Vitamin D Market Share, Size, Trends, Industry Analysis Report

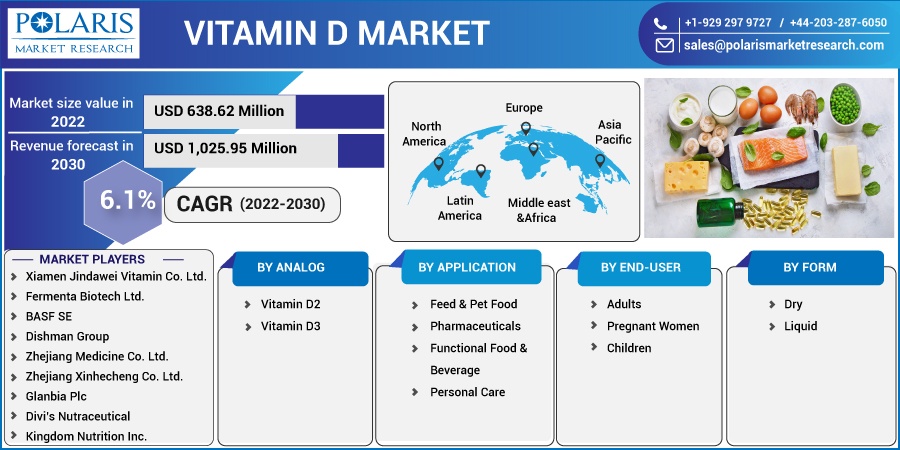

By Analog (Vitamin D2 and Vitamin D3); By Application; By End-User; By Form; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 114

- Format: PDF

- Report ID: PM2921

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

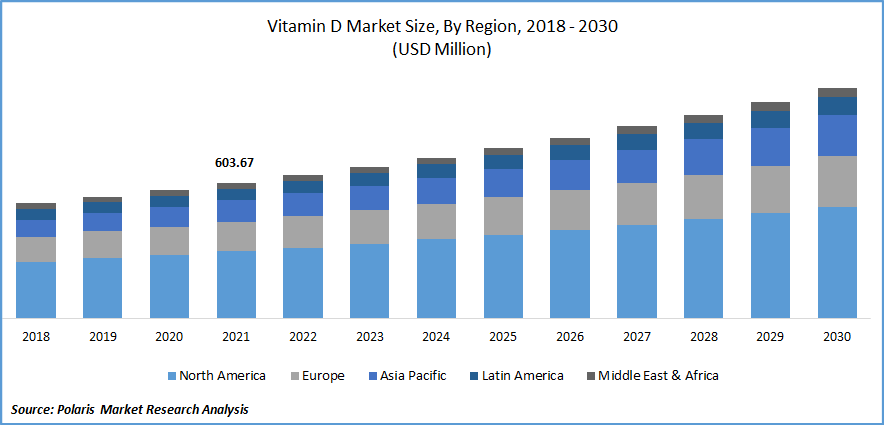

The global vitamin D market was valued at USD 603.67 million in 2021 and is expected to grow at a CAGR of 6.1% during the forecast period.

The growing consumer awareness towards the intake of a healthy diet, increasing consumer spending capacity on their well-being, especially in the developed region, and wide availability of vitamin D products across the globe are major factors driving the growth of the global market. In addition, the surge in diabetic & obese populations in countries like India & China has resulted in the uptake of Vitamin A-rich nutritional diet, which, in turn, is likely to propel the market growth. According to our findings, the number of people living with diabetes was around 74 million in 2021, the second highest in the world after china with a total diabetic population of 141 million. Approximately, 6.7 million adults are estimated to have died from diabetes or its complications, in 2021.

Know more about this report: Request for sample pages

The high influence of various types of vitamin D supplements on body consumption, pubertal development, and growth of the bones among school-aged children across the world is on the rise coupled with the rising penetration of improving anthropometric and metabolic outcomes among consumers is pushing the market growth forward.

