Vitamin and Mineral Premixes Market Size, Share, Trends, & Industry Analysis Report

By Type, By Form (Dry and Liquid), By Application, By Functionality, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5977

- Base Year: 2024

- Historical Data: 2020-2023

Overview

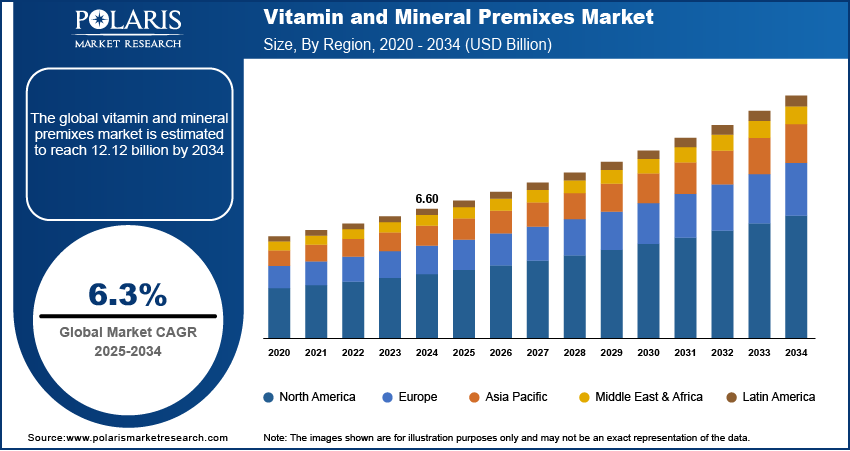

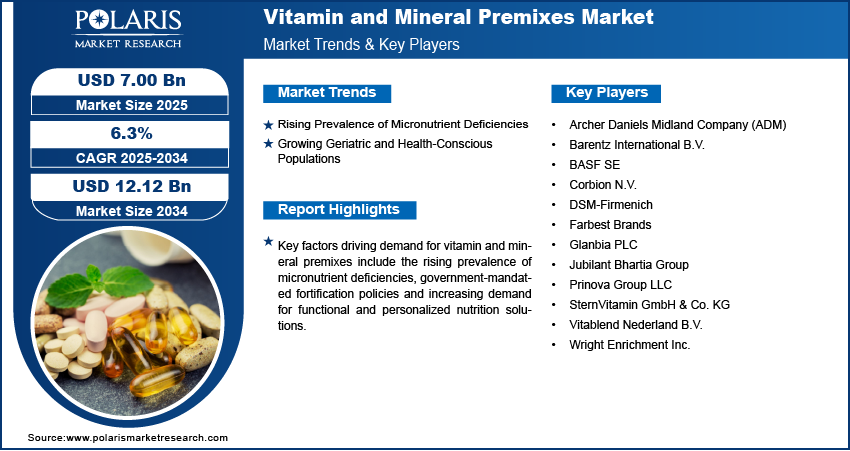

The global vitamin and mineral premixes market size was valued at USD 6.60 billion in 2024, growing at a CAGR of 6.3% from 2025–2034. The increasing micronutrient deficiencies along with growing geriatric and health-conscious populations are driving the demand for vitamin and mineral premixes products.

Key Insights

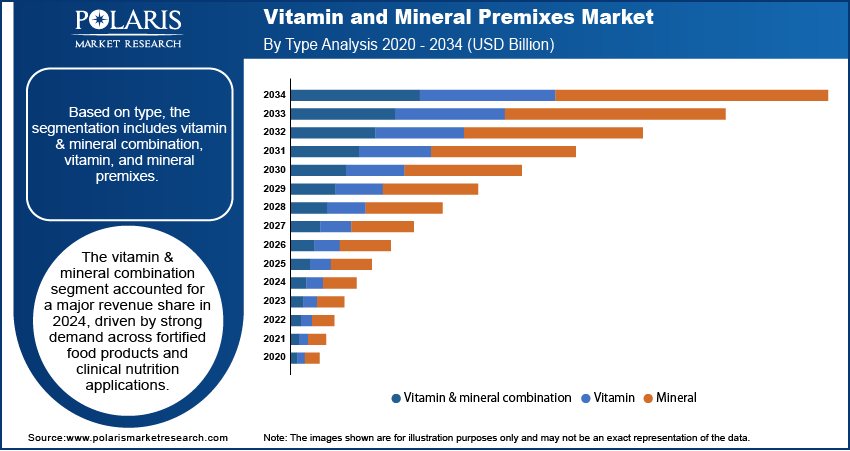

- The vitamin & mineral combination segment accounted for largest market share in 2024.

