Surfactants Market Size, Share, Trends, Industry Analysis Report

By Substrate (Synthetic Surfactants and Bio-Based Surfactants), By Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6224

- Base Year: 2024

- Historical Data: 2020-2023

Overview

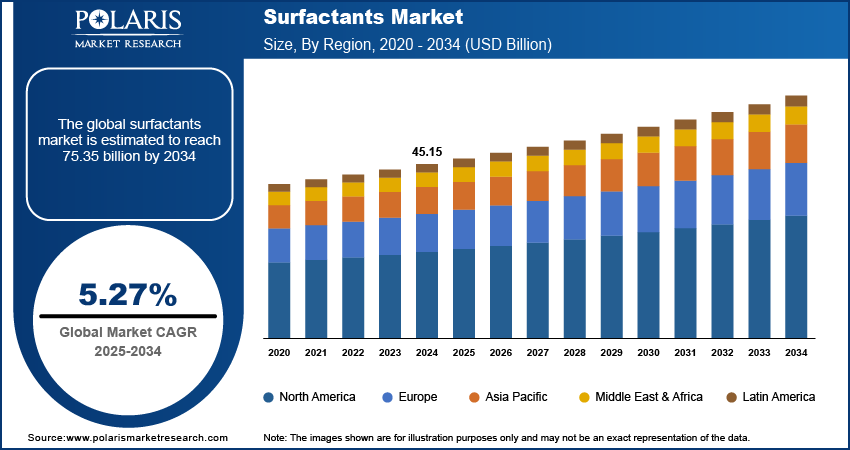

The global surfactants market size was valued at USD 45.15 billion in 2024, growing at a CAGR of 5.27% from 2025 to 2034. Key factors driving demand for surfactants include growing urbanization worldwide and increasing sales in chemical industry.

Key Insights

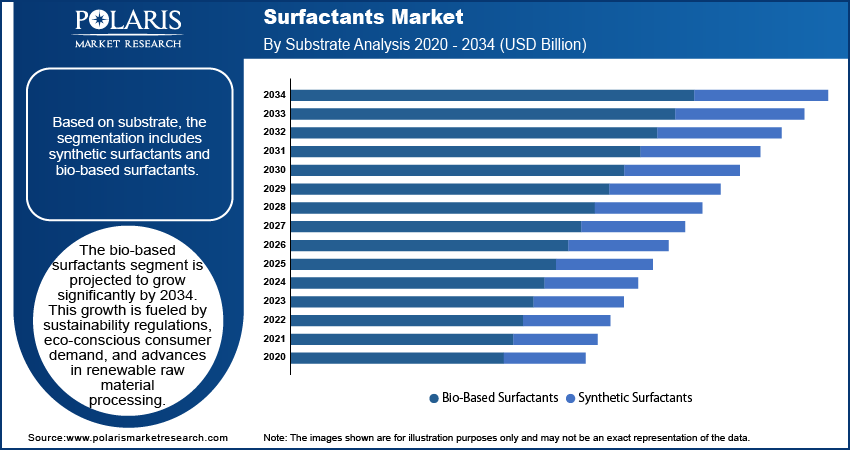

- The synthetic surfactants segment dominated the market share in 2024.

- The non-ionic surfactants are projected to grow at a rapid pace in the coming years, driven by its wide application in detergents, personal care products, agrochemicals, and industrial cleaning agents.

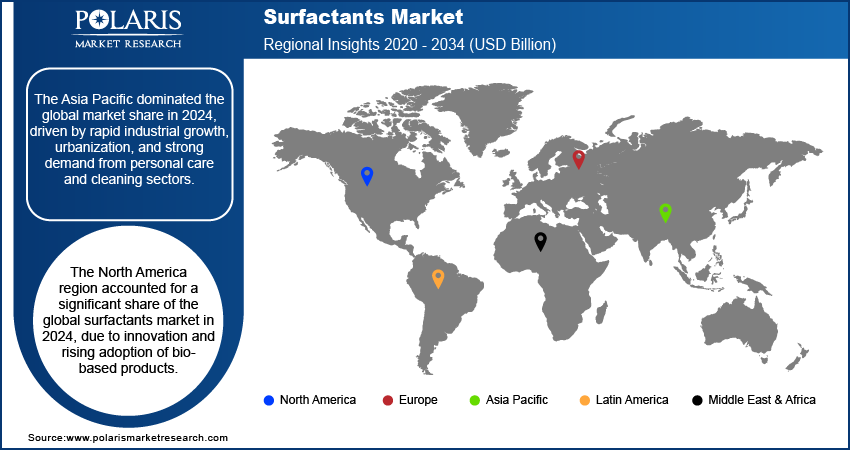

- The Asia Pacific surfactant market dominated the global market share in 2024.

