Market Overview

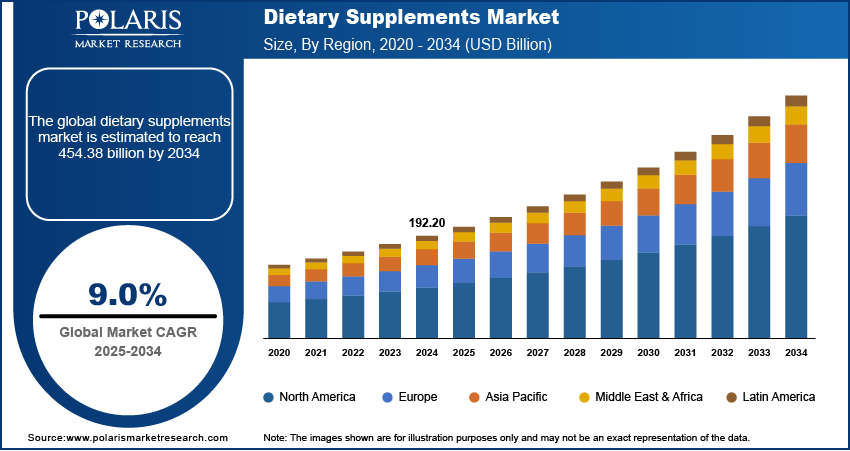

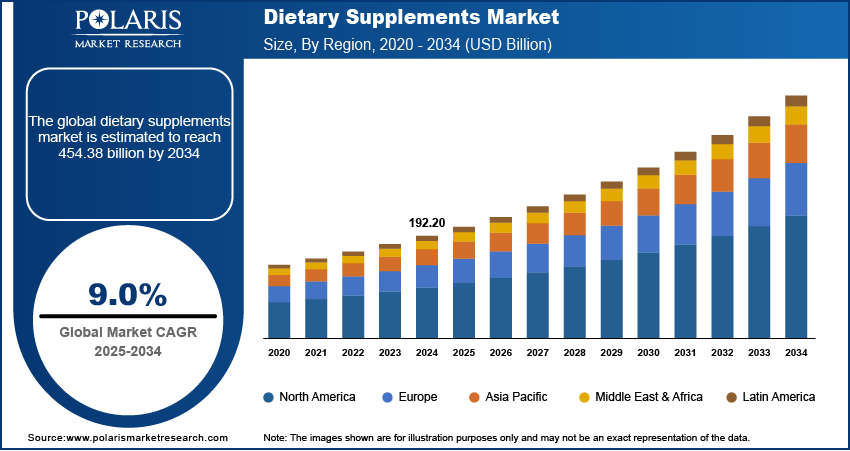

The dietary supplements market size was valued at USD 192.20 billion in 2024 and is expected to register a CAGR of 9.0% during 2025–2034. The market growth is driven by the increasing demand for supplements that enhance sports performance. Consumers are increasingly seeking supplements to meet their daily micronutrient requirements, which is driving demand for diet supplements. Moreover, the increasing consumer spending on health and wellness products boosts the industry expansion.

