Light Tower Market Size, Share, Trends, & Industry Analysis Report

By Product (Stationary and Mobile), By Light Type, By Fuel Type, By End-User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6025

- Base Year: 2024

- Historical Data: 2020-2023

Overview

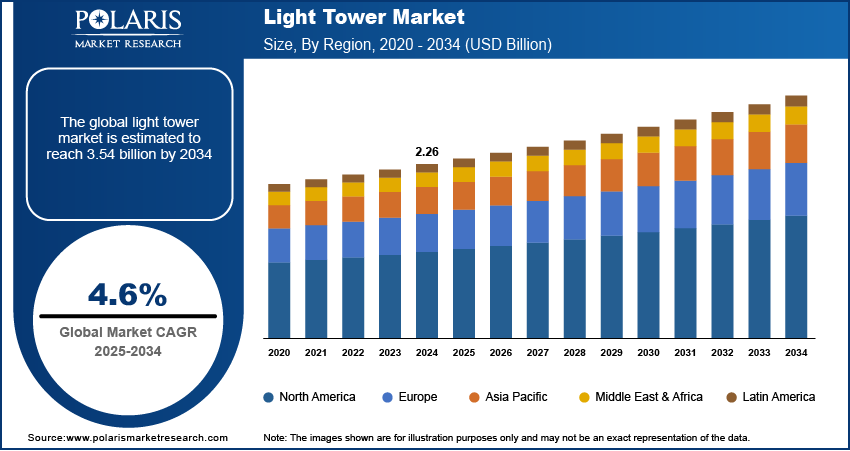

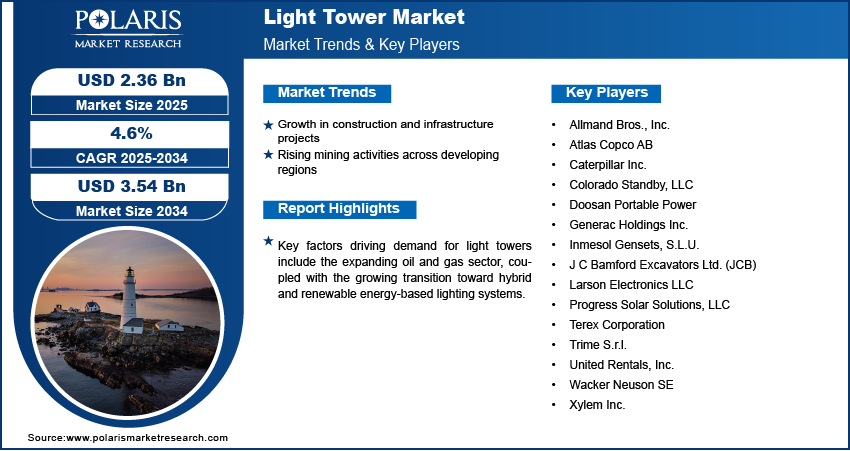

The global light tower market size was valued at USD 2.26 billion in 2024, growing at a CAGR of 4.6% from 2025–2034. Growth in construction and infrastructure projects coupled with rising mining activities across developing regions is boosting the demand for light towers worldwide.

Key Insights

- The mobile segment accounted for largest market share in 2024.

- The LED segment is projected to grow at the fastest rate over the forecast period, due to the growing demand for energy efficiency, lower maintenance needs, and extended operational lifespan.

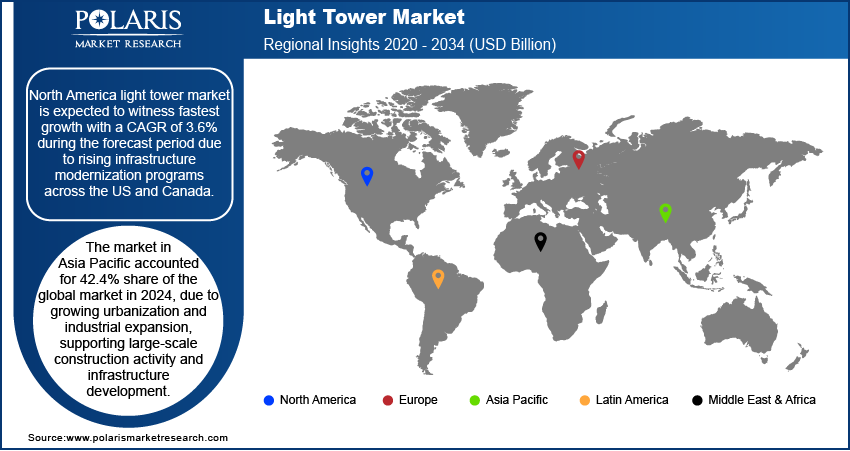

- The North America light tower market is expected to witness fastest growth with a CAGR of 3.6% during the forecast period.