- The India surfactant market is growing due to expansion of food and biotech sector that utilizes surfactants in fermentation processes, enzyme stabilization, and food emulsification applications.

- The market in North America is projected to grow at a fast pace from 2025-2034, propelled by advancements in bio-based surfactant technologies.

- Countries such as China and Japan are playing a key role in regional growth, due to significant investments in R&D for sustainable surfactant production and growing consumer preference for eco-friendly cleaning and personal care products.

Industry Dynamics

- Rising pace of urbanization worldwide is fueling the market growth due to increased demand for household cleaning products, personal care items, and construction-related chemicals that utilize surfactants.

- Increasing sales of chemical drive, the demand for surfactants as they serve as essential agents in formulations for detergents, paints, agrochemicals, pharmaceuticals, and industrial cleaning applications.

- R&D in novel technologies, including enzymatic synthesis and multifunctional surfactant formulations, is expected to create lucrative opportunities during the forecast period.

- The potential environmental and health hazards associated with some surfactants are anticipated to restrain market growth.

Market Statistics

- 2024 Market Size: USD 45.15 Billion

- 2034 Projected Market Size: USD 75.35 Billion

- CAGR (2025–2034): 5.27%

- Asia Pacific: Largest Market Share

AI Impact on Surfactants Market

- AI accelerates surfactant formulation by predicting molecular interactions, reducing R&D time for eco-friendly and high-performance blends.

- Machine learning optimizes production processes, cutting energy use and raw material waste in surfactant manufacturing plants.

- AI-powered quality control detects impurities in real-time, ensuring consistent product performance across batches.

- Demand forecasting models adjust surfactant production schedules dynamically, minimizing overstock and shortages in fast-moving markets.

Surfactants are chemical compounds that reduce surface and interfacial tension between liquids, solids, and gases, enabling improved spreading, wetting, and emulsification. They are widely used across industries such as personal care, household cleaning, food processing, agriculture, and oil & gas for applications including detergents, emulsifiers, foaming agents, and dispersants. The key product types such as anionic, cationic, nonionic, and amphoteric surfactants offers specific functional benefits depending on the end-use application. These compounds are formulated from either synthetic sources derived from petrochemicals or bio-based alternatives made from plant oils and sugars to meet varying performance and sustainability requirements. The market continues to grow as innovation, regulatory compliance, and performance optimization shape product development across multiple industrial and consumer applications.

The increase in oil demand worldwide is driving the surfactant market due to the growing requirement for efficient chemical agents in enhanced oil recovery, drilling, and refining processes. According to the IEA, world oil demand increased by 700 kb/d in 2025 and is projected to expand by 720 kb/d in 2026. Oil and gas producers are focusing on optimizing extraction and processing efficiency, which fuels the adoption of high-performance surfactants. These formulations improve crude recovery rates, reduce operational downtime, and support cleaning and maintenance in refineries, thereby boosting market growth across the petroleum sector.

The global growth of the food and biotechnology industries is driving the surfactant market, as these sectors rely on surfactants for applications such as food emulsification, fermentation, enzyme stabilization, and bioprocess optimization. Expanding processed food consumption, coupled with rising biopharmaceutical production, is boosting demand for specialty and bio-based surfactants that meet safety, performance, and sustainability standards. This trend is further backed by technological advancements enabling the development of high-purity, functional surfactants tailored for food-grade and biotech-grade applications.

Drivers & Opportunities

Growing Urbanization Worldwide: The rising pace of urbanization and infrastructure development is propelling growth in the surfactant market, driven by increasing demand for surfactant-based formulations in construction materials, coatings, and cleaning products used across residential, commercial, and industrial projects. According to the United Nations, the urban population represented 57% of the global population and is projected to reach 68% by 2050. This steady migration toward cities fuels the need for efficient cleaning agents, emulsifiers, and processing additives, thereby accelerating surfactant adoption in urban-centric industries.

Increasing Sales in Chemical Industry Worldwide: The rapid expansion of the global chemical industry is fueling the surfactant market, as rising sales of chemicals indicate increasing consumption across key end-use sectors such as detergents, personal care ingredients, agrochemicals, and industrial cleaning products. Surfactants serve as essential functional ingredients in these applications, and higher chemical sales reflect a robust supply chain and expanding production capacity. According to the European Chemical Industry Council (Cefic), global chemical sales reached USD 6.1 billion in 2023 from USD 3.6 billion in 2013. This growth is boosting investments in surfactant innovation and large-scale manufacturing to meet the rising global demand.

