Peptide Therapeutics Market Size, Share, Trends, & Industry Analysis Report

By Type (Generic and Innovative), By Type of Manufacturers, By Route of Administration, By Synthesis Technology, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6027

- Base Year: 2024

- Historical Data: 2020-2023

Overview

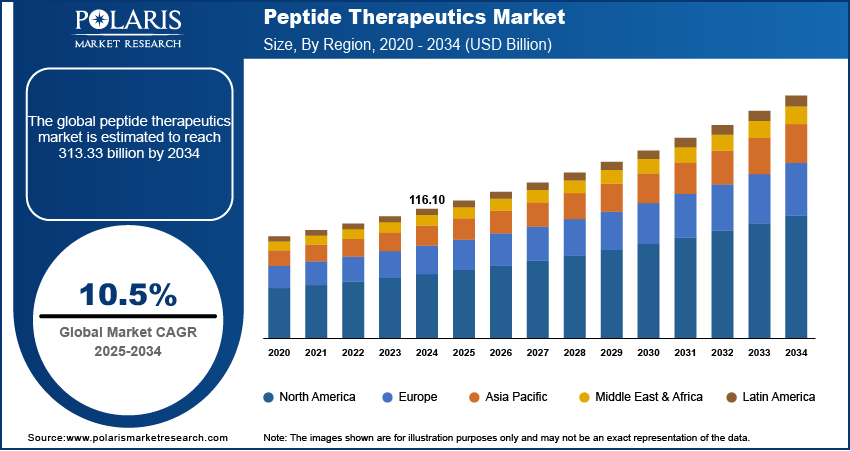

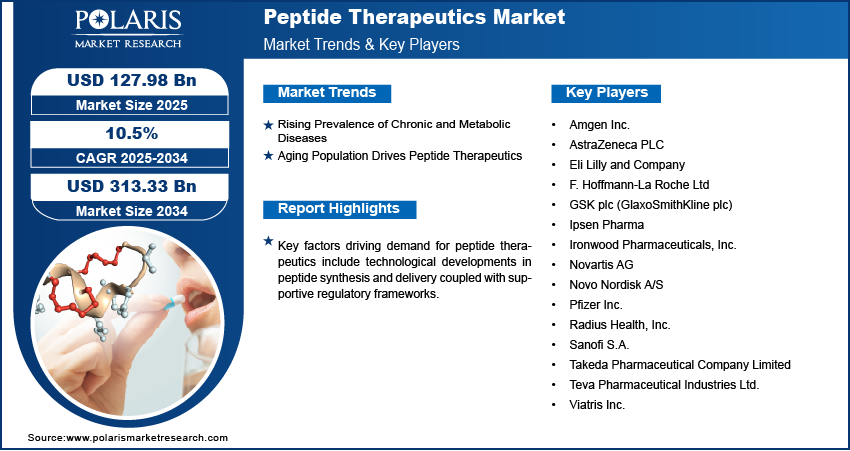

The global peptide therapeutics market size was valued at USD 116.10 billion in 2024, growing at a CAGR of 10.5% from 2025–2034. Rising prevalence of chronic and metabolic diseases coupled with rapid aging population is propelling the demand for peptide therapeutics worldwide.

Key Insights

- The innovative peptide therapeutics segment accounted for largest market share in 2024.

- The oral route segment is projected to grow at the fastest rate over the forecast period, due to advancements in formulation technologies, enabling the development of peptides that remain stable in the gastrointestinal tract.

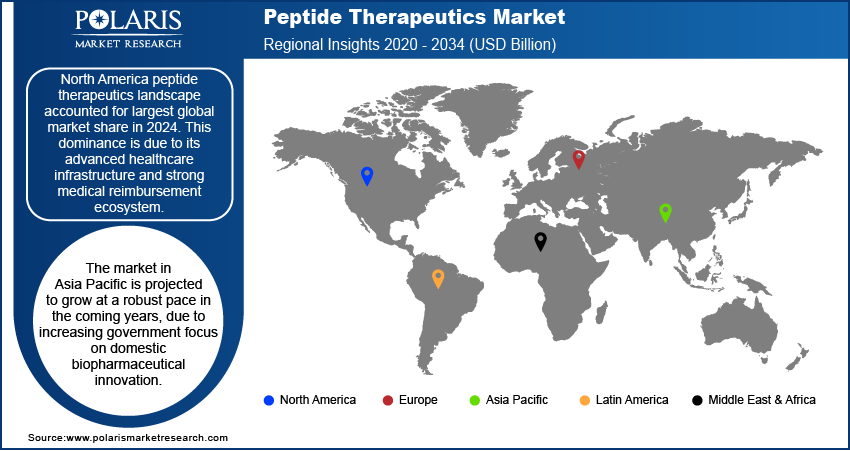

- The North America peptide therapeutics market accounted for largest of the global market share in 2024.