- The US light tower market held significant share of the North America landscape in 2024, driven by the increasing frequency of climate-related disasters, including hurricanes, wildfires, and floods.

- The market in Asia Pacific captured 42.4% share of the market in 2024, due to growing urbanization and industrial expansion, supporting large-scale construction activity and infrastructure development.

- The market in China is expanding due to the rising wind and solar energy projects.

Industry Dynamics

- Growth in construction and infrastructure projects is boosting the demand for light towers, as urban development and highway expansion activities increasingly require portable, high-intensity lighting to support operations during nighttime or in low-light environments.

- Rising mining activities across developing regions are fueling light tower adoption, with continuous extraction and safety monitoring needs in remote and poorly lit areas necessitating durable and mobile lighting systems.

- Limited operating capacity in harsh weather is restricting wider deployment of solar and hybrid-powered light towers, as performance drops in extreme conditions such as heavy rainfall, snow, or extended cloud cover.

- Integration of telematics and IoT technologies is creating growth opportunities, enabling remote tracking, diagnostics, and performance optimization beneficial for rental fleets and multi-site contractors seeking operational efficiency.

Market Statistics

- 2024 Market Size: USD 2.26 billion

- 2034 Projected Market Size: USD 3.54 billion

- CAGR (2025-2034): 4.6%

- Asia Pacific: Largest market in 2024

Light towers are commonly equipped with high-intensity lamps and mast systems, mounted on mobile trailers or skid bases, and powered by diesel engines, hybrid systems, or solar modules. The application of light towers is expanding across projects that require temporary illumination in off-grid locations or demand quick installation and high mobility. These systems are increasingly preferred in infrastructure development, emergency response, and remote industrial operations due to their adaptability and ease of deployment. Growing focus on worker safety regulations and 24-hour operations in construction and utilities is increasing deployment rates, in roadworks, rail repairs, and emergency response zones.

The expanding oil and gas sector is increasing the demand for light towers, in regions with high exploration and production activity. According to the International Energy Agency (IEA), global oil supply is expected to increase by 1.8 million barrels per day (mb/d) in 2025, reaching 104.9 mb/d, followed by a further rise of 1.1 mb/d in 2026. Upstream operations including drilling, site surveying, and pipeline maintenance require durable lighting systems capable of operating in remote, off-grid locations. Projects in offshore fields and desert zones are prioritizing equipment with long runtime, rugged construction, and optimized fuel efficiency. Rising global investments in upstream energy projects are fueling the demand for light towers within the oilfield services segment, boosting extended operations and improved site visibility in remote and hazardous environments.

Additionally, the growing transition toward hybrid and renewable energy-based lighting systems is further propelling the growth of the market. Light towers are designed with solar panels, battery storage, and energy-efficient LED lighting technologies to minimize fuel consumption and reduce emissions. This shift aligns with international sustainability commitments and cost-saving objectives, among event organizers, municipalities, and infrastructure contractors. Strict environmental regulations and fluctuating fuel prices are accelerating the adoption of solar-powered and hybrid light towers, which offer cleaner operation and reduced maintenance requirements.

Drivers, Trends/Opportunities

Growth in Construction and Infrastructure Projects

The global surge in infrastructure projects is significantly contributing to the growth of the light tower market. Rising investment in residential complexes, commercial buildings, industrial zones, and civil engineering projects is leading to increased adoption of portable lighting equipment. According to Oxford Economics, the global construction industry is projected to expand from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037. This growth will be primarily driven by urban development and green infrastructure initiatives, with China, the US, and India leading the surge. Construction activities extend into night hours or take place in regions with inadequate grid access, making mobile light towers essential for ensuring safe and efficient work conditions. Government-led programs focusing on road upgrades, urban development, and smart city infrastructure are further contributing to the steady growth of reliable lighting systems at construction sites.

