Agrochemicals Market Share, Size, & Industry Analysis Report

By Type (Fertilizers, Pesticides); By Pesticide Type; By Fertilizer Type; By Crop Type; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 147

- Format: PDF

- Report ID: PM1187

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

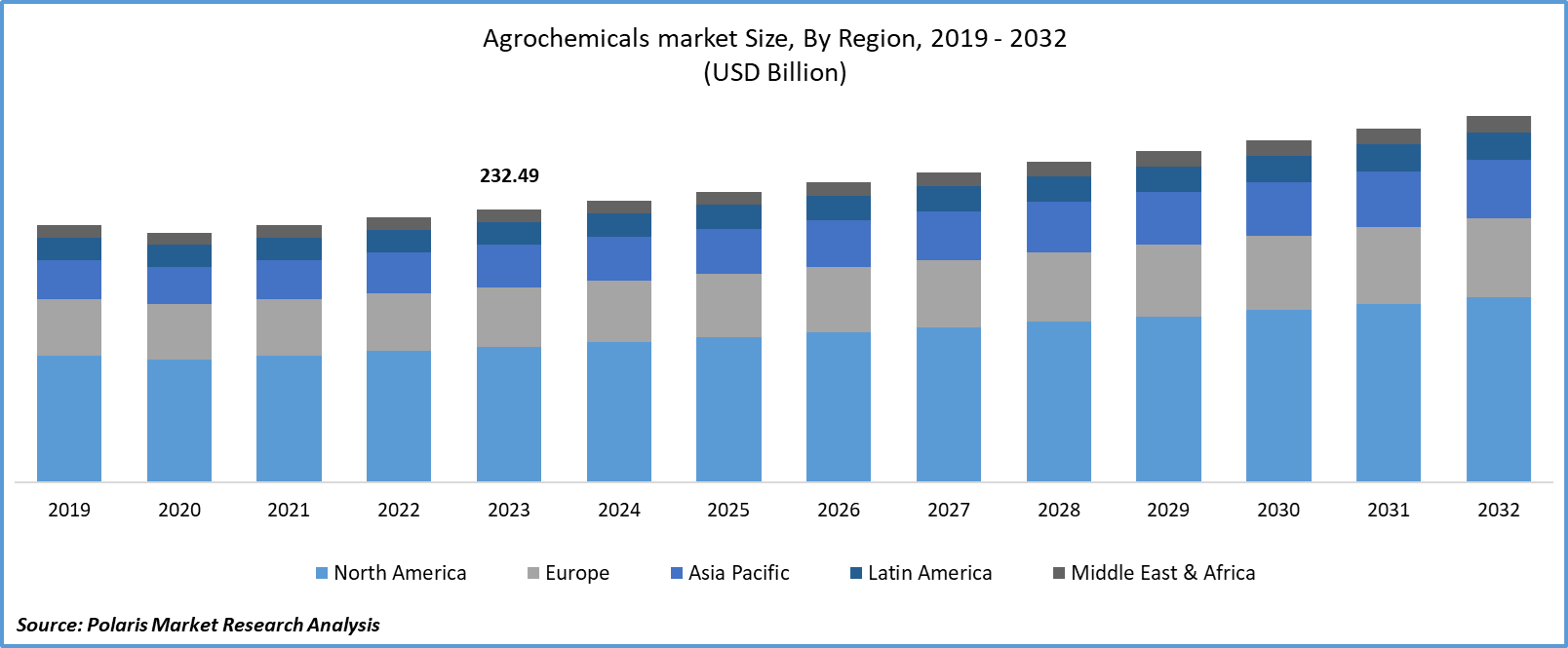

The global agrochemicals market was valued at USD 297.04 billion in 2024 and is expected to register a CAGR of 4.0% from 2025 to 2034. The market growth is driven by the increasing demand for food and the need to enhance crop yields. The increasing demand for sustainable products propels the requirement for sustainable agrochemicals, driving industry expansion.

Key Insights

- The fertilizer segment is projected to register the highest CAGR during the forecast period. It is mainly driven by the rising development of sustainable fertilizers with the potential to promote agricultural productivity.

- The nitrogenous fertilizers segment held a significant share in revenue in 2024. The dominance is highly attributed to the need for nitrogen to develop chlorophyll, which is essential in the plant's photosynthesis process.

- The industry in Asia Pacific is expected to witness the highest CAGR during the forecast period. With a rapidly growing population and increasing urbanization, there is a rising demand for food in the region. Agrichemicals, including fertilizers, pesticides, and plant growth regulators, play a crucial role in enhancing agricultural productivity and ensuring sufficient food production to meet the needs of a growing population.

Industry Dynamics

- The rising population across the world propels the demand for food, which drives the demand for agrochemicals to support efficient agricultural production.

- Growing demand for fertilizers to promote plant growth fuels the industry growth.

- Technological advancements in agrochemicals, such as the development of novel active ingredients and formulations, is expected to offer opportunities during the forecast period.

- The rising imposition of stringent government regulations on agrochemicals to promote food safety and soil health restricts the manufacturing of new agrochemicals, which hinders the market expansion.

