Laboratory Centrifuge Market Size, Share, Trends, & Industry Analysis Report

By Product, By Model Type (Equipment, Accessories), By Rotor Design, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5973

- Base Year: 2024

- Historical Data: 2020-2023

Overview

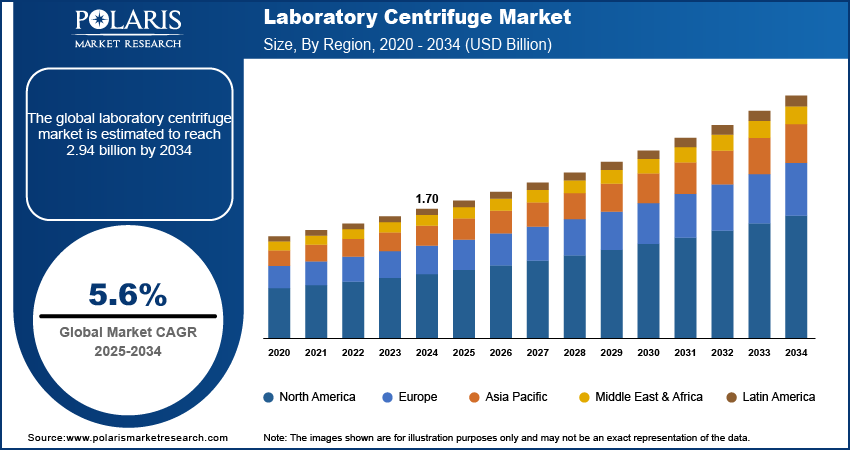

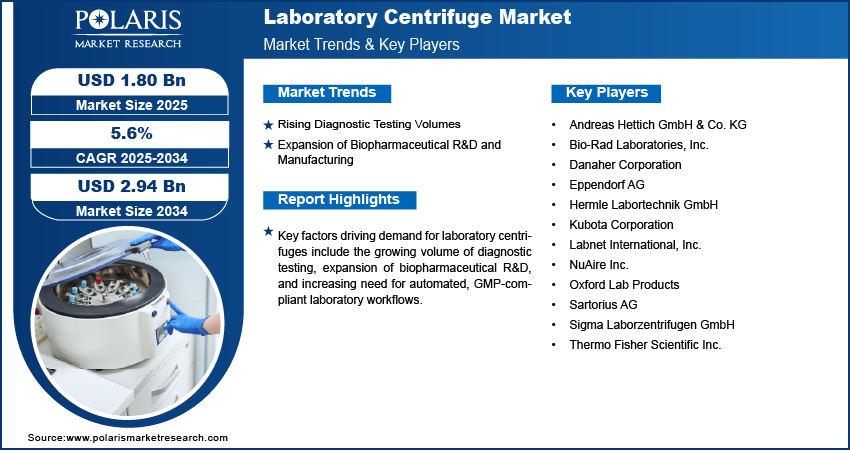

The global laboratory centrifuge market size was valued at USD 1.70 billion in 2024, growing at a CAGR of 5.6% from 2025–2034. Increasing diagnostic test volumes and growing investment in biopharmaceutical research are driving demand for laboratory centrifuges.

Key Insights

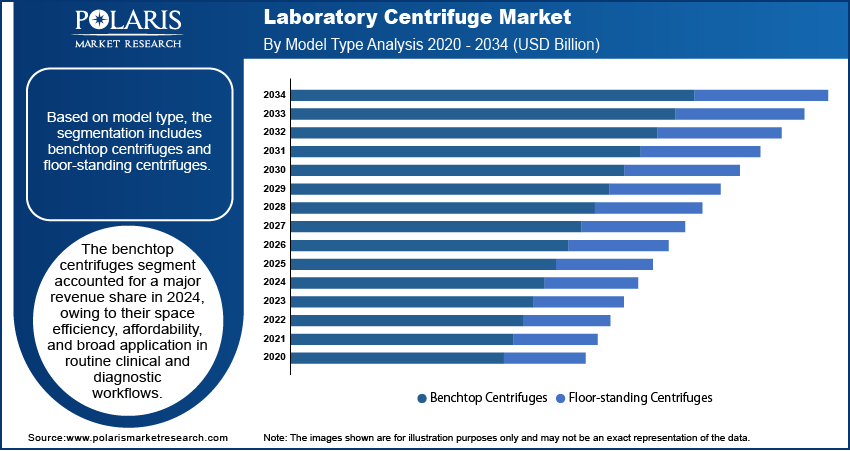

- The benchtop centrifuges segment accounted for largest market share in 2024.

