U.S. Foldable and Collapsible Container Market Size, Share, Trends, & Industry Analysis Report

By Material, By Product Type (Plastic, Metal, Paperboard), By Capacity, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM5976

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

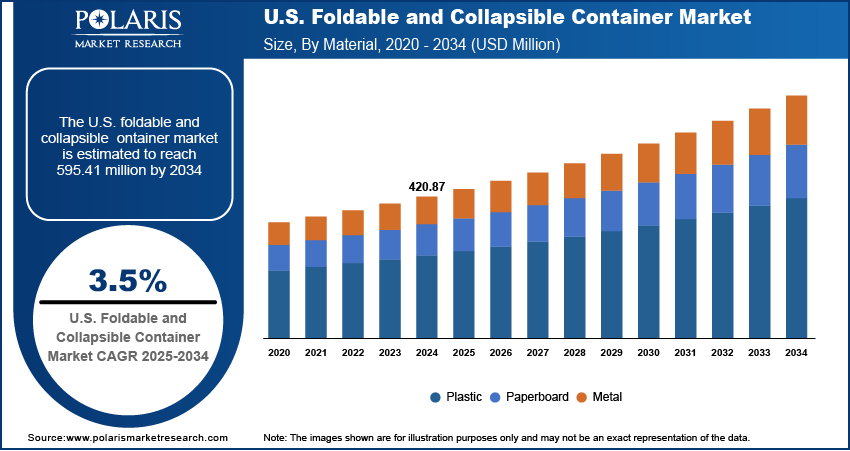

The U.S. foldable and collapsible container market size was valued at USD 420.87 million in 2024, growing at a CAGR of 3.5% during 2025–2034. Expansion of e-commerce and industrial sectors such as automotive and food processing is driving demand for foldable container across the US market.

Key Insights

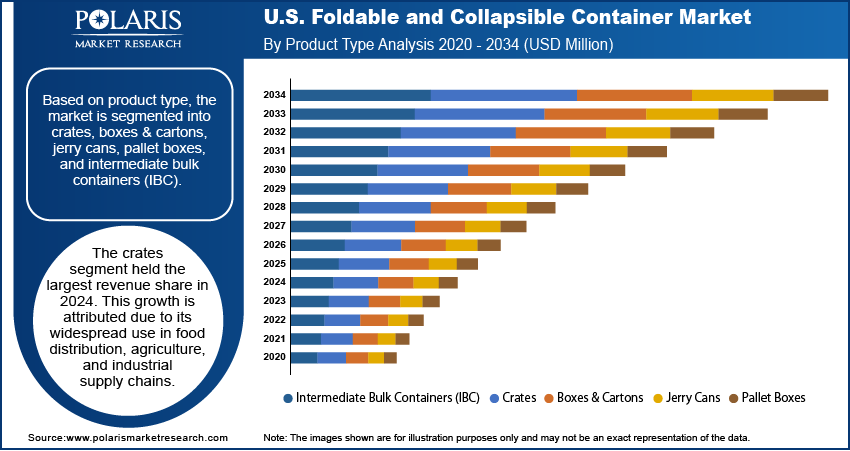

- The crates segment accounted for largest share of the market in 2024.

- The intermediate bulk containers (IBC) segment is projected to grow at the fastest rate over the forecast period, driven by increasing demand for safe and efficient bulk transport in US-based pharmaceutical, chemical, and food manufacturing sectors.

- The US market is expanding steadily, fueled by investments in cold chain infrastructure and rising preference for automation-compatible containers.

Foldable and collapsible containers are growing significant in the US, due to their reusable design that supports efficient transport and storage operations. These containers are engineered to minimize space consumption during return logistics and idle storage by enabling folding or collapsing when not in use. Their adoption is rising across sectors such as food and beverage processing, automotive parts logistics, retail supply chains and agricultural produce handling.

Additionally, the demand is fueled by operational needs for improved warehouse space efficiency, lower transport costs, and regulatory compliance on sustainability across the US. For instance, in August 2023, RPP Containers collaborated with ALPAL to introduce stackable, foldable intermediate bulk containers (IBCs) in the US, targeting durable and reusable container solutions across industrial applications.

The key performance attributes such as stackability, ergonomic handling, high load-bearing capacity, and long-term durability remain essential considerations for end-users for the adoption of these containers. There is a growing preference for recyclable, lightweight materials such as high-density polyethylene (HDPE), polypropylene (PP), and composite blends. Thus, this is driving the need for sustainable, durable, and cost-efficient packaging and transport solutions across industrial sectors. The US market is also witnessing an increase in smart container designs equipped with Radio-Frequency Identification RFID tags, tamper-evident features, and modular configurations to support automation and traceability in large-scale distribution operations. Additionally, rising pressure to reduce single-use packaging, combined with the need for scalable, compliant, and cost-effective logistics infrastructure, continues to boost market growth across major US industries. For example, in July 2024, the US government announced a new target to eliminate the use of single-use plastics in federal procurement for food service operations, events, and packaging by 2027, with a complete phase-out across all federal operations by 2035.