Segmental Insights

Substrate Analysis

Based on substrate, the segmentation includes synthetic surfactants and bio-based surfactants. The synthetic surfactants segment held the dominating share in 2024 due to its cost-effectiveness, high production scalability, and consistent performance across a wide range of end-use applications. Its extensive utilization in home care detergents, personal care products, textile processing, and industrial cleaning solutions is cementing its position as the preferred choice for manufacturers. Furthermore, the availability of a mature petrochemical-based supply chain and established production technologies continues to support its dominance in the market.

The bio-based surfactants segment is projected to grow at a robust pace in the coming years, driven by rising consumer awareness regarding environmental sustainability and increasing regulatory pressure to reduce the use of non-biodegradable chemicals. Derived from renewable sources such as plant oils and sugars, these surfactants are witnessing increasing adoption in eco-friendly detergents, cosmetics, and food processing applications. For instance, biosurfactant producers Dispersa and AGAE Technologies are scaling up operations, collectively adding over 1,000 metric tons of new annual capacity for biobased surfactants, boosting the growing market demand. Therefore, the growing emphasis on green chemistry, combined with supportive government initiatives and incentives for sustainable manufacturing, is expected to accelerate its adoption globally.

Type Analysis

In term of type, the segmentation is divided into anionic surfactants, non-ionic surfactants, cationic surfactants, and amphoteric surfactants. The anionic surfactants segment held the dominant share of the market in 2024, due to its superior foaming, emulsifying, and cleaning capabilities, which make it essential for laundry detergents, dishwashing liquids, and shampoos. The cost competitiveness, abundant raw material availability, and reliable performance across different water hardness conditions is enhancing its market leadership.

The non-ionic surfactants segment is anticipated to witness the most rapid growth during the forecast period, owing to its versatility, low toxicity, and stability across a broad pH range. These attributes make them suitable for sensitive applications such as baby care, skincare formulations, and food processing. The shift toward milder, sulfate-free formulations in cosmetics and personal care products is further boosting demand for non-ionic surfactants, in premium and specialized product categories.

Application Analysis

In terms of application, the segmentation includes home care, personal care, textile, industrial & institutional (I&I) cleaning, elastomers & plastics, oilfield chemicals, agrochemicals, food & beverage, and others. The home care segment dominated the surfactant market in 2024, driven by robust demand for laundry detergents, dishwashing liquids, and multi-surface cleaners across developed and emerging economies. Rapid urbanization, rising household incomes, and evolving cleaning habits in high-growth markets are fueling consumption levels. Additionally, heightened hygiene awareness is boosting the role of surfactants as key functional ingredients in household cleaning solutions.

The personal care segment is expected to grow at a rapid pace in the coming years, fueled by the expansion of the cosmetics, skincare, and haircare industries. Surfactants play a vital role in these sectors as emulsifiers, foaming agents, and stabilizers, enables the production of high-performance and aesthetically appealing formulations. Increasing consumer inclination toward mild, natural, and eco-friendly ingredients is propelling manufacturers to invest in advanced, sustainable surfactant technologies. This shift is further boosting adoption in premium beauty and wellness products across global markets.

Regional Analysis

Asia Pacific dominated the global surfactant market in 2024, primarily driven by rapid industrial expansion, urbanization, and food and biotech development across major economies such as China, India, and Japan among others. Expanding personal care, household cleaning, and industrial manufacturing sectors are fueling substantial demand for surfactant-based formulations. Additionally, the region benefits from cost-effective raw material availability, a strong manufacturing base, and increasing investments in bio-based surfactants to address sustainability goals.

India Surfactants Market Insights

The expansion of the global food and beverage industry is fueling demand for surfactants, driven by their essential role in emulsification, dispersion, and texture enhancement in processed foods, beverages, and dairy products. Rising consumption of convenience and packaged foods, coupled with increasing use of natural and plant-based emulsifiers, is boosting manufacturers to develop innovative surfactant formulations that meet clean-label and sustainability standards. According to DPT-BIRAC, the food processing sector was valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030 in the country, highlighting significant growth potential for surfactant applications in value-added and processed food categories.

Europe Surfactants Market Assessments

The market in Europe is projected to hold a substantial revenue share in 2034 due to well-established chemical manufacturing base, stringent environmental compliance frameworks, and growing consumer inclination toward sustainable product choices. Countries such as Germany, France, and the U.K. are at the forefront of integrating plant-based ingredients into detergents, cosmetics, and industrial formulations. This shift is further boosted by industry-wide implementation of green chemistry principles and circular economy practices that allows manufacturers to invest in eco-friendly production technologies and renewable raw material sourcing.

