Telehealth Market Size, Share, Trends, Industry Analysis Report

By Product (Hardware, Software, Services), By Delivery Mode, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM1113

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

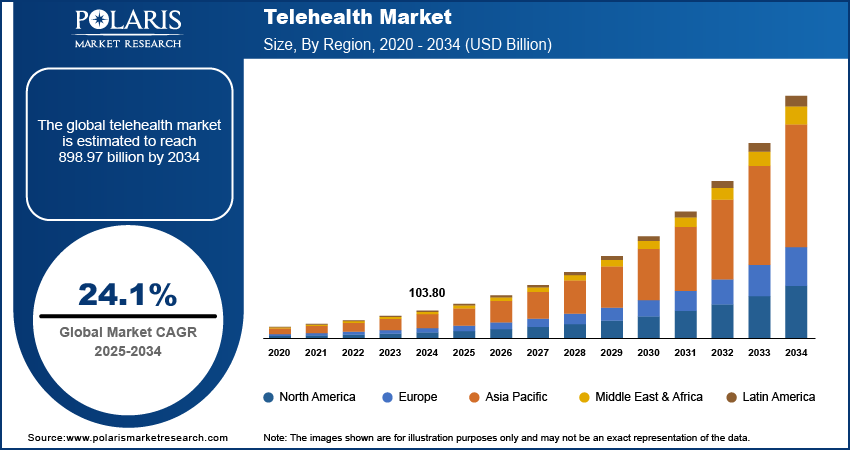

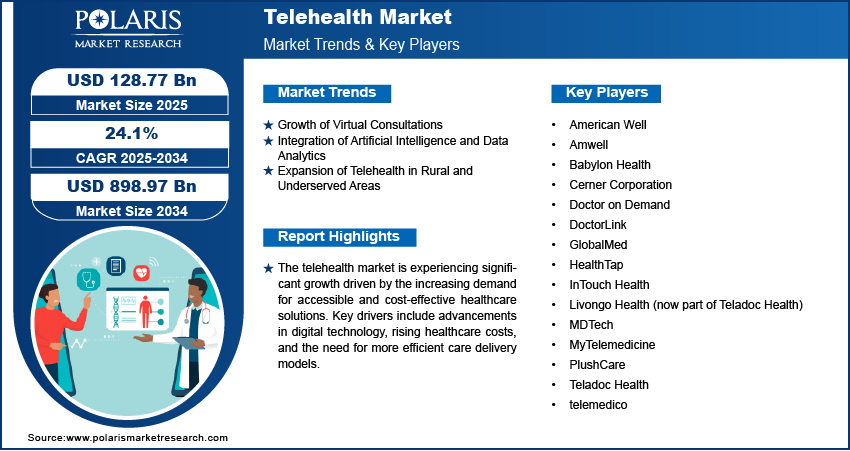

The telehealth market size was valued at USD 103.80 billion in 2024 and is projected to exhibit a CAGR of 24.1% from 2025 to 2034. The increasing demand for accessible healthcare and advancements in telecommunication technologies are driving industry expansion. In addition, the rising prevalence of chronic diseases propels the demand for telehealth services.

Key Insights

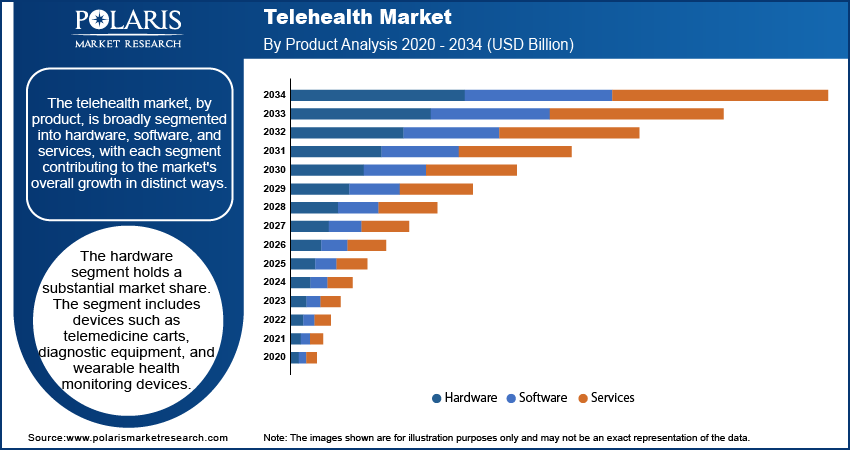

- The hardware segment held the largest market share in 2024. The rising demand for remote monitoring devices and the growing trend of personalized healthcare drive the segment expansion.

