centers offer rapid turnaround times, cost-effective services, and growing adoption of PET-CT and SPECT imaging systems, driving higher utilization of radiopharmaceuticals across community healthcare settings.

Regional Analysis

North America Radiopharmaceuticals market accounted for largest global market share in 2024, due to the highly advanced nuclear medicine infrastructure. The region benefits from widespread availability of PET and SPECT scanners across hospitals and diagnostic centers, which enables high volumes of nuclear imaging procedures for cancer, cardiology, and neurology. In addition, strong government and private sector investments in precision medicine and oncology research are further contributing to market expansion. These initiatives are facilitating the development and commercialization of new radiopharmaceuticals aimed at targeted imaging and therapy.

The US Radiopharmaceuticals Market Insight

The US held largest regional share in the North America radiopharmaceuticals landscape in 2024, due to the high prevalence of cancer and cardiovascular diseases. According to the American Cancer Society, over 2 million new cancer cases are projected by the end of 2025. This surge in such life-threatening conditions are significantly increasing the reliance on early and accurate diagnostic techniques. These compounds enable clinicians to visualize disease progression at a molecular level, allowing for more precise treatment planning. The rising number of patients in need of advanced imaging is fueling demand for radiopharmaceuticals across hospitals, cancer treatment centers, and diagnostic facilities throughout the US.

Asia Pacific Radiopharmaceuticals Market

The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, due to the rapid expansion of healthcare infrastructure across countries such as India, China, and South Korea. Governments and private hospitals are investing in nuclear medicine departments and acquiring advanced imaging systems to improve access to radiotracer-based diagnostics and therapies. Furthermore, the rising burden of chronic diseases, including cancer and neurological disorders is further contributing to the regional demand. Physicians are increasingly using radiopharmaceuticals for early detection and personalized therapy in oncology and brain disorders. Growing awareness of nuclear medicine among healthcare providers and patients is boosting the demand for diagnostic and therapeutic radiotracers across the region.

China Radiopharmaceuticals Market Overview

The market in the China is expanding due to the supportive government initiatives. National-level investments in nuclear technology and cancer control programs are facilitating the expansion of radiopharmaceutical production and clinical use. For instance, in May 2023, the International Agency for Research on Cancer (IARC) and the National Cancer Center of China launched a Regional Learning Centre in China to enhance cancer research and training across the Asia-Pacific region. The initiative aims to strengthen regional capacity in cancer prevention, early detection and data analysis through specialized education and collaboration. These initiatives are fueling the adoption of radiopharmaceuticals for cancer diagnosis and treatment across urban and secondary care facilities.

Europe Radiopharmaceuticals Market

The radiopharmaceuticals landscape in the Europe is projected to hold a substantial share in 2034, driven by strong emphasis on early disease detection across national healthcare systems. Countries in the region are focusing on improving diagnostic accuracy in oncology and neurology through expanded use of PET and SPECT imaging. For instance, the EU-funded PRISMAP project established a sustainable medical radionuclide programme aimed at enhancing radiopharmaceutical innovation for cancer diagnosis and treatment. The program connected 23 institutions in 13 countries, enabling cutting-edge radiotracer development for theranostic applications. These initiatives by the government bodies are fueling clinical adoption of diagnostic radiopharmaceuticals for cancer staging and neurological assessment.

Key Players & Competitive Analysis Report

The radiopharmaceuticals market is moderately consolidated, with competition centered around innovation in radioisotope development, precision targeting, and therapeutic efficacy. Leading companies are heavily investing in research and development to enhance diagnostic and therapeutic radiopharmaceutical offerings, including next-generation PET and SPECT tracers and targeted radionuclide therapies for oncology, cardiology, and neurology applications. The integration of theranostic approaches combining diagnostics with personalized treatment is gaining traction, prompting manufacturers to develop dual-purpose radiopharmaceuticals that enable early detection and targeted therapy within a single clinical workflow. Manufacturers are prioritizing the development of radioisotopes with shorter half-lives, improved imaging clarity, and minimized side effects to meet clinical demands and regulatory standards. In addition, digital advancements such as AI-powered imaging interpretation and integration with molecular imaging platforms are adopted to enhance precision and diagnostic efficiency.

Prominent players in the radiopharmaceuticals market include Advanced Accelerator Applications SA, AstraZeneca plc, Bayer AG, Boehringer Ingelheim International GmbH, Bracco Imaging S.p.A., Cardinal Health, Inc., Curium Pharma, Eckert & Ziegler SE, F. Hoffmann-La Roche Ltd, GE HealthCare Technologies Inc., GlaxoSmithKline plc (GSK plc), Jubilant Radiopharma Limited, Lantheus Holdings, Inc., Eli Lilly and Company, and Mallinckrodt plc.

Key Players

- Advanced Accelerator Applications SA

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bracco Imaging S.p.A.

- Cardinal Health, Inc.

- Curium Pharma

- Eckert & Ziegler SE

- F. Hoffmann-La Roche Ltd

- GE HealthCare Technologies Inc.

- GlaxoSmithKline plc (GSK plc)

- Jubilant Radiopharma Limited

- Lantheus Holdings, Inc.

- Eli Lilly and Company

- Mallinckrodt plc

Industry Developments

- March 2025: GE HealthCare launched the Revolution Vibe CT scanner and introduced its PET coronary radiotracer, Flyrcado (flurpiridaz F‑18), approved by the FDA and reimbursed by CMS for outpatient use. Reimbursement support and bundled diagnostics increased adoption potential in cardiology and molecular imaging workflows.

- June 2023: UPMC and PharmaLogic partnered to build one of the largest radiopharmaceutical research, production, and distribution facilities on the UPMC Pittsburgh campus. The facility was expected to include cyclotrons and cGMP clean-rooms, supporting future expansion through PharmaLogic’s national network.

Radiopharmaceuticals Market Segmentation

By Radioisotope Type Outlook (Revenue, USD Billion, 2020–2034)

- Technetium-99

- Fluorine-18

- Iodine-131

- Lutetium-177

- Yttrium-90

- Gallium-68

- Gallium-67

- Rubidium-82

- Iodine-123

- Iodine-125

- Indium-111

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Cardiology

- Gastroenterology

- Neuroendocrinology

- Neurology

- Nephrology

- Others

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Nuclear Reactors

- Cyclotrons

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Diagnostic Centers

- Cancer Research Institutes

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Radiopharmaceuticals Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.83 Billion |

|

Market Size in 2025 |

USD 8.63 Billion |

|

Revenue Forecast by 2034 |

USD 20.94 Billion |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.83 billion in 2024 and is projected to grow to USD 20.94 billion by 2034.

The global market is projected to register a CAGR of 10.4% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Advanced Accelerator Applications SA, AstraZeneca plc, Bayer AG, Boehringer Ingelheim International GmbH, Bracco Imaging S.p.A., Cardinal Health, Inc., Curium Pharma, Eckert & Ziegler SE, F. Hoffmann-La Roche Ltd, GE HealthCare Technologies Inc., GlaxoSmithKline plc (GSK plc), Jubilant Radiopharma Limited, Lantheus Holdings, Inc., Eli Lilly and Company, and Mallinckrodt plc.

The technetium-99 segment dominated the market in 2024.

The oncology segment is expected to witness the fastest growth during the forecast period.