Male Urinary Incontinence Market Size, Share, Trends, Industry Analysis Report

By Product (Non-Absorbents, Absorbents), By Incontinence Type, By Usage, Distribution Channel, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6245

- Base Year: 2024

- Historical Data: 2020-2023

Overview

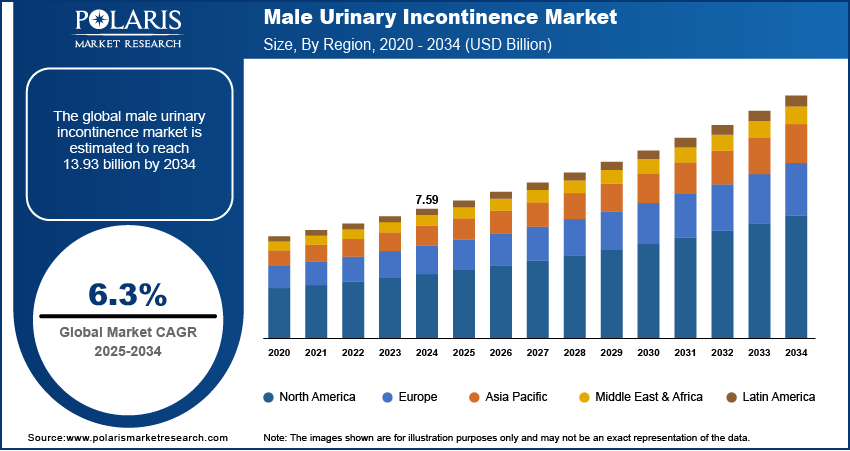

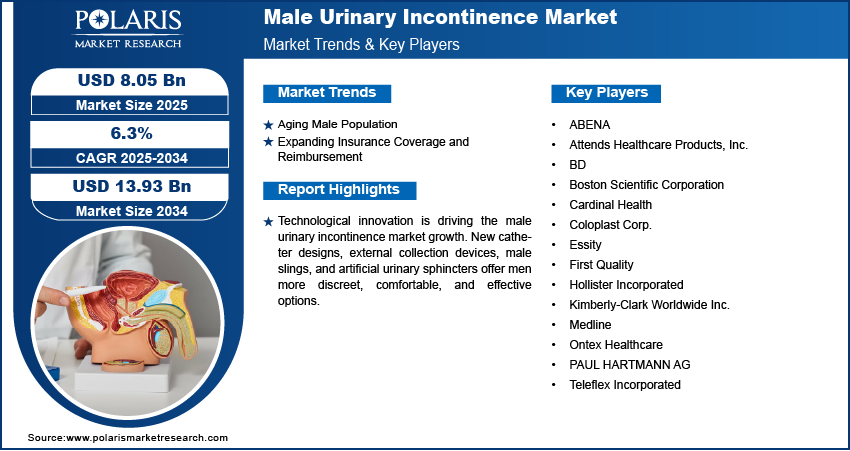

The global male urinary incontinence market size was valued at USD 7.59 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. The male urinary incontinence market is driven by an aging population, rising prostate surgeries, increasing obesity rates, awareness campaigns, and advancements in minimally invasive treatments, along with improved healthcare access and growing demand for effective management solutions.

Key Insights

- In 2024, the absorbents segment held the largest market share, driven by the widespread use of pads, adult diapers, and briefs as the most common and accessible solutions for managing male urinary incontinence.

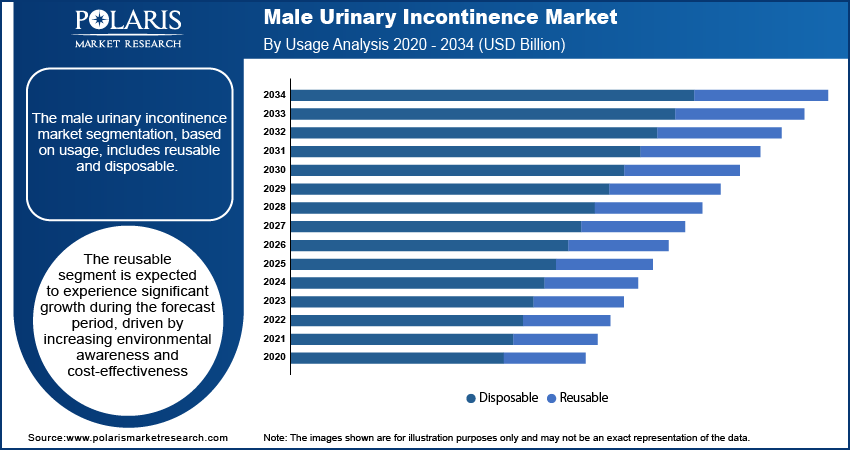

- The reusable products segment is projected to grow significantly during the forecast period, fueled by rising environmental consciousness and the long-term cost benefits of washable, sustainable options.

