Near-Eye Display Market Size, Share, & Industry Analysis Report

By Brightness Level (500 To 1,000 Nits), By Component, By Technology, By Device Type, By Industry Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6026

- Base Year: 2024

- Historical Data: 2020-2023

Overview

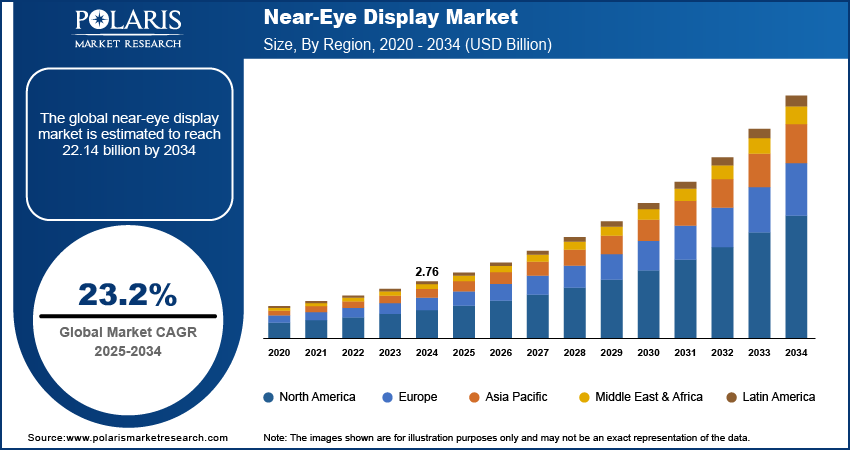

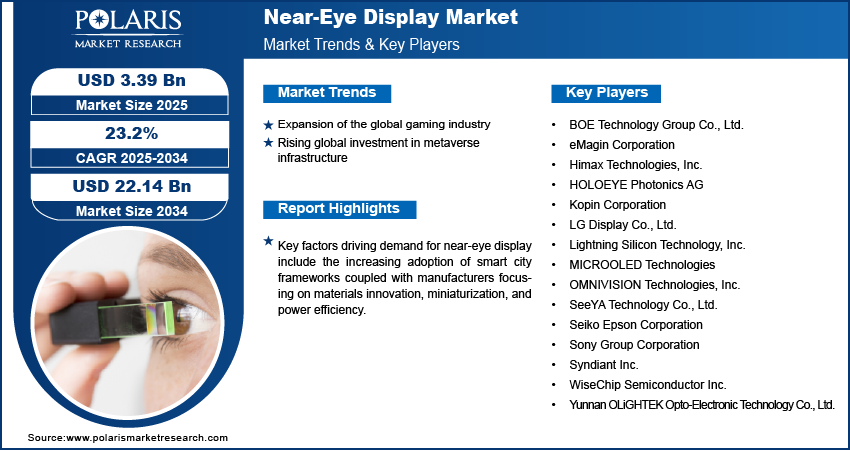

The global near-eye display market size was valued at USD 2.76 billion in 2024, growing at a CAGR of 23.2% from 2025–2034. Expansion of the global gaming industry coupled with rising investment in metaverse infrastructure is propelling the demand for near-eye display worldwide.

Key Insights

- The OLEDOS segment accounted for largest market share in 2024.

- The optical combiners segment is projected to grow at the fastest rate over the forecast period, due to the growing demand for transparent, lightweight, and high-contrast optics in AR headsets.

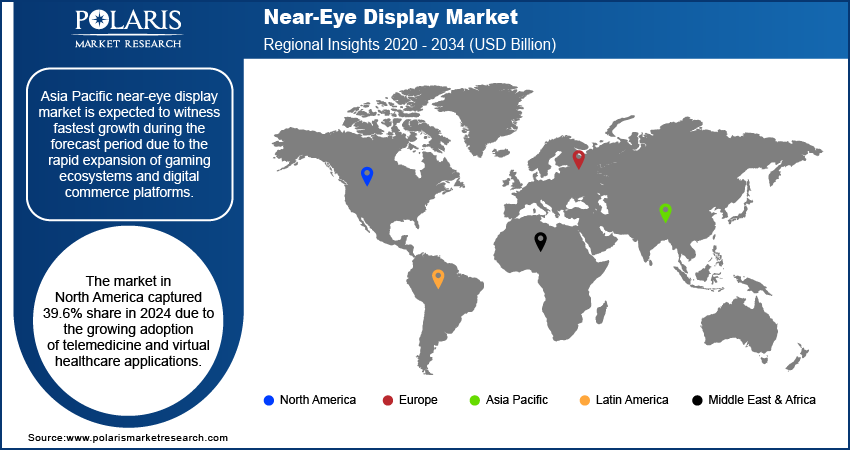

- Asia Pacific near-eye display market is expected to witness fastest growth during the forecast period due to the rapid expansion of gaming ecosystems and digital commerce platforms.

- The China near-eye display market held significant share of the Asia Pacific landscape in 2024, due to the presence of a robust electronic manufacturing base.

- The market in North America captured 39.6% share in 2024 due to the growing adoption of telemedicine and virtual healthcare applications.

- The market in the US is expanding due to the presence of a large number of video game users in the country.

Industry Dynamics

- Expansion of the global gaming industry is fueling demand for near-eye display technologies, as immersive AR/VR experiences become central to gameplay across consoles, PCs, and standalone headsets.

- Rising global investment in metaverse infrastructure is further accelerating the adoption of near-eye displays, with tech giants and startups developing hardware platforms to support virtual collaboration, social interaction, and immersive commerce through advanced visual interfaces.

- High development and manufacturing costs are restraining the market growth for cutting-edge display components such as OLED micro displays and waveguide optics.

- Integration of AI and spatial computing is creating market growth opportunities, enabling near-eye display systems to deliver context-aware content, real-time environmental interaction, and personalized visual experiences.

Market Statistics

- 2024 Market Size: USD 2.76 billion

- 2034 Projected Market Size: USD 22.14 billion

- CAGR (2025-2034): 23.2%

- North America: Largest market in 2024

Near-eye display technology refers to a class of compact visual systems designed to project images directly into a user's field of vision, typically through head-mounted or wearable devices. This technology includes micro displays, waveguides, and projection optics that enable immersive visual experiences while maintaining a lightweight, ergonomic form factor. Near-eye displays are integral to applications such as augmented reality, virtual reality, and mixed reality, supporting industries ranging from gaming and entertainment to aerospace, healthcare, and industrial training. The market holds strong potential for advancing highly interactive, portable, and personalized digital experiences.

The increasing adoption of smart city frameworks is contributing to the growth of the market. Governments and urban developers are exploring AR-powered solutions for public services, infrastructure monitoring, and on-site maintenance. Near-eye displays are supporting mobile field personnel in navigation, diagnostics, and hazard detection across complex urban environments. Smart glasses equipped with context-aware visualization and data overlay are gaining relevance in emergency response and law enforcement operations within metropolitan areas.

Manufacturers are focusing on materials innovation, miniaturization, and power efficiency to enhance display performance and support a broader range of applications, thus fueling the market growth. Improvements in waveguide optics, eye-tracking integration, and 3D imaging technologies are enabling more natural interaction in head-mounted systems. For instance, in March 2025, Meta unveiled a new line of augmented reality (AR) glasses equipped with heart rate monitoring capabilities, marking a significant advancement in wearable AR technology. This development enhances user health tracking demonstrating the growing multifunctionality of AR devices. The convergence of sensor technologies, AI processing, and wireless connectivity is further strengthening the ecosystem for near-eye displays. These advancements are allowing developers to bring lightweight, multifunctional devices to market for consumer, enterprise, and defense use.

Drivers, Trends/Opportunities

Expansion of the Global Gaming Industry: The rapid growth of the gaming sector worldwide is significantly boosting the adoption of near-eye display systems. According to the International Trade Administration, the global video game industry was valued at USD 184 billion in 2023, supported by a worldwide gaming population exceeding 3.2 billion players. AR/VR headsets equipped with advanced near-eye displays are enhancing player engagement by offering wider fields of view, faster refresh rates, and reduced motion latency. Developers are optimizing display modules to improve depth perception and minimize visual fatigue, aligning with the evolving expectations of professional and recreational gamers.

Rising Global Investment in Metaverse Infrastructure: Surge in investments by global technology companies, venture capital firms, and institutional stakeholders in metaverse platforms is boosting the growth of the market. For instance, in January 2025, Infinite Reality, a metaverse-focused startup secured USD 3 billion in funding, highlighting continued investor interest in immersive digital ecosystems. The expansion of virtual environments across retail, education, entertainment, and remote collaboration is fueling the demand for hardware that delivers continuous, high-resolution content. Near-eye displays enable spatial computing in immersive settings, where precision rendering and contextual data overlay are necessary. Manufacturers are developing compact and energy-efficient display solutions to support all-day wearable devices that meet the visual and ergonomic standards of the emerging metaverse ecosystem.

Segmental Insights

Brightness Level Analysis

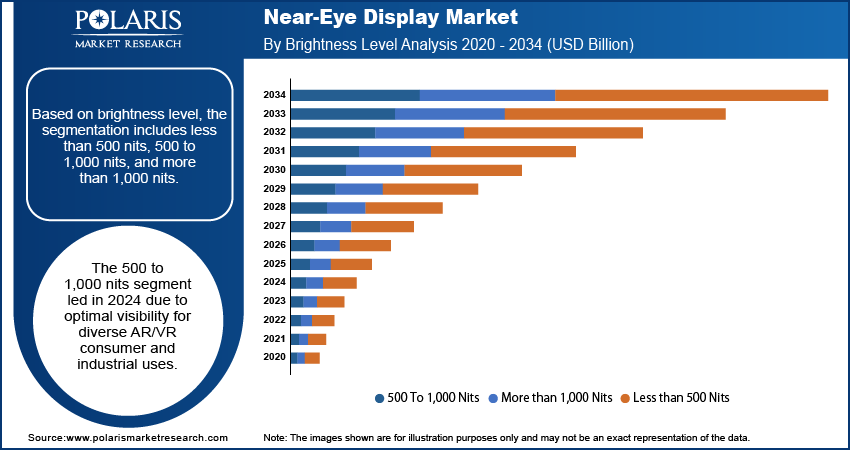

Based on brightness level, the segmentation includes less than 500 nits, 500 to 1,000 nits, and more than 1,000 nits. The 500 to 1,000 nits segment accounted for largest revenue share in 2024, due to the optimal visibility under varied ambient lighting, making them suitable for a broad range of AR and VR applications in consumer electronics and industrial environments. The balance between battery efficiency and display clarity at this brightness level is driving widespread adoption across mainstream headset models.

The more than 1,000 nits segment is projected to grow at the fastest pace through the forecast period. High-brightness displays are increasingly demanded for outdoor and industrial use cases where strong sunlight interferes with visual clarity. Advanced military and enterprise-grade AR systems are adopting high-nit displays to ensure uninterrupted visual performance in critical settings.

Component Analysis

By component, the market includes image generators, optical combiners and imaging optics. The image generators segment held the largest revenue share in 2024, owing to the real-time graphics rendering and enhancing visual fidelity in immersive environments. These components continue to evolve to support compact form factors and low-latency streaming for AR/VR applications.

The optical combiners segment is projected to witness the highest growth rate from 2025 to 2034. These elements are increasingly used in augmented reality devices to overlay digital content onto real-world views. Growing demand for transparent, lightweight, and high-contrast optics in AR headsets is boosting the development and integration of advanced combiners.

Technology Analysis

By technology, the market includes TFT LCD, AMOLED, LCOS, OLEDOS, MicroLED, and laser beam scanning. The OLEDOS segment held the largest revenue share in 2024, owing to its ability to deliver high contrast ratios, deep blacks, and superior color reproduction. Its compact size and efficiency make it well-suited for wearable applications in consumer and military-grade AR/VR systems.

The MicroLED segment is expected to grow at the fastest rate during the forecast period. The technology offers superior brightness, low power consumption, and extended lifespan, making it attractive for next-generation near-eye display development. Manufacturers are actively investing in MicroLED-based headsets for enhanced visual clarity and outdoor usability. For instance, in January 2025, RayNeo announced the X3 Pro AR headset, featuring the world’s smallest MicroLED-based optical display system. The X3 Pro also integrates advanced spatial computing capabilities, enabling more precise environmental interaction and real-time visual rendering in AR scenarios.

Device Type Analysis

By device type, the market includes augmented reality (AR), virtual reality (VR), and EVFS. The VR segment held the largest revenue share in 2024 due to the rising demand for virtual environments in gaming, simulation training, and enterprise collaboration. The segment continues to benefit from innovation in motion tracking and spatial audio systems, further supporting immersive display needs.

The AR segment is anticipated to register the fastest growth during the forecast period. The increasing use of AR technology in healthcare, field services, and retail navigation is boosting demand for AR devices with seamless integration of near-eye displays that enable real-time data visualization and interaction.

Industry Vertical Analysis

By industry vertical, the market includes automotive, industrial & enterprise, military, aerospace, & defense, retail & hospitality, medical, education, sports & entertainment, and others. The sports & entertainment segment dominated the market in 2024, driven by strong demand for gaming, entertainment, and smart wearable devices. Increasing use of near-eye displays in headsets, smart glasses, and immersive platforms is propelling the growth as consumers seek personalized and interactive experiences.

The military, aerospace, and defense segment is projected to grow at the fastest CAGR from 2025 to 2034. Demand for advanced head-mounted systems for situational awareness, target acquisition, and mission planning is contributing to sustained investment in near-eye display technology across defense procurement programs.

Regional Analysis

Asia Pacific near-eye display market is expected to witness fastest growth during the forecast period due to the rapid expansion of gaming ecosystems and digital commerce platforms. The growing population of tech-savvy users across mobile-first economies is driving demand for immersive retail interfaces and virtual gaming environments that utilize near-eye displays for interactive experiences. Additionally, government-led smart city initiatives and investments in high-speed 5G infrastructure are creating a favorable environment for AR applications that depend on seamless data transmission and real-time visualization. These factors are improving the operational capabilities of near-eye devices and accelerating broader integration in consumer and enterprise segments.

China Near-Eye Display Market Insight

China held significant market share in the Asia Pacific near-eye display landscape in 2024, due to the presence of a robust electronic manufacturing base. China continues to lead in the large-scale production of OLEDs, Micro-LEDs, and precision optical components used in near-eye systems. For instance, in the first five months of 2025, China’s electronic information manufacturing sector recorded strong growth, with value-added industrial output rising 11.1% year-on-year. According to the Ministry of Industry and Information Technology, major firms in the sector generated USD 907.1 billion in revenue, up 9.4%, while profits grew 11.9% to USD 30.2 billion. This concentration of production capabilities supports cost optimization and rapid technology deployment across consumer electronics and wearable devices, therefore fueling the market growth.

North America Near-Eye Display Market Outlook

The market in North America captured 39.6% share in 2024 due to the growing adoption of telemedicine and virtual healthcare applications. The increasing use of AR-enabled surgical and diagnostic tools in hospitals is fueling demand for precision-focused visual systems that enhance procedural accuracy and real-time data access. Additionally, the robust venture capital and startup ecosystem, with strong funding support for wearable tech and extended reality (XR) companies is further propelling the market growth. This dynamic environment is accelerating product development and commercialization, contributing to the sustained growth of near-eye display solutions across healthcare and enterprise sectors.

The US Near-Eye Display Market Overview

The market in the US is expanding due to the presence of a large number of video game users in the country. This strong gaming base is driving demand for immersive technologies such as augmented and virtual reality, where near-eye displays are crucial in delivering high-quality visual experiences. As per the International Trade Administration report, more than 190 million Americans engage in video gaming, with 78% of US households using at least one gaming device in 2022. Furthermore, major technology companies such as Meta, Apple, and Microsoft are investing heavily in the development of compact, high-resolution display modules tailored for gaming and interactive content. These firms are allocating substantial resources to R&D and commercialization, which is fueling the growth of the market.

Europe Near-Eye Display Market Trend

The near-eye display landscape in Europe is projected to hold a substantial share in 2034, driven by industrial digitalization and increasing adoption of the Industry 4.0 framework. Manufacturers across Germany, France, and the UK are implementing AR-based solutions for remote equipment inspection, assembly line support, and predictive maintenance. The region’s focus on digital transformation in sectors such as automotive manufacturing, aerospace, and industrial automation is boosting demand for hands-free, real-time visualization tools. Additionally, aging populations and the evolution of healthcare delivery systems are increasing the usage of AR devices in clinical settings for surgery, rehabilitation, and patient monitoring, contributing to steady growth across the healthcare sector in the region.

