Rental Air Compressor Market Size, Share, Trends, & Industry Analysis Report

By Product (Portable and Stationary), By Technology, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6031

- Base Year: 2024

- Historical Data: 2020-2023

Overview

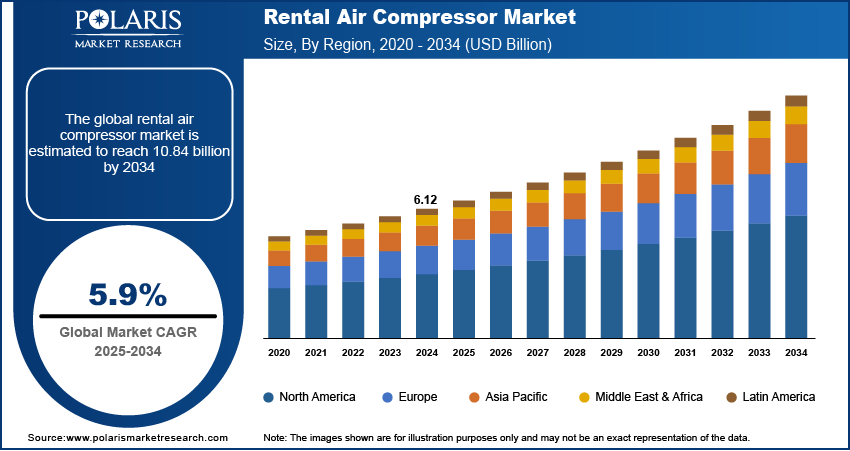

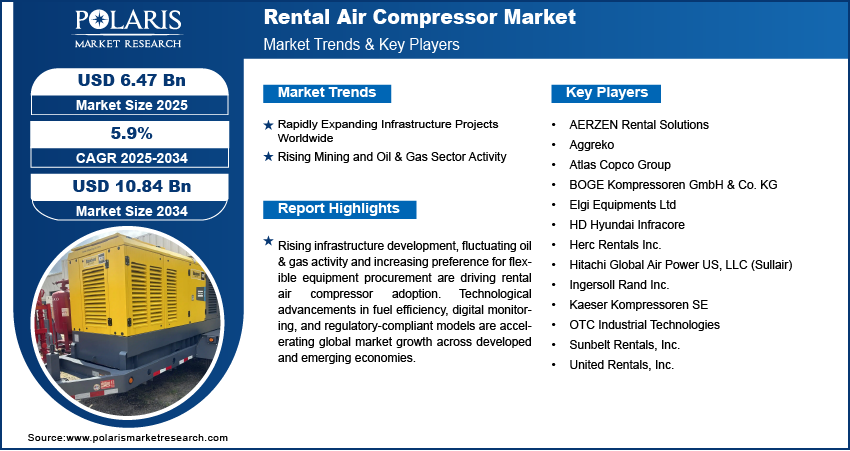

The global rental air compressor market size was valued at USD 6.12 billion in 2024, growing at a CAGR of 5.9% from 2025–2034. Rapid expansion of infrastructure projects and rising activity in the mining and oil & gas sectors are driving demand for rental air compressors across global markets.

Key Insights

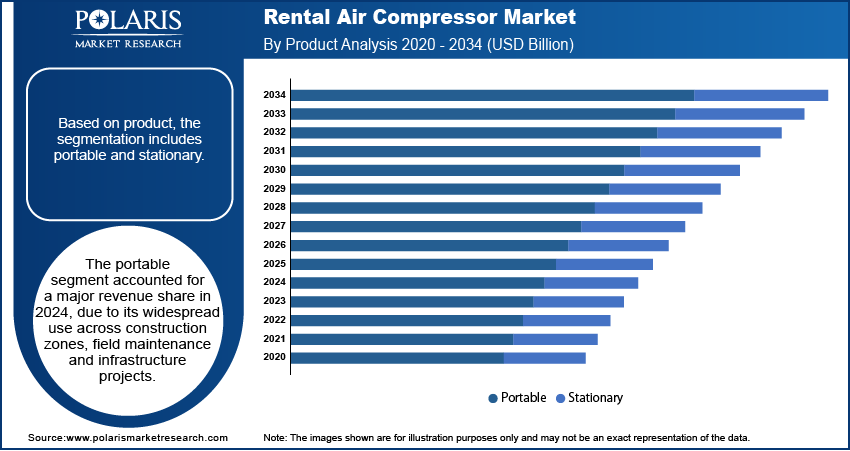

- The portable segment accounted for 65.5% market share in 2024.