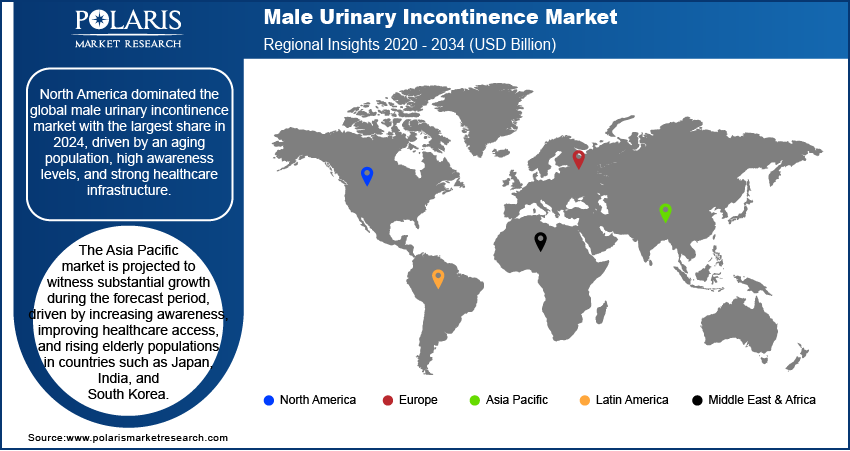

- North America led the male urinary incontinence market share in 2024, supported by a large aging population, high awareness levels, and a robust healthcare infrastructure.

- The U.S. market is expected to experience notable growth in the coming years, driven by substantial healthcare expenditure and an increasingly informed and proactive patient base.

- The market in Asia Pacific is anticipated to witness strong expansion during the forecast period, attributed to improving healthcare accessibility, growing awareness, and an aging male population in countries such as Japan, India, and South Korea.

Industry Dynamics

- Aging male population drives the demand for managing urinary incontinence.

- Expanding insurance coverage and reimbursement are fueling the industry growth.

- Technological innovation is driving the male urinary incontinence demand. New catheter designs, external collection devices, male slings, and artificial urinary sphincters offer men more discreet, comfortable, and effective options.

- Limited awareness and social stigma among men regarding urinary incontinence often lead to underreporting and delayed treatment, restraining market growth.

Market Statistics

- 2024 Market Size: USD 7.59 billion

- 2034 Projected Market Size: USD 13.93 billion

- CAGR (2025–2034): 6.3%

- North America: Largest market in 2024

AI Impact on Male Urinary Incontinence Market

- In diagnostics, Artificial intelligence (AI) algorithms analyze urodynamic data, patient-reported symptoms, and bladder scans to accurately identify the type and severity of urinary incontinence in men.

- In personalized treatment, AI tools recommend customized therapy options, including pelvic floor training, surgical interventions, and neuromodulation, based on the historical and real-time data of the patient.

- In device development, AI technology accelerates research and development (R&D) for male-specific continence devices by simulating design performance before clinical trials.

- AI platforms assess treatment effectiveness in real time and adapt care plans for better continence restoration.

Male urinary incontinence is the unintentional loss of urine in men, often caused by weakened bladder muscles, nerve damage, or prostate issues. It can range from occasional leaks to a complete inability to control urination. Common types include stress incontinence, urge incontinence, and overflow incontinence.

Urinary incontinence in men was often underreported in the past due to embarrassment or lack of awareness. Today, growing public health campaigns, increased education, and media coverage have reduced the stigma and encouraged more men to seek help. The demand for treatments and management products grows as more men talk to healthcare providers and get diagnosed early. Urologists and general practitioners now screen for incontinence more routinely, especially in older male patients. This shift in behavior is leading to higher diagnosis rates and a corresponding rise in the use of devices, medications, and absorbent products designed specifically for male needs, thereby driving the growth.

Technological innovation is driving the male urinary incontinence demand. New catheter designs, external collection devices, male slings, and artificial urinary sphincters offer men more discreet, comfortable, and effective options. Advancements further include smart wearables medical devices and sensors that track leakage patterns and bladder activity. These technologies improve patient comfort, maintain dignity, and help physicians tailor treatments more precisely. Men are more likely to adopt these solutions with better outcomes and reduced side effects. Adoption of technology would offer opportunities for greater market penetration and consumer acceptance as it continues to evolve, thereby fueling the growth.

