Personalized Medicine Market Size, Share, Trend, Industry Analysis Report

By Product (Personalized Medicine Diagnostics, Personalized Medicine Therapeutics, Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5986

- Base Year: 2024

- Historical Data: 2020-2023

Overview

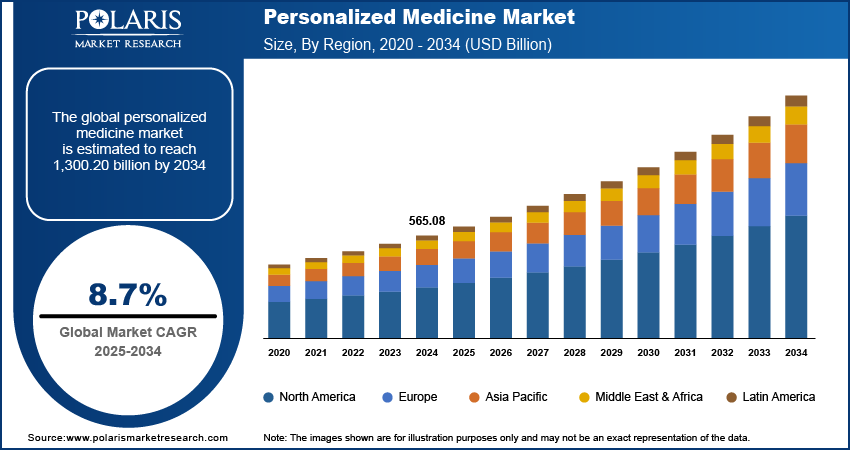

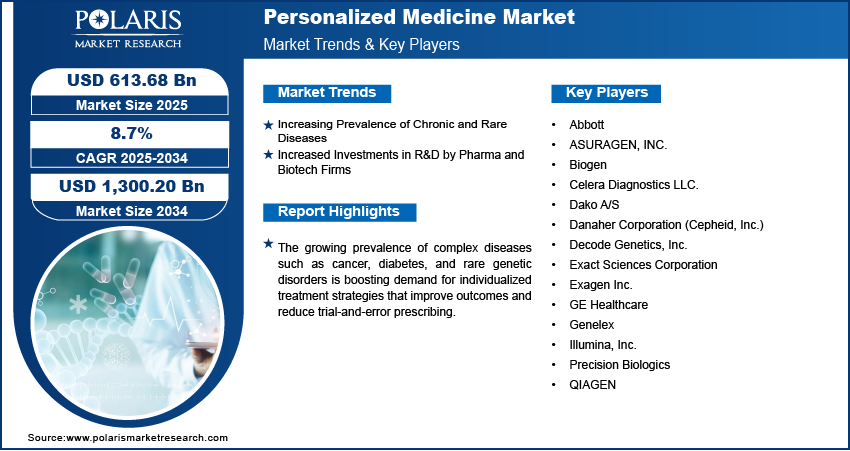

The global personalized medicine market size was valued at USD 565.08 billion in 2024, growing at a CAGR of 8.7% from 2025 to 2034. Growing prevalence of complex diseases such as cancer, diabetes, and rare genetic disorders is boosting demand for individualized treatment strategies that improve outcomes and reduce trial-and-error prescribing.

Key Insights

- The personalized nutrition & wellness segment accounted for ~33% of the revenue share in 2024.

- The hospitals segment accounted for the largest share in 2024.

- North America accounted for ~40% share of the global personalized medicine market in 2024.

- In 2024, the U.S. held the largest revenue share in North America.

- The market in Asia Pacific is expected to register a CAGR of 12.2% from 2025 to 2034.

- The personalized medicine landscape in Europe is growing at a rapid pace due to collaborative efforts between research institutions, healthcare providers, and biotech firms are enhancing access to individualized therapies.

The personalized medicine market encompasses diagnostic tools, therapies, and technologies tailored to an individual's genetic, environmental, and lifestyle factors. It aims to optimize treatment efficacy and minimize adverse effects by customizing medical care to the unique biological profile of each patient. This market spans genomics, pharmacogenomics, companion diagnostics, targeted therapies, and precision healthcare platforms, reflecting a shift from the traditional “one-size-fits-all” approach to a more patient-centric model. The declining costs of genome sequencing and improved accuracy of next-generation sequencing platforms are accelerating the identification of genetic markers, enabling the development of personalized diagnostics and targeted treatments.

To Understand More About this Research: Request a Free Sample Report

Various agencies such as the FDA and EMA are providing accelerated pathways and clearer guidelines for personalized therapies and companion diagnostics, encouraging innovation and market entry. Moreover, the use of artificial intelligence (AI) and machine learning (ML) for biomarker discovery, patient stratification, and predictive modeling enhances the precision and scalability of personalized healthcare solutions.

