LED Lighting Market Share, Size, Trends, Industry Analysis Report

By Product (LED Lamps, LED Fixtures); By Application; By End-user; By Region; Segment Forecast, 2025-2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM3252

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

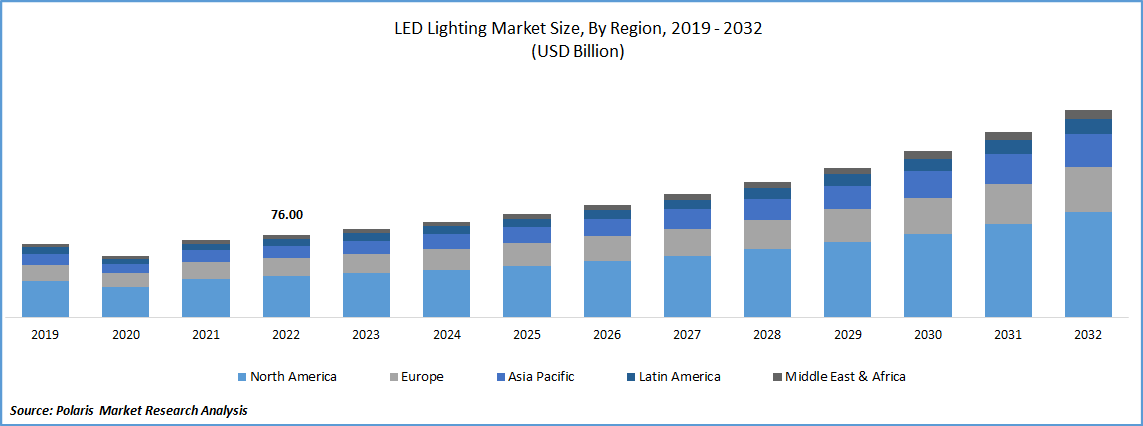

The global led lighting market was valued at USD 89.72 billion in 2024, growing at a CAGR of 10.2% from 2025 to 2034. Key factors driving the demand includes technological advancement in LED lighting, increasing construction activities in the commercial sectors, less energy requirement which leads to financial savings, environment-friendly, owing to minimum use of mercury, and less flickering.

Key Insights

- The luminaries segment dominated the market in 2024. This is due to the installation of additional track lights and light poles, resulting from the growth of commercial building space and the evolution of smart city initiatives.

- In 2024, indoor lighting held the largest market share due to the replacement of high-intensity discharge and fluorescent bulbs in supermarkets, shopping centers, and retail stores.

- In 2024, the Asia-Pacific LED Lighting market held the largest market share. This is due to the smart city project, aided by government-led initiatives or subsidies that encourage energy savings and reduce the carbon footprint.

- North America is anticipated to witness considerable expansion. This is attributed to strong government initiatives aimed at accelerating the transition to energy-efficient upgrades in LED technology.

Industry Dynamics

- The creation of new revenue streams by transforming lights from simple illumination to data points drives the expansion of the market.

- The demand for hyper-efficiency, predictive maintenance, and automated building management systems drives the market growth.

- Basic and low-margin LED products create challenges for companies to make profits.

- A shift towards smart data and systems for intelligent lighting systems creates growth opportunities.

Market Statistics

- 2024 Market Size: USD 89.72 billion

- 2034 Projected Market Size: USD 235.94 billion

- CAGR (2025-2034): 10.2%

- Asia Pacific: Largest market in 2024

AI Impact on LED Lighting Industry

- Reduces energy cost by adapting occupancy and daylight.

- Enables smart building management decisions by collecting space usage data.

- Adjust light color and intensity to enhance human centric lighting.

- Reduce maintenance needs and operational expense to predict failure before they happen.

To Understand More About this Research: Request a Free Sample Report

What Does the Current Market Landscape Look for LED Lighting Sector?

A light-emitting diode (LED) is a semiconductor light source that converts electrical energy directly into light energy. These devices are often used in lamps as replacement of incandescent light sources. LED lighting is expected to be one of the most energy-efficient and rapidly developing lighting technology in the global market. LED lights operate for a longer duration, are durable in nature, and offer better lighting quality compared to the traditional lighting technologies. The government has encouraged investments in energy-efficient lighting technology, which has expanded the use of LED lights in a variety of industrial, commercial, and residential sectors. Furthermore, lighting uses between 18 to 40 percent of the electricity used in business buildings, compared to just 10% in houses. The market is expanding due to the rising demand for energy conservation. The switch to energy-efficient lighting is anticipated to decrease the world's need for electricity for lighting by 30 to 40% by 2032. Moreover, LED lighting is being adopted widely in nations all around the world. For instance, New York intended to switch to LEDs for 250,000 of its streetlights, which was to be followed by the switchover of metropolitan areas' decorative lighting. Additionally, Barcelona (Spain) installed approximately 3,000 LED-based smart streetlights that collect data on noise, humidity, pollution, and other environmental factors.