Rising Mining Activities Across Developing Regions

The growing need for minerals, rare earth elements, and metals is leading to increased mining operations across developing economies. Countries in Africa, Latin America, and the Asia Pacific are witnessing higher exploration and extraction activities, particularly in remote locations with limited infrastructure. These sites require robust lighting equipment that withstands harsh environmental conditions while offering long operational hours and easy mobility. In July 2023, the IEA released its first Critical Minerals Market Review, highlighting that demand for key minerals such as lithium, cobalt, nickel, and copper surged due to the rapid scale-up of clean energy technologies. From 2017 to 2022, lithium demand tripled, while cobalt and nickel rose by 70% and 40%, respectively. The energy transition minerals market reached USD 320 billion in 2022, underscoring its rising importance in the global mining landscape. This growth in mining operations is increasing the demand for heavy-duty, high-intensity light towers. These systems are essential for enabling round-the-clock extraction, improving visibility, and ensuring worker safety in low-light and harsh environmental conditions.

Segmental Insights

Product Analysis

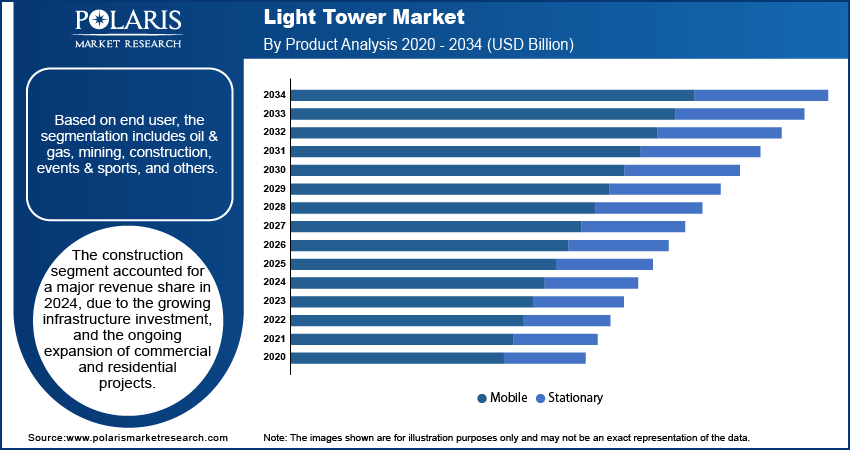

Based on the product, the segmentation includes stationary and mobile. The mobile segment accounted for largest revenue share in 2024, due to the high demand across construction sites, mining operations, emergency response zones, and outdoor events where lighting flexibility and rapid deployment are essential. Mobile light towers are preferred for ease of transportation, quick setup capabilities, and the ability to operate in remote or off-grid areas. Additionally, the increasing adoption of hybrid and solar-powered mobile units is further increasing the demand in energy-conscious industries looking to reduce fuel consumption and emissions.

The stationary segment is projected to grow at the fastest CAGR during the forecast period, driven by rising investments in infrastructure development and long-term industrial operations. These light towers are extensively used in large-scale facilities such as ports, highways, oil refineries, and airport maintenance zones, where continuous, high-intensity lighting is required over extended durations. Furthermore, advancements in LED integration, automatic operation systems, and energy-efficient technologies are contributing to the growing use of stationary light towers in permanent or semi-permanent lighting environments.

Light Type Analysis

Based on light type, the segmentation includes metal halide and LED. The metal halide segment dominated the market in 2024, due to its widespread adoption in high lumen output, durability, and suitability for large-area illumination. These lighting systems remain a standard across construction, mining, and oilfield applications that require intense lighting. The lower upfront costs compared to advanced alternatives further contribute to higher preference in budget-constrained projects across developing markets.

The LED segment is projected to register the fastest growth rate during the forecast period. LED-based light towers are gaining popularity due to their energy efficiency, lower maintenance needs, and extended operational lifespan. LED-based towers generate less heat, offer better visibility, and perform reliably in varying environmental conditions.

Fuel Type Analysis

By fuel type, the market includes diesel, solar/hybrid, and direct power. The diesel-powered light tower segment held the largest revenue share in 2024, owing to the high-power output, independence from grid connections, and ability to function continuously in off-grid and harsh environments. The versatility makes diesel-powered light towers the preferred choice for infrastructure development, oilfields, and mining operations, in regions with minimal renewable integration.