The majority of the world’s population is facing a high deficiency of vitamin D due to a lack of a balanced diet and very less exposure to sunlight. Hence, several government organizations are undertaking required initiatives to combat the deficiency of vitamin D all over the world. Moreover, various key market companies such as BASF SE, Xiamen Kingdomway Vitamin Corporation, and Alliance Nutrition Inc. are increasing their focus on developing improved and enhanced products enriched with vitamin D to cater to the rising need of consumers all over the world.

For instance, in November 2022, Nix & Kix, announced the launch of a Vitamin-Enriched soft drink named “Vitamin Vitality”. The product is available in 2 different flavors including orange passionfruit and tropical, which combines fruit juices, and added vitamins D, C, B6, and B12 and contain no added sugar.

The outbreak of the COVID-19 pandemic has positively impacted the growth of the vitamin D market. The emergence of the deadly virus has resulted in increased consumer awareness of their better health and high immunity. As a result, people have started buying nutritional products including vitamin D supplements in bulk quantities. This fueled the launch of numerous products to cater to the rising need and the manufacturers were encouraging people to buy their products from online platforms to stay safe in their homes.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Increasing preferences among consumers regarding forfeited food and high awareness regarding this are encouraging them to incorporate forfeited food into their regular meals and diets are major factors propelling the market growth. In recent years, consumers are constantly looking for not only nutritional-rich food but also for those types of food that provide them with essential ingredients for better health and prevent possible diseases.

Moreover, rising incidences of various types of chronic disorders like rickets, which are caused by deficiency of vitamin D along with poor dietary habits of consumers is another factor likely to boost the growth. The prevalence of rickets was found to be more in males at around 70% than in females at 30% and most of the cases of rickets belonged to children of age group 0-5 years. Urban residents usually most of their time in workplaces, therefore these people are more likely to have vitamin D deficiency, as a result, the demand for various vitamin D supplements and components is expected to grow rapidly in urban regions.

Report Segmentation

The market is primarily segmented based on analog, application, end-user, form, and region.

|

By Analog |

By Application |

By End-User |

By Form |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Vitamin D3 segment accounted for the highest market share

The vitamin D3 segment accounted for over significant market share in 2021 and is expected to retain its position over the anticipated period due to increased awareness regarding its several uses and the continuously rising number of people suffering from rheumatoid arthritis and many other bone-related disorders. Vitamin D3 is mainly used for the person suffering from bone-related diseases because of its ability to give strength to the bones and many other benefits.

Moreover, the vitamin D2 segment exhibits the fastest growth rate over the study period, owing to its growing importance to treat various calcium disorders & parathyroid disorders. In addition, it is also preferred for patients with chronic kidney diseases, as it plays a crucial role in bone health and helps to absorb calcium and phosphorus.

Pharmaceuticals segment held the largest market share in 2021

The pharmaceutical segment led the global market with a holding of significant market share, in 2021. Rising usage of both plant and animal-based products as a source of vitamin D for the composition of various types of medicines. In addition, an extensive rise in the number of people suffering from vitamin D deficiency across the globe is also expected to fuel the growth of the segment market in the next coming years.

Furthermore, the functional food & beverage segment is likely to register the highest growth over the anticipated period on account owing to the high utilization of products in manufacturing several functional food & beverages including snacks & cereals, food supplements, dairy products, and fruit juices and drinks. The growing demand for these functional food items across the globe for maintaining a healthier lifestyle and nutritional benefits is also likely to propel the product demand.

Adults segment is expected to hold the significant revenue share

The adult segment is anticipated to grow at a steady rate in the global market throughout the projected period. The increasing prevalence of many types of diseases in people more than 50 years of age like osteomalacia, osteopenia, and osteoporosis owing to severe deficiency of vitamin D is a key factor expected to foster the growth and demand for the product in the segment’s growth. The high content of vitamins D2 & D3 is used to correct deficiencies in the human body and is required for healthy bones & teeth, which has paved the way for higher adoption of the product among adult consumers all over the world.