LED lights consume 75% less energy and last 25 times longer than incandescent bulbs. They have the highest potential for saving energy and cost. Hence, replacing old lighting systems with LED lightings has been beneficial. The demand for new installations in the outdoor LED lighting market is significantly increasing.

LED is expected to take over the conventional Compact Fluorescent Lamp (CFL) and Cold Cathode Fluorescent Lamp (CCFL) lighting market due to advanced features. Moreover, it is a cost-effective solution for all lighting as well as other applications, including backlighting in large screen displays and non-backlight displays (OLED). Apart from the aforementioned cost benefit, the initial cost of LED lighting is very high and this restricts its initial acceptance. However, due to longer lifespan of LEDs, the overall cost of the same is found to be very low in comparison to CFLs

Factors that drive the growth of the LED lighting market are less energy requirement which leads to financial savings, environment-friendly, owing to minimum use of mercury, and less flickering. Furthermore, lower production cost of LED light is anticipated to provide lucrative LED Market Opportunity. There are various factors that significantly affect the LED market. Factors such as increase in demand for cost effective and energy-saving LED lighting, government initiatives toward LED adoption, and surge in need to replace traditional lighting system drive the growth of the market. However, high initial cost of LED lighting technology and presence of voltage sensitivity & temperature dependence hamper the market growth. Furthermore, increase in adoption of smart lighting system and LED display backlighting is expected to offer lucrative growth opportunities toward the LED market outlook.

The American National Standards Institute, China Compulsory Certification, and International Electrotechnical Commission are a few significant regulatory bodies that manage product certification. Manufacturing after obtaining the required licenses permits to do business, offer services, and import and export products. Governments in both developed and developing economies are attempting to lower high energy usage.

They are doing this by upholding a number of quality laws that assist them in preserving consumer safety, managing energy use, and monitoring environmental issues. LED lighting is an energy-saving solution with a 50,000-hour lifespan and lower electricity use. As a result, it is anticipated that stringent government rules limiting the use of lighting that uses a lot of energy will promote the expansion of the market.

The LED market revenue experienced decline in its growth rate, owing to delayed construction projects. However, the demand for UV LED from the medical industry accelerated during the pandemic. Furthermore, market players invested in R&D of smart lighting system, owing to new government initiatives across the globe. Therefore, the LED market size was anticipated to gain momentum by the end of 2021.

The notable factors positively affecting the global LED market include increase in demand for cost-effective & energy-saving LED lighting, government initiatives toward LED adoption, and surge in need to replace traditional lighting system are expected to fuel the market growth. However, high initial cost of LED lighting system and voltage sensitivity & temperature dependence are expected to hinder the market growth

Globally, APAC is the largest market for LEDs, accounting for around 50% revenue share in 2022. This is mainly attributed to the increasing demand for LEDs from the residential sector, primarily in countries such as China, India, and South Korea, on account of the increasing disposable income, growth in the construction of housing establishments., and the presence of a large number of companies operating in these countries.

Moreover, due to the increasing population, budding infrastructure development activities in developing countries, and rising government initiatives with a focus on energy efficiency, the demand for commercial and industrial applications is increasing, thus driving the production of LEDs in the region.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Market Expansion?

In the current market strategy, LED light bulbs are witnessing the early adoption phase of the product life cycle. However, continued technological advancement in LED lighting poised these product offerings to enter and advance through the growth phase. Lumileds Holding introduced its new LUXEON 2835 commercial LEDs. These LEDs are engineered and designed to support the increasing demand for high-volume, high-efficacy mid-power LEDs to serve commercial indoor lighting applications. Typical commercial indoor applications include troffers, panels, and high-bay, among other formats.

Advancements in light-emitting diode technology have authorized LED lighting products to penetrate the commercial lighting demand with enormous growth potential. Commercial buildings, including offices, stores, restaurants, hospitals, and schools, account for almost 20% of US energy consumption, and 38% is attributed to lighting.

According to the long-term energy forecast for Annual Energy Outlook, the US Energy Information Administration expects LED lighting to continue to grow, meeting up to 95% of the commercial lighting demand by 2050.

Overall, rapid urbanization and the increasing construction activities in the commercial sectors of different countries are expected to fuel the market demand during the forecast period. For instance, in June 2022, Wipro Lighting announced the creation of a new business unit combining commercial lighting and seating solutions. It aims to offer more comprehensive solutions to its customers in the B2B (business-to-business) space and deliver more value. Such developments will further drive market growth.

Report Segmentation

The market is primarily segmented based on product, application, end-user, and region.

|

By Product |

By Application |

By End-User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Which Segments by Product Impacted the Market Growth?