- The mineral premixes segment is projected to grow at the fastest rate over the forecast period, driven by rising awareness of deficiencies such as iron and calcium.

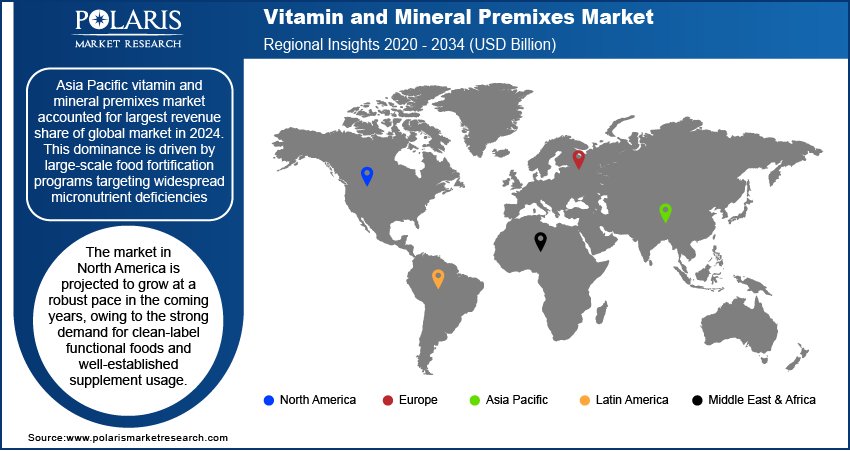

- The Asia Pacific vitamin and mineral premixes market accounted for majority of the global market share in 2024.

- The India vitamin and mineral premixes market held largest regional share of the Asia Pacific market in 2024, driven by national mandates for fortifying staples and expanding public distribution of fortified foods.

- The market in North America is projected to grow with a significant CAGR during the forecast period, owing to the high supplement consumption and advanced food processing infrastructure.

- The US market is expanding steadily, driven by growing demand for on-the-go wellness products and personalized nutritional formulations across consumer segments.

Vitamin and mineral premixes are custom nutrient blends designed to improve the nutritional profile and functional performance of food, beverages, pharmaceuticals and animal feed. These formulations integrate essential micronutrients, including vitamins A, D, E, and B-complex along with trace minerals such as iron, zinc, and selenium to address dietary deficiencies and support metabolic health. Premixes are widely incorporated across fortified food products, dietary supplements, infant nutrition, and animal feed applications to ensure nutritional consistency and product stability.

Growing global awareness of micronutrient deficiencies is contributing to the market expansion. These deficiencies are linked to immune dysfunction, developmental delays and increasing disease risk in vulnerable populations such as children and pregnant women. According to the World Health Organization (WHO), more than 700 women died each day from preventable pregnancy and childbirth-related causes in 2023. A maternal death happened nearly every 2 minutes, with over 90% of these deaths occurring in low- and lower-middle-income countries. This is rapidly increasing the need for fortified products using premix solutions to improve population health outcomes and meet regulatory standards for nutritional adequacy.

The growing demand for vitamin and mineral premixes is driven by the increasing industrial-scale production of functional and fortified food products. Food and beverage manufacturers are continuously seeking standardized, easy-to-integrate nutrient solutions to streamline formulation processes and ensure consistent product quality. Premixes offer convenience, reduced formulation error and improved batch uniformity, which are essential in high-volume production environments. Additionally, growing automation in food processing is boosting premix demand due to easier dosing and reduced handling steps. Moreover, the growth of contract manufacturing and private-label nutrition brands is driving demand for these products, due to its cost-efficiency, scalable production and customizable fortification options tailored to varying market needs. For instance, in March 2025, Kirin Kirin Group along with its subsidiary Blackmores launched their first co-developed immune health supplement in Taiwan. The product combines Blackmores’ nutritional expertise with Kirin’s LC-Plasma ingredient to support daily immune defense.

Industry Dynamics

- Rising prevalence of micronutrient deficiencies is driving demand for vitamin and mineral premixes to support metabolic and immune health.

- Rising geriatric and health-conscious populations are driving the market growth to enhance immunity, bone health, cognition and chronic disease management.

- Increasing demand for fortified cereals, dairy alternatives, sports nutrition and convenience foods is creating lucrative opportunity in the market.