- The oil & gas segment is projected to grow at the fastest rate over the forecast period, driven by rising exploration activity, field-based operations, and demand for ruggedized compressors in remote locations.

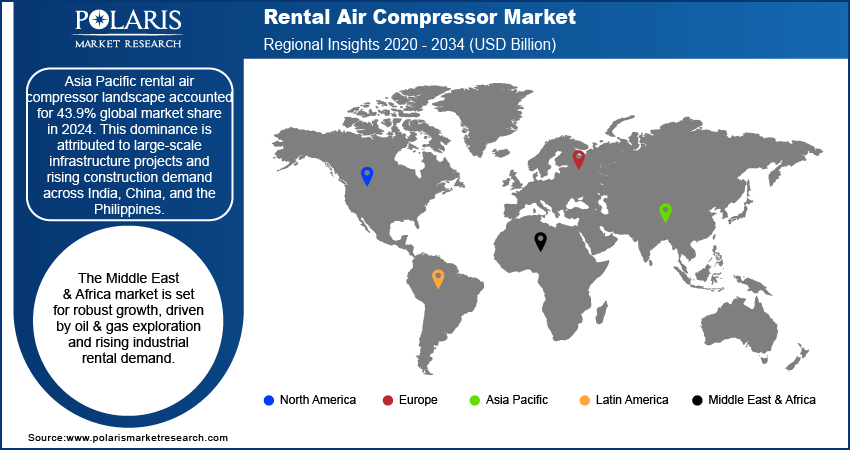

- The Asia Pacific rental air compressor market accounted for 43.9% of the global market share in 2024.

- The India rental air compressor market held significant share of the Asia Pacific market in 2024, fueled by public infrastructure programs, mining projects, and industrial corridor expansions.

- The market in Middle East & Africa is projected to grow significantly from 2025-2034, driven by oil & gas exploration and increasing rental demand for construction and industrial utility needs.

- The Saudi Arabia market is expanding steadily, fueled by rapid infrastructure megaprojects under Vision 2030 and recurring compressor rentals across upstream and midstream oil & gas operations.

Rental air compressors are used across construction, manufacturing, mining, and oil and gas sectors to meet temporary compressed air needs without large capital investments. These systems support planned maintenance, unplanned shutdowns, and project-based operations. Diesel and electric variants are offered based on site conditions and energy requirements. Rental providers minimize downtime by offering pre-serviced compressors with flexible rental terms suited to short-term industrial needs. Companies prefer rental compressors to manage peak load demands and avoid long equipment ownership costs.

The rental air compressor market is expanding due to rising infrastructure development and increasing equipment replacement needs across industrial sectors. Construction activities in the US, China, India, and the Middle East & Africa (MEA) are driving short-term demand for mobile compressor units. Regulatory pressure on emissions is pushing end users to choose fuel-efficient and low-emission rental models. Service providers are adding advanced units with digital control systems and remote monitoring capabilities to improve operational reliability and energy performance. Growing focus on project-based equipment use is driving the shift toward rental-based compressed air solutions.

The growing need for temporary and mobile compressed air supply in critical operations is driving the deployment of rental air compressors across large infrastructure projects, turnaround maintenance, and emergency repair tasks. Industries are using rental units to ensure business continuity during unplanned outages, utility disruptions, or high-load events. Service providers are developing rapid response models that enable same-day equipment availability, on-site installation, and 24/7 technical support to meet urgent operational requirements. For instance, in April 2025, MANN+HUMMEL equipped ELGi’s EG Series oil-lubricated screw air compressor on a rental basis to reduce operational costs and increase efficiency. The rental compressor ensured uninterrupted performance, avoided upfront capital expenditure, and provided a scalable solution for varying production demands while saving USD 500,000 for the company.