Market Statistics

2024 Market Size: USD 297.04 billion

2034 Projected Market Size: USD 439.07 billion

CAGR (2025–2034): 4.00%

Asia Pacific: Largest market in 2024

AI Impact on Agrochemicals Market

- Artificial intelligence (AI) revolutionizes the agrochemicals industry. The technology helps enhance precision agriculture, accelerate product discovery, and drive sustainability. This enables safer, smarter, and efficient crop protection solutions.

- AI tools reduce costs and timelines of research and development (R&D). They analyze vast datasets faster than conventional methods to identify promising compounds.

- AI systems predict toxicity and adverse environmental impact early in the design phase, which helps companies avoid costly failures.

- AI companies and agrochemical firms are collaborating to boost innovations in drone delivery, gene editing, and data sharing.

To Understand More About this Research:Request a Free Sample Report

Companies are increasing their efforts to boost agricultural productivity. There will be a huge demand for agrochemicals as the availability of effective fertilizers and pesticides increases around the world. Additionally, rising government regulations to boost food production are optimally stimulating agrochemical availability.

For instance, in September 2023, the Ministry of Agriculture and Rural Affairs in China announced the approval of 12 novel pesticides, including Metarhizium anisopliae PL-GM1, Cyclobutrifluram, and Flusulfinam. In this, chemical pesticides, biopesticides, and microbial pesticides constitute 33%, 17%, and 50%, respectively.

Moreover, the increasing demand for sustainable products is transforming the agrochemicals market, driven by rising environmental-friendly fertilizers development by the major players. For instance, in January 2023, Sumitomo Chemical announced the acquisition of a bio-stimulant firm to expand its capacity to produce sustainable agrochemicals.

Agrochemicals play a crucial role in enhancing agricultural productivity by controlling pests, diseases, and weeds, thus ensuring sufficient food production to meet the needs of a growing population. With the expansion of agriculture into previously uncultivated areas and the intensification of farming practices, there is a growing need for crop protection products to safeguard crops from pests, diseases, and adverse weather conditions. Agrochemicals such as insecticides, fungicides, and herbicides safeners help farmers protect their crops and maximize yields.

The adoption of modern farming practices, including precision farming, integrated pest management (IPM), and genetically modified (GM) crops, drives the demand for agrochemicals. These practices require the use of specialized agrochemicals tailored to specific crops, soil conditions, and insect pest control strategies.

Ongoing technological advancements in agrochemicals, such as the development of novel active ingredients, formulations, delivery systems, and application techniques, contribute to the growth of the market. Innovations in biotechnology, nanotechnology, and digital agriculture offer new opportunities for improving the efficacy, safety, and environmental sustainability of agrochemical products.

However, the higher cost of investment in agrochemical research and development activities is anticipated to hamper the emergence of new companies in the marketplace. The increasing demand for organic products is projected to lower the use of agrochemicals over the forecast period.

Growth Drivers

Increasing Global Population

The rising population growth, mainly among developing nations, is creating huge concerns about increasing agricultural productivity. As per the United Nations Food and Agricultural Organization and the International Food Policy Research Institute Report, by 2050, world food demand is projected to grow by 70% to feed 9.3 billion of the global population, along with the growing consumer income in Asia, Latin America, & Eastern Europe. This is driving the demand for agrochemicals in the world, driven by their potential to protect plants from weeds, pests, and insects.

Growing Demand for Fertilizers

Farmers are increasing the use of fertilizers in their crop cultivation to promote plant growth and supply the required soil nutrients. According to the data published in the Economic Times in 2023, from 54.62 lakh tonnes in 2021-22, the imports of DAP (di-ammonium phosphate) reached 65.83 lakh tonnes in 2022-23, while from 11.7 lakh tonnes, NPK (nitrogen, phosphorus, and potassium) fertilizers imports grew to 27.5 lakh tonnes. This demonstrates the growing fertilizer consumption among farmers. Additionally, rising plant protection agrochemicals are registering significant demand with the growing new product launches.

Restraining Factors

Regulatory Hurdles are Likely to Impede Market Growth

The rising stringent government regulations on agrochemicals to promote food safety and soil health are anticipated to restrict the manufacturing of new agrochemicals in the long run. The prevalence of harmful pesticides and other agrochemicals is likely to experience lower demand with the rising prevalence of human diseases in the world. Additionally, the growing development of electrical tools to remove weeds is potentially hindering market growth.

Report Segmentation

The agrochemicals market is primarily segmented based on type, pesticide type, fertilizer type, crop type, and region.

|

By Type |

By Pesticide Type |

By Fertilizer Type |

By Crop Type |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

The fertilizer segment is projected to grow at highest CAGR during the projected period, mainly driven by the rising development of sustainable fertilizers with the potential to promote agriculture productivity. Fertilizers play a crucial role in enhancing agricultural productivity by providing essential nutrients to crops, thus increasing yields and ensuring food security for a growing population.