Drivers & Opportunities

Aging Male Population: The growing number of elderly men is driving the demand for the management of urinary incontinence. According to the U.S. Census Bureau, in the U.S. alone, 0.57% of males are 50 years old as of 2024. The muscles that control urination weaken, and conditions such as benign prostatic hyperplasia (BPH), prostate cancer, and neurological disorders become more common as men age. These issues lead to difficulty in bladder control, increasing demand for urinary incontinence products and treatments. The need for solutions ranging from absorbent products to surgical interventions continues to expand with life expectancy rising and more men seeking to maintain their quality of life, fueling growth across healthcare and consumer segments.

Expanding Insurance Coverage and Reimbursement: Wider insurance coverage for urinary incontinence treatments and products is making it easier for men to seek care without high out-of-pocket expenses. Many public and private health plans in the U.S. and other major countries now reimburse for medical devices such as catheters, absorbent products, and even surgical procedures related to incontinence. This financial support encourages more men to pursue effective treatment options, rather than avoiding care due to cost concerns. Better reimbursement policies further benefit healthcare providers and suppliers by increasing product accessibility and demand, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes non-absorbents and absorbents. In 2024, the absorbents segment dominated with the largest share. Absorbent products, such as pads, adult diapers, and briefs, are the most commonly used solutions for managing male urinary incontinence. These products offer ease of use, affordability, and immediate symptom control without the need for medical intervention. Increasing awareness, improved comfort and fit, and discreet designs have made them more acceptable to men of all ages. More men are turning to absorbent products for daily protection with the growing elderly population and rise in prostate-related conditions. Their wide availability in pharmacies and online further supports segment growth.

Incontinence Type Analysis

The segmentation, based on incontinence type, includes stress urinary incontinence, urge urinary incontinence, overflow incontinence, functional urinary incontinence, and mixed urinary incontinence. The mixed urinary incontinence segment accounted for significant growth due to its increasing prevalence among older men and post-surgical patients, particularly after prostate surgery. Many men experience overlapping symptoms that require more comprehensive management solutions. Growing awareness and accurate diagnosis of mixed incontinence are encouraging tailored treatments, including combination therapies and specialized absorbent products. More targeted support and education are being provided as medical professionals better recognize this type, driving demand for multi-functional products and contributing to the segment expansion.

Usage Analysis

The segmentation, based on usage, includes reusable and disposable. The reusable segment is expected to experience significant growth during the forecast period, driven by increasing environmental awareness and cost-effectiveness. Products such as washable incontinence underwear and reusable bed pads offer long-term savings and are gaining popularity among men who prefer sustainable and durable solutions. Advances in fabric technology have made these products more absorbent, comfortable, and easier to maintain. Reusable products are being adopted more widely as patients and caregivers become more eco-conscious and seek less wasteful alternatives. Additionally, their availability in various sizes and styles to suit different levels of incontinence is improving their appeal across a broader male demographic, fueling the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online and offline. The offline segment dominated with the largest share in 2024 due to the trust and accessibility they offer, especially to older male customers. In-store purchases allow buyers to assess product quality, get recommendations, and receive immediate support. Pharmacists and retail staff further play a crucial role in educating consumers about suitable products. Many men still prefer buying incontinence products discreetly in person, especially when using insurance. The growing availability of incontinence solutions in retail chains and hospital pharmacies supports the expansion of offline sales, driving the segment growth.

Regional Analysis

North America Male Urinary Incontinence Market Trends

North America dominated the market with the largest share in 2024, driven by an aging population, high awareness levels, and strong healthcare infrastructure. The region benefits from wide availability of advanced treatment options, including absorbent products, catheters, and surgical devices. Public health campaigns and insurance coverage further support early diagnosis and ongoing management of incontinence. Increasing prostate-related surgeries and chronic health conditions, such as diabetes and neurological disorders, further contribute to rising cases. Moreover, a strong presence of key players and well-established retail and online distribution networks further drives the growth.

U.S. Male Urinary Incontinence Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, driven by high healthcare spending and a well-informed patient population. The demand for incontinence products and treatments continues to rise, driven by the prevalence of prostate issues, rising obesity rates, and a growing elderly demographic. Availability of both over-the-counter and prescription options, coupled with insurance reimbursement for many products, has made management more accessible. Additionally, the U.S. sees strong innovation in wearable technology and urological devices, which improves patient comfort and treatment effectiveness, driving the growth.

Asia Pacific Male Urinary Incontinence Market Analysis

The Asia Pacific market is projected to witness substantial growth during the forecast period, driven by increasing awareness, improving healthcare access, and rising elderly populations in countries such as Japan, India, and South Korea. The demand for both disposable and reