Water and Wastewater Treatment Equipment Market Size, Share, Trends, Industry Analysis Report

By Type (Membrane Separation, Disinfection, Biological, Sludge Treatment, Others), By Process, By Application, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2476

- Base Year: 2024

- Historical Data: 2020-2023

Overview

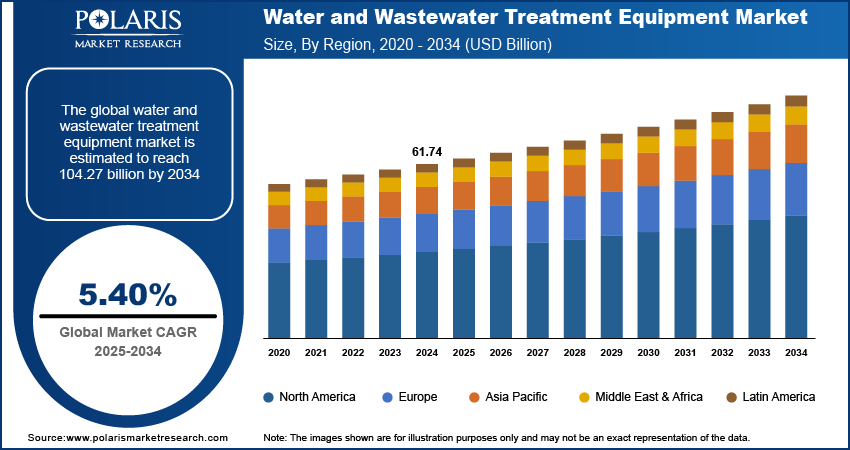

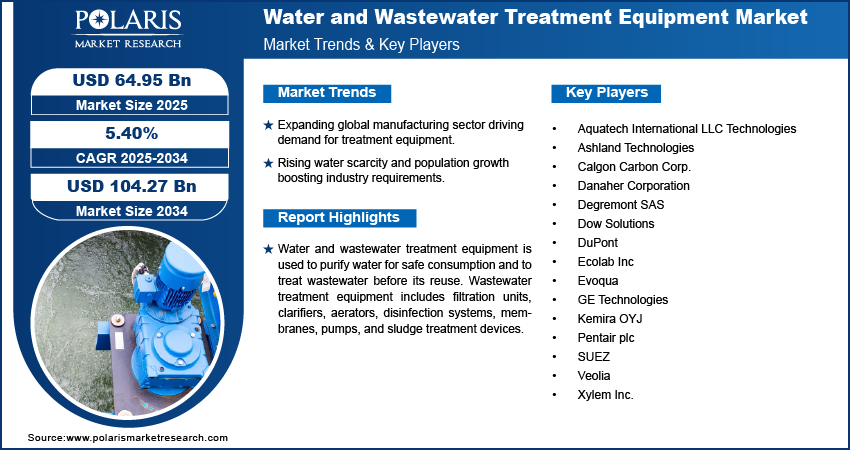

The global water and wastewater treatment equipment market size was valued at USD 61.74 billion in 2024. The market is projected to grow at a CAGR of 5.40% during 2025 to 2034. Key factors driving demand for water and wastewater treatment equipment include increasing global population and urbanization, growing water scarcity and pollution, stricter government regulations on water quality and discharge, and rapid industrialization.

Key Insights

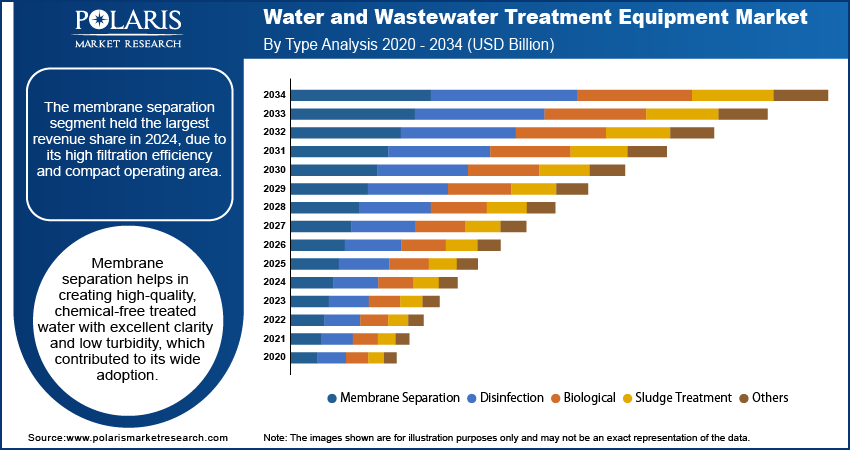

- The membrane separation segment held the largest revenue share in 2024, due to its high filtration efficiency and compact operating area.