- The floor-standing centrifuges segment is projected to grow at the fastest rate over the forecast period, driven by demand from pharmaceutical manufacturing and high-throughput research laboratories.

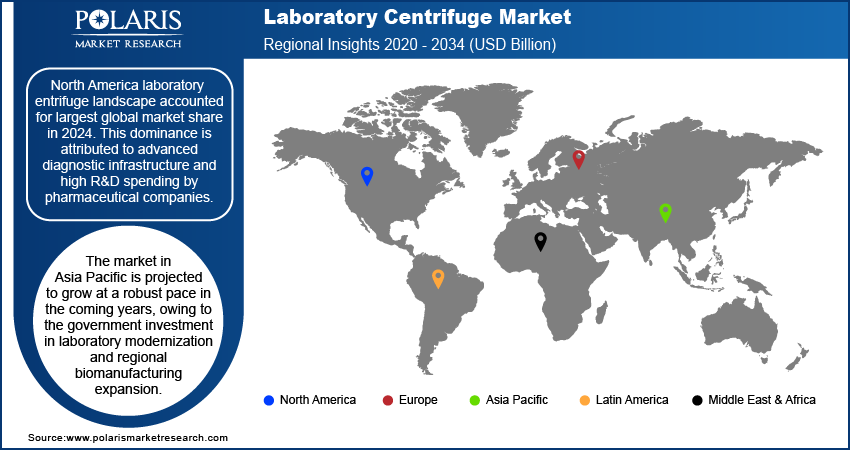

- The North America laboratory centrifuge market accounted for largest revenue share in 2024.

- The U.S. laboratory centrifuge market held largest revenue share of the North America market share in 2024, driven by centralized laboratory automation, strong clinical trial activity, and robust pharmaceutical R&D funding.

- The market in Asia Pacific is projected to grow with fastest CAGR from 2025-2034, owing to the expanding diagnostic volumes and rapid growth in biologics production.

- The India market is expanding steadily, fueled by rising diagnostics, expanding domestic manufacturing, and cost-effective adoption of centrifuge systems.

Laboratory centrifuges are essential instruments used to separate biological components by applying centrifugal force. These devices play a critical role in sample processing workflows such as blood component separation, cell pellet recovery, DNA extraction, and protein purification. Centrifuges are widely deployed in clinical laboratories, pharmaceutical manufacturing, academic research institutes, and biotechnology companies. Operational efficiency, precision control, and compliance with safety and quality standards are key selection criteria for users.

Rising demand for molecular testing and cell-based assays is accelerating the adoption of advanced centrifugation technologies. Rapid growth in personalized medicine, infectious disease screening, and vaccine R&D is increasing the volume of biological sample processing. The market is witnessing growing demand for high-throughput and refrigerated models with programmable settings, digital interfaces, and safety interlocks.

To Understand More About this Research: Request a Free Sample Report

Centrifuge manufacturers are investing in innovations such as automated rotor recognition, imbalance detection, and maintenance alerts to enhance operational reliability and minimize downtime. Regulatory compliance is a key priority, with end-users requiring equipment that complies with global standards, including FDA 21 CFR Part 11, CE marking, ISO 13485, and GMP guidelines.