Industry Dynamics

- The growing burden of chronic and rare diseases is pushing healthcare systems toward more precise treatment approaches.

- Pharmaceutical and biotechnology companies are increasingly channeling resources into personalized medicine research.

- Advancements in genomics and biomarker research are enabling tailored therapies, driving growth in targeted treatments for cancer, rare diseases, and chronic conditions.

- High development and diagnostic costs, along with limited reimbursement policies, hinder widespread adoption of personalized medicine across key markets.

Increasing Prevalence of Chronic and Rare Diseases: The growing burden of chronic and rare diseases is pushing healthcare systems toward more precise treatment approaches. According to the National Institutes of Health, 7,000 rare diseases affect 25 to 30 million Americans, or about 1 in 10 individuals. Cancer, diabetes, cardiovascular conditions, and a wide range of orphan diseases often vary significantly in presentation and progression from one patient to another. This variability creates challenges in applying standard treatment protocols effectively. Personalized medicine addresses this issue by tailoring interventions based on an individual's genetic makeup, disease subtype, and other personal health data. The ability to predict disease progression and response to therapy enhances patient care and minimizes the risk of ineffective treatments. The rising cases of such complex health conditions accelerate the demand for patient-specific therapeutic solutions that improve clinical outcomes and reduce healthcare costs.

Increased Investments in R&D by Pharma and Biotech Firms: Pharmaceutical and biotechnology companies are increasingly channeling resources into personalized medicine research. There is a strategic shift toward developing targeted therapies that rely on biomarker identification and molecular profiling. This trend is visible in both oncology and non-oncology pipelines, where drugs are being designed for specific patient subgroups. Collaborative research efforts between pharma firms and genomics companies are helping accelerate discovery and development timelines. Investments are also being made in companion diagnostics and AI-driven data analysis tools. In 2023, the Pharmaceutical Research and Manufacturers Association (PhRMA) reported that U.S. biopharmaceutical firms invested around USD 96 billion in research and development, accounting for over 20% of total sales. These initiatives are expanding drug portfolios while addressing unmet medical needs. The growing R&D focus supports a broader shift toward precision-based treatment models in modern healthcare.

Segmental Insights

Product Analysis

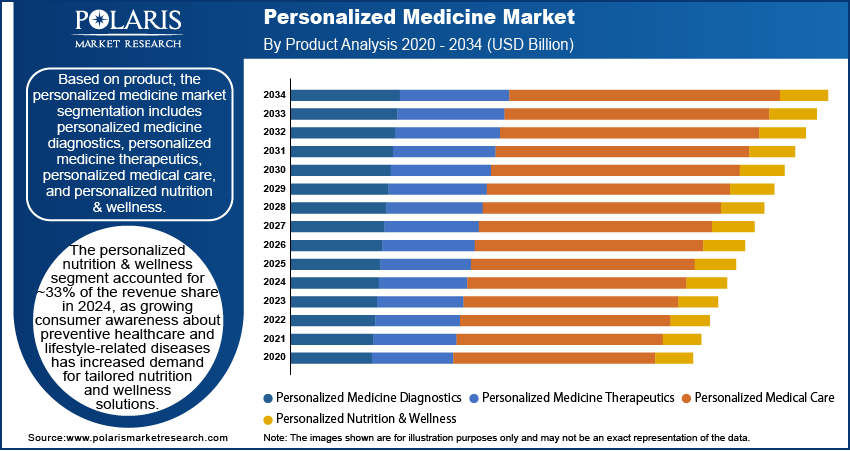

Based on product, the segmentation includes personalized medicine diagnostics, personalized medicine therapeutics, personalized medical care, and personalized nutrition & wellness. The personalized nutrition & wellness segment accounted for ~33% of the revenue share in 2024 as growing consumer awareness about preventive healthcare and lifestyle-related diseases has increased the demand for tailored nutrition and wellness solutions. Access to at-home genetic testing kits and personalized diet plans tailored to individual DNA, gut microbiome, and metabolic profiles is expanding rapidly. Technology-driven wellness platforms are offering real-time health tracking, enabling users to make data-informed dietary and fitness decisions. Consumer willingness to invest in long-term health management, combined with the rise of functional foods and nutrigenomics, is supporting the segment’s leadership.