- High costs associated with high-quality raw materials, precision blending and regulatory compliance are limiting affordability in cost-sensitive regions and applications.

Rising Prevalence of Micronutrient Deficiencies: Widespread deficiencies in essential vitamins and minerals such as iron, vitamin A, iodine, and zinc continue to impact large segments of the global population in low- and middle-income countries. According to latest report by Lancet, over 5 billion people lack enough iodine, vitamin E, and calcium in their diets globally. Additionally, more than 4 billion people do not get enough iron, riboflavin, folate, and vitamin C. This growing public health concern is driving demand for fortified food products and dietary supplements that incorporate standardized premix solutions to deliver targeted nutritional value. Governments and non-profit organizations are pushing fortification policies and public nutrition campaigns, further accelerating adoption of premixes across food, beverage and pharmaceutical industries.

Growing Geriatric and Health-Conscious Populations: Global demographic shifts are increasing the proportion of elderly individuals that require specialized nutrition to manage age-related health risks including osteoporosis, cardiovascular conditions and cognitive decline. According to the World Health Organization (WHO), one in six people globally will be aged 60 or older by 2030. The number will rise from 1 billion in 2020 to 1.4 billion, and is expected to reach 2.1 billion by 2050. Those aged 80 and above will triple to 426 million by 2050. At the same time, younger demographics are showing greater interest in preventive healthcare and wellness-based diets. These trends are contributing to rising consumption of functional foods and dietary supplements enriched with vitamin and mineral premixes. Customized premix formulations are enabling manufacturers to develop products that address age-specific and lifestyle-oriented health needs, such as bone strength, immunity support, and energy metabolism. This shift toward proactive health management is creating long-term demand for differentiated and high-quality premix solutions.

Segmental Insights

Type Analysis

Based on type, the segmentation includes vitamin & mineral combination, vitamin, and mineral premixes. The vitamin & mineral combination segment accounted for XY% revenue share in 2024, primarily due to its comprehensive nutrient delivery and wide applicability across food, beverage, healthcare, and animal feed industries. These blends allow manufacturers to simplify formulation processes, reduce ingredient complexity, and ensure nutrient synergy in fortified products. Combination premixes are commonly used in infant formula, sports nutrition, and clinical supplements, where balanced micronutrient intake is essential. Additionally, government-led fortification programs across multiple countries are accelerating the adoption of multi-nutrient blends to address widespread dietary deficiencies.

The mineral premixes segment is projected to grow at the fastest pace during the forecast period, owing to increasing awareness of iron, calcium, and zinc deficiencies. Rapid urbanization, changing dietary habits, and a rise in bone-related and immune disorders are increasing the need for mineral-enriched foods and supplements. In animal nutrition, mineral premixes are widely incorporated to improve fertility, immunity, and weight gain. Moreover, innovations in encapsulation technologies and plant-based mineral sourcing are strengthening demand among health-conscious and vegan consumers seeking bioavailable, clean-label mineral products.

Form Analysis

By form, the market is segmented into dry and liquid premixes. The dry premixes segment dominated the market in 2024 due to advantages in stability, storage, and handling. These blends are extensively used in powdered food mixes, baking, infant nutrition, and feed formulations. Their lower moisture content reduces microbial risks, offering longer shelf life and better ingredient preservation. Dry premixes also enable accurate dosing and compatibility with automated mixing processes, making them the preferred choice in high-volume industrial applications. Their cost-effectiveness and logistical convenience is driving the adoption of these products in large-scale food fortification and mass-market nutritional products.

The liquid premixes segment is expected to witness the fastest growth over the coming years. This trend is fueled by the growing popularity of ready-to-drink functional beverages, emulsified nutritional products, and pediatric formulations that require uniform micronutrient distribution. Liquid premixes offer enhanced solubility, ease of blending, and rapid absorption in oral formulations. Increased consumer demand for convenience and fast-acting wellness solutions is pushing manufacturers to adopt liquid premixes for use in functional drinks, dairy products, and pharmaceutical liquids. Technological advances in stabilization and shelf-life extension are further supporting commercial viability in this segment.

Application Analysis

By application, the market includes food & beverage, animal feed, healthcare, personal care & cosmetics, and other applications. The food & beverage segment held the largest revenue share in 2024, driven by increasing demand for fortified processed foods, plant-based products, and dietary supplements. Premixes are widely incorporated in breakfast cereals, dairy, snacks, and beverages to enhance nutritional value and meet consumer expectations for balanced diets. Government-backed fortification programs targeting staple foods, combined with evolving health trends are boosting the usage of premixes in this segment. Manufacturers continue to adopt tailored blends that improve health claims and market differentiation.