- The US peptide therapeutics market held largest regional share of the North America landscape in 2024, driven by the rising burden of chronic diseases, including cancer, diabetes, and cardiovascular conditions.

- The market in Asia Pacific is projected to grow with fastest CAGR from 2025-2034, due to increasing government focus on domestic biopharmaceutical innovation.

- The market in the China is expanding due to the rising geriatric population, increasing the demand for targeted treatments to manage age-related conditions such as osteoporosis, cardiovascular disorders and neurodegenerative diseases.

Industry Dynamics

- Rising prevalence of chronic and metabolic diseases is propelling demand for peptide therapeutics, as healthcare systems are adopting targeted, low-toxicity treatments for conditions such as diabetes, cancer and cardiovascular disorders.

- Rapid global aging populations are contributing to expanded usage of peptide-based therapies for managing age-related conditions such as osteoporosis, hormonal deficiencies and neurodegenerative diseases.

- High manufacturing costs associated with peptide synthesis, purification and formulation are restraining the market growth, for small to mid-sized pharmaceutical companies looking to scale operations in competitive markets.

- Peptide–drug conjugates (PDCs) are emerging as a transformative opportunity for the market, offering enhanced targeting capabilities and reduced side effects by combining therapeutic peptides with cytotoxic or imaging agents.

Market Statistics

- 2024 Market Size: USD 116.10 billion

- 2034 Projected Market Size: USD 313.33 billion

- CAGR (2025-2034): 10.5%

- North America: Largest market in 2024

Peptides are synthetic or naturally occurring short chains of amino acids that mimic biological functions or block pathological pathways. The ability to modulate difficult targets and maintain low immunogenicity makes it suitable for addressing complex diseases. Growing awareness of personalized medicine and rise in biologics alternatives are helping establish peptides as viable therapeutic options across a broad range of indications in oncology and rare diseases.

Technological developments in peptide synthesis and delivery are accelerating market growth. Innovations such as solid-phase peptide synthesis, PEGylation, nanoparticle formulations and long-acting injectables are enhancing stability, solubility and bioavailability. For example, in September 2024, Cambrex (via Snapdragon Chemistry) launched a new Liquid‑Phase Peptide Synthesis (LPPS) technology using traditional API batch reactors and continuous flow, reducing solvent usage and eliminating reliance on specialized solid-phase reactors. These advancements are expanding the therapeutic potential of peptides while improving patient compliance through reduced dosing frequency and simplified administration methods.

Moreover, supportive regulatory frameworks are contributing to the expansion of the peptide therapeutics market. Health authorities such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) implemented fast-track pathways and streamlined review processes for peptide-based drugs, targeting high-burden or underserved conditions. These regulatory efficiencies are enabling quicker market entry and pharmaceutical companies to prioritize peptide innovation in drug development strategies.

Drivers/Trends, Opportunity

Rising Prevalence of Chronic and Metabolic Diseases

The increasing burden of chronic diseases worldwide is significantly propelling the growth of the peptide therapeutics market. Conditions such as cancer, diabetes, and cardiovascular disorders require long-term and targeted therapeutic approaches, which are addressed effectively by peptide-based drugs. According to the World Health Organization (WHO), chronic illnesses including cardiovascular diseases, cancer, diabetes, and respiratory conditions are projected to be responsible for 86% of the estimated 90 million annual deaths by 2050. These treatments offer high receptor selectivity and reduced off-target effects, making it suitable for managing complex disease pathways. Growing focus on reducing treatment-related complications and improving clinical outcomes is boosting the demand for precision therapies such as peptides in chronic disease management.

