Patient Access Solutions Market Size, Share, Trends, Industry Analysis Report

By Product (Software and Services), By Deployment, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6501

- Base Year: 2024

- Historical Data: 2020-2023

Overview

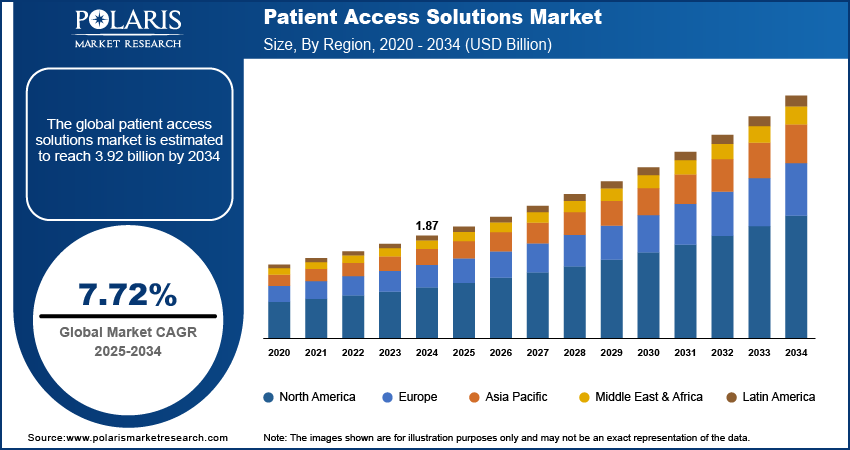

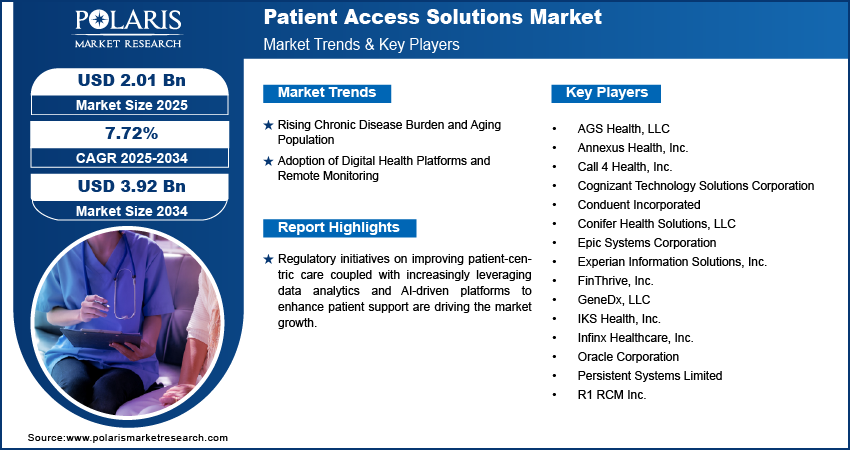

The global patient access solutions market size was valued at USD 1.87 billion in 2024, growing at a CAGR of 7.72% from 2025 to 2034. Rising chronic disease burden and aging population coupled with adoption of digital health platforms and remote monitoring is propelling the market growth.

Key Insights

- The software segment dominated the patient access solutions market in 2024, driven by the growing need for efficient patient scheduling, registration, billing, and insurance verification.

- HCIT outsourcing companies held significant share, fueled by rising demand from smaller healthcare providers seeking expert support for managing patient access operations efficiently.

