Centrifuge Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Laboratory Centrifuge, Medical Centrifuge, Industrial Centrifuge, and Other Centrifuges), Capacity, Speed Range, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM5563

- Base Year: 2024

- Historical Data: 2020-2023

Centrifuge Market Overview

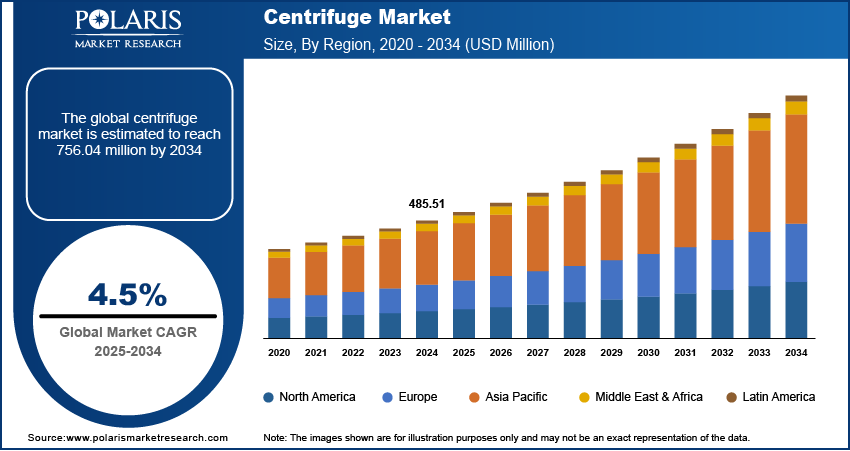

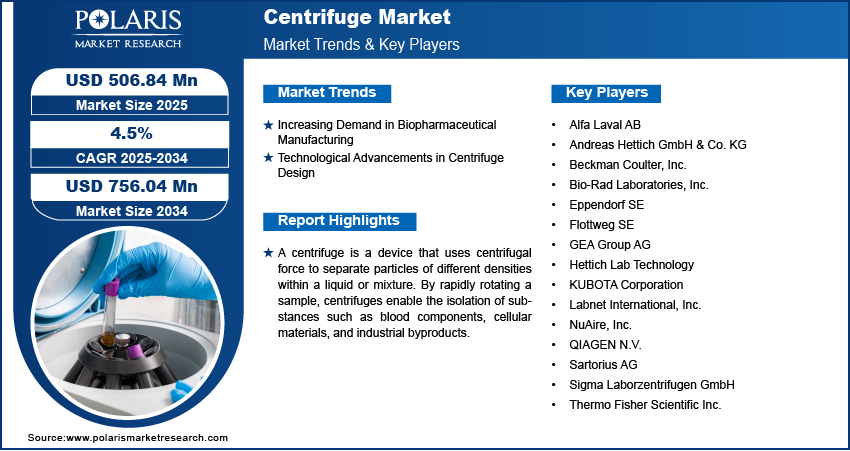

The centrifuge market size was valued at USD 485.51 million in 2024. The market is projected to grow from USD 506.84 million in 2025 to USD 756.04 million by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

The centrifuge market focuses on the manufacturing, distribution, and application of centrifuge equipment used in laboratories, industrial processes, and medical diagnostics. Centrifuges are critical for separating substances of different densities, including biological samples, chemicals, and wastewater components. The market is driven by advancements in biotechnology, increasing demand for diagnostics, and the expanding pharmaceutical and healthcare sectors. Additionally, the growing need for efficient water and wastewater treatment and industrial processing applications further supports centrifuge market demand. Technological innovations, such as high-speed and automated centrifuges, are also enhancing operational efficiency and broadening application scope.

Key drivers of the centrifuge market growth include the rising prevalence of chronic diseases, leading to increased diagnostic testing, as well as stringent regulatory requirements for pharmaceutical and biotechnology research. The expansion of the food and beverage industry, where centrifuges are used for quality control and processing, also contributes to market growth. Furthermore, the adoption of high-capacity and energy-efficient centrifuges is gaining traction in industrial and laboratory applications.