Rapid Aging Population Drives Peptide Therapeutics

The growing global geriatric population is further influencing market growth, as older adults are more prone to age-related conditions such as osteoporosis, neurodegenerative disorders and hormonal imbalances. According to the World Health Organization, one in six people globally will be aged 60 or older by 2030. The population in this age group is expected to double, reaching 2.1 billion people worldwide, by 2050. As a result, peptide therapeutics are utilized in these areas due to favorable safety profiles and ability to interact with biological targets associated with aging. The growth is resulting in increasing use of peptide-based drugs across hospital and outpatient settings, contributing to higher prescription volumes and product development activity.

Segmental Insights

Type Analysis

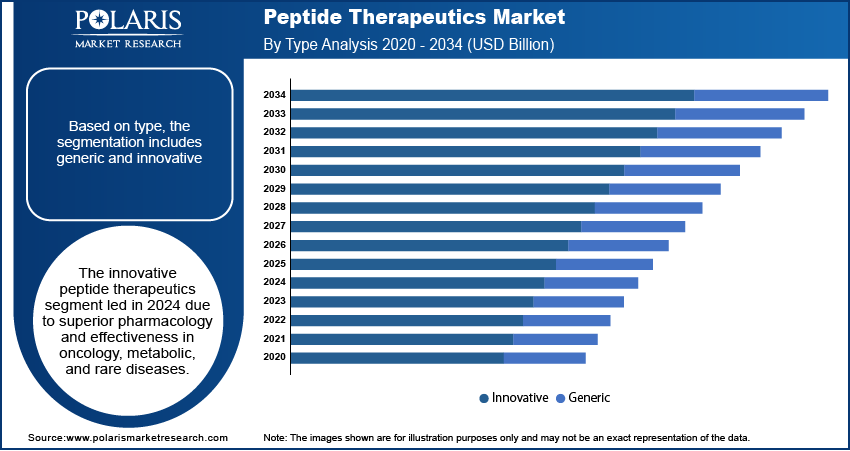

Based on type, the segmentation includes generic and innovative. The innovative peptide therapeutics segment accounted for largest revenue share in 2024, due to the its enhanced pharmacological profiles and ability to address unmet medical needs in oncology, metabolic disorders, and rare diseases. Major pharmaceutical companies are prioritizing novel peptide drugs in their pipelines, supported by strong regulatory incentives and patent protection strategies.

The generic segment is expected to grow at the fastest pace over the forecast period. Patent expiries of key branded peptides are allowing the entry of cost-effective alternatives into the market. The rising demand for affordable treatment options in emerging economies such as China, India, Mexico and Indonesia is pushing manufacturers to develop biosimilar and generic peptide therapeutics to expand accessibility.

Type of Manufacturer Analysis

By type of manufacturer, the market includes in-house and outsourced. The in-house manufacturing segment held the largest revenue share in 2024, due to the strategic preference of large pharmaceutical companies to maintain comprehensive control over drug production. This approach allows firms to safeguard proprietary technologies, ensure stringent quality assurance, and manage supply chain efficiency. In-house capabilities are vital for the development of complex peptide drugs that require advanced synthesis techniques and regulatory compliance, which are more reliably managed within internal facilities.

The outsourced manufacturing segment is projected to witness the highest growth rate during the forecast period. Smaller biotech firms and specialty developers are increasingly relying on contract development and manufacturing organizations (CDMOs) to reduce overheads and expedite production timelines. CDMOs with expertise in solid-phase and hybrid synthesis technologies are witnessing growing demand for scalable and flexible peptide production.

Route of Administration Analysis

By route of administration, the market includes parenteral route, oral route, pulmonary, mucosal, and others. The parenteral route segment held the largest revenue share in 2024, owing to its dominance in delivering peptides for cancer, diabetes, and cardiovascular disorders. Intravenous and subcutaneous formulations are widely used due to their ability to achieve precise bioavailability and rapid therapeutic action.

The oral route is expected to grow at the fastest CAGR through 2030, due to advancements in formulation technologies, enabling the development of peptides that remain stable in the gastrointestinal tract. The increasing preference for convenient, non-invasive treatment options among patients is propelling pharmaceutical innovation in oral peptide delivery systems.

Synthesis Technology Analysis

By synthesis technology, the market includes solid phase peptide synthesis (SPPS), recombinant DNA technology, hybrid technology, liquid-phase peptide synthesis (LPPS), and others. The solid-phase peptide synthesis (SPPS) segment held the largest revenue share in 2024, owing to the widespread use in clinical and commercial applications. SPPS enables rapid synthesis cycles, which suits large-scale pharmaceutical workflows.