Key Insights

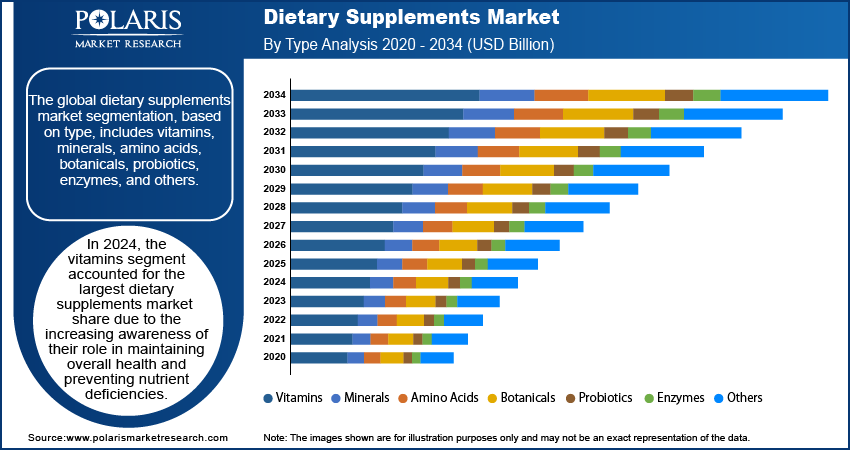

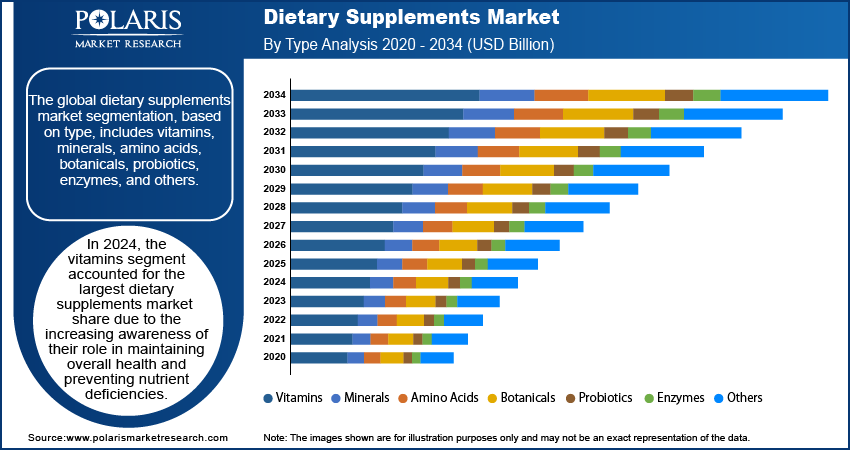

- In 2024, the vitamins segment accounted for the largest industry share due to the increasing awareness of their role in maintaining overall health and preventing nutrient deficiencies.

- The adult segment is expected to witness the fastest growth during 2025–2034, due to the increasing health awareness among the working population, emerging fitness trends, and a growing emphasis on preventive healthcare.

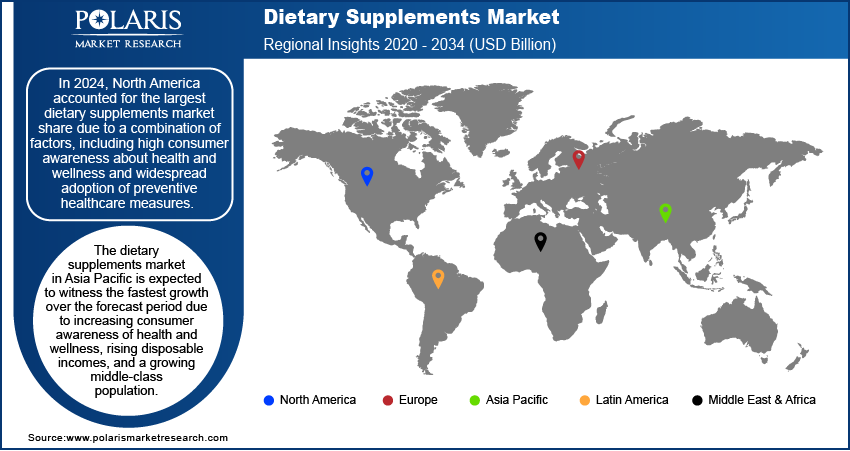

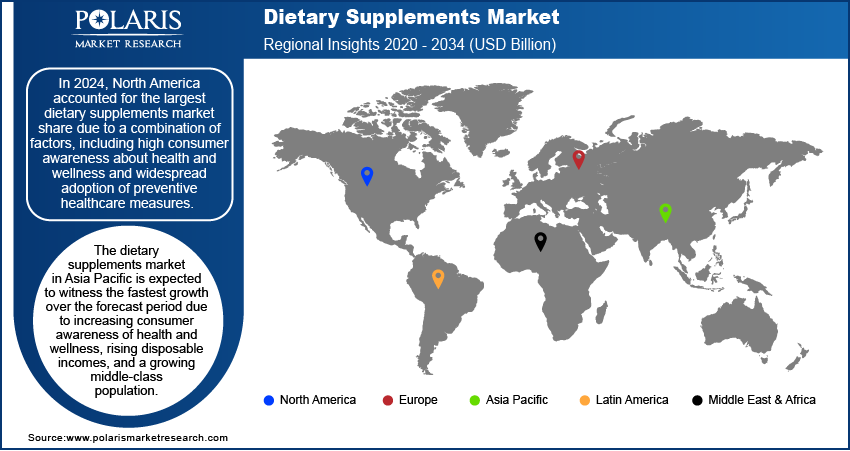

- In 2024, North America held the largest global revenue share. The widespread adoption of preventive healthcare measures and the presence of a well-established supplement industry boost the regional market expansion.