- Based on the process, the tertiary segment accounted for a major revenue share in 2024 due to its high usage to improve water emission quality before reusing.

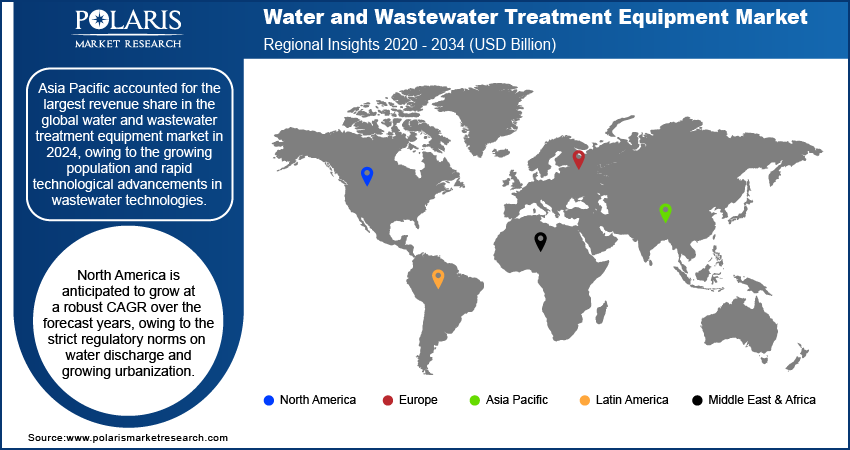

- Asia Pacific accounted for the largest revenue share in the global water and wastewater treatment equipment market in 2024, owing to the growing population and rapid technological advancements in wastewater technologies.

- North America is anticipated to grow at a robust CAGR over the forecast years, owing to the strict regulatory norms on water discharge and growing urbanization.

Industry Dynamics

- The rising penetration of manufacturing industries across the world fuels the industry growth.

- The growing public awareness, rising water scarcity, and an increase in population are also anticipated to increase demand for water and wastewater treatment equipment.

- The rising investments by the government for cleaning water bodies in major emerging economies are creating a lucrative market opportunity.

- High energy consumption may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 61.74 Billion

- 2034 Projected Market Size: USD 104.27 Billion

- CAGR (2025-2034): 5.40%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Water and wastewater treatment equipment is used to purify water for safe consumption and to treat wastewater before its reuse. Wastewater treatment equipment includes filtration units, clarifiers, aerators, disinfection systems, membranes, pumps, and sludge treatment devices. The main goal of this equipment is to remove contaminants such as suspended solids, harmful microorganisms, chemicals, and organic matter. This machine is used in municipal, industrial, and commercial spaces for safe drinking water production and industrial process water recycling. Water and wastewater treatment equipment also helps meet regulatory standards and promote sustainability.

Wastewater treatment equipment is widely used in urban areas to supply safe drinking water and manage sewage. Equipment such as filtration systems, disinfection units, and sludge treatment is used to ensure that contaminants are removed from water sources and wastewater is treated before being discharged back into rivers or reused. This equipment protects public health. Water treatment equipment is used in industries such as chemicals, pharmaceuticals, and others to purify process water, recycle wastewater, and meet stringent discharge regulations. Hotels, office buildings, hospitals, and shopping complexes further use compact water and wastewater treatment systems to provide clean drinking water.

Industry Dynamics

Market Drivers

The growth in urbanization is leading to the market growth. United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population in 2050. This is increasing the need for infrastructure to provide safe drinking water and manage sewage efficiently, which is driving the the adoption of wastewater treatment equipment. Urbanization is further propeling the contruction of residential complexes, commercial spaces, and industrial hubs. This is creating need for clean water supply and effective wastewater management, which is leadint to the market frowth. Moreover, the growing population in countries such as India and China along with government focus on safe drinking water is driving the demand for wastewater treatment equipment.