- The cloud-based segment accounted for the largest share in 2024, due to its scalability, cost-effectiveness, and ease of integration.

- The provider segment dominated the market in 2024. Healthcare organizations and hospitals are adopting telehealth solutions to enhance care delivery and reach more patients, particularly in remote areas.

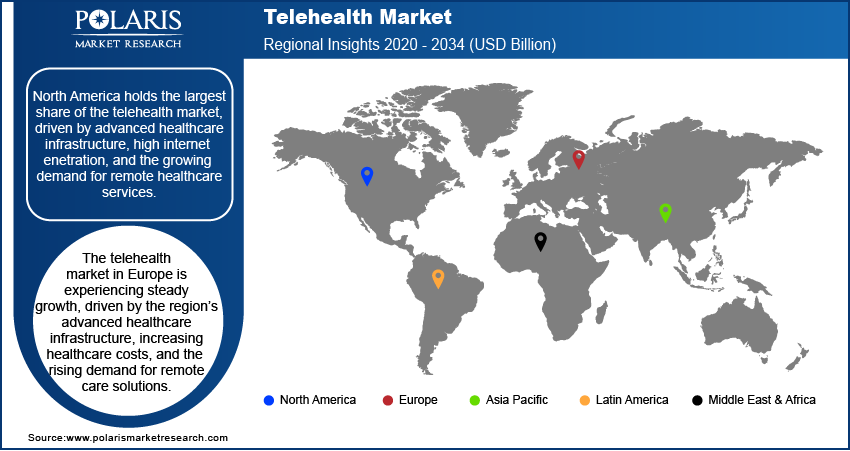

- North America held the largest share of market revenue in 2024. The dominance is driven by advanced healthcare infrastructure and high internet penetration.

- The Europe telehealth market is experiencing steady growth. The region’s advanced healthcare infrastructure and the rising demand for remote care solutions fuel the industry growth in Europe.

Industry Dynamics

- Rising adoption of virtual consultations, especially after the COVID-19 pandemic, drives the telehealth market growth.

- The increasing integration of technologies such as artificial intelligence (AI) and data analytics propels the industry expansion.

- Penetration of telehealth services in rural and underserved areas is expected to offer lucrative opportunities during the forecast period.

- High cost of telehealth products hinders the market growth.

Market Statistics

2024 Market Size: USD 103.80 billion

2034 Projected Market Size: USD 898.97 billion

CAGR (2025–2034): 24.1%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The telehealth refers to the use of digital technologies to provide healthcare services remotely, including consultations, remote health monitoring, and diagnostics. Key drivers of the market demand include the growing adoption of smartphones and wearable health devices, the need for more efficient healthcare delivery, and the expansion of insurance coverage for telehealth services. Telehealth include the integration of artificial intelligence (AI) and machine learning (ML) for diagnostics and patient management, as well as the continued expansion of telehealth services in rural and underserved areas.

Market Dynamics

Growing Adoption of Virtual Consultations

The convenience of accessing healthcare services remotely has driven a surge in the use of telemedicine for routine check-ups, mental health screening and services, and specialized care. In particular, virtual consultations have gained popularity due to their ability to reduce the need for in-person visits, lower costs, and provide quicker access to medical professionals. As healthcare systems adapt to the demand for convenience and reduced waiting times, virtual consultations are likely to remain a key driver of the market growth.

Integration of Artificial Intelligence and Data Analytics

Artificial technologies (AI) are being used to improve the accuracy of diagnostics, predict patient outcomes, and personalize treatment plans. AI-powered tools can analyze patient data from virtual consultations and wearable technology devices to provide healthcare providers with insights that enhance decision-making. A study published in the Journal of Medical Internet Research highlighted that AI in telemedicine has the potential to reduce diagnostic errors and improve overall patient care. Additionally, predictive analytics is being used to manage chronic conditions such as diabetes and hypertension by monitoring patients remotely and alerting healthcare providers when intervention is required. As these technologies continue to evolve, they are expected to enhance the effectiveness and reliability of telehealth services. Therefore, the integration of AI and data analytics into telehealth services is expected to become a significant industry trend during the forecast period.