- The dietary supplements industry in Asia Pacific is expected to witness the fastest growth during the forecast period. The industry growth is attributed to the increasing consumer awareness of health and wellness and a growing middle-class population.

Industry Dynamics

- The rising availability of dietary supplements on e-commerce platforms and digital shopping sites propels the sales of these products, driving the industry growth.

- The increasing focus on health and diet, especially among the young population, fuels the market demand.

- Rising collaborations and partnerships among market players for innovative product development are expected to offer lucrative opportunities for the market in the coming years.

- Surging shift toward plant-based products is expected to provide opportunities for the industry players during the forecast period.

- High cost of supplements restrains the industry growth.

Market Statistics

2024 Market Size: USD 192.20 billion

2034 Projected Market Size: USD 454.38 billion

CAGR (2025–2034): 9.0%

North America: Largest market in 2024

AI Impact on Dietary Supplements Market

- AI tools are used to analyze current and emerging industry trends, customer feedback, SEO analytics, and competitor product analysis. This study helps identify opportunities to develop new supplements and create appropriate marketing materials.

- The tools analyze vast datasets of ingredient properties and their health outcomes. It is used to develop more clinically effective and less costly supplement formulas.

- Industry players adopt AI systems to ensure their products, marketing materials, and social media presence comply with legal requirements and recommendations.

To Understand More About this Research: Request a Free Sample Report

The dietary supplements market produces and sells products that are designed to supplement the diet with additional nutrients, vitamins, minerals, and other substances that need to be obtained in sufficient quantities from food alone.

Dietary supplements are used for multiple purposes, such as improving overall health, supporting specific bodily functions, helping in weight loss, and enhancing athletic performance which is further contributing to the dietary supplements market growth. Furthermore, the COVID-19 pandemic has positively impacted the industry, as consumers seek products that boost their immune function and reduce the risk of infection; thus, the demand for dietary supplements is fueling the market expansion.

Market Dynamics

Rising Aging Population

The growing global geriatric population is driving demand for dietary supplements designed to address age-related health concerns. These products target issues such as bone density, cognitive decline, and immune support, catering to the specific needs of aging individuals. For instance, according to the WHO, the population aged 60 and older is projected to reach 2.1 billion by 2050. Additionally, those aged 80 and above are expected to triple to approximately 426 million between 2020 and 2050. Older people often experience a decline in physiological functions, leading to a higher prevalence of chronic conditions and nutrient deficiencies. This demographic shift is boosting market expansion for supplements specifically designed to support critical aspects of health in older adults. Products such as bone and joint health supplements are in high demand due to the increased risk of osteoporosis, arthritis, and other musculoskeletal issues among the elderly. Calcium, vitamin D, and collagen supplements, along with glucosamine and chondroitin, are commonly sought to maintain bone density and alleviate joint discomfort.

Rapid E-commerce Expansion

The rapid expansion of online retail platforms has increased the accessibility of dietary supplements, which is further fueling the dietary supplements market expansion. For instance, The US Census Bureau reported that Q3 2024 retail e-commerce sales, adjusted for seasonal variation, reached USD 300.1 billion, reflecting a 2.6 percent increase from Q2 2024. E-commerce software platforms, including major marketplaces such as Amazon, health-specific retailers, and direct-to-consumer websites, have enabled consumers to browse and purchase supplements from the comfort of their homes. The global reach of e-commerce has also adopted the growth of niche and specialized brands, offering unique formulations and addressing specific consumer preferences, such as vegan, gluten-free, or organic supplements. Additionally, competitive pricing, frequent promotions, and bundling options make it easier for consumers to access premium products at more affordable rates.

Segment Insights

Market Assessment by Type Outlook

The global dietary supplements market segmentation, based on type, includes vitamins, minerals, amino acids, botanicals, probiotics, enzymes, and others. In 2024, the vitamins segment accounted for the largest dietary supplements market share due to the increasing awareness of their role in maintaining overall health and preventing nutrient deficiencies. Key factors driving this growth include the rising demand for immunity-boosting products, particularly the COVID-19 pandemic, and the widespread use of multivitamins as a convenient solution for meeting daily nutritional requirements. Additionally, the growing prevalence of lifestyle-related diseases, such as diabetes and cardiovascular conditions, has led to a surge in the consumption of vitamin D, C, and B-complex, which are known to support immunity, energy production, and overall well-being.

