Drinking Water Adsorbents Market Share, Size, Trends, Industry Analysis Report

By Products (Zeolite, Clay, Alumina, Activated Alumina, Activated Carbon, Manganese Oxide, Cellulose, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:Aug-2023

- Pages: 115

- Format: PDF

- Report ID: PM1975

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global drinking water adsorbents market was valued at USD 559.8 million in 2022 and is expected to grow at a CAGR of 5.7% during the forecast period.

Adsorbents are compounds derived from clay minerals, iron ores carbon, alumina, zeolite, industrial byproducts, and natural products such as parts of plants, algal biomass, and herbs that offer the promising potential of removal. In water purification, adsorption is applied for the elimination of dissolved impurities. The most common procedure is using activated carbon to eliminate organic substances.

The demand for drinking water adsorbents is fueled by stringent quality rules and government industries to invest in treatment enterprises. Rapid economic expansion, urbanization, and raised market for bio-adsorbents also contribute to the market's growth. Furthermore, the need for drinking H2O treatment chemicals, including adsorbents, is expected to receive a boost from increased investments by private and government bodies in consuming water treatment plants in the future.

To Understand More About this Research: Request a Free Sample Report

Governments worldwide have implemented strict waste treatment and pollution control regulations to safeguard groundwater and natural resources due to the escalating water pollution levels. These regulations compel companies to adopt efficient and environmentally friendly treatment and disposal techniques.

The drinking water adsorbents is experiencing growth due to the surging focus on using natural materials to produce activated carbon. Activated carbon is a widely used adsorbent in drinking water treatment processes due to its high adsorption capacity and effectiveness in removing contaminants.

Traditionally, activated carbon has been produced from non-renewable sources such as coal and petroleum-based materials. However, there is a growing demand for environmentally friendly products and sustainable solutions in water treatment. As a result, the industry is shifting towards using natural materials like coconut shells, wood, and plant waste as feedstocks for activated carbon production.

Wood-based activated carbon is derived from sustainable forestry practices, where timber is harvested and processed to obtain carbon-rich materials. Coconut shell-based activated carbon is produced from the coconut industry's waste, using a byproduct that would otherwise be discarded. Plant waste, such as agricultural residues or biomass, is also being explored as a potential feedstock for activated carbon production.

Moreover, activated carbon derived from natural materials is known to have excellent adsorption properties and can effectively remove contaminants such as organic compounds, chlorine, taste, and odor from drinking water. It is a preferred choice for water treatment applications, further driving its market growth.

The global market growth is anticipated to be hampered by the COVID-19 pandemic, primarily due to the widespread implementation of lockdown measures in numerous countries to curb the spread of the virus. These restrictions have led to the temporary closure of manufacturing industries, consequently impacting the production of adsorbents. Moreover, the disruption in supply chains caused by transportation restrictions is expected to hinder further the expansion of the global drinking water adsorbents market.

Industry Dynamics

Growth Drivers

Rapid industrialization and urbanization

The expanding global population and increased pollution of freshwater sources due to rapid industrialization and urbanization drive market growth. In response to these challenges, governments have implemented stringent initiatives to invest in water treatment industries, while technological advancements have also played a crucial role. These factors are expected to drive the global market growth throughout the forecast period.

The global scenario highlights a concerning issue, with 785 million individuals lacking access to basic drinking facilities and nearly 2 billion people consuming contaminated water plagued with diseases such as cholera, dysentery, diarrhea, and typhoid. The pressing need for purified drinking water in light of these challenges is a significant driver for the growth of the global market for drinking water adsorbents.

The global market is witnessing a significant rise in underground water pollution, primarily driven by rapid industrialization across numerous countries. In India, for instance, over 50% of districts have groundwater with nitrate levels surpassing the permissible limit. This pollution can be attributed to industries improperly discharging toxic substances without adhering to scientific methods. Consequently, many countries are now implementing stringent measures to control pollution, making it mandatory for enterprises to adopt efficient treatment and disposal techniques. These developments are expected to contribute to the global market's growth significantly.

Report Segmentation

The market is primarily segmented based on product, and region.

|

By Product |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

Activated carbon segment accounted for the highest market share in 2022

In 2022, the activated carbon segment accounted for the highest market share. The growing utilization of these materials to eliminate organic pollutants is fueling the expansion of this segment. Activated carbon encompasses a range of compounds and carbonaceous substances with exceptional adsorptive properties.