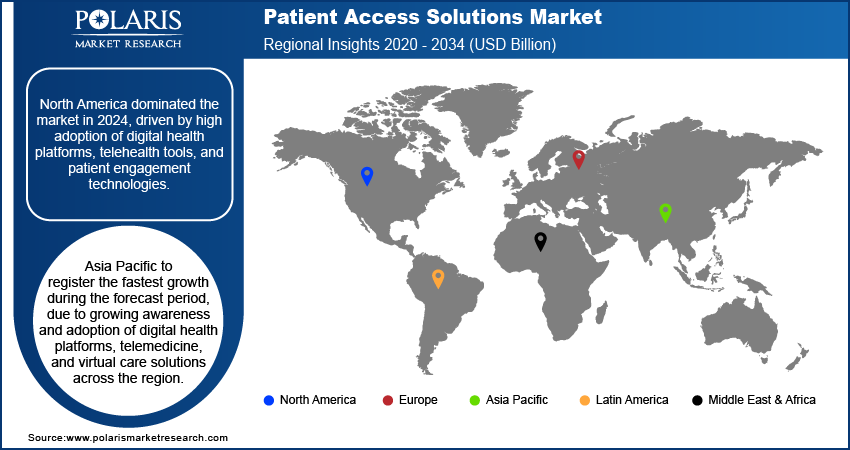

- North America dominated the global market in 2024, driven by rising adoption of digital health platforms, telehealth solutions, and patient engagement technologies.

- The U.S. held significant market share in North America, led by the rising incidence of chronic and lifestyle diseases, coupled with a fast-growing aging population.

- Asia Pacific is expected to experience robust growth, driven by increasing awareness and adoption of telemedicine and digital healthcare solutions.

- India dominated the market in Asia Pacific fueled by rising biotechnology, pharmaceutical, and healthcare technology industries.

- Key players operating in the market include AGS Health, LLC, Annexus Health, Inc., Call 4 Health, Inc., Cognizant Technology Solutions Corporation, Conduent Incorporated, Conifer Health Solutions, LLC, Epic Systems Corporation, Experian Information Solutions, Inc., FinThrive, Inc., GeneDx, LLC, IKS Health, Inc., Infinx Healthcare, Inc., Oracle Corporation, Persistent Systems Limited, and R1 RCM Inc.

Industry Dynamics

- Growing burden of chronic diseases and aging population are fueling the use of patient access solutions, with increased demand for transparent patient data management and synchronized care delivery.

- Growing utilization of digital health platforms and remote monitoring devices is improving patient participation, operational effectiveness, and access to healthcare.

- The high cost of implementation and integration continues restrain the market, particularly for smaller and mid-sized healthcare organizations with restricted IT budgets.

- Implementation of AI-powered virtual assistants are creating market opportunities, allowing automated scheduling, claim processing, and real-time communication to enhance patient experience and workflow efficiency.

Market Statistics

- 2024 Market Size: USD 1.87 Billion

- 2034 Projected Market Size: USD 3.92 Billion

- CAGR (2025–2034): 7.72%

- North America: Largest Market Share

The patient access solutions market comprises digital products and services intended to optimize patient interactions with healthcare providers, payers, and pharmacies. Solutions are widely used for appointment scheduling, insurance verification, prior authorizations, and patient financial counseling in order to improve care efficiency and patient experience. Cloud computing, artificial intelligence, and integration with mobile are enhancing accessibility, data security, and operational efficiency.

Regulatory efforts aimed at enhancing patient-focused care and timely access to critical medicines are driving patient access solutions market. Programs such as the UK's Innovative Licensing and Access Pathway (ILAP) aim to accelerate development and delivery of life-changing therapies, with patients getting access to innovative treatments sooner.

Healthcare professionals increasingly utilize data analysis and AI-based platforms to optimize patient support, track adherence, and enhance health outcomes. Such technologies allow for more tailored interventions, coordinated care, and effective resource distribution across treatment pathways.

Drivers & Opportunities

Rising Chronic Disease Burden and Aging Population: The rising incidence of chronic illnesses and an aging population are driving the demand for coordinated care solutions. According to the United Nations, by the late 2070s, the combined global population over the age of 65 will stand at 2.2 billion, highlighting long-term demand for patient access solutions to manage chronic disease.

Adoption of Digital Health Platforms and Remote Monitoring: Increasing growth of digital health platforms, telehealth, and remote patient monitoring is also contributing to market growth. In August 2023, the World Health Organization initiated the Global Initiative on Digital Health (GIDH) during the G20 Health Ministers' Meeting in India, with an objective to boost the WHO Global Strategy on Digital Health 2020–2025, emphasizing the growing interest in technology-empowered patient care.