Market Evaluation by End Use Outlook

The global dietary supplements market segmentation, based on end use, includes, adults, children, infants, pregnant women, and geriatric. The adult segment is expected to experience the fastest growth during the forecast period due to the increasing health awareness among the working population, a rise in fitness trends, and a growing emphasis on preventive healthcare. Factors such as busy lifestyles, inadequate dietary intake, and stress-related health concerns have driven the adoption of supplements to boost energy, immunity, and overall wellness. Additionally, the popularity of targeted supplements, such as those for weight management, muscle recovery, and stress reduction, further contributes to the segment's rapid growth.

Market Regional Insights

By region, the study provides dietary supplements market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to a combination of factors, including high consumer, widespread adoption of preventive healthcare measures, and the presence of a well-established supplement industry. The region benefits from robust distribution channels, including retail stores and e-commerce platforms, making supplements widely accessible. For instance, according to a research report by the National Institutes of Health Nutrition, poor diets are significantly impacting the US economy, with the combined healthcare spending and lost productivity from poor nutrition costing over USD 1 trillion annually. This economic burden has intensified the focus on dietary supplements as a cost-effective strategy to address nutritional deficiencies, improve public health, and reduce the prevalence of diet-related chronic diseases.

The dietary supplements market in Asia Pacific is expected to witness the fastest growth over the forecast period due to the increasing consumer awareness of health and wellness, rising disposable incomes, and a growing middle-class population. The region's diverse dietary habits and prevalence of nutrient deficiencies have driven demand for supplements to address specific health concerns. Additionally, rapid urbanization and the adoption of Western lifestyles have contributed to an increased focus on fitness and preventive healthcare. The expanding e-commerce sector and the presence of local and international supplement brands offering affordable and tailored products further fuel the market's growth. Cultural practices and traditional medicine systems, such as Ayurveda and Traditional Chinese Medicine, also play a significant role in shaping the demand for herbal supplements and natural supplements in the region.

Key Players and Competitive Analysis Report

The competitive landscape of the dietary supplements market is highly fragmented, with a blend of large multinational corporations, niche players, and regional brands. Major global companies such as Amway, Herbalife, Nestlé, Abbott Laboratories, and GNC dominate the market, offering a broad range of products and leveraging strong brand recognition, vast distribution networks, and substantial research and development resources. These companies provide diverse consumer needs across various segments such as vitamins, minerals supplements, and probiotics. Companies such as Thorne Research, Garden of Life, and Vital Proteins appeal to health-conscious consumers with clean-label and high-quality offerings. The rise of e-commerce has allowed smaller brands, such as Ritual and Care/of, to increase by providing personalized nutrition solutions through subscription models.

Regional brands often address local preferences or traditional wellness practices, such as Ayurvedic or Traditional Chinese Medicine-based supplements. Innovation and product diversification are crucial strategies, with companies developing vegan, organic, and gluten-free products to meet changing consumer preferences. Effective marketing, including influencer partnerships and consumer education, along with adherence to regulatory standards, further influences the market. The competitive landscape is shaped by constant innovation and the ability to meet consumers' evolving health and wellness demands. A few key major players are Abbott Laboratories; Glanbia Plc; The Archer-Daniels-Midland Company; Nature’s Sunshine Products, Inc.; GlaxoSmithKline plc; Amway Corp.; Herbalife International of America, Inc.; XanGo, LLC; PharmaNutrics Himalaya Global Holdings Ltd.; Nutraceutics Corp.; Pfizer Inc.; Bayer AG.

Bayer AG is a multinational conglomerate with core competencies in Life Sciences, encompassing healthcare and agriculture. The company has evolved into a global powerhouse with a diverse portfolio of products and solutions to improve lives and address some of the world's most pressing challenges. Bayer is advancing medical science and enhancing patient well-being in the healthcare sector. The company's pharmaceutical division researches, develops, and manufactures innovative medicines to prevent, treat, and cure many diseases. This includes cardiology, oncology, neurology, and women's health. In addition, Bayer's consumer health division offers a variety of over-the-counter products that promote personal well-being and health.