Report Segmentation

The market is primarily segmented based on type, process, application, and region.

|

By Type |

By Process |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Membrane Separation Segment Accounted for the Largest Market in 2024

The membrane separation segment held the largest revenue share in 2024, due to its high filtration efficiency and compact operating area. Membrane separation helps in creating high-quality, chemical-free treated water with excellent clarity and low turbidity, which contributed to its wide adoption. The low energy consumption of membrane separation further propelled many industries to turn to this system for removing water containments with lower operating cost. These factors led the segment dominance in 2024.

The biological treatment segment is projected to grow at a robust pace in the coming years. Various developed countries such as the U.S., Canada, Japan, and Germany are enhancing the usage of biological cleaning equipment by imposing stringent regulations for minimizing water pollution in the manufacturing sectors by using such eco-friendly methods.

Tertiary Segment Accounted for the Largest Market Share in 2024

Based on the process, the tertiary segment dominated the revenue share in 2024, due to its high usage to improve water emission quality before reusing and discharging the same in the ecosystem. In the tertiary process, effluent is reused by removing inorganic elements such as viruses, bacteria, and parasites, and therefore, making the water ideal for reuse. The segment's dominance is further attributed to its ability to help in meeting compliance with stringent environmental regulations. Agricultural irrigation and public water supply contributed to the segment's dominance as these sector heavily use tertiary process for the treatment of water.

Asia Pacific Dominated the Global Water and Wastewater Treatment Equipment Market in 2024

The Asia Pacific water and wastewater treatment equipment market held the largest revenue share in 2024. This dominance is attributed to the high presence of manufacturing facilities, particualry in countries like South Korea, India, China, and Japan. The growing population in countries like India and China also created the demand for water and wastewater treatment equipment. The increasing deployment of regulation norms on safe discharing of wastewater into water bbodies further contributed to the market dominance in the region. Moreover, the high urban population in the region lead the adoption of water and wastewater treatment equipment in 2024. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050.

North America is anticipated to grow at a robust CAGR over the forecast years, owing to the strict regulatory norms on water discharge and growing urbanization. The existence of prominent market companies in the region along with rapid technolgical advancemet in wastewater treatment equipment is driving the market in the region. The high awarness among people about the water-borne diseases is further leading the market growth. Increasing product launches and growing government investment in the development of water treatment facilities is fueling the market revenue in the region.

Competitive Insight

Some of the major players operating in the global wastewater treatment equipment market include Ashland Technologies, Aquatech International LLC Technologies, Calgon Carbon Corp., Danaher Corporation, Degremont SAS, Dow Solutions, DuPont, Ecolab Inc, Evoqua, GE Technologies, Kemira OYJ, Pentair plc, SUEZ, Veolia, and Xylem Inc.

Recent Developments

- In March 2021, Xylem Inc., extended its emphasis on smart H2O technology to focus on H2O shortage and operational costs concerns. The company Xylem Inc. intends to acquire several smart H2O companies and also intends in making R&D investments.

- Further, Danaher Corporation has made substantial investments in industrial capital punishment and innovation, which will aid them in gaining market presence in the wastewater treatment equipment market. The company is also intending to expand its product portfolio with surging development for delivering long-term and sustainable investor value.

Water and Wastewater Treatment Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 61.74 billion |

| Market size value in 2025 | USD 64.95 billion |

|

Revenue forecast in 2034 |

USD 104.27 billion |

|

CAGR |

5.40% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Ashland Technologies, Aquatech International LLC Technologies, Calgon Carbon Corp., Danaher Corporation, Degremont SAS, Dow Solutions, DuPont, Ecolab Inc, Evoqua, GE Technologies, Kemira OYJ, Pentair plc, SUEZ, Veolia, Xylem Inc. |

FAQ's

• The global market size was valued at USD 61.74 billion in 2024 and is projected to grow to USD 104.27 billion by 2034.

• The global market is projected to register a CAGR of 5.40% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market include Ashland Technologies, Aquatech International LLC Technologies, Calgon Carbon Corp., Danaher Corporation, Degremont SAS, Dow Solutions, DuPont, Ecolab Inc., Evoqua, GE Technologies, Kemira OYJ, Pentair plc, SUEZ, Veolia, Xylem Inc.

• The membrane separation segment dominated the market revenue share in 2024.