Industry Dynamics

- The growing e-commerce and omnichannel retail environment in the US is accelerating demand for reusable, automation-compatible containers across fulfillment centers and last-mile delivery networks.

- Expansion in US-based food processing and automotive production is boosting adoption of hygienic, stackable containers for efficient handling of perishable goods and industrial components.

- Increasing integration of RFID and IoT systems in the US logistics sector is enhancing the utility of foldable containers by enabling real-time tracking and inventory visibility.

- High upfront investment and ongoing maintenance costs continue to limit adoption among small and mid-sized enterprises in the US with constrained capital budgets.

E-commerce Expansion Driving Reusable Packaging Adoption: The rapid growth of e-commerce and omnichannel retail in the US is increasing the demand for reusable packaging systems compatible with automated warehouses and last-mile logistics. According to the U.S. Census Bureau, e-commerce sales reached USD 300.2 million in Q1 2025, rising by 6.1% from Q1 2024 and accounting for 16.2% of total retail sales. Fulfillment centers are deploying foldable containers that support stackability, RFID/barcode tracking, and integration with conveyor and robotic systems. These containers help minimize product damage, streamline handling, and reduce waste from single-use corrugated packaging.

Adoption of Foldable Containers in Food & Automotive Industries: The food and beverage and automotive sectors in the US continue to drive demand for durable, collapsible containers. In food distribution, reusable crates made from hygienic, food-grade materials support cold chain efficiency and regulatory compliance. Automotive OEMs and suppliers are using collapsible bins for transporting large components, enabling just-in-time (JIT) delivery and efficient use of warehouse space. According to the OICA, in 2020, US automotive production reached 8.82 million, rising to 10.61 million by the end of 2023. This represents an increase of approximately 20.3% over the three-year period. Reusability and material efficiency remain important factors for packaging procurement across these industries.

Segmental Insights

Material Analysis

Based on material, the segmentation includes plastic, metal, and paperboard. The plastic segment accounted for largest revenue share in 2024, due to their lightweight, durable, and reusable characteristics. High-density polyethylene (HDPE) and polypropylene (PP) are widely preferred in logistics, retail, and food handling applications for their strength, resistance to moisture, and cost-efficiency. Plastic containers offer superior design flexibility, enabling collapsible features, tamper resistance, and ergonomic handling. Moreover, established recycling infrastructure in the US supports the circular use of plastic containers, comply with sustainability targets across industries.

The paperboard segment is projected to grow at the fastest pace during the forecast period, driven by increasing focus on biodegradable, recyclable packaging alternatives. Regulatory pressure to reduce plastic waste and the growing adoption of paper-based solutions across non-hazardous goods handling in e-commerce and food packaging. Moreover, paperboard containers are lightweight, cost-effective, and compliant with short-term, low-load applications, making them suitable for retail distribution. The rising shift toward sustainable, disposable alternatives across US states with strict plastic bans is contributing to the growth of this segment.

Product Type Analysis

By product type, the market includes boxes & cartons, crates, jerry cans, pallet boxes, and intermediate bulk containers (IBCs). The crates segment held the largest revenue share in 2024, due to their widespread use in food, beverage, agriculture, and industrial distribution networks. These containers offer high load-bearing capacity, efficient stackability, and long service life under frequent reuse cycles. In the US, food-grade plastic crates are a standard in perishables logistics, meeting hygiene and regulatory requirements. The integration of collapsible sidewalls and nesting capabilities improves storage efficiency during return transit. Crates are equipped with barcodes and tracking tags to improve inventory accuracy. Their role in organized retail and temperature-sensitive supply chains continues to drive the segment dominance.

The intermediate bulk containers (IBCs) segment is anticipated to grow at the fastest rate, owing to rising adoption in chemicals, pharmaceuticals, and food processing sectors. IBCs offer high-volume handling capacity, structural durability, and compatibility with liquids and semi-solids. In the US, demand is increasing for reusable IBCs that reduce drum use and support closed-loop supply chains. Features such as foldability, stackability, and valve fittings enhance their suitability for bulk transport and storage. Regulatory emphasis on cleanable, non-contaminant packaging in chemical and pharmaceutical sectors further fuels IBC deployment for hazardous and temperature-sensitive materials.

Capacity Analysis

By capacity, the market includes 50 kg, 50–250 kg, and above 250 kg. The 50–250 kg segment held the largest revenue share in 2024, owing to its compatibility with a wide range of industrial and retail applications. Containers in this range provide an optimal balance between volume, portability and load capacity. They are widely used in food processing, retail distribution, and automotive parts handling. Collapsible formats in this category are driven due to their efficiency in warehouse stacking and reverse logistics. Manufacturers are offering modular designs with customizable dimensions to suit industry-specific workflows.