The personalized medicine therapeutics segment is expected to grow at a CAGR of 11.3% during the forecast period as increased deployment of biomarker-guided therapies and companion diagnostics enables more accurate drug targeting, particularly in oncology, neurology, and rare disease treatment. Pharmaceutical companies are expanding their personalized drug pipelines, focusing on genotype-phenotype correlations and targeted mechanisms of action. Clinicians are adopting individualized regimens to improve treatment efficacy and reduce adverse events. Greater acceptance of pharmacogenomics among physicians and payers is also supporting faster integration into clinical protocols. Expanding FDA approvals for genetically stratified therapies are fueling innovation in this segment, while value-based healthcare models continue to favor outcome-driven precision treatments.

End Use Analysis

In terms of end use, the segmentation includes hospitals, diagnostic centers, research & academic institutes, and others. The hospitals segment accounted for the largest share in 2024. Advanced infrastructure and broader access to molecular testing platforms make hospitals key centers for implementing precision medicine. Multidisciplinary teams within hospital systems are increasingly adopting genomic diagnostics and personalized treatment algorithms. Institutional partnerships with research entities and pharmaceutical companies enable rapid translation of discoveries into clinical use. Integrated electronic health records and centralized data systems also facilitate personalized care planning. Inpatient and outpatient facilities are using tailored therapies for chronic and complex conditions such as cancer and cardiovascular disease, reinforcing the role of hospitals in mainstreaming personalized medicine. Educational initiatives and training programs are helping hospital-based clinicians stay updated with emerging precision technologies.

The diagnostic centers segment is projected to witness the highest CAGR during the forecast period. Rapid advancements in genomics, proteomics, and metabolomics have enabled diagnostic centers to offer specialized and cost-efficient personalized testing services. High-throughput sequencing, liquid biopsy technologies, and non-invasive genetic screening tools are becoming more widely available. Increasing referrals from hospitals and primary care providers are strengthening the role of diagnostic labs in early detection and risk stratification. These centers are scaling their offerings to include multi-omics panels, enabling more comprehensive health insights. Growing demand for direct-to-consumer and wellness-oriented tests is also accelerating expansion. Strategic partnerships with biotech firms and integration of digital health platforms are further enhancing service delivery and market reach.

Regional Analysis

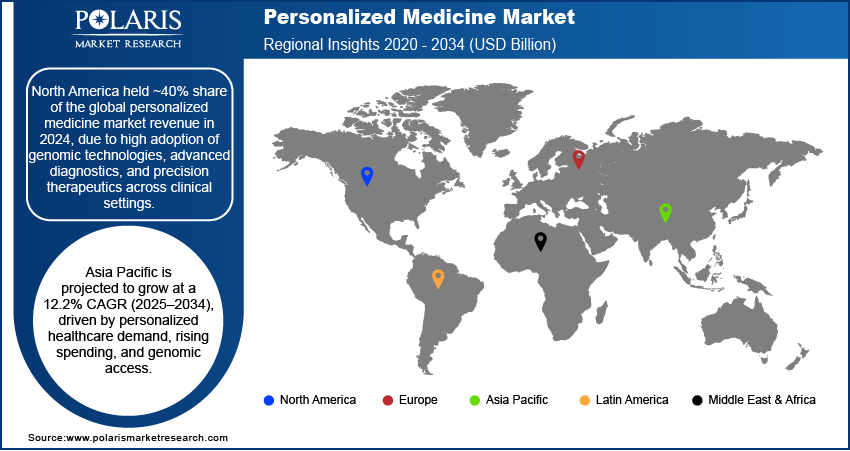

The North America personalized medicine market accounted for ~40% of the revenue share in 2024, due to high adoption of genomic technologies, advanced diagnostics, and precision therapeutics across clinical settings. The strong integration of pharmacogenomics into standard healthcare practices and the widespread availability of personalized treatment solutions accelerated regional industry growth. The rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, which demand tailored diagnostic and treatment solutions, is driving the market growth. According to the US Department of Health and Human Services, an estimated 129 million people in the U.S. have at least one major chronic disease, with 42% experiencing two or more conditions and 12% having five or more. Reimbursement frameworks supporting molecular testing and targeted therapies are well established. Leading research institutions and pharmaceutical companies based in the region are continuously advancing biomarker-based innovations. Regulatory bodies such as the FDA also facilitate a favorable environment for the development and approval of personalized treatments. This mature ecosystem, supported by infrastructure, funding, and a well-informed patient population, has firmly positioned North America at the forefront of the global personalized medicine market.

U.S. Personalized Medicine Market Insight

In 2024, the U.S. held the largest revenue share in North America. The healthcare system’s focus on innovation and precision treatment strategies has resulted in high uptake of genomic testing, personalized drugs, and companion diagnostics. Strong collaborations between academic institutions and biotech companies boost innovation. Substantial federal funding and private investments in personalized medicine research continue to fuel product development and commercialization.