Increasing adoption of automation in life sciences and healthcare laboratories is boosting integrated centrifuge platforms with robotic arms, IoT connectivity, and cloud-based performance monitoring. These systems reduce human error, enhance traceability, and improve sample consistency. Additionally, the rising number of clinical trials globally is driving the growth of the market, due to the use of validated centrifuge systems to process clinical specimens under strict quality protocols by pharmaceutical companies. According to the World Health Organization (WHO), around 39,952 clinical trials were conducted worldwide in 2024, up from 30,669 in 2010, showing a 30.3% increase over the period. Growth in biologics manufacturing and expansion of BSL-3/BSL-4 laboratories are further driving demand for specialized centrifuge units with sealed rotors and aerosol containment features.

Industry Dynamics

- Rising diagnostic test volumes in infectious disease and oncology screening are driving the need for precise and high-throughput centrifuge systems in clinical laboratories.

- Expansion of biopharmaceutical R&D and manufacturing fuels the market growth for processing sensitive biological materials under strict quality protocols.

- Rising demand for traceable, audit-ready workflows is creating opportunities for centrifuge systems integrated with LIMS platforms for centralized monitoring and data management.

- High capital investment and maintenance costs are limiting scalability in budget-constrained laboratories.

Rising Diagnostic Testing Volumes: The growing prevalence of chronic and infectious diseases is increasing the volume of diagnostic tests conducted across hospital laboratories, diagnostic centers, and public health institutions. According to the latest report by World Health Organization (WHO) 2024, chronic diseases such as heart disease, stroke, cancer, diabetes, and chronic respiratory conditions led to around 43 million deaths worldwide in 2021, accounting for 75% of all non-pandemic deaths. About 18 million of these were premature deaths, mostly in low- and middle-income countries. Laboratory centrifuges play a critical role in sample separation workflows such as blood fractionation, urine sedimentation, and viral load analysis. As diagnostic testing becomes more essential to early disease detection and treatment planning, laboratories are adopting high-speed, automated centrifuges to improve throughput and accuracy. According to the World Health Organization, diagnostic services contributed to half of clinical decision-making globally in 2024, highlighting the critical role of centrifugation in evidence-based healthcare delivery.

Expansion of Biopharmaceutical R&D and Manufacturing: Rapid growth in biologics, cell and gene therapies, and personalized medicine is driving demand for laboratory centrifuges in biopharmaceutical R&D and production. Centrifugation is essential in upstream and downstream processes, including cell harvesting, protein clarification, and purification of therapeutic agents. Biopharma companies and contract development and manufacturing organizations (CDMOs) are investing in scalable, GMP-compliant centrifuge systems to meet quality and regulatory requirements. Advanced centrifuges with temperature control, sealed rotors, and automation features are adopted to handle sensitive biologics. This expansion is driving the need for validated centrifugation solutions across discovery, clinical, and commercial-scale operations.

Segmental Insights

Product Analysis

Based on the product, the segmentation includes equipment and accessories. The equipment segment accounted for largest revenue share in 2024, due to rising demand for advanced centrifuge systems across diagnostics, biotechnology, and pharmaceutical settings is driving this segment. Equipment such as refrigerated centrifuges, high-speed benchtop units, and automated floor-standing models is preferred for their performance efficiency and regulatory compliance. Laboratories seek robust devices capable of high-throughput, precise control, and compatibility with biohazard safety protocols. Continuous product innovations and growing procurement by diagnostic chains and research labs are boosting this segment’s leading position in overall market revenue.

The accessories segment is projected to grow at the fastest pace during the forecast period, owing to rising replacement cycles and demand for specialized components. Laboratories require compatible rotors, buckets, tube adapters, and sealing lids to support diverse applications, including blood separation, DNA extraction, and cell culturing. The need for rotor upgrades to meet evolving biosafety standards and performance requirements is further accelerating accessory sales. Additionally, OEM and third-party vendors are expanding their portfolios with customizable, application-specific centrifuge components, enabling greater operational flexibility for end users.