The healthcare segment is anticipated to grow at the fastest rate due to the rising demand for clinical nutrition and therapeutic supplements addressing chronic diseases and nutrient absorption disorders. Premixes are used in enteral nutrition, medical foods, and pharmacy-grade dietary supplements to deliver precise and regulated doses of essential micronutrients. Rising incidence of lifestyle-related disorders, coupled with growing interest in preventive and restorative health practices, is supporting growth in this segment. Healthcare providers are also adopting condition-specific formulations for immunity, bone density, and post-operative recovery, enhancing the value of premixes in therapeutic settings.

Functionality Analysis

Based on functionality, the market is segmented into bone health, skin health, energy, immunity, digestion, and other functionalities. The immunity segment led the market in 2024, fueled by heightened awareness of immune health and increasing demand for preventive wellness products. The global COVID-19 pandemic significantly elevated the importance of vitamins C, D, and zinc in supporting immune function. In September 2024, Airborne introduced a new immune support formula featuring zinc, vitamin D, and elderberry extract. The product aims to offer daily immune health benefits in a convenient, naturally flavored gummy format. As a result, immunity-boosting premixes are incorporated into a wide range of products including beverages, capsules, gummies, and sachets. Growing retail availability of immune-enhancing supplements and functional foods is driving consistent demand from general and vulnerable populations.

The bone health segment is expected to register the highest growth rate during the forecast period, due to rising cases of osteoporosis and calcium deficiency among older adults. Increasing focus on mobility and musculoskeletal strength is accelerating the use of premixes containing calcium, vitamin D, magnesium, and vitamin K in functional foods and supplements. The segment is witnessing expanding applications in dairy products, protein shakes, and clinical nutrition for orthopedic recovery and post-menopausal support. Advancements in formulation science are improving the bioavailability of these nutrients, making bone health premixes more effective and commercially attractive.

Regional Analysis

Asia Pacific vitamin and mineral premixes market accounted for largest revenue share of global market in 2024. This dominance is driven by large-scale food fortification programs targeting widespread micronutrient deficiencies. Therefore, many countries such as India, China, and Indonesia are implementing mandatory fortification of staples including rice, flour, and edible oils to address hidden hunger in vulnerable populations. These initiatives by national governments and international health agencies are increasing demand for standardized premix formulations across public and private sector food chains. The region’s continued investment in nutrition-focused public health policies is driving market adoption across food and supplement industries.

India Vitamin and Mineral Premixes Market Insight

India held largest market share in Asia Pacific vitamin and mineral premixes landscape in 2024, due to national food fortification programs and a strong policy focus on nutritional security. Government initiatives mandating the fortification of staples such as rice, wheat flour, and edible oil are increasing the demand for standardized premix solutions across public distribution systems. As an example, in September 2023, Fermenta Biotech inaugurated its new premix manufacturing facility in Daman to expand its offerings in micronutrient premixes. The plant aims to support food fortification and improve nutritional access across various sectors. These efforts are accelerating adoption across food manufacturing and public health nutrition segments.

North America Vitamin and Mineral Premixes Market

The market in North America is projected to grow at a significant CAGR from 2025-2034, driven by widespread supplement consumption and strong consumer preference for functional and fortified food products. High adoption of dietary supplements across the region is driving manufacturers to incorporate customized premixes targeting energy, immunity and bone health. This demand is fueled by the well-established retail and healthcare infrastructure that facilitates access to a wide range of nutrition-focused products. According to the Council for Responsible Nutrition (CRN), over 75% of adults in the US used dietary supplements in 2023, supporting strong uptake of premix formulations.

US Vitamin and Mineral Premixes Market Overview

The market in US is expanding due to the rising demand for on-the-go wellness products and personalized formulations. For instance, in October 2024, Immunotec launched SunRay, a once-weekly vitamin D supplement designed to support immune, bone, and muscle health. This product uses a proprietary formulation for improved absorption and sustained release, aiming to simplify dosing and enhance compliance. Consumers are rapidly looking for convenient solutions that support their daily health needs, thus driving the use of customized premixes in supplements and meal replacements. This trend is fueled by a strong supplement industry and well-established retail networks across the country. Additionally, innovation in organic and vegan-friendly blends is contributing to market growth, meeting the demand for clean-label and plant-based nutrition across mainstream and niche health segments.

Middle East & Africa Vitamin and Mineral Premixes Market

The vitamin and mineral premixes landscape in Middle East & Africa is projected to hold a substantial share in 2034, driven by large-scale government led food fortification programs aimed at resolving widespread micronutrient deficiencies in the countries such as Nigeria and Saudi Arabia. These countries introduced mandatory fortification policies for staples including wheat flour and edible oil to improve nutritional intake among vulnerable populations. Thus, driving the demand for standardized premix solutions across food manufacturing sectors. Moreover, the region’s focus on enhancing food security through nutrient-enriched products is fueling consistent adoption of vitamin and mineral premixes across domestic and institutional supply chains.

Key Players & Competitive Analysis Report

The vitamin and mineral premixes market is moderately consolidated, with global and regional players such as DSM-Firmenich, Glanbia PLC, BASF SE, SternVitamin GmbH & Co. KG, Archer Daniels Midland Company (ADM) competing on formulation precision, clean-label innovation and regulatory compliance. Companies are focusing on customized blends targeting health functions such as immunity, bone health and energy, while expanding through partnerships, acquisitions and localized production in high-growth regions. Emphasis on sustainability, traceability and third-party certifications is increasing in markets with strict nutritional standards. Regional manufacturers are fueled by offering cost-effective solutions, faster turnaround, and tailored R&D support.

Major companies operating in the vitamin and mineral premixes industry include DSM-Firmenich, Glanbia PLC, BASF SE, Archer Daniels Midland Company (ADM), Barentz International B.V., Jubilant Bhartia Group, Vitablend Nederland B.V., Prinova Group LLC, Farbest Brands, Wright Enrichment Inc., SternVitamin GmbH & Co. KG, and Corbion N.V.

Key Players

- Archer Daniels Midland Company (ADM)

- Barentz International B.V.

- BASF SE

- Corbion N.V.

- DSM-Firmenich

- Farbest Brands

- Glanbia PLC

- Jubilant Bhartia Group

- Prinova Group LLC

- SternVitamin GmbH & Co. KG

- Vitablend Nederland B.V.

- Wright Enrichment Inc.

Industry Developments

- May 2025: Pharmavite inaugurated a new USD 250 million production facility in New Albany, Ohio, US. This site marks the company’s first investment in the Midwest and is expected to significantly expand its manufacturing capacity to meet growing demand for high-quality vitamins and supplements across the US.

- March 2025: Louis Dreyfus Company (LDC) launched a new line of plant-based vitamin E products at Food Ingredients China 2025. This marks LDC’s entry into the health and nutrition market, supporting its strategy to diversify beyond traditional agri-commodities and meet rising demand for natural, sustainable ingredients.

- October 2024: DSM-Firmenich launched a new dry Vitamin A form specifically designed for early life nutrition. This innovation offers improved stability, easier processing and better shelf life, helping manufacturers develop safer and more effective nutritional products for infants and young children.

Vitamin and Mineral Premixes Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Vitamin & mineral combination

- Vitamin

- Mineral

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Dry

- Liquid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food & Beverage

- Bakery Products

- Beverages

- Dairy Products

- Cereals

- Other Food Applications

- Animal Feed

- Healthcare

- Nutritional Products

- Dietary Supplements

- Personal Care & Cosmetics

- Other Applications

By Functionality Outlook (Revenue, USD Billion, 2020–2034)

- Bone health

- Skin health

- Energy

- Immunity

- Digestion

- Other Functionalities

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vitamin and Mineral Premixes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.60 Billion |

|

Market Size in 2025 |

USD 7.00 Billion |

|

Revenue Forecast by 2034 |

USD 12.12 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.60 billion in 2024 and is projected to grow to USD 12.12 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are DSM-Firmenich, Glanbia PLC, BASF SE, Archer Daniels Midland Company (ADM), Barentz International B.V., Jubilant Bhartia Group, Vitablend Nederland B.V., Prinova Group LLC, Farbest Brands, Wright Enrichment Inc., SternVitamin GmbH & Co. KG, and Corbion N.V.

The vitamin & mineral combination segment dominated the market in 2024. This is due to its high demand in fortified foods and clinical nutrition.

The bone health segment is expected to witness the fastest growth during the forecast period. Due to rising osteoporosis cases and increasing use of calcium and vitamin D premixes in functional foods and clinical nutrition.