Segmental Insights

By Product

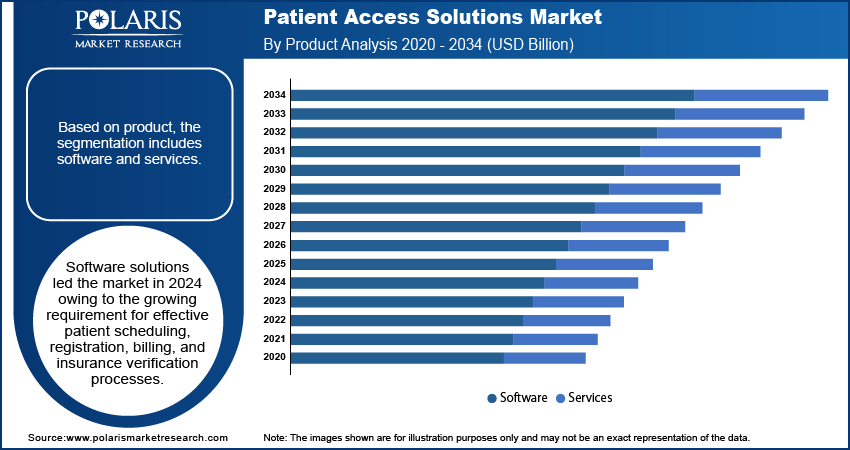

Based on product, the patient access solutions market is divided into software and services. Software solutions led the market in 2024 owing to the growing requirement for effective patient scheduling, registration, billing, and insurance verification processes.

Services are anticipated to grow rapidly during the forecast period, driven by the growing need for outsourced patient access management, consulting, and support solutions. This improves operational efficiency and minimize administrative burdens for healthcare providers.

By Deployment

On the basis of deployment, the market is categorized into web and cloud-based solutions and on-premise solutions. Web and cloud-based solutions contributed the largest market share in 2024 due to its scalability, remote accessibility, and inexpensive implementation for healthcare providers of all sizes.

On-premise offerings are anticipated to grow at a consistent rate over the forecast period, within large hospitals and networked healthcare organizations where high data security and full control over patients' information are needed.

By End User

On the basis of end users, the market is segmented into healthcare providers, HCIT outsourcing firms, and other end users. Healthcare providers dominated the market in 2024, owing to growing adoption of patient access solutions among hospitals, clinics, and specialty care facilities.

HCIT outsourcing firms are expected to experience fast growth with growing demand from small healthcare providers that look for professional assistance in streamlining patient access operations effectively.

Regional Analysis

North America leads the patient access solutions market due to strong adoption of digital health platforms, telehealth solutions, and patient engagement technologies. The presence of strong specialty pharmaceutical and biotech companies in the region also stimulates demand for programs that help patients manage complex therapy choices, enhance adherence, and maintain control of treatment plans effectively.

The U.S. Patient Access Solutions Market Overview

The U.S. held a strong market position in North America, fueled by increasing incidence of lifestyle and chronic disease in the country. The Centers for Disease Control and Prevention reported that nearly 129 million individuals in the U.S. got at least one significant chronic condition, highlighting the imperative of patient access solutions to facilitate timely treatment, improve health outcomes, and decrease hospital readmissions.

Asia Pacific Patient Access Solutions Market Insights

The Asia Pacific is expected to grow rapidly due to the increasing awareness and embracement of digital health platforms, telemedicine, and virtual care solutions within the region. Governments are focusing towards enhancing access to drugs, healthcare infrastructure, and setting up universal healthcare programs, which are creating rapid demand for patient support and engagement programs.

India Patient Access Solutions Market Analysis

India led the market in Asia Pacific, driven by the growing pharmaceutical, biotechnology, and healthcare technology industries. Indian drug firms are expected to post revenue expansion of 9–11% in FY25, as per the India Brand Equity Foundation, based on robust performance in the U.S., Europe, and other emerging economies. Increasing clinical trials, specialty drug approvals, and government incentives in support of healthcare digitization are further emphasizing the increasing significance of patient-centric programs in the region.

