Herbicide Safeners Market Share, Size, Trends, Industry Analysis Report

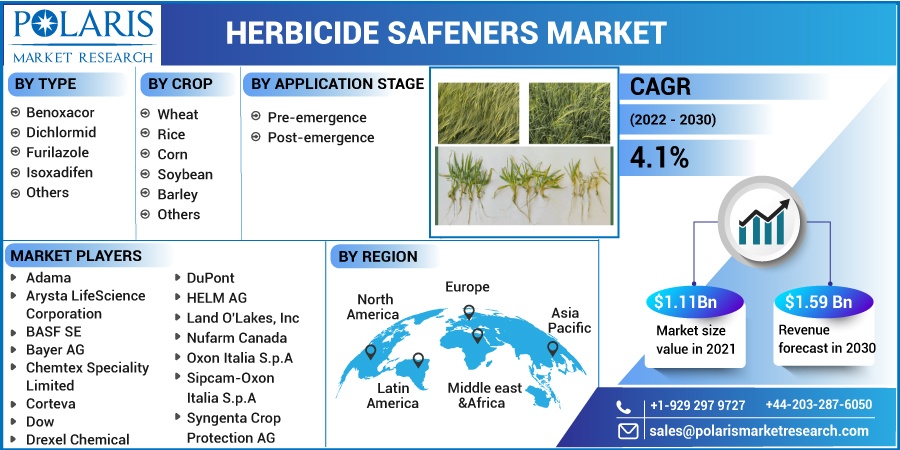

By Type (Benoxacor, Dichlormid, Furilazole, Isoxadifen, Others); By Crop; By Application Stage; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 112

- Format: PDF

- Report ID: PM2490

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

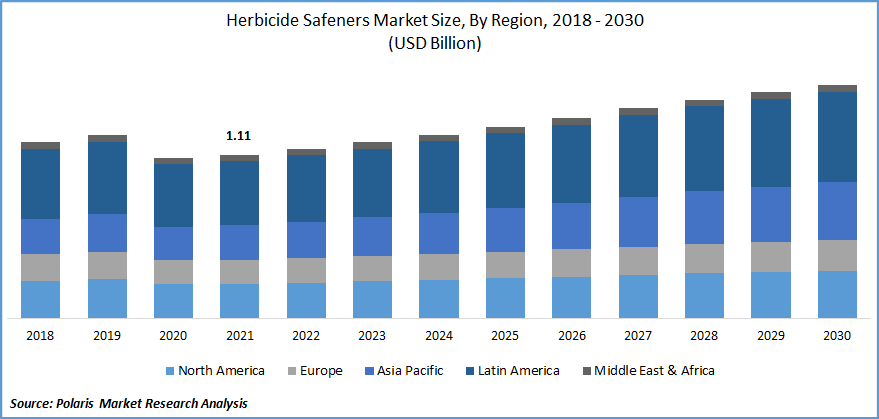

The global herbicide safeners market was valued at USD 1.11 billion in 2021 and is expected to grow at a CAGR of 4.1% during the forecast period. The herbicide safeners are chemicals that aid in safeguarding and protecting the crops from the potential damage caused due to the usage of the chemical.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

These safeners can effectively escalate the tolerance of cereal plants to herbicide application without impacting weed control efficiency. These safeners are of various types, such as riluzole, dichloride, benefactor, and isoxadifen, among others, which are highly used in various crops such as wheat, corn, sorghum, rice, soybean, barley, and other crops.

The safeners are antidotes for herbicides. They are the chemical agents that increase the tolerance level in cereal plants from the impact of chemicals. They also provide several benefits, such as agriculture weed control and a decrease in the impact of selective chemicals.

Safeners help remove weeds at their early stage of life while also improving the productivity and yield of the crops. The growing urbanization and industrialization and increasing population have increased the need for food products, whereas the land area available is limited.

The outbreak of the COVID-19 pandemic was declared by the International Health Regulations Emergency Committee of the World Health Organization (WHO) on January 30, 2020. The COVID-19 outbreak was a public health emergency of international concern. Originating in China, the virus has spread to almost 213 countries and territories across the world. Several private and government sector businesses are operating at a limited capacity or have ceased operations completely due to recent events surrounding the COVID-19 pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

There has been an increase in the observation of herbicide-induced crop damage across the globe. They can selectively protect crop plants from damage caused by pesticides while not reducing herbicide activity on unwanted & ubiquitous weed species. Multiple commercial safeners are currently in use to improve the overall pesticide selectivity between weed and crop species, which can be applied along with the pesticide as a mixture. Furthermore, the growing market demand for organic additives in crops is also expected to further drive the growth of the market during the forecast period.

They are applied to the pre or post-emergence treatment for crops to obtain better quality results in terms of yield and quality. Therefore, the increasing instances and growing awareness of insecticide damage to the crop are likely to grow the market demand for safener-based formulations. Hence, the growing awareness of such chemicals among farmers is driving the growth of the herbicide safeners market in the forecasting period.

Report Segmentation

The market is primarily segmented based on type, crop, application stage, and region.

|

By Type |

By Crop |

By Application Stage |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Benoxacor segment is expected to witness the fastest growth

The benoxacor segment is used in the majority of safeners available in various markets. Benoxacor safeners are mainly used on various crops such as soybeans, corn, and sorghum. Benoxacor is a safener mostly suited to the selective herbicide safeners market and extensively used for both pre and post-emergent application methods.