North America Surfactants Market Trends

North America is projected to witness the fastest growth over the forecast period, underpinned by robust innovation in specialty surfactant development and rapid commercialization of advanced formulations across multiple end-use industries. Rising adoption of environmentally friendly cleaning agents, premium personal care products, and bio-based industrial additives is stimulating market demand. The region’s strong R&D infrastructure, coupled with strategic investments in high-performance, low-toxicity surfactants, is enabling manufacturers to meet evolving regulatory requirements and consumer expectations. Additionally, expanding applications in pharmaceuticals, food processing, and oilfield chemicals are broadening the scope for market penetration, positioning North America as a key growth engine in the coming years.

The U.S. Surfactants Market Overview

The increasing preference for eco-friendly and renewable raw materials is driving the U.S. surfactant market, as industries aim to reduce environmental impact and comply with stringent sustainability regulations. Companies are investing in bio-based surfactant innovations to cater to environmentally conscious consumers and industrial users. For example, in May 2025, Pilot Chemical Company formed an exclusive partnership with Novvi LLC to introduce CalCare AOS, a fully biobased alpha olefin sulfonate surfactant line to the North American market, reflecting the industry’s strong shift toward sustainable product development.

Key Players & Competitive Analysis

The global surfactants market is moderately competitive, with key players are competing on product performance, formulation versatility, and cost efficiency. These companies focus on developing sustainable and bio-based surfactants, high-performance blends, and application-specific solutions for industries including personal care, home care, agrochemicals, food processing, and oilfield chemicals. The competitive dynamics are further shaped by strategic partnerships, capacity expansions, and acquisitions aimed at enhancing manufacturing capabilities and expanding into high-growth regions. Additionally, increasing investment in R&D for biodegradable, low-foaming, and mild surfactant formulations coupled with evolving environmental regulations is also influencing market positioning.

A few major companies operating in the surfactants industry include BASF SE, Evonik Industries AG, Dow Inc., Solvay S.A., Clariant AG, Croda International Plc, Kao Corporation, Galaxy Surfactants Ltd., Godrej Industries Ltd., Nouryon, Esteem Industries, and Adeka Corporation.

Key Players

- Adeka Corporation

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- Esteem Industries

- Evonik Industries AG

- Galaxy Surfactants Ltd.

- Godrej Industries Ltd.

- Kao Corporation

- Nouryon

- Solvay S.A.

Surfactants Industry Developments

March 2025: Galaxy Surfactants Limited collaborated with a key global customer to provide EPC services such as process design, procurement, engineering, construction, and commissioning for an overseas performance surfactants and specialty ingredients plant. This aims to supports Galaxy’s goal of expanding its geographical footprint in key target markets.

November 2024: Godrej Industries Limited acquired the surfactants business of Savannah Surfactants Pvt. Ltd., to enhance production capabilities, expand market presence and support the company’s growth in domestic and export markets.

Surfactants Market Segmentation

By Substrate Outlook (Revenue, USD Billion, 2020–2034)

- Synthetic Surfactants

- Bio-Based Surfactants

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Anionic Surfactants

- Non-Ionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Home Care

- Personal Care

- Textile

- Industrial & Institutional (I&I) Cleaning

- Elastomers & Plastics

- Oilfield Chemicals

- Agrochemicals

- Food & Beverage

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surfactants Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 45.15 Billion |

|

Market Size in 2025 |

USD 47.48 Billion |

|

Revenue Forecast by 2034 |

USD 75.35 Billion |

|

CAGR |

5.27% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 45.15 billion in 2024 and is projected to grow to USD 75.35 billion by 2034.

The global market is projected to register a CAGR of 5.27% during the forecast period.

Asia Pacific dominated the market in 2024 due to robust industrial expansion and strong demand from sectors such as personal care, household cleaning, and industrial applications.

A few of the key players in the market are BASF SE, Evonik Industries AG, Dow Inc., Solvay S.A., Clariant AG, Croda International Plc, Kao Corporation, Galaxy Surfactants Ltd., Godrej Industries Ltd., Nouryon, Esteem Industries, and Adeka Corporation.

The anionic surfactants segment dominated the market revenue share in 2024 due to its wide use in detergents, shampoos, and cleaning products, owing to strong cleaning performance, cost-effectiveness, and compatibility with various formulations.

The personal care segment is projected to witness the fastest growth during the forecast period due to increasing demand for skincare, haircare, and cosmetic products.