To Understand More About this Research: Request a Free Sample Report

Centrifuge Market Dynamics

Increasing Demand in Biopharmaceutical Manufacturing

Centrifuge devices are essential for processes such as cell harvesting, protein purification, and viral vector separation. The surge in biologics and personalized medicine production necessitates efficient separation technologies to ensure product purity and efficacy. For instance, Sartorius introduced a high-capacity bioprocess centrifuge in July 2023 to meet the escalating needs of large-scale biopharmaceutical manufacturing. Thus, the biopharmaceutical industry's expansion significantly drives the centrifuge market development.

Technological Advancements in Centrifuge Design

Continuous technological advancements in centrifuge design have led to the development of centrifuges with enhanced automation, improved safety features, and energy-efficient models, thereby boosting their performance and reliability. These advancements reduce human error, streamline processes, and lower operational costs, making centrifuges more appealing across various applications. For example, in April 2023, Eppendorf launched a new series of microcentrifuges featuring advanced rotor designs and intuitive digital controls, enhancing laboratory efficiency and user experience. Hence, the rising technological advancements in centrifuge design contribute to the centrifuge market opportunities.

Centrifuge Market Segment Insights

Centrifuge Market Assessment – By Product Type

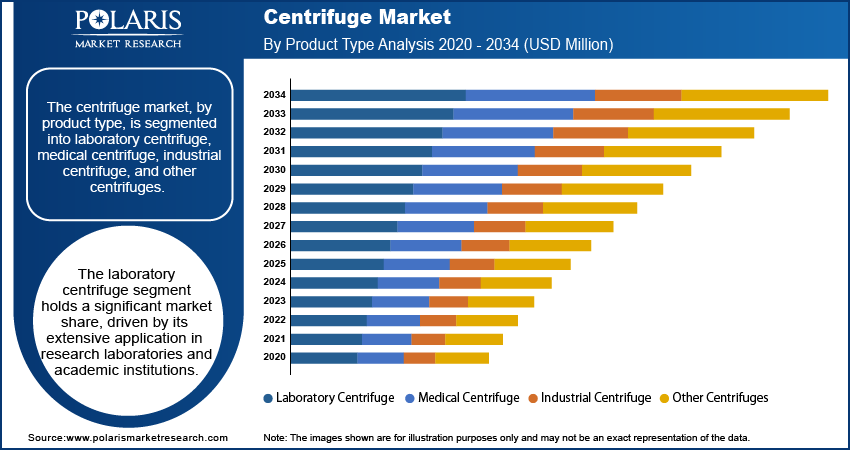

The centrifuge market, by product type, is segmented into laboratory centrifuge, medical centrifuge, industrial centrifuge, and other centrifuges. The laboratory centrifuge segment holds a significant centrifuge market share, driven by its extensive application in research laboratories and academic institutions. These centrifuges are essential for processes such as cell culture, protein purification, and nucleic acid extraction. The demand for efficient and accurate sample separation techniques has led to technological advancements, with key industry participants focusing on developing novel equipment.

Centrifuge Market Evaluation – By Capacity

The centrifuge market, by capacity, is segmented into small capacity, medium capacity, and large capacity. The medium capacity segment holds a significant centrifuge market revenue share, driven by its versatility and widespread application across various industries. These centrifuges, typically accommodating volumes between 10 to 100 liters, are extensively utilized in sectors such as biotechnology, pharmaceuticals, and wastewater treatment. Their ability to efficiently process moderate sample sizes makes them ideal for research laboratories and industrial processes that require reliable separation techniques. The growing emphasis on research and development activities, coupled with the need for efficient sample processing, has led to increased adoption of medium-capacity centrifuges. Additionally, advancements in centrifuge technology have enhanced the performance and user-friendliness of these devices, further boosting their demand in the market.