Expansion of Telehealth in Rural and Underserved Areas

Telehealth services are increasingly being deployed in rural and underserved regions to address the lack of healthcare access. Patients in these areas often face significant barriers to healthcare, such as long travel distances, limited healthcare facilities, and a shortage of medical professionals. Telehealth has emerged as a solution to bridge these gaps by providing remote consultations and monitoring. According to the National Rural Health Association, nearly 20% of rural Americans report having difficulty accessing healthcare services, but telehealth has helped mitigate this issue by offering healthcare remotely. The expansion of broadband infrastructure and the increased availability of mobile devices have facilitated telehealth adoption in these areas. Telehealth is expected to play an essential role in improving healthcare equity, especially in rural and underserved communities, which is projected to boost the market development in the coming years.

Segment Insights

Market Assessment – Product-Based Insights

The market, by product, is broadly segmented into hardware, software, and services. The hardware segment holds a substantial market share. The segment includes devices such as telemedicine carts, diagnostic equipment, and wearable medical device. The increasing demand for remote monitoring devices and the growing trend of personalized healthcare are driving the hardware segment's expansion. Devices that track vital signs in chronic disease management have become essential in telehealth applications, fostering growth in this segment. The services segment is witnessing the highest growth, particularly driven by the rising adoption of virtual consultations and remote care services.

As healthcare providers increasingly integrate telehealth into their offerings, services such as telemedicine consultations, mental health support, and ongoing patient monitoring are in high demand. This surge is fueled by the growing preference for convenient healthcare options, as well as expanded insurance coverage for telehealth services. Additionally, the software segment, which includes telehealth platforms, electronic health records (EHR) systems, and mobile health applications, continues to grow steadily as healthcare providers adopt software for patient management and remote consultations. The development of AI-based diagnostic tools and integrated telehealth software is also contributing to the market expansion.

Market Outlook – Delivery Mode-Based Insights

The market, by delivery mode, is segmented into on-premise, web-based, and cloud-based platforms, each offering distinct advantages to healthcare providers. The cloud-based segment holds the largest market share and is experiencing the highest growth due to its scalability, cost-effectiveness, and ease of integration. Cloud-based solutions allow healthcare providers to store and access patient data remotely, facilitating efficient remote consultations and real-time monitoring. The ability to scale these solutions to meet the growing demand for telehealth services, especially in large healthcare networks, has contributed significantly to the expansion of this segment.

Cloud-based systems enable seamless integration with other healthcare systems, enhancing the overall functionality and interoperability of telehealth services. The web-based delivery mode is also gaining traction, particularly among smaller healthcare providers, as it allows for easy access to telehealth services through standard web browsers without the need for extensive hardware or software investments. Despite its advantages, the on-premise segment is experiencing slower growth due to its higher upfront costs, complexity, and maintenance requirements, which make it less attractive compared to more flexible and affordable alternatives such as cloud-based solutions.

Market Evaluation – End Use Based Insights

The market segmentation, by end use, includes payers, providers, and patients, each driving distinct aspects of the market's development. The provider segment holds the largest market share, as healthcare organizations and hospitals continue to adopt telehealth solutions to enhance care delivery, hesitant patient for conditions such as prostate health and reach more patients. Providers benefit from the ability to offer remote consultations, manage chronic conditions more effectively, and reduce patient waiting times. The growing need for cost-efficient healthcare delivery models, particularly in response to the increasing demand for healthcare services, has significantly contributed to the adoption of telehealth among providers.

This segment is also registering robust growth due to the expansion of telemedicine services, telemonitoring, and mental health support, which are increasingly integrated into healthcare systems. The payer segment, consisting of insurance companies and government health programs, is also experiencing growth as telehealth becomes more integrated into reimbursement policies. Payers are increasingly supporting telehealth services, recognizing the potential for reducing healthcare costs by minimizing hospital readmissions and emergency room visits. The patient segment, while smaller in comparison, is growing rapidly, as patients increasingly seek the convenience of remote consultations and digital health services. The adoption of telehealth by patients is driven by its convenience, accessibility, and cost-effectiveness, especially in rural and underserved areas.

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of market revenue, driven by advanced healthcare infrastructure, high internet penetration, and the growing demand for remote healthcare services. The US, in particular, has been a key adopter of telehealth, fueled by government initiatives such as the expansion of Medicare and Medicaid coverage for telehealth services, along with significant investments in healthcare technology. The region also benefits from a high level of awareness among healthcare providers and patients about the advantages of telemedicine, including convenience and cost-effectiveness. Additionally, the COVID-19 pandemic accelerated the adoption of telehealth solutions in North America, leading to sustained demand for virtual consultations, remote patient monitoring, and digital health tools.