The solar/hybrid segment is expected to expand at the fastest CAGR during the forecast period. The rising emphasis on reducing carbon emissions and minimizing operating costs is boosting the wider adoption of solar-powered and hybrid systems. These models combine photovoltaic panels, battery storage, and backup diesel generators to offer sustainable and low-noise lighting. Government incentives and environmental mandates are further boosting the demand across the urban construction and outdoor event segments.

End User Analysis

By end user, the market includes oil & gas, mining, construction, events & sports, and others. The construction segment held the largest revenue share in 2024, due to the growing infrastructure investment, and ongoing expansion of commercial and residential projects. Contractors prefer portable lighting systems to maintain site safety, meet project deadlines, and ensure operational continuity in low-light or nighttime environments.

The events and sports segment is expected to witness the highest growth over the forecast period. Rising demand for outdoor entertainment, concerts, and sporting events across urban and suburban areas is increasing the deployment of mobile light towers. These units provide flexible lighting arrangements and easy transportation, ideal for temporary event infrastructure.

Regional Analysis

North America light tower market is expected to witness fastest growth with a CAGR of 3.6% during the forecast period due to rising infrastructure modernization programs across the US and Canada. Investment in upgrading highway, utility networks, and public service infrastructure requires dependable illumination during nighttime construction and maintenance. In addition, the ongoing expansion of oil and gas operations in high-activity regions such as the Permian Basin and Alberta oil sands, is leading to higher deployment of light towers for well pad illumination and pipeline work. These trends are boosting steady growth in construction and energy-related applications across the region.

The US Light Tower Market Insight

The US held substantial regional share in the North America light tower landscape in 2024, driven by the increasing frequency of climate-related disasters, including hurricanes, wildfires, and floods. These mobile lighting systems are crucial in supporting emergency response teams, enabling recovery operations, and maintaining field coordination during crises. According to the Center for American Progress, the US experienced a 250% increase in wildfires over the past two decades, highlighting a sharp rise in climate-related emergencies nationwide. This growing reliance is further pushing public agencies and disaster management units to invest in high-performance, durable lighting solutions, thus fueling the market growth.

Asia Pacific Light Tower Market

The market in Asia Pacific accounted for 42.4% share of the global market in 2024, due to growing urbanization and industrial expansion, supporting large-scale construction activity and infrastructure development. Countries such as India, China, and Indonesia are investing heavily in transportation corridors, metro rail, energy distribution, and real estate. These projects frequently require temporary lighting in areas with limited grid access, increasing the adoption of mobile light towers. In addition, rising mining and quarrying activity in Australia, Indonesia, and Mongolia is further contributing to market expansion by creating consistent demand for durable and fuel-efficient lighting equipment at remote extraction sites.

China Light Tower Market Overview

The market in China is expanding due to the rising wind and solar energy projects. This surge in renewable energy projects is boosting the demand for reliable nighttime lighting during site preparation and maintenance activities. According to China’s National Energy Administration, China’s utility-scale solar power capacity exceeded 880 gigawatts (GW) in 2024, the highest in the world. The country added 277 GW of new utility-scale solar capacity during the year. Construction of renewable energy facilities in vast, off-grid regions requires equipment that combines high luminosity, long runtime, and low emissions. This resulted in growing interest in hybrid and solar-powered light towers to support project execution while aligning with national carbon neutrality goals.

Europe Light Tower Market

The light tower landscape in Europe is projected to hold a significant share in 2034, driven by extensive renovation of aging roadways, bridges, and energy infrastructure. Regional governments are prioritizing investments in infrastructure renewal to improve safety, efficiency, and connectivity. For example, the European Commission’s Renovation Wave initiative targets the renovation of 35 million buildings by 2030, aiming to double the EU’s annual rate of energy-efficient building upgrades. Furthermore, stringent EU emissions directives are accelerating the adoption of hybrid and electric light towers across European construction sites. Equipment manufacturers are focusing on battery-based lighting units with lower noise and emissions to meet sustainability targets and regulatory compliance across member states.