Centrifuge Market Regional Insights

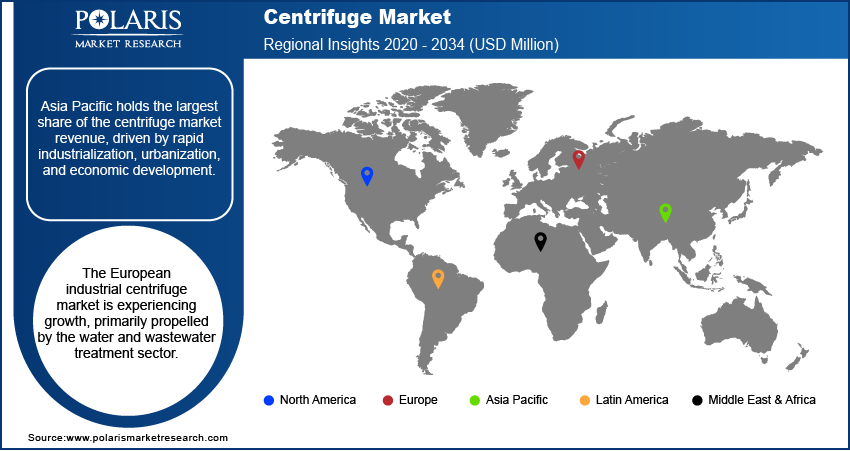

By region, the study provides centrifuge market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the market, driven by rapid industrialization, urbanization, and economic development. These factors have led to increased demand across sectors such as oil and gas, pharmaceuticals, and wastewater treatment. The region's focus on environmental testing and sustainability and stringent regulatory frameworks has further propelled the adoption of centrifuges for efficient liquid-solid separation. Additionally, significant investments in research and development have contributed to technological advancements, enhancing the efficiency and appeal of centrifuge technologies in the region.

The European industrial centrifuge market is experiencing growth, primarily propelled by the growing demand from the water and wastewater treatment sector. Government initiatives aimed at environmental protection have led to significant investments in wastewater treatment facilities across the region. For instance, the European Investment Bank allocated approximately USD 21.4392 million in December 2021 for constructing a new wastewater treatment plant in Mitrovica, Kosovo, and for rehabilitating existing wastewater collection systems.

Centrifuge Market – Key Players and Competitive Insights

The centrifuge market comprises several active key players contributing to its dynamic landscape. Notable companies include Thermo Fisher Scientific Inc., Eppendorf AG, Beckman Coulter (a subsidiary of Danaher Corporation), Sartorius AG, QIAGEN, Hettich Lab Technology, Labnet International, Bio-Rad Laboratories, KUBOTA Corporation, NuAire, Sigma Laborzentrifugen GmbH, Andreas Hettich GmbH & Co. KG, Flottweg SE, Alfa Laval AB, GEA Group AG, and others.

The companies offer a diverse range of centrifuge products catering to various industries, including biotechnology, pharmaceuticals, and environmental science. Thermo Fisher Scientific Inc. and Eppendorf AG are recognized for their comprehensive laboratory centrifuge portfolios, addressing the needs of research and clinical laboratories. Beckman Coulter, under Danaher Corporation, provides advanced centrifugation solutions emphasizing automation and efficiency. Sartorius AG and QIAGEN focus on integrating centrifugation with molecular biology workflows, enhancing sample preparation and analysis processes.

In the industrial sector, companies such as Alfa Laval AB, GEA Group AG, and Flottweg SE specialize in large-scale centrifuge systems designed for applications such as wastewater treatment, food and beverage processing, and chemical production. These organizations invest in research and development to innovate energy-efficient and high-performance centrifuges, aligning with global sustainability trends. The competitive landscape is characterized by continuous product development, strategic partnerships, and a commitment to meeting the evolving demands of diverse end-user industries.