The Canada telehealth market is experiencing strong growth, driven by increased demand for remote healthcare services, especially in rural and underserved regions. Provinces like British Columbia and Ontario have led the way in adopting telehealth platforms supported by government funding and digital health initiatives. The COVID-19 pandemic accelerated the shift toward virtual care, making it a permanent part of Canada’s healthcare system. Many Canadians now prefer the convenience of virtual consultations for non-emergency care. Improved internet access, growing tech awareness, and a focus on reducing healthcare costs are further expanding telehealth services across the country, thereby driving the market growth.

The Europe telehealth market is experiencing steady growth, driven by the region’s advanced healthcare infrastructure, increasing healthcare costs, and the rising demand for remote care solutions. European countries, particularly those in the European Union, have made significant strides in implementing telehealth services, supported by favorable government policies and funding initiatives. The adoption of telemedicine is growing in countries such as the UK, Germany, and France, where healthcare systems are increasingly integrating telehealth into mainstream services. The COVID-19 pandemic accelerated the shift to virtual consultations, and many countries are now focusing on expanding telehealth services to address access gaps, especially in rural areas. However, the market's growth is somewhat moderated by varying regulations and reimbursement models across different European nations, which can impact the pace of adoption.

The Asia Pacific market is one of the fastest growing globally, driven by increasing healthcare demand, particularly in countries such as China, India, and Japan. The region's large population, coupled with the need for affordable and accessible healthcare, has spurred the growth of telemedicine services. In countries such as India, telehealth is gaining traction due to limited access to healthcare professionals in rural areas and a growing digital health infrastructure. Meanwhile, Japan's well-established healthcare system is increasingly adopting telehealth solutions for remote patient monitoring and elder care. The market is also witnessing increased investments in telehealth technologies, supported by government initiatives and private sector involvement. Despite this growth, challenges such as digital literacy, regulatory hurdles, and infrastructure gaps in some countries may limit the speed of telehealth market expansion in certain countries in Asia Pacific.

Key Players and Competitive Insights

A few key players include Teladoc Health, Amwell, Doctor on Demand, Livongo Health (now part of Teladoc Health), MDTech, American Well, Cerner Corporation, Babylon Health, MyTelemedicine, HealthTap, PlushCare, DoctorLink, GlobalMed, telemedico, and InTouch Health. These companies provide a wide range of telehealth services, such as virtual consultations, remote patient monitoring, and telemedicine platforms for healthcare providers. They are known for integrating advanced technologies such as artificial intelligence, cloud-based software, and wearable health devices to offer comprehensive care solutions to patients and healthcare professionals alike. Some of these companies have also ventured into areas such as mental health, chronic disease management, and urgent care, broadening the scope of telehealth services they provide.

In terms of competition, the telehealth market is characterized by a diverse group of players, each offering unique solutions catering to different aspects of healthcare delivery. Some players, including Teladoc Health, have made strategic acquisitions to strengthen their market position, such as the acquisition of Livongo Health to expand into chronic condition management. Companies such as Amwell and Doctor on Demand focus heavily on partnerships with insurance providers and healthcare systems, enabling them to integrate telehealth services within established medical networks. This trend reflects a move toward making telemedicine services an integral part of healthcare infrastructure. The competitive landscape is also shaped by regional players who focus on addressing local healthcare needs, such as GlobalMed, which provides telemedicine solutions tailored to international markets.

The key competitive strategy in the telehealth market revolves around technology integration, partnerships, and expanding service offerings. Many companies are prioritizing the development of user-friendly, scalable platforms that can be easily integrated into existing healthcare systems. Additionally, with increasing demand for mental health services and ongoing patient care, telehealth companies are expanding their services to include specialties such as behavioral health, dermatology, and chronic disease management. This diversification allows companies to capture a broader customer base. Competitive differentiation is also taking place through the use of AI and data analytics to improve the accuracy of diagnostics and patient care, as well as expanding accessibility in underserved regions.

Teladoc Health is a prominent player in the telehealth market, providing virtual healthcare services through video consultations, remote monitoring, and telemedicine platforms. It serves patients across a wide range of specialties, including general healthcare, mental health, and chronic condition management. The company is known for its broad network of healthcare professionals, allowing patients to access healthcare remotely.

Amwell is another significant player in the telehealth market, offering telemedicine solutions to healthcare providers and patients. The company enables healthcare organizations to integrate telehealth services into their operations, providing access to remote consultations, patient management, and telehealth platforms. Amwell has been particularly focused on enhancing its services for urgent care, mental health, and chronic disease management.