Model Type Analysis

By model type, the market includes benchtop centrifuges and floor-standing centrifuges. The benchtop centrifuges segment held the largest revenue share in 2024, driven by their compact footprint, ease of use, and suitability for a wide range of applications. These models are extensively used in clinical laboratories, academic research settings, and diagnostic centers for routine blood processing, protein assays, and nucleic acid isolation. Their cost-effectiveness and versatility make them a preferred choice in small to mid-sized laboratories. Manufacturers continue to enhance benchtop models with digital displays, imbalance detection, and rotor recognition technologies to improve user safety and throughput without occupying significant laboratory space.

The floor-standing centrifuges segment is anticipated to grow at the fastest rate, owing to increasing demand from large-volume testing facilities and pharmaceutical manufacturing units. These systems offer higher capacity, stronger centrifugal force, and better temperature control, making them ideal for high-throughput sample processing. Their application spans bioproduction workflows, blood banking, and genomic research, requiring consistent, large-batch separations. Rising deployment in biopharmaceutical facilities and reference laboratories across developed markets is contributing to this segment’s rapid growth, alongside the increasing need for scalable and automated laboratory instrumentation.

Rotor Design Analysis

Based on rotor design, the segmentation includes fixed-angle rotors, swinging-bucket rotors, vertical rotors, and other rotors. The fixed-angle rotors segment accounted for largest revenue share in 2024, due to their widespread use in standard laboratory applications, including pelleting cells, bacteria, and precipitated proteins. These rotors enable efficient sedimentation at higher speeds and shorter durations, fueling productivity across diagnostic and research settings. Their compatibility with various tube sizes and rugged design makes them a preferred choice for routine centrifugation tasks. Continued use in clinical labs, coupled with minimal maintenance requirements and reliable separation performance, sustains their dominance in the global market.

The swinging-bucket rotors segment is projected to grow at the fastest pace during the forecast period, owing to rising demand for even sedimentation and separation of layered samples. These rotors are ideal for blood component fractionation, density gradient separations, and cytology applications. Their ability to maintain horizontal position during operation ensures better separation and minimal cross-contamination. Increased use in clinical diagnostics for platelet-rich plasma and cell suspension protocols is driving adoption. Product enhancements such as sealed buckets and autoclavable components are driving growth in biosafety-sensitive environments.

Application Analysis

Based on application, the segmentation includes diagnostics, microbiology, cellomics, genomics, proteomics, blood component separation, and other applications. The blood component separation segment accounted for significant revenue share in 2024, due to its widespread use of centrifugation in processing whole blood into plasma, platelets, and red blood cells. Hospitals, blood banks, and transfusion centers require high-performance centrifuges for consistent and sterile separation. Rising blood donation rates and therapeutic demand for specific components are supporting the segment’s growth. Additionally, adherence to strict quality standards and cold chain protocols makes advanced centrifuge models indispensable in blood banking.

The genomics segment is projected to grow at the fastest pace during the forecast period, owing to increasing research in DNA sequencing, genetic diagnostics, and gene editing. Centrifuges play a critical role in nucleic acid extraction, purification, and quantification workflows. As genomics expands into personalized medicine, oncology, and infectious disease research, demand for high-speed and temperature-controlled centrifuges is rising. Advanced models with compatibility for microtubes and PCR strips are growing in research and commercial genomics labs. Investment in genomic infrastructure in Asia Pacific and North America is further boosting segment expansion.

End User Analysis

By end user, the market includes hospitals, biotechnology & pharmaceutical companies, and academic & research institutions. The hospitals segment held the largest revenue share in 2024, driven by the high volume of diagnostic testing and in-house laboratory services. For instance, in July 2024, Drucker Diagnostics expanded its DASH STAT centrifuge family with three new models, such as the compact DASH Apex 4, the versatile DASH Flex 6, and an upgraded DASH Coag tailored for fast, reliable performance in busy hospital labs. Centrifuges are routinely used in hematology, biochemistry, and microbiology departments for blood and urine processing. Hospital labs require reliable, easy-to-maintain centrifuge systems that comply with clinical safety regulations and integrate into existing diagnostic workflows. Rising patient admissions and expanding outpatient diagnostic services continue to drive procurement in this segment.