Key Players & Competitive Analysis Report

The light tower market is moderately consolidated, with competition focused on durability, energy efficiency, and application-specific innovation. Leading manufacturers are investing in the development of advanced lighting systems that cater to evolving customer demands across construction, mining, oil & gas, and emergency response sectors. The market is shifting toward hybrid, solar-powered, and LED-based light towers, as users seek fuel efficiency, lower emissions, and reduced maintenance costs. To meet sustainability goals and adhere to regional emission standards, companies are prioritizing product lines that integrate lithium-ion batteries, automatic dimming sensors, and renewable power sources. Technological integration, such as telematics and remote diagnostics, is growing significantly as fleet operators and rental service providers look for ways to optimize performance and reduce downtime. Additionally, the rise in equipment rental is pushing manufacturers to offer modular, service-friendly models designed for quick deployment and mobility.

Prominent players in the Light Tower market include Allmand Bros., Inc., Atlas Copco AB, Caterpillar Inc., Colorado Standby, LLC, Doosan Portable Power, Generac Holdings Inc., Inmesol Gensets, S.L.U., J C Bamford Excavators Ltd. (JCB), Larson Electronics LLC, Progress Solar Solutions, LLC, Terex Corporation, Trime S.r.l.. United Rentals, Inc., Wacker Neuson SE, and Xylem Inc.

Key Players

- Allmand Bros., Inc.

- Atlas Copco AB

- Caterpillar Inc.

- Colorado Standby, LLC

- Doosan Portable Power

- Generac Holdings Inc.

- Inmesol Gensets, S.L.U.

- J C Bamford Excavators Ltd. (JCB)

- Larson Electronics LLC

- Progress Solar Solutions, LLC

- Terex Corporation

- Trime S.r.l.

- United Rentals, Inc.

- Wacker Neuson SE

- Xylem Inc.

- Larson Electronics LLC

- Progress Solar Solutions, LLC

- Terex Corporation

- Trime S.r.l.

- United Rentals, Inc.

- Wacker Neuson SE

- Xylem Inc.

Industry Developments

- October 2024: Generac Mobile launched two new GLT hybrid light tower models (GLT4‑A and GLT4‑M), featuring modular design, LED floodlights (240 – 320 W), fuel-efficient 2-cylinder engines, and AGM battery packs designed for entry and hydraulic mast options. The GLT series standardized digital controllers and spill containment features to meet the global rental and regulatory needs.

- December 2023: Atlas Copco launched the HiLight BI+ 4 hybrid LED light tower, offering four operating modes (battery, diesel, mains, or hybrid), 20 hours of quiet, emission-free battery operation, and up to 7-ton CO₂ savings per unit annually. It also featured a 15% lighter chassis allowing up to 22 units per truck load improving transport and fleet efficiency.

- July 2023: Atlas Copco introduced the ultra‑quiet HiLight B5+ LED tower, operating at just 55 dBA, ideal for urban and residential use while covering up to 5,000 m² at 20 lux and featuring SmartMast sensors for automated wind and obstacle response. SmartMast auto-lowered the mast in high winds and improved placement precision enhancing safety and ease of use.

Light Tower Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Stationary

- Mobile

By Light Type Outlook (Revenue, USD Billion, 2020–2034)

- Metal Halide

- LED

By Fuel Type Outlook (Revenue, USD Billion, 2020–2034)

- Diesel

- Solar/Hybrid

- Direct Power

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Mining

- Construction

- Events & Sports

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Light Tower Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.26 Billion |

|

Market Size in 2025 |

USD 2.36 Billion |

|

Revenue Forecast by 2034 |

USD 3.54 Billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.26 billion in 2024 and is projected to grow to USD 3.54 billion by 2034.

The global market is projected to register a CAGR of 4.6% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Allmand Bros., Inc., Atlas Copco AB, Caterpillar Inc., Colorado Standby, LLC, Doosan Portable Power, Generac Holdings Inc., Inmesol Gensets, S.L.U., J C Bamford Excavators Ltd. (JCB), Larson Electronics LLC, Progress Solar Solutions, LLC, Terex Corporation, Trime S.r.l., United Rentals, Inc., Wacker Neuson SE, and Xylem Inc.

The mobile segment dominated the market in 2024.

The metal halide segment is expected to witness the fastest growth during the forecast period.