List of Key Companies

- American Well

- Amwell

- Babylon Health

- Cerner Corporation

- Doctor on Demand

- DoctorLink

- GlobalMed

- HealthTap

- InTouch Health

- Livongo Health (now part of Teladoc Health)

- MDTech

- MyTelemedicine

- PlushCare

- Teladoc Health

- telemedico

Telehealth Industry Developments

- In August 2024, Teladoc Health announced that it had expanded its partnership with major healthcare providers to offer more comprehensive telehealth services, particularly in the field of behavioral health.

- In April 2024, Amwell made headlines by launching a new virtual care platform for healthcare systems, aiming to streamline the delivery of remote care and expand access to healthcare services for underserved populations.

Telehealth Market Segmentation

By Product Outlook

- Hardware

- Software

- Services

By Delivery Mode Outlook

- On-Premise

- Web-Based

- Cloud-Based

By End Use Outlook

- Payers

- Providers

- Patients

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 103.80 billion |

|

Market Size Value in 2025 |

USD 128.77 billion |

|

Revenue Forecast by 2034 |

USD 898.97 billion |

|

CAGR |

24.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The telehealth market has been segmented on the basis of product, delivery mode, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The telehealth market growth and marketing strategy focuses on expanding service offerings, enhancing technology integration, and forming strategic partnerships with healthcare providers, payers, and insurance companies. Companies are investing in user-friendly platforms and advanced technologies such as artificial intelligence and remote monitoring to improve patient care and streamline healthcare delivery. Expanding access to underserved and rural populations is also a key focus, facilitated by mobile and cloud-based solutions. Additionally, companies are leveraging digital marketing, patient education, and outreach programs to increase awareness of telehealth services and build customer trust. As demand for virtual healthcare services continues to rise, telehealth providers aim to solidify their market presence through continuous innovation and collaboration with healthcare systems.

FAQ's

? The telehealth market size was valued at USD 103.80 billion in 2024 and is projected to grow to USD 898.97 billion by 2034.

? The market is projected to register a CAGR of 24.1% during the forecast period.

? North America held the largest share of the market in 2024.

? A few key players in the telehealth market include Teladoc Health, Amwell, Doctor on Demand, Livongo Health (now part of Teladoc Health), MDTech, American Well, Cerner Corporation, Babylon Health, MyTelemedicine, HealthTap, PlushCare, DoctorLink, GlobalMed, telemedico, and InTouch Health.

? The services segment accounted for the largest market share in 2024.

? The cloud-based segment accounted for the largest share of the market in 2024.

? Telehealth refers to the use of digital technologies, such as video calls, mobile apps, and remote monitoring devices, to provide healthcare services remotely. It enables patients to consult with healthcare professionals without needing to visit a clinic or hospital in person. Telehealth includes a wide range of services, such as virtual consultations, diagnostic services, remote monitoring of chronic conditions, mental health support, and follow-up care. It helps improve access to healthcare, particularly for individuals in rural or underserved areas, and is increasingly being integrated into traditional healthcare systems to enhance care delivery and reduce healthcare costs.

? A few key trends in the market are described below: Increased Adoption of Virtual Consultations: More patients are opting for virtual consultations due to convenience, cost-effectiveness, and accessibility. Integration of Artificial Intelligence: AI is being used for diagnostic support, predictive analytics, and personalized patient care to enhance telehealth services. Expansion of Telehealth Services in Rural Areas: Telehealth is being deployed in underserved regions to improve access to healthcare, particularly for remote and rural populations. Rise in Remote Patient Monitoring: Wearable devices and mobile apps are increasingly used to monitor chronic conditions and track patient health metrics remotely.

? A new company entering the telehealth market could focus on enhancing user experience through the development of intuitive, easy-to-use platforms that integrate video consultations, remote monitoring, and AI-powered diagnostics. Emphasizing services in underserved regions, particularly rural areas, where access to healthcare is limited, could help gain a strong foothold. Focusing on specialized services such as mental health care, chronic disease management, or elder care would also differentiate the company. Additionally, ensuring data security and compliance with regulations will build trust with both patients and healthcare providers. Offering seamless integration with existing healthcare systems and expanding insurance coverage options for telehealth services would further enhance competitiveness.

? Companies manufacturing, distributing, or purchasing telehealth-related products and other consulting firms must buy the report.