- Rapid expansion of infrastructure projects is increasing short-term demand for high-capacity rental compressors in construction, road development, and industrial utility installations.

- Rising activity in mining and oil & gas sectors is driving the need for portable and ruggedized compressor units to support on-site drilling, excavation, and field operations.

- Growing implementation of clean energy regulations is creating opportunities for electric-powered rental compressors in urban construction zones with strict emission regulations.

- High operating and maintenance costs, such as fuel expenses, transportation charges, and frequent servicing requirements are hindering the adoption of the rental air compressor industry.

Drivers & Opportunities/Trends

Rapidly Expanding Infrastructure Projects Worldwide: Infrastructure development is increasing across regions due to rising investments in roads, bridges, railways, and industrial facilities. According to Preqin, the number of infrastructure funds and total fundraising volume rose from USD 63.5 billion in 2014 to USD 94.6 billion in 2024, marking a 49.0% increase over the decade. Construction companies are renting air compressors to manage temporary compressed air needs during project execution. Rental air compressors ensure uninterrupted pneumatic tool use, helping avoid delays during infrastructure project execution. Growing government infrastructure programs in countries such as India, the US, China, Saudi Arabia, and the UAE are creating steady demand for short-term equipment rental. Rental air compressors are used during plant installation, pipeline work and civil works where mobility and quick deployment are essential. This trend is fueling consistent market growth globally.

Rising Mining and Oil & Gas Sector Activity: The mining and oil & gas sectors are increasing the use of rental air compressors to support exploration, drilling, and maintenance operations. As per the International Energy Statistics, the US is the world’s top crude oil producer for six straight years. In 2023, it averaged 12.9 million barrels per day, hitting a record of over 13.3 million barrels per day in December. Many sites operate in remote locations where portable compressors are required to power pneumatic tools and remove debris. Companies prefer rentals to avoid high equipment ownership costs and ensure flexibility in operations. Rapidly expanding project pipelines in regions such as Australia, Latin America, and the Middle East are creating repeat demand for rental compressors. These units help maintain productivity during short-term and seasonal projects. Increasing mining and oilfield activity is directly supporting the expansion of rental air compressor services.

Segmental Insights

Product Analysis

Based on product, the segmentation includes portable and stationary. The portable segment accounted for 65.5% revenue share in 2024, driven by rising demand across construction, mining, and field-based industrial operations. These compressors are preferred for their mobility, ease of deployment and ability to support short-term and project-based compressed air needs. Contractors and service providers are renting portable units to avoid high capital expenditure and ensure operational flexibility across changing project locations. Increasing adoption in remote infrastructure development combined with demand for fuel-efficient and emission-compliant models is contributing to the segment’s continued dominance across regions.

The stationary segment is projected to grow at the fastest pace during the forecast period, fueled by its increasing use in continuous operations within manufacturing, chemical, and processing plants. These compressors are integrated into fixed systems requiring stable airflow and high pressure over long durations. Rising demand during planned plant maintenance, retrofitting and utility upgrades is driving segment growth. Companies are opting for short-term and mid-term rental contracts to reduce downtime without investing in permanent systems. Additionally, technological advancements in energy-efficient electric stationary models are meeting sustainability goals to further boost market expansion in industrial facilities.

Technology Analysis

Based on technology, the segmentation includes rotary/screw and reciprocating. The rotary/screw segment accounted for 58.4% revenue share in 2024, owing to its high efficiency, continuous operation capability and suitability for large-scale industrial use. For instance, in March 2025, Aerzen Rental Solutions expanded its operations with a new facility in Houston, Texas, aimed at strengthening its presence across North America. The expansion enhances its ability to deliver rental air compressors and blower solutions for critical industrial applications. These compressors are commonly deployed in oil & gas processing, manufacturing lines and chemical plants where an uninterrupted compressed air supply is essential. Rotary units are widely used in rental fleets due to durability, low maintenance, and integration with automated systems. Demand for energy-efficient and low-noise rotary models is further contributing to segment leadership in industrial and utility-based applications.