Europe Patient Access Solutions Market Assessment

Europe held significant share in the patient access solutions market fueled by strict regulatory structures. These structures guarantee that patients receive access to innovative and specialty therapies, particularly in the rare disease and biologics space. Increasing investments in specialty drugs, biologics, and patient support services are propelling the use of end-to-end programs with a focus on enhancing treatment adherence and results. In July 2025, the European Investment Bank (EIB) announced an investment of USD 175.2 million to Alfasigma, an Italian pharmaceutical firm, to drive innovation in specialty care and rare diseases, reflecting the region's strong support for patient-driven healthcare solutions.

Key Players & Competitive Analysis

The global patient access solutions market is driven by dynamic growth, fueled by the escalating demand for integrated healthcare administration, increasing patient engagement, and effective revenue cycle management. Healthcare expenditures, heightened adoption of digital health platforms, and attention on patient experience improvement are top drivers of the market expansion. Automated solutions, real-time eligibility verification, prior authorization services, and patient financial support programs are highlighted by providers and payers to achieve optimal operational efficiency.

Key players in the global patient access solutions market include AGS Health, LLC, Annexus Health, Inc., Call 4 Health, Inc., Cognizant Technology Solutions Corporation, Conduent Incorporated, Conifer Health Solutions, LLC, Epic Systems Corporation, Experian Information Solutions, Inc., FinThrive, Inc., GeneDx, LLC, IKS Health, Inc., Infinx Healthcare, Inc., Oracle Corporation, Persistent Systems Limited, and R1 RCM Inc.

Key Players

- AGS Health, LLC

- Annexus Health, Inc.

- Call 4 Health, Inc.

- Cognizant Technology Solutions Corporation

- Conduent Incorporated

- Conifer Health Solutions, LLC

- Epic Systems Corporation

- Experian Information Solutions, Inc.

- FinThrive, Inc.

- GeneDx, LLC

- IKS Health, Inc.

- Infinx Healthcare, Inc.

- Oracle Corporation

- Persistent Systems Limited

- R1 RCM Inc.

Patient Access Solutions Industry Developments

In March 2025, Relatient introduced Dash Direct, an intelligent open scheduling API platform that automates patient appointment booking, rescheduling, and cancellations across multiple digital channels. The platform reduces manual workload, enhances patient access and convenience, and seamlessly integrates with various healthcare technologies.

In August 2024, SoundHound AI collaborated with MUSC Health to deploy an AI agent named Emily via its Amelia Patient Engagement solution. Integrated with Epic, the agent enables patients to manage appointments and receive answers to non-clinical queries 24/7.

Patient Access Solutions Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Claims Denial and Appeal Management Solutions

- Payment Estimation Solutions

- Other Software

- Services

By Development Outlook (Revenue, USD Billion, 2020–2034)

- Web and Cloud-based Solutions

- On-premise Solutions

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Healthcare Providers

- HCIT Outsourcing Companies

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Access Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.87 Billion |

|

Market Size in 2025 |

USD 2.01 Billion |

|

Revenue Forecast by 2034 |

USD 3.92 Billion |

|

CAGR |

7.72% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.87 billion in 2024 and is projected to grow to USD 3.92 billion by 2034.

The global market is projected to register a CAGR of 7.72% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are AGS Health, LLC, Annexus Health, Inc., Call 4 Health, Inc., Cognizant Technology Solutions Corporation, Conduent Incorporated, Conifer Health Solutions, LLC, Epic Systems Corporation, Experian Information Solutions, Inc., FinThrive, Inc., GeneDx, LLC, IKS Health, Inc., Infinx Healthcare, Inc., Oracle Corporation, Persistent Systems Limited, and R1 RCM Inc.

The software segment dominated the market revenue share in 2024.

The on-premise segment is projected to witness the fastest growth during the forecast period.