Benoxacor safeners are used with metolachlor to strengthen the use of such safeners. Increasing adaption of the same across the globe is expected to further boost the overall market growth in the forecasting period.

The growing market demand and utilization of benoxacor in pesticides for crucial crops such as corn, sorghum, and soybean is another significant factor that is expected to contribute positively to the growth of the market. The benoxacor safeners have low aqueous solubility, which is also very volatile and has a significant potential for leaching into groundwater based on its chemical properties.

The benoxacor safeners are moderately persistent in soil systems but not so much in the water. It also has low mammalian toxicity and a strong potential for bioaccumulation. They are moderately toxic to honeybees, birds, earthworms, and most aquatic organisms. Fichloroacetamide safeners, such as riluzole and benefactor, are often used in chloroacetamide pesticide formulations.

Soybean accounted for a significant share in 2021

The soybean is an important global crop, providing oil and protein. Approximately 88% of the soybean crop is crushed & processed for industrial purposes, especially for feed production every year. China has seen rapid market growth and becoming a major importer of soybean from many countries. South America is the biggest exporter to cater to the increasing domestic demand in the Chinese market.

The Benoxacor safener is the most used safener in combination with the active pesticide ingredient, S-metolachlor, & atrazine in pesticides. Many companies across the globe provide safeners premixed with a pesticide such as syngenta, corteva agriscience, tenkoz, and adama. They are mainly used due to their selective action in protecting weeds and crops, soybeans being one of the most important crops. Hence the market demand for safeners in the regions which have soybean growth is massively growing.

The increasing use of selective pesticides, which kills some plants while leaving others, has benefited soybean crops. These safeners can also improve selectivity, which allows grass-weed pesticides to be developed for use in grass crops, including soybean, cereals, corn, and rice.

The pre-emergence sector is expected to hold the significant revenue share

Pre-emergence pesticides prevent sprouted weed seedlings from establishing themselves by inhibiting shoot, root, or both growths. In order to be effective, the herbicide must be integrated into the soil via irrigation or rainfall, and it must be present when the weed seeds are germinated. Pre-emergence herbicides show no effect on weed seeds, and as a result, they are expected to witness the fastest growth during the forecast period.

The pre-emergence herbicides stay in the soil for a while as a residue that prevents weed growth. The herbicides can be selective or non-selective depending upon the variety of the active ingredient for the treatment of various kinds of weeds. Selective pre-emergent herbicides control precise types of weeds, whereas non-selective pre-emergent herbicides are able to kill the seeds of any plant, thus preventing the growth of vegetation. The growing adaption of the pre-emergent herbicide safener market to target a specific type of weed across various crops is expected to cater to the growth of the herbicide safeners market.

The demand in Latin America is expected to witness significant growth

Latin America is expected to experience growth during the forecast period owing to the high adoption of the herbicide safeners market and growing production of crops such as soybean & corn to meet the export requirement within the region. The water and land are abundant in Latin America; hence the region accounts for 13% of the global agricultural & fish commodities production and almost 17% of the net export value of such products.

The export demand is a critical growth factor for agriculture in this region, which is evident because the region is dominated by large export-oriented commercial farms, especially in Brazil and Argentina. Latin America has about 9% of the global population and is expected to add another 58 million people by 2030.

Owing to food insecurity in the region, crop production expansion by agricultural intensification is crucial. The region is expected to further increase the market demand for crop protection chemicals such as herbicides, insecticides, and nematicides, leading to greater market demand for safeners added with herbicides to protect crops against herbicide injury.

Competitive Insight

Some of the major players operating in the global market include Adama, Arysta LifeScience Corporation, BASF SE, Bayer AG, Chemtex Speciality Limited, Corteva, Dow, Drexel Chemical, DuPont, HELM AG, Land O'Lakes, Inc, Nufarm Canada, Oxon Italia S.p.A, and Sipcam-Oxon Italia S.p.A, Syngenta Crop Protection AG among others.

Recent Developments

In July 2021, Syngenta Crop Protection announced the acquisition of Dipagro. The company will be signing off the contract for the distribution of agricultural inputs in the Brazilian state of Mato Grosso. The acquisition is expected to increase the farmers’ access to Syngenta’s technologies and services in various regions experiencing rapid agricultural growth.

Furthermore, In May 2021, BASF Canada Agricultural Solutions (BASF) and Corteva Agriscience announced a collaboration on a joint approach to weed control by recommending the use of Liberty 200 Enlist and SN herbicides in combination on Enlist E3TM soybean acres.

Herbicides Safener Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.11 billion |

|

Revenue forecast in 2030 |

USD 1.59 billion |

|

CAGR |

4.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Crop, By Application Stage, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Adama, Arysta LifeScience Corporation, BASF SE, Bayer AG, Chemtex Speciality Limited, Corteva, Dow, Drexel Chemical, DuPont, HELM AG, Land O'Lakes, Inc, Nufarm Canada, Oxon Italia S.p.A, Sipcam-Oxon Italia S.p.A, Syngenta Crop Protection AG |