The reciprocating segment is projected to grow at the fastest pace during the forecast period, driven by increasing adoption in maintenance tasks, small-scale construction and temporary workshop operations. These compressors are suitable for intermittent use and are widely rented for their lower cost, compact structure and simple service requirements. In developing markets, small and mid-sized enterprises are renting reciprocating compressors to support operations without large capital investments. Expanding use in decentralized applications and periodic service tasks is contributing to segment growth in locations where high airflow continuity is not required.

End User Analysis

By end user, the market includes construction, oil & gas, mining, manufacturing, chemical, and others. The construction segment held the largest revenue share in 2024, due to ongoing global infrastructure projects, including roads, bridges and commercial developments. Air compressors are essential for operating pneumatic tools and equipment on construction sites. Companies prefer rentals to avoid equipment storage and maintenance costs in time-bound projects. Government investments in transport and smart city infrastructure across Asia Pacific, the Middle East & Africa are further fueling the segment’s growth within urban and semi-urban construction activities.

The oil & gas segment is anticipated to grow at the fastest rate, due to increasing exploration, drilling, and field maintenance activities. Rental air compressors are widely used for wellhead servicing, pipeline testing and emergency backup applications in onshore and offshore environments. Many prominent companies in the US, Latin America, and the Middle East are adopting rentals to meet fluctuating operational needs while minimizing capital risk. The demand for rugged, high-capacity compressors capable of functioning under harsh site conditions is driving the rapid adoption of rental air compressors. In addition, the increasing use of rental services during shutdowns and field expansions is further driving segment growth.

Regional Analysis

Asia Pacific rental air compressor market accounted for 43.9% of the global market share in 2024. This dominance is driven by rapid infrastructure development and rising construction activity across India, China, and the Philippines among others. Also, the growing government initiative towards urban development programs, highway expansions and industrial corridor projects is boosting demand for portable compressor rentals. Additionally, the strong presence of mining operations and small-to-mid-scale manufacturing units across the region is driving repeat short-term compressor leasing for maintenance, utility upgrades and production continuity.

India Rental Air Compressor Market Insight

India held largest market share in the Asia Pacific rental air compressor landscape in 2024, driven by large-scale government-based infrastructure projects under programs such as Bharatmala, Smart Cities Mission, and Gati Shakti. The construction firms in India rapidly renting portable compressors to meet short-term needs in road, rail, and utility projects. Additionally, the country’s expanding mining and cement production activities are generating steady demand for ruggedized compressor units. According to Infomerics, India’s cement industry reached a market size of 3.96 billion tonnes in FY23 and is projected to reach 5.99 billion tonnes by 2032, growing at a CAGR of 4.7% from 2024 to 2032. The market is further driven by the presence of local rental companies offering flexible contracts and wide equipment availability across Tier 1 and Tier 2 cities.

Middle East & Africa Rental Air Compressor Market

The market in the Middle East & Africa is projected to grow at a significant CAGR from 2025-2034. This growth is driven by increasing oil & gas exploration activities and expanding infrastructure investments across Saudi Arabia, the UAE, and South Africa. The rapid adoption of rental compressors in this region is driven by its utilization in temporary power support, pressure testing and equipment cleaning across remote and large-scale project sites. Moreover, the rising demand for rugged and fuel-efficient rental units is boosting the growth of rental compressors due to their cost flexibility and rapid deployment for on-site operations.

Saudi Arabia Rental Air Compressor Market Overview

The market in Saudi Arabia is expanding due to high oil & gas activity and continuous investments in infrastructure megaprojects such as NEOM and Vision 2030 initiatives. As of September 2024, the total value of projects under Saudi Arabia’s Vision 2030 reached USD 1.3 trillion. This investment indicates Saudi Arabia’s strategic focus on economic diversification across infrastructure, tourism, and industrial sectors. Thus, the demand for air compressors is rising across upstream and midstream operations where temporary compressed air supply is required during exploration and maintenance tasks. Additionally, the large-scale construction of industrial zones, transportation corridors and smart city frameworks is increasing the use of rental solutions for on-site utility operations.