With the expansion of agriculture into previously uncultivated areas and the intensification of farming practices, there is a growing need for fertilizers to replenish soil nutrients and maintain soil fertility. Fertilizers help farmers optimize crop production on both existing and newly cultivated land. he adoption of high-yielding crop varieties, including genetically modified (GM) crops, increases the demand for fertilizers. High-yielding varieties have greater nutrient requirements to support their growth and development, making fertilizers essential for maximizing their potential yields.

The herbicide segment accounted for the largest market share in 2024, attributable to the rising development of multiple weeds on agricultural land, leading to a lack of nutrients for the plants. Additionally, the growing new herbicide development activities by the key companies with technology integration are promoting the availability of effective agrochemicals.

For instance, in May 2023, BASF introduced two new herbicides, Duvelon and Facet, in India to aid tea and rice farmers in protecting their plants from weeds.

By Fertilizer Type Analysis

The nitrogenous fertilizers segment held a significant market share in revenue in 2024, which is highly accelerated due to the need for nitrogen to develop chlorophyll, which is essential in the plant's photosynthesis process. It plays a crucial role in plant growth and the development of quality flowers and fruits. This is encouraging agrochemical companies to expand their production capacity.

For instance, in April 2024, Genesis Fertilizers Limited and Thyssenkrupp Uhde announced their plans to construct a nitrogenous fertilizers complex in Saskatchewan, Canada, with lower emissions.

Regional Insights

Asia Pacific region expected to witness the fastest growing CAGR of the agrochemicals industry during the forecast period. The Asia Pacific region is home to some of the world's largest agricultural economies, including China, India, Indonesia, and Vietnam. Agriculture is a major contributor to the region's economy, employing a significant portion of the population and supporting food security and rural development. With a rapidly growing population and increasing urbanization, there is a rising demand for food in the Asia Pacific region. Agrichemicals, including fertilizers, pesticides, and plant growth regulators, play a crucial role in enhancing agricultural productivity and ensuring sufficient food production to meet the needs of a growing population.

Many countries in the Asia Pacific region are experiencing a shift towards commercial farming and modern agricultural practices. Large-scale commercial farms and agribusinesses require specialized agrichemicals to optimize crop production, manage pests and diseases, and maximize returns on investment. Governments in the Asia Pacific region often provide subsidies, incentives, and support programs to promote agricultural productivity and rural development. This includes subsidies for the purchase of agrichemicals, agricultural machinery, and irrigation systems, stimulating demand for agrichemical products among farmers. Furthermore, the growing launch of new agrochemicals is expected to create significant adoption during the forecast period.

For instance, in June 2023, Crystal Crop Protection Ltd. unveiled Sikosa, an herbicide to safeguard paddy from weeds.

Key Players & Competitive Insights

The agrochemicals market is a mix of fragmentation and consolidation. Key players are stepping forward with new strategies to innovate new agrochemical development and brand coverage through expansion activities. Evaluate the product portfolio of key players, including fertilizers, pesticides, herbicides, fungicides, and plant growth regulators. Companies that offer a diverse range of agrichemical products tailored to different crops, pests, and farming practices have a competitive advantage in meeting the varied needs of farmers.

Some of the major players operating in the global market include:

- ADAMA Ltd.

- Ashland, Inc.

- BASF SE

- Bayer AG

- Clariant AG

- Croda International Pic

- Evonik Industries AG

- FMC Corp.

- Helena Agri-Enterprises, LLC

- Huntsman International LLC

- Land O' Lakes, Inc.

- Nufarm

- Solvay

- Stepan Company

- The DOW Chemical Company

- UPL

Recent Developments in the Industry

- May 2025: ADAMA Ltd., a leading global crop protection company, announced the U.S. registration of its latest herbicide, Temper More. Designed to combat herbicide-resistant weeds in row crops, it provides strong burndown performance and extended residual control. Utilizing ADAMA’s proprietary Sesgama Formulation Technology, the product enhances weed resistance management for farmers.

- March 2025: ADAMA US introduced Maxentis SC, a next-generation fungicide designed to protect corn, soybean, and wheat crops from major diseases like tar spot and frogeye leaf spot. It combines prothioconazole and azoxystrobin in a single, easy-to-use formula for long-lasting disease control and improved plant health.

- In August 2024, Syngenta India launched two crop protection products, Miravis Duo and Reflect Top. Miravis Duo targeted diseases in tomato, chili, groundnut, and grape, while Reflect Top offered long-lasting protection against sheath blight in rice, supporting Indian farmers’ productivity.

- In September 2023, Croda unveiled its latest product, Atlox BS-50, designed as a delivery system tailored to the expanding biopesticide market's requirements.

Report Coverage

The agrochemicals market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, pesticide type, fertilizer type, crop type, and their futuristic growth opportunities.

Agrochemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 308.92 billion |

|

Revenue forecast in 2034 |

USD 439.07 billion |

|

CAGR |

4.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Agrochemicals Market report covering key segments are type, pesticide type, fertilizer type, crop type, and region.

Agrochemicals Market Size Worth USD 439.07 Billion By 2034

Agrochemicals Market exhibiting the CAGR of 4.00% during the forecast period.

Asia Pacific is leading the global market.

The key driving factors in Agrochemicals Market are Increasing global population