The recombinant DNA technology segment is projected to grow at the fastest rate over the forecast period. This technology allows for scalable and sustainable production of longer or structurally complex peptides, with lower environmental impact. Increasing use in producing biosimilar peptides and hormone-based drugs is accelerating adoption among leading manufacturers.

Application Analysis

By application, the market includes cancer, metabolic disorders, cardiovascular disorders, respiratory disorders, gastrointestinal disorders, infectious diseases, pain, dermatological disorders, neurological disorders, renal disorders, and others. The cancer segment held the largest revenue share in 2024, due to the growing focus on targeted therapy and immunomodulation in oncology. Pharmaceutical companies are actively developing peptide receptor agonists and antagonists for several cancer types.

The metabolic disorders segment is expected to experience the fastest growth during the forecast period. Rising prevalence of conditions such as type 2 diabetes and obesity is boosting demand for peptide therapeutics that regulate insulin signaling, appetite suppression, and glucose metabolism. According to the International Diabetes Federation, approximately 589 million adults aged 20 to 79 are currently living with diabetes worldwide. This number is projected to increase to 853 million by 2050. Products such as GLP-1 receptor agonists are becoming crucial in treatment regimens in this category.

Regional Analysis

North America peptide therapeutics market accounted for 60.21% of the global market share in 2024. This dominance is attributed to its advanced healthcare infrastructure and strong medical reimbursement ecosystem. High access to specialty clinics and availability of high-end therapies are supporting widespread adoption of peptide-based drugs for chronic and complex conditions. In addition, the presence of favorable regulatory pathways is further contributing to the regional market growth. As an example, in June 2023, the US Food and Drug Administration (FDA) introduced expedited approval mechanisms such as Fast Track, Breakthrough Therap, and Orphan Drug designations for peptide drugs addressing unmet clinical needs. These programs are enabling faster clinical translation and commercialization of novel peptide therapies, thus fueling the market growth in this region.

The US Peptide Therapeutics Market Insight

The US held largest regional share in the North America peptide therapeutics landscape in 2024, driven by the rising burden of chronic diseases, including cancer, diabetes, and cardiovascular conditions. According to the latest report by the Centers for Disease Control and Prevention, approximately 129 million people in the US are living with at least one major chronic disease. Thus, healthcare providers are rapidly incorporating peptide drugs into standard treatment protocols for metabolic and oncological disorders, this in turn boost the market growth across the country.

Asia Pacific Peptide Therapeutics Market

The market in Asia Pacific is projected to grow with fastest CAGR from 2025-2034, due to increasing government focus on domestic biopharmaceutical innovation. For example, the national health policies in countries such as India, China, and South Korea are fueling the development of peptide-based drugs through R&D funding, technology transfer initiatives, and incentives for local manufacturers. Additionally, growing healthcare access across emerging economies is the boosting peptide therapeutic market. This includes countries in Southeast Asia and South Asia that are investing in hospital infrastructure, diagnostic capabilities and insurance expansion, which is enabling broader access to specialty drugs including peptide therapeutics in this region.

China Peptide Therapeutics Market Overview

The market in the China is expanding due to the rising geriatric population, increasing the demand for targeted treatments to manage age-related conditions such as osteoporosis, cardiovascular disorders, and neurodegenerative diseases. According to the World Health Organization, China is one of the most rapidly aging populations globally, with individuals aged over 60 expected to make up 28% of the country's total population by 2040. The rising prevalence of age-related conditions such as osteoporosis, neurodegenerative disorders, and diabetes is pushing healthcare providers to incorporate peptide therapies into treatment plans for improved disease management and patient outcomes.

Europe Peptide Therapeutics Market

The peptide therapeutics landscape in the Europe is projected to hold a substantial share in 2034, driven by strong collaboration between academic institutions and biotechnology firms. The research universities and public health agencies are working with pharmaceutical companies to advance peptide drug discovery in rare disease and oncology pipelines. For instance, in June 2025, Isogenica and Charles River collaborated to accelerate the discovery of synthetic peptides and VHH antibodies using Isogenica’s diverse CIS Display libraries paired with Charles River’s drug development infrastructure. This collaborative ecosystem is producing a steady stream of clinical candidates, supporting innovation across early-stage and late-stage development. Additionally, the regulatory environment in Europe remains favorable for peptide-based therapies. The European Medicines Agency (EMA) offer accelerated procedures and orphan drug incentives that streamline product approval and support market entry. These regulatory advantages along with Europe’s structured healthcare systems are pushing developers to pursue peptide innovations aimed at high-burden and underserved patient segments.