Abbott is a global healthcare company that discovers, develops, manufactures, and sells a wide range of healthcare products worldwide. The company operates in four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. Abbott’s established pharmaceutical products segment offers generic pharmaceuticals for various medical conditions such as hypertension, pancreatic exocrine insufficiency, and pain management. The diagnostic products segment provides laboratory and transfusion medicine systems, point-of-care testing, molecular diagnostics, and informatics solutions for clinical laboratories. Abbott offers solutions designed to enhance overall wellness, focusing on bone health, cognitive function, and immune support, particularly for aging populations. The companys flagship products, such as Ensure and Similac, emphasize targeted nutrition for various life stages.

List Of Key Companies

- Abbott Laboratories

- Glanbia Plc

- The Archer-Daniels-Midland Company

- Nature’s Sunshine Products, Inc.

- GlaxoSmithKline plc

- Amway Corp.

- Herbalife International of America, Inc.

- XanGo, LLC

- PharmaNutrics Himalaya Global Holdings Ltd.

- Nutraceutics Corp.

- Pfizer Inc.

- Bayer AG

Dietary Supplements Industry Developments

In February 2025, Vitaboom and GetHealthy formed a strategic alliance aimed at reshaping the personalized nutrition landscape. By integrating Vitaboom’s proficiency in nutritional supplements with GetHealthy’s AI-powered digital health platform, the partnership will provide consumers with customized supplement plans and wellness programs. Using data-driven insights and user behavior, the collaboration seeks to deliver personalized nutrition solutions that support individual health goals. This initiative is positioned to redefine the standard for personalized wellness and enhance long-term health outcomes.

In October 2024, Vantage Nutrition introduced a new line of high-concentration VitaCholine in transparent liquid capsules, offering a distinctive dosage format that delivers 275mg to 550mg of free choline per capsule. Designed to be both effective and visually appealing, the launch underscores Vantage Nutrition’s dedication to innovation, quality, and agile market delivery. The new product line is scheduled for debut at Supply Side West in Las Vegas.

In April 2024, Naturacare rolled out four new nutraceutical innovations, reinforcing its manufacturing capabilities and international expansion plans. The lineup features:

-

Vital Extend – a bilayer tablet enhancing energy and vitality

-

Bacti Serenity – targeting stress relief and gut-brain balance

-

Electrolytes – an effervescent recovery tablet post-exercise

-

Ovo Immune – an immune-support formula with pipette delivery

January 2024: Abbott launched its PROTALITY brand, starting with a high-protein nutrition shake. This product targets adults seeking weight management while preserving muscle mass and optimizing nutrition, aligning with contemporary trends in nutritional science.

October 2023: Optimum Nutrition launched Clear Protein, an innovative transparent protein shake made from 100% plant-based protein isolate. Each serving provides 20 grams of high-quality protein and a refreshing fruity flavor, effectively supporting training and nutrition goals.

September 2022: Abbott launched Ensure with HMB in India, designed to protect and strengthen muscle health in adults. The new formula includes HMB (β-Hydroxy β-Methylbutyrate), which helps prevent muscle breakdown and promotes recovery, addressing muscle loss, especially in aging populations.

Dietary Supplements Market Segmentation

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Vitamins

- Minerals

- Amino Acids

- Botanicals

- Probiotics

- Enzymes

- Others

By Form Outlook (Revenue, USD Billion; 2020–2034)

- Tablets

- Capsules

- Gummies

- Powder

- Soft Gels

- Liquids

- Others

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Energy & Weight Management

- Bone & Joint Health

- Immunity

- General Health

- Cardia Health

- Others

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Online Platforms

- Offline Stores

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Adults

- Children

- Infants

- Pregnant Women

- Geriatric

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dietary Supplements Report Scope

|

Report Attributes

|

Details

|

|

Market Size Value in 2024

|

USD 192.20 billion

|

|

Market Size Value in 2025

|

USD 209.04 billion

|

|

Revenue Forecast by 2034

|

USD 454.38 billion

|

|

CAGR

|

9.0% from 2025 to 2034

|

|

Base Year

|

2024

|

|

Historical Data

|

2020–2023

|

|

Forecast Period

|

2025–2034

|

|

Quantitative Units

|

Revenue in USD billion, 2020–2034 and CAGR from 2025 to 2034

|

|

Report Coverage

|

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends

|

|

Segments Covered

|

- By Type

- By Form

- By Application

- By Distribution Channel

- By End Use

|

|

Regional Scope

|

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

|

|

Competitive Landscape

|

- Dietary Supplements Industry Trend Analysis (2024)

- Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments

|

|

Report Format

|

|

|

Customization

|

Report customization as per your requirements with respect to countries, regions, and segmentation.

|