Asia Pacific Personalized Medicine Market Trends

The Asia Pacific market is expected to register a CAGR of 12.2% from 2025 to 2034, due to surging demand for tailored healthcare in densely populated countries, rising healthcare spending, and growing access to genomic services. Emerging economies are investing in biotech infrastructure and precision health initiatives. Public-private partnerships and the digitization of healthcare are also contributing to rapid industry growth across the region.

China Personalized Medicine Market Overview

China accounted for the dominant share in Asia Pacific in 2024, due to aggressive investments in genomics and biotechnology, government-backed precision medicine initiatives, and a rising base of chronic disease patients. China's focus on domestic innovation, coupled with expanding diagnostic capabilities, is boosting the integration of personalized treatment strategies in clinical practice.

Europe Personalized Medicine Market Outlook

The market in Europe is growing at a rapid pace due to collaborative efforts between research institutions, healthcare providers, and biotech firms, which are enhancing access to personalized therapies. EU-backed programs are supporting precision medicine research, while regulatory pathways are being streamlined to facilitate the development of biomarker-driven drugs. Rising awareness among clinicians and patients is also accelerating adoption. In October 2023, the European Partnership for Personalized Medicine was launched to advance precision medicine research across the European Research Area. With 49 partners involved, the initiative aims to foster innovation, facilitate knowledge transfer, and integrate precision medicine into health systems for continuous improvement.

Key Players and Competitive Analysis

The competitive landscape of the personalized medicine market is shaped by an evolving mix of biotechnology, diagnostics, and healthcare service providers leveraging innovation and precision-based approaches. Industry analysis highlights a growing number of market participants executing strategic alliances and joint ventures to co-develop companion diagnostics and genotype-specific therapies. Mergers and acquisitions are central to portfolio diversification, particularly in genomics, AI-enabled analytics, and bioinformatics platforms. Post-merger integration is focused on consolidating clinical research infrastructure and accelerating regulatory approvals.

Technology advancements in next-generation sequencing, multi-omics data interpretation, and AI-powered decision-support tools are enabling firms to expand capabilities across the value chain. Companies are pursuing market expansion strategies by targeting specific therapeutic areas such as oncology, cardiology, and rare diseases, while enhancing access to point-of-care diagnostics and telehealth-integrated services. Strategic partnerships with academic institutions and regulatory bodies are facilitating clinical validation and reimbursement pathways. Competitive intensity is also rising through agile entrants offering personalized nutrition, digital therapeutics, and direct-to-consumer genetic testing.

Key Players

- Abbott

- ASURAGEN, INC.

- Biogen

- Celera Diagnostics LLC.

- Dako A/S

- Danaher Corporation (Cepheid, Inc.)

- Decode Genetics, Inc.

- Exact Sciences Corporation

- Exagen Inc.

- GE Healthcare

- Genelex

- Illumina, Inc.

- Precision Biologics

- QIAGEN

Industry Developments

June 2025: MGI Tech and GenePoweRx formed a co-marketing partnership aimed at advancing AI-driven genomic solutions within the realm of personalized medicine.

September 2023: Agilent Technologies partnered with ACTRIS to enhance the development and implementation of cell and gene therapies in Singapore. This collaboration aims to leverage Agilent's advanced analytical tools and ACTRIS's expertise in bioscience research to accelerate the translation of innovative therapies from the lab to clinical application.

Personalized Medicine Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Others

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Personalized Nutrition & Wellness

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Personalized Medicine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 565.08 billion |

|

Market Size in 2025 |

USD 613.68 billion |

|

Revenue Forecast by 2034 |

USD 1,300.20 billion |

|

CAGR |

8.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 565.08 billion in 2024 and is projected to grow to USD 1,300.20 billion by 2034.

The global market is projected to register a CAGR of 8.7% during the forecast period.

North America accounted for ~40% share of the global personalized medicine market revenue in 2024 due to high adoption of genomic technologies, advanced diagnostics, and precision therapeutics across clinical settings.

A few of the key players in the market are Abbott; ASURAGEN, INC.; Biogen; Celera Diagnostics LLC.; Dako A/S; Danaher Corporation (Cepheid, Inc.); Decode Genetics, Inc.; Exact Sciences Corporation; Exagen Inc.; GE Healthcare; Genelex; Illumina, Inc.; and Precision Biologics; QIAGEN.

The personalized nutrition & wellness segment accounted for ~33% of the revenue share in 2024 due to growing consumer awareness about preventive healthcare and lifestyle-related diseases.

The hospitals segment accounted for the largest share in 2024 as advanced infrastructure and broader access to molecular testing platforms make hospitals key centers for implementing precision medicine.