These materials possess distinctive physical attributes that assist in reducing dissolved pollutants and addressing issues related to color, odor, taste, and harmful toxins. The industry for activated carbon is expected to experience significant growth over the forecast period, supported by stringent government regulations and a strong emphasis on research and development activities.

Activated carbon is a widely utilized adsorbent in the industrial sector, renowned for its exceptional adsorption capacity and adaptability in treating various contaminants. It eliminates organic compounds, volatile organic compounds (VOCs), pesticides, and industrial chemicals from water, making it an optimal selection for various industrial applications.

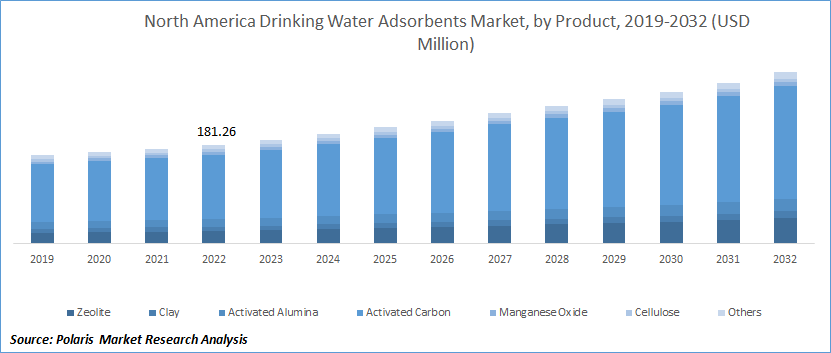

North America dominated the global market in 2022

In 2022, North America dominated the global market for drinking water adsorbents. It can be including several factors, such as robust industrial base, manufacturers, rapid urbanization, the availability of advanced adsorbent technology, and growing demand for clean and safe drinking water.

The region benefits from ample raw material availability and convenient accessibility, further driving the industry's growth. Additionally, implementing stringent measures like the Safe Drinking Water Act (SDWA) in countries like the U.S. will contribute to the continued expansion of the industry in the region.

Asia Pacific is projected to grow substantially in the global drinking water adsorbents industry throughout the forecast period. This growth can be attributed to the region's large population and rapid industrialization, particularly in India and China.

Elevated levels of toxic pollutants such as arsenic, fluoride, and nitrate in the groundwater of countries like India have necessitated stringent environmental policies for water treatment, which is expected to drive the industry's growth in the region.

Moreover, there is a rising demand for environmentally and cost-effective adsorbents from essential end sectors such as petrochemicals/chemicals, petroleum refining, and gas refining, further contributing to the industry's growth in Asia.

Competitive Insight

Some of the major players operating in the global market include The Dow Chemical Company, CycloPure Inc., DuPont, Evoqua Water Technologies LLC, TIGG LLC, Lenntech B.V., KMI Zeolite, Kuraray Co. Ltd., Purolite, and BASF SE.

Recent Developments

- In June 2019, BASF introduced Durasorb HG, an adsorbent for mercury removal. Durasorb HG is a non-regenerable adsorbent made of mixed metal oxide, meticulously designed to exhibit optimal performance even in wet conditions. BASF's strategy of consistently launching new and improved products at regular intervals is expected to play a pivotal role in retaining its existing customers while attracting new ones.

Drinking Water Adsorbents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 588.8 million |

|

Revenue forecast in 2032 |

USD 966.4 million |

|

CAGR |

5.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Products, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

The Dow Chemical Company, CycloPure Inc., DuPont, Evoqua Water Technologies LLC, TIGG LLC, Lenntech B.V., KMI Zeolite, Kuraray Co. Ltd., Purolite, and BASF SE. |

FAQ's

The Drinking Water Adsorbents Market report covering key segments are product, and region.

Drinking Water Adsorbents Market Size Worth $ 966.4 Million By 2032

The global drinking water adsorbents market is expected to grow at a CAGR of 5.7% during the forecast period.

North America regions is leading the global market.

Key driving factors in drinking water adsorbents market. Rapid industrialization and urbanization.