North America Rental Air Compressor Market

The rental air compressor landscape in North America is projected to grow with a 5.2% CAGR during the forecast period, driven by aging infrastructure upgrades and strong industrial demand. For instance, in October 2024, Statistics Canada released the 2022 survey of government agencies responsible for public infrastructure, estimating that replacing road and water systems in poor or very poor condition is projected to cost USD 356.7 billion, which is an increase of over USD 100 billion since 2020. This is due to the high adoption of rental solutions across manufacturing, utilities, and energy sectors. Increasing regulatory focus on emission control is pushing rental providers to upgrade fleets with energy-efficient and low-emission models. In addition, growing preference for digital fleet tracking and remote monitoring is improving equipment availability and operational transparency, which in turn drives rental air compressor across industrial and municipal applications.

Key Players & Competitive Analysis Report

The rental air compressor market is moderately competitive, with key players focusing on fleet modernization, service customization and digital fleet management to strengthen market share. Leading companies are investing in low-emission and electric-powered compressor units to meet environmental regulations and urban deployment needs. Growing strategic collaborations with construction firms, industrial contractors and energy operators are enhancing long-term rental contracts and cross-sector service reach. Additionally, firms are adopting IoT-enabled tracking, predictive maintenance systems and remote performance monitoring to improve uptime and operational transparency. The rising focus on on-demand delivery, technical support and flexible rental models is driving competitive differentiation.

Major companies operating in the rental air compressor industry include Atlas Copco Group, Sunbelt Rentals, Inc., United Rentals, Inc., Ingersoll Rand Inc., Aggreko, Kaeser Kompressoren SE, Herc Rentals Inc., Hitachi Global Air Power US, LLC (Sullair), HD Hyundai Infracore, BOGE Kompressoren GmbH & Co. KG., Elgi Equipments Ltd, AERZEN Rental Solutions, and OTC Industrial Technologies.

Key Players

- AERZEN Rental Solutions

- Aggreko

- Atlas Copco Group

- BOGE Kompressoren GmbH & Co. KG

- Elgi Equipments Ltd

- HD Hyundai Infracore

- Herc Rentals Inc.

- Hitachi Global Air Power US, LLC (Sullair)

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- OTC Industrial Technologies

- Sunbelt Rentals, Inc.

- United Rentals, Inc.

Industry Developments

- January 2025: Hitachi Global Air Power launched the Sullair E425H electric portable air compressor, designed to deliver 425 cfm at 150 psi for heavy-duty applications. The model strengthens the rental air compressor portfolio by offering a zero-emission, low-noise solution suited for urban job sites and environmentally regulated projects.

- September 2024: Atlas Copco expanded its specialty rental portfolio through the acquisition of Suter Group and Air Plus, enhancing its presence in the European market. These acquisitions strengthen Atlas Copco’s rental air compressor offerings, enabling faster service delivery and tailored support for industrial and infrastructure projects.

Rental Air Compressor Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Stationary

- Portable

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Reciprocating

- Rotary/Screw

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Oil & Gas

- Mining

- Manufacturing

- Chemical

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rental Air Compressor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.12 Billion |

|

Market Size in 2025 |

USD 6.47 Billion |

|

Revenue Forecast by 2034 |

USD 10.84 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.12 billion in 2024 and is projected to grow to USD 10.84 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

Asia Pacific dominated the market in 2024, holding 43.9% share.

A few of the key players in the market are Atlas Copco Group, Sunbelt Rentals, Inc., United Rentals, Inc., Ingersoll Rand Inc., Aggreko, Kaeser Kompressoren SE, Herc Rentals Inc., Hitachi Global Air Power US, LLC (Sullair), HD Hyundai Infracore, and BOGE Kompressoren GmbH & Co. KG.

The portable segment dominated the market in 2024, holding 65.5% share. This dominance is attributed to its wide usage in construction, mining, and short-term industrial operations.

The oil & gas segment is expected to witness the fastest growth during the forecast period, owing to expanding field operations, rising exploration activity and increasing demand for flexible, high-performance compressors in offshore and remote site environments.