LED lighting market segmentation, based on product type, includes lamps and luminaries. The luminaries segment dominated the market in 2024 and lamps is projected to be the faster-growing segment during the forecast period. This is due to the LED lights are utilized only in track lighting, high bays, troffers, and street lighting fixtures. The installation of additional track lights and light poles as a result of the growing commercial building space and evolving smart city initiatives is the main factor driving the segment's growth. Hence, rising utilization of LED lights for the development of the cities are anticipated to positively impacts the market growth.

What are the Factors by Application Affected the Market Expansion?

The LED lighting market data has been bifurcated by end-use application into indoor lighting and outdoor lighting. In 2024, indoor lighting held the largest market share, while the outdoor lighting segment is expected to be the fastest-growing segment in the forecast period. This growth is due to the new replacement of high-intensity discharge and fluorescent bulbs from supermarkets, shopping centers, and retail stores. Moreover, governments' global push towards smart cities adds to the demand for outdoor lighting. Public infrastructure in smart cities is becoming energy-efficient LED systems to increase safety and management. Rising security concerns, as well as heightened focus on architectural landscape lighting of highways, parking lots, and facades of homes, are also factors. The newest LED technologies have significantly better energy efficiency, longevity, and maintenance costs than any other traditional lighting technologies, so they are a common-sense, economical alternative for large-scale outdoor public works initiatives. Consequently, manufacturers are paying increased attention to smart, connected outdoor lighting systems that integrate motion detectors and allow for remote monitoring, which will also serve to advance growth in the outdoor lighting sector.

Regional Analysis

Why Asia Pacific Dominated the Market in 2024

In 2024, the Asia-Pacific LED Lighting market held the largest market share. This is driven by rapid building construction and investment in the smart city project in the area. The smart city project has been aided by government-led initiative or subsidies that encourage energy savings and carbon footprint. The region benefits from a powerful manufacturing base, particularly in China and Vietnam, which allows for low-cost and ample supply of LED lighting. Additionally, urbanization and disposable incomes increasingly enable mass adoption of LEDs for residential and commercial applications.

What Factors Contributed to the Growth of North America?

North America is anticipated to witness considerable expansion. This is attributed to the strong government initiatives and incentives that aim to accelerate the move towards energy-efficient upgrades to LED technology. The early adoption of smart city initiatives and connected lighting technology will contribute to market expansion in the region. Further, the elimination of inefficient technologies due to regulations is part of the transition as well. Finally, strong consumer attention and continued focus on decreasing operational costs for businesses and municipalities encourage this expeditious growth.

Competitive Insight

Some of the major players operating in the global market include Cree, Inc., Everlight Electronics Co., Ltd., General Electric Company, LG Innotek Co., Ltd., Lumens Co., Ltd., Lumileds Holding B.V., Nichia Corporation, Koninklijke Philips N.V., Osram Licht AG, and Seoul Semiconductor Co. Ltd.

Recent Developments

- March 2025: Signify and Dixon Technologies collaborated to form a joint venture to enhance manufacturing excellence in India. This collaboration, which aims to form a joint venture pending required regulatory approvals, will produce lighting products and accessories for leading brands in the highly competitive Indian market.

- June 2022: The acquisition of Fluence by Signify from ams OSRAM was disclosed. The transaction would strengthen Signify's agriculture lighting growth platform and strengthen its position in the wealthy North American horticulture lighting market.

- May 2022: The Syska LED Recessed SMD Downlight was unveiled by SYSKA LED (Glowslick-SSK-SLP). Because it may be utilised in homes, offices, showrooms, retail establishments, and shopping malls, this lighting solution is perfect for indoor applications

LED Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 89.72 billion |

| Market size value in 2025 | USD 98.62 billion |

|

Revenue forecast in 2034 |

USD 235.94 billion |

|

CAGR |

10.2% from 2025-2034 |

|

Base year |

2024 |

|

Historical data |

2020- 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product , By Application, By End-user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cree, Inc., Everlight Electronics Co., Ltd., General Electric Company, LG Innotek Co., Ltd., Lumens Co., Ltd., Lumileds Holding B.V., Nichia Corporation, Koninklijke Philips N.V., Osram Licht AG, and Seoul Semiconductor Co. Ltd. |

FAQ's

The global led lighting market size is expected to reach USD 235.94 billion by 2034.

Key players in the led lighting market are Cree, Inc., Everlight Electronics Co., Ltd., General Electric Company, LG Innotek Co., Ltd., Lumens Co., Ltd., Lumileds Holding B.V., Nichia Corporation, Koninklijke Philips N.V.

Asia-Pacific dominated the market share in 2024.

The global led lighting market growing at a CAGR of 10.2% from 2025 to 2034.

The led lighting market report covering key segments are product, application, end-user, and region.