Thermo Fisher Scientific Inc. is a prominent provider of scientific instrumentation, reagents, and consumables, serving sectors such as healthcare, life sciences, and industrial applications. The company offers a comprehensive range of products, including laboratory equipment, analytical instruments, and diagnostic tools, supporting research and development activities globally.

Bio-Rad Laboratories, Inc., founded in 1952 by David and Alice Schwartz, is a life sciences and clinical diagnostics company headquartered in Hercules, California. Bio-Rad focuses on developing and manufacturing instruments, software, reagents, and consumables for research in cell biology, gene expression, protein purification, drug discovery, food safety, and science education. Its diagnostic products are used in blood transfusion, diabetes monitoring, autoimmune disease testing, and infectious disease diagnostics. Bio-Rad's centrifuge offerings include the ID-Centrifuge L, which is designed to handle various laboratory tasks. This device combines gel card, traditional tube, and sample centrifugation capabilities using interchangeable heads. It automatically adjusts its settings based on the installed head type. The centrifuge features a post-transportation ID-card centrifugation head, an analytical centrifuge head, a traditional tube centrifuge head, and a sample tube centrifuge head. The device is equipped with a touchscreen interface for ease of use. Bio-Rad operates in multiple regions worldwide, including North America, Europe, Asia, and other areas such as Canada and Latin America.

List of Key Companies in Centrifuge Market

- Alfa Laval AB

- Andreas Hettich GmbH & Co. KG

- Beckman Coulter, Inc. (a subsidiary of Danaher Corporation)

- Bio-Rad Laboratories, Inc.

- Eppendorf SE

- Flottweg SE

- GEA Group AG

- Hettich Lab Technology

- KUBOTA Corporation

- Labnet International, Inc.

- NuAire, Inc.

- QIAGEN N.V.

- Sartorius AG

- Sigma Laborzentrifugen GmbH

- Thermo Fisher Scientific Inc.

Centrifuge Industry Developments

- February 2025: Thermo Fisher announced its agreement to acquire Solventum's purification and filtration division for approximately USD 4.1 billion. This strategic move aims to enhance Thermo Fisher's bioprocessing capabilities by entering the filtration segment, complementing its existing services in accelerating drug development for biopharmaceutical companies.

Centrifuge Market Segmentation

By Product Type Outlook (Revenue-USD Million, 2020–2034)

- Laboratory Centrifuge

- Medical Centrifuge

- Industrial Centrifuge

- Other Centrifuges

By Capacity Outlook (Revenue-USD Million, 2020–2034)

- Small Capacity

- Medium Capacity

- Large Capacity

By Speed Range Outlook (Revenue-USD Million, 2020–2034)

- Low Speed

- Medium Speed

- High Speed

By Application Outlook (Revenue-USD Million, 2020–2034)

- Blood Separation

- Biotechnology

- Pharmaceutical

- Food & Beverage

- Oil & Gas

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Centrifuge Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 485.51 million |

|

Market Size Value in 2025 |

USD 506.84 million |

|

Revenue Forecast by 2034 |

USD 756.04 million |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 485.51 million in 2024 and is projected to grow to USD 756.04 million by 2034.

The market is projected to register a CAGR of 4.5% during the forecast period.

North America held the largest share of the market in 2024.

A few notable companies include Thermo Fisher Scientific Inc., Eppendorf AG, Beckman Coulter (a subsidiary of Danaher Corporation), Sartorius AG, QIAGEN, Hettich Lab Technology, Labnet International, Bio-Rad Laboratories, KUBOTA Corporation, NuAire, Sigma Laborzentrifugen GmbH, Andreas Hettich GmbH & Co. KG, Flottweg SE, Alfa Laval AB, and GEA Group AG.

The laboratory centrifuge segment accounted for the largest share of the market in 2024.

A centrifuge is a mechanical device used to separate components of a mixture based on their density by applying centrifugal force.