Liquid form segment is likely to witness the highest growth

The liquid segment is anticipated to witness the fastest growth over the study period, owing to its usage in the food and beverage applications & pharmaceuticals industry. The liquid form segment is mainly used in food supplements for the purpose to boost immunity, maintain cardiovascular health, and support bone strength.

However, the dry segment held the largest market share, in 2021, and is likely to grow at a considerable growth over the study period, which is accelerated by increasing demand for vitamin D in powder and capsule forms for its high solubility. Additionally, dry vitamin products are easy to store and handle, convenient to utilize in an array of products, and highly stable, which is driving the segment market growth.

Asia Pacific dominated the global vitamin D market in 2021

The Asia Pacific region dominated the market in 2021 with a holding of significant market revenue share and is projected to maintain its dominance throughout the forecast period. The easy availability of raw products such as milk and continuously rising consumer disposable income in the region are major factors driving the growth and demand of the market in the region. In addition, Malaysia has a high deficiency of vitamin D as compared to other regions all over the world owing to the high prevalence of various non-communicable diseases in the Country. According to Malaysia’s National Health survey, the prevalence of diabetes mellitus is increasing rapidly in Malaysia with an overall exceeding of 18% and the prevalence of blood glucose is even higher with 43.3% among people aged 65-69 years in the year 2019.

Furthermore, the North America region is expected to gain high traction in the next coming years due to increased consumer awareness regarding various health benefits associated with the consumption of vitamin D. Moreover, the lack of vitamin D presence in food alone of Canadian people has resulted in a deficiency of vitamin D levels as they are not getting enough vitamin for their body. According to data collected by Canadian Community Health Survey, most of the age and gender groups had nearly 90% of prevalence of inadequate intakes. So, to fulfill the need for vitamin D among the Canadian population, Genestra Brands, in November 2022, introduces two new and improved supplements of vitamin D named D-Mulsion 2500 and D3 2500, which helps to reduce deficiency of vitamin D and the risk of developing osteoporosis.

Furthermore, for instance, in July 2022, KaraMD, a US-based company, announced the launch of Pure D3 Plus, a vitamin D3, and magnesium supplement. The product has launched to strengthen heart and bone health and boost immunity. These include the capabilities of reducing risks of cardiovascular diseases and some types of illness.

Competitive Insight

Key players include Zhejiang Garden Biochemical, Taizhou Haisheng Pharmaceutical, Xiamen Jindawei Vitamin, Fermenta Biotech, BASF SE, Dishman Group, Zhejiang Medicine, Zhejiang Xinhecheng, Glanbia Plc, Divi’s Nutraceutical, Kingdom Nutrition, McKinley Resources, and New Gen Pharma.

Recent Developments

In October 2022, Xtend, a Nutrabolt, expanded its product line of hydration & recovery amino acids through the launch of its “Xtend Healthy Hydration Sticks”. It is an on-the-go type electrolyte supplement, which offers zero sugar hydration and is also a major source of vitamin D and B. The sticks are available in three different flavors including strawberry banana, lemon-lime, and raspberry lemonade.

Furthermore, in April 2022, Abbott, a leading global healthcare product and services provider announced the launch of Arachitol Gummies in India, which is a type of dietary supplement that helps in maintaining required levels of vitamin D. As of now, the product is launched is orange flavor and are approved by Food Safety and Standards Authority in India. It’s a crucial step to fill the nutritional gaps and enhances the health of the human body.

Vitamin D Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 638.62 million |

|

Revenue forecast in 2030 |

USD 1,025.95 million |

|

CAGR |

6.1% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Analog, By Application, By End-User, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Zhejiang Garden Biochemical High-Tech Co. Ltd., Taizhou Haisheng Pharmaceutical Co. Ltd., Xiamen Jindawei Vitamin Co. Ltd., Fermenta Biotech Ltd., BASF SE, Dishman Group, Zhejiang Medicine Co. Ltd., Zhejiang Xinhecheng Co. Ltd., Glanbia Plc, Divi’s Nutraceutical, Kingdom Nutrition Inc., McKinley Resources Inc., and New Gen Pharma Inc. |