The above 250 kg segment is anticipated to grow at the fastest rate due to rising demand from the chemical, fertilizer, and heavy industrial sectors. These containers are used for transporting bulk materials including powders, liquids, and dense components. In the US, the shift toward reusable, heavy-duty containers to reduce costs and meet safety regulations is boosting adoption. Additionally, improved structural integrity, resistance to deformation, and secure locking mechanisms make these containers suitable for long-distance transport. Foldable large-format IBCs and pallet boxes are used in centralized warehousing and cross-border logistics operations.

End User Analysis

By end user, the market includes retail & e-commerce, food & beverage, pharmaceutical, automotive, chemical & fertilizer, building & construction, shipping & logistics, and other end users. The food & beverage segment held the largest revenue share in 2024, driven by strong demand for hygienic, reusable, and stackable containers across food processing and distribution operations. Collapsible crates and bins made from food-grade plastics are widely adopted to meet sanitation and handling standards. In the US, reusable container systems are integrated into cold chain logistics to maintain temperature control and reduce spoilage. The segment benefits from the expansion of grocery retail, foodservice, and meal kit delivery models, where space optimization and fast turnaround are essential. Regulatory focus on sustainable food packaging also fuels the segment growth.

The retail & e-commerce segment is anticipated to grow at the fastest rate, due to increasing reliance on temperature-controlled and contamination-resistant container systems. The growing pharmaceutical logistics shift toward more sustainable, validated cold chain packaging, is driving the adoption of reusable foldable containers that support thermal insulation and compliance with GMP and FDA guidelines. The US market is witnessing rapid innovation in smart containers equipped with IoT sensors for temperature and humidity monitoring. Moreover, growth in biopharmaceuticals and vaccine distribution along with heightened supply chain scrutiny is accelerating the transition from single-use to returnable container systems in this segment.

Key Players & Competitive Analysis Report

The US foldable and collapsible container industry is moderately consolidated, with competition centered around product innovation, material durability, automation compatibility, and sustainability compliance. Manufacturers are focusing on delivering reusable container systems that support warehouse automation, improve return logistics, and to meet with ESG standards. Key strategies include developing RFID-integrated products, expanding AS/RS-compatible product lines, and enhancing modularity for sector-specific requirements such as cold chain, retail, and industrial bulk handling.

Key companies in the US foldable and collapsible container industry include ORBIS Corporation, Monoflo International, Compact Container Systems (CCS), RPP Containers, Myers Industries, Inc, TranPak Inc., Loadhog Inc, Flex Container, Georg Utz Holding AG, Green Processing Company, and CHEP.

Key Players

- CHEP

- Compact Container Systems (CCS)

- Flex Container

- Georg Utz Holding AG

- Green Processing Company

- Loadhog Inc

- Monoflo International

- Myers Industries, Inc

- ORBIS Corporation

- RPP Containers

- TranPak Inc.

Industry Developments

October 2024: CCS introduced the world’s first five-in-one foldable container designed to optimize space, cut emissions, and reduce reverse logistics costs. This innovation integrates the functions of five standard containers into a single collapsible unit, enhancing efficiency across supply chains.

U.S. Foldable and Collapsible Container Market Segmentation

By Material Outlook (Revenue, USD Million, 2020–2034)

- Plastic

- Metal

- Paperboard

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Boxes & Cartons

- Crates

- Jerry Cans

- Pallet Boxes

- Intermediate Bulk Containers (IBC)

By Capacity Outlook (Revenue, USD Million, 2020–2034)

- Up to 50 kg

- 50–250 kg

- Above 250 kg

By End User Outlook (Revenue, USD Million, 2020–2034)

- Retail & E-commerce

- Food & Beverage

- Pharmaceutical

- Automotive

- Chemical & Fertilizer

- Building & Construction

- Shipping & Logistics

- Other End Users

US Foldable and Collapsible Container Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 420.87 Million |

|

Market Size in 2025 |

USD 435.41 Million |

|

Revenue Forecast by 2034 |

USD 595.41 Million |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to country and segmentation. |

FAQ's

The US market size was valued at USD 420.87 million in 2024 and is projected to grow to USD 595.41 million by 2034.

The US market is projected to register a CAGR of 3.5% during the forecast period.

A few of the key players in the market are ORBIS Corporation, Monoflo International, Compact Container Systems (CCS), RPP Containers, Myers Industries, Inc, TranPak Inc., Loadhog Inc, Flex Container, Georg Utz Holding AG, Green Processing Company, and CHEP.

The crates segment dominated the market share in 2024, due to high demand across food distribution, agriculture, and industrial logistics.

The retail & e-commerce segment is expected to witness the fastest growth during the forecast period, driven by expansion of fulfillment centers, last-mile delivery infrastructure and demand for reusable packaging.