Key Players & Competitive Analysis Report

The near-eye display market is moderately consolidated, with competition focused on enhancing display resolution, reducing form factor, and improving power efficiency across a wide range of applications. Manufacturers are prioritizing the development of compact and lightweight display modules that support augmented reality (AR), virtual reality (VR), and mixed reality (MR) solutions for use in gaming, enterprise collaboration, defense, medical diagnostics, and smart wearables. The market is rapidly evolving as companies integrate advanced technologies such as OLED-on-silicon, MicroLED, and waveguide optics to meet growing demand for high-brightness, low-latency, and immersive visual experiences. Strategic R&D collaborations with semiconductor firms, optical component manufacturers, and platform developers are accelerating innovation cycles. Furthermore, companies are expanding their presence across Asia Pacific, North America, and Europe by partnering with AR/VR device makers and securing supply contracts with leading tech firms.

Prominent players in the near-eye display market include BOE Technology Group Co., Ltd., eMagin Corporation, Himax Technologies, Inc., HOLOEYE Photonics AG, Kopin Corporation, LG Display Co., Ltd., Lightning Silicon Technology, Inc., MICROOLED Technologies, OMNIVISION Technologies, Inc., SeeYA Technology Co., Ltd., Seiko Epson Corporation, Sony Group Corporation, Syndiant Inc., WiseChip Semiconductor Inc., and Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

Key Players

- BOE Technology Group Co., Ltd.

- eMagin Corporation

- Himax Technologies, Inc.

- HOLOEYE Photonics AG

- Kopin Corporation

- LG Display Co., Ltd.

- Lightning Silicon Technology, Inc.

- MICROOLED Technologies

- OMNIVISION Technologies, Inc.

- SeeYA Technology Co., Ltd.

- Seiko Epson Corporation

- Sony Group Corporation

- Syndiant Inc.

- WiseChip Semiconductor Inc.

- Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

Industry Developments

- September 2024: Sony Semiconductor Solutions Corporation introduced the ECX350F, a 0.44-type Full HD OLED microdisplay featuring ultra-fine 5.1 µm pixels and a peak brightness of up to 10,000 cd/m². Designed for augmented reality (AR) glasses, the display integrates a newly developed OLED structure and microlens array to achieve enhanced brightness and further miniaturization.

- May 2023: eMagin Corporation launched an upgraded WUXGA (1920x1200) OLED-on-silicon microdisplay delivering 15,000 cd/m² full-color brightness using its proprietary direct patterning display (dPd) technology. The new display surpasses its 2021 model and supports a wide range of applications, including consumer electronics, industrial tools, medical visualization, and military-grade AR systems.

Near-Eye Display Market Segmentation

By Brightness Level Outlook (Revenue, USD Billion, 2020–2034)

- Less than 500 Nits

- 500 To 1,000 Nits

- More than 1,000 Nits

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Image Generators

- Optical Combiners

- Imaging Optics

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- TFT LCD

- Amoled

- LCOS

- OLEDOS

- MicroLED

- Laser Beam Scanning

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- AR

- VR

- EVFS (Electronic Viewfinder Systems)

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial & Enterprise

- Military, Aerospace, & Defense

- Retail & Hospitality

- Medical

- Education

- Sports & Entertainment

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Near-Eye Display Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.76 Billion |

|

Market Size in 2025 |

USD 3.39 Billion |

|

Revenue Forecast by 2034 |

USD 22.14 Billion |

|

CAGR |

23.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.76 billion in 2024 and is projected to grow to USD 22.14 billion by 2034.

The global market is projected to register a CAGR of 23.2% during the forecast period.

North America dominated the market with 39.6% share in 2024.

A few of the key players in the market are BOE Technology Group Co., Ltd., eMagin Corporation, Himax Technologies, Inc., HOLOEYE Photonics AG, Kopin Corporation, LG Display Co., Ltd., Lightning Silicon Technology, Inc., MICROOLED Technologies, OMNIVISION Technologies, Inc., SeeYA Technology Co., Ltd., Seiko Epson Corporation, Sony Group Corporation, Syndiant Inc., WiseChip Semiconductor Inc., and Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

The 500 to 1,000 nits segment dominated the market in 2024. This is due to the optimal visibility under varied ambient lighting.

The optical combiners segment is expected to witness the fastest growth during the forecast period. This is attributed to the growing demand for transparent, lightweight, and high-contrast optics in AR headsets.