The biotechnology & pharmaceutical companies segment is anticipated to grow at the fastest rate, owing to increasing R&D investments and biologics manufacturing. These companies utilize centrifuges for cell separation, protein extraction, and process development under GMP conditions. Growing biologics pipelines, expansion of biomanufacturing capacity, and emphasis on process scalability are driving centrifuge adoption. High-performance and customizable systems that meet stringent quality and traceability standards are preferred in late-phase development and commercial production environments.

Regional Analysis

The North America laboratory centrifuge market accounted for largest global market share in 2024. This dominance is primarily driven by advanced diagnostic infrastructure and strong R&D funding. Clinical laboratories across the U.S. and Canada are adopting automated centrifuge systems to support large-scale testing in blood banks, pathology labs, and infectious disease screening. As an example, in August 2023, Boekel Scientific introduced a new range of centrifuges with 11 models in the US. It features programmable settings, removable rotors, and supports 6 to 24 tubes for various lab applications. Moreover, the presence of major pharmaceutical and biotechnology companies with high investment in bioprocessing workflows continues to support demand for GMP-compliant, temperature-controlled centrifuge equipment. These systems are critical for sample processing in preclinical research and biologics manufacturing. Continuous upgrades in laboratory automation is further driving the market growth across North America.

US Laboratory Centrifuge Market Insight

The U.S. held largest regional share in North America laboratory centrifuge landscape in 2024, driven by the country’s leadership in pharmaceutical R&D and its extensive clinical trial infrastructure. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), the U.S. biopharma sector invested over USD 100 billion in R&D in 2023. This is creating sustainable demand for high-capacity centrifuges in drug discovery and manufacturing. Additionally, the expansion of decentralized diagnostic networks and point-of-care testing is increasing the procurement of compact benchtop models that support high-throughput blood processing across outpatient settings and regional diagnostic labs.

Asia Pacific Laboratory Centrifuge Market

The market in Asia Pacific is projected to witness fastest CAGR during the forecast period, driven by expanding public health diagnostics and local biopharma manufacturing. Countries such as China and South Korea are investing heavily in laboratory automation to improve disease surveillance and molecular testing capabilities. These efforts are accelerating the adoption of mid-speed and high-speed centrifuge systems across hospitals and national reference laboratories. Additionally, the expansion of biologics and vaccine production facilities across the region is driving demand for floor-standing centrifuges equipped with temperature control and aerosol-tight rotors in BSL-3 environments. Thus, these developments position Asia Pacific as the fastest-growing regional market.

India Laboratory Centrifuge Market Overview

The market in India is expanding due to the growth of diagnostic services and domestic biopharmaceutical manufacturing. Rapidly increasing test volumes across public and private diagnostic chains are driving procurement of benchtop centrifuge systems for routine blood, serum, and urine processing. Moreover, Indian pharmaceutical and vaccine manufacturers are scaling up R&D infrastructure and require validated centrifuges for cell separation, protein purification, and sterile processing. For instance, in January 2024, Coalition for Epidemic Preparedness Innovations (CEPI) invested up to USD 30 million in Serum Institute of India (SII) to enhance rapid and affordable vaccine production for infectious disease. Local availability of cost-effective models and favorable regulatory policies are driving adoption. These trends coupled with India’s growing clinical trial activity are creating the country’s position as a key contributor to regional market growth.

Europe Laboratory Centrifuge Market

The laboratory centrifuge landscape in Europe is projected to hold a substantial share in 2034, driven by regulatory consistency and high-volume research activity. The region’s centralized oversight by the European Medicines Agency (EMA) and Medicines and Healthcare products Regulatory Agency (MHRA) ensures predictable approval pathways and equipment procurement to comply with biosafety and traceability requirements. Additionally, academic and clinical research institutions across Germany, France, and the UK continue to expand molecular biology, proteomics, and vaccine research programs. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), pharmaceutical R&D spending in the European Union (EU) increased from USD 31.81 billion in 2010 to USD 54.43 billion in 2022, growing at an average annual rate of 4.4%. These facilities require reliable centrifuge systems capable of fueling high-speed, application-specific sample processing. Europe remains a critical hub for centrifuge deployment in clinical and research environments due to the growing demand for precision diagnostics and biologics.