Key Players & Competitive Analysis Report

The peptide therapeutics market is moderately consolidated, with competition centered on innovation in synthesis technologies, therapeutic precision, and expanded indications across chronic and rare diseases. Manufacturers are advancing drug delivery routes such as oral, transdermal, and injectable options to improve patient adherence and therapeutic outcomes. Growing emphasis on sustainable manufacturing, cost efficiency, and scalable production methods is pushing companies to adopt hybrid and recombinant synthesis techniques. The rising collaborations with academic institutions, contract research organizations (CROs), and diagnostics firms are enabling faster clinical validation and regulatory approvals. In addition, companies are integrating AI-based modeling, bioinformatics, and molecular design platforms to accelerate peptide discovery and reduce time-to-market.

Prominent players in the peptide therapeutics market include Amgen Inc., AstraZeneca PLC, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc (GlaxoSmithKline plc), Ipsen Pharma, Ironwood Pharmaceuticals, Inc., Novartis AG, Novo Nordisk A/S, Pfizer Inc., Radius Health, Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., and Viatris Inc.

Key Players

- Amgen Inc.

- AstraZeneca PLC

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- GSK plc (GlaxoSmithKline plc)

- Ipsen Pharma

- Ironwood Pharmaceuticals, Inc.

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Radius Health, Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Industry Developments

- January 2025: Cytovance Biologics partnered with PolyPeptide for the surging global demand for peptide-based therapeutics. This collaboration aims to combine Cytovance’s advanced capabilities in microbial and mammalian expression systems, process development and cGMP biologics manufacturing with PolyPeptide’s long-standing expertise in complex peptide synthesis.

- March 2023: Ono Pharmaceutical Co., Ltd., collaborated with PeptiDream Inc. to co-develop novel macrocyclic constrained peptide candidates. These peptides are designed to target a broad range of disease areas with high unmet medical needs.

- October 2023: Biosynth acquired Pepceuticals Limited, a UK-based synthetic peptide manufacturer, as part of its strategy to strengthen and expand its peptide therapeutics business. This acquisition enhances Biosynth’s production capacity and technical capabilities in custom peptide synthesis and GMP-grade peptides, which are essential for preclinical and clinical drug development.

Peptide Therapeutics Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Generic

- Innovative

By Type of Manufacturers Outlook (Revenue, USD Billion, 2020–2034)

- In-house

- Outsourced

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Parenteral Route

- Oral Route

- Pulmonary

- Mucosal

- Others

By Synthesis Technology Outlook (Revenue, USD Billion, 2020–2034)

- Solid Phase Peptide Synthesis (SPPS)

- Recombinant DNA Technology

- Hybrid Technology

- Liquid-Phase Peptide Synthesis (LPPS)

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cancer

- Metabolic Disorders

- Cardiovascular Disorders

- Respiratory Disorders

- Gastrointestinal Disorders

- Infectious Diseases

- Pain

- Dermatological Disorders

- Neurological Disorders

- Renal Disorders

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Peptide Therapeutics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 116.10 Billion |

|

Market Size in 2025 |

USD 127.98 Billion |

|

Revenue Forecast by 2034 |

USD 313.33 Billion |

|

CAGR |

10.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 116.10 billion in 2024 and is projected to grow to USD 313.33 billion by 2034.

The global market is projected to register a CAGR of 10.5% during the forecast period.

North America dominated the market in 2024, holding 60.21% share.

A few of the key players in the market are Amgen Inc., AstraZeneca PLC, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GSK plc (GlaxoSmithKline plc), Ipsen Pharma, Ironwood Pharmaceuticals, Inc., Novartis AG, Novo Nordisk A/S, Pfizer Inc., Radius Health, Inc., Sanofi S.A., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., and Viatris Inc.

The innovative peptide therapeutics segment dominated the market in 2024 due to its enhanced pharmacological profiles and ability to address unmet medical needs in oncology, metabolic disorders, and rare diseases

The outsourced manufacturing segment is expected to witness the fastest growth during the forecast period.