Key Players & Competitive Analysis Report

The laboratory centrifuge market is moderately consolidated, with key players competing on product innovation, regulatory compliance, and application versatility. Leading manufacturers are investing in high-performance, automated centrifuge systems with features such as digital interfaces, rotor recognition, and cold-chain compatibility to meet clinical and research demands. Moreover, strategic initiatives include expanding regional manufacturing, integrating with LIMS platforms, and strengthening aftermarket service networks. Additionally, companies are focusing on compact and energy-efficient models to cater to decentralized diagnostics and bioprocessing workflows.

Major companies operating in the laboratory centrifuge industry include Thermo Fisher Scientific Inc., Eppendorf AG, Danaher Corporation, Andreas Hettich GmbH & Co. KG, Sartorius AG, Kubota Corporation, NuAire Inc., Sigma Laborzentrifugen GmbH, Hermle Labortechnik GmbH, Oxford Lab Products, Bio-Rad Laboratories, Inc., and Labnet International, Inc.

Key Players

- Andreas Hettich GmbH & Co. KG

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eppendorf AG

- Hermle Labortechnik GmbH

- Kubota Corporation

- Labnet International, Inc.

- NuAire Inc.

- Oxford Lab Products

- Sartorius AG

- Sigma Laborzentrifugen GmbH

- Thermo Fisher Scientific Inc.

Industry Developments

- June 2025: OHAUS launched the Frontier 5706P Multi Centrifuge, designed for efficient and compact lab centrifugation. It features an intuitive interface, quick-spin function, and programmable settings for streamlined sample processing.

- May 2025: ELMI North America launched the CM-50 Pro micro-centrifuge with a compact design and speed up to 15,000 RPM. It features a touchscreen, 11 preset programs, and supports quick and efficient lab sample processing.

- January 2025: Dynarex introduced its LabChoice product line, featuring precision lab tools including centrifuge tubes and accessories to support sample processing. The range aims to enhance efficiency in laboratory centrifugation and other routine procedures.

Laboratory Centrifuge Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Equipment

- Multipurpose Centrifuges

- Microcentrifuges

- Ultracentrifuges

- Preparative Ultracentrifuges

- Analytical Ultracentrifuges

- Mini centrifuges

- Other Equipment

- Accessories

- Rotors

- Tubes

- Centrifuge Bottles

- Buckets

- Plates

- Other Accessories

By Model Type Outlook (Revenue, USD Billion, 2020–2034)

- Benchtop Centrifuges

- Floor-standing Centrifuges

By Rotor Design Outlook (Revenue, USD Billion, 2020–2034)

- Fixed-angle Rotors

- Swinging-bucket Rotors

- Vertical Rotors

- Other Rotors

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Diagnostics

- Microbiology

- Cellomics

- Genomics

- Proteomics

- Blood Component Separation

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutions

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Laboratory Centrifuge Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.70 Billion |

|

Market Size in 2025 |

USD 1.80 Billion |

|

Revenue Forecast by 2034 |

USD 2.94 Billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.70 billion in 2024 and is projected to grow to USD 2.94 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Thermo Fisher Scientific Inc., Eppendorf AG, Danaher Corporation, Andreas Hettich GmbH & Co. KG, Sartorius AG, Kubota Corporation, NuAire Inc., Sigma Laborzentrifugen GmbH, Hermle Labortechnik GmbH, Oxford Lab Products, Bio-Rad Laboratories, Inc., and Labnet International, Inc.

The benchtop centrifuges segment dominated the market in 2024. This is due to their widespread use in hospital labs, diagnostic centers, and academic institutions for routine sample processing.

The biotechnology and pharmaceutical segment is expected to witness the fastest growth during the forecast period, owing to increasing investments in biologics R&D and rising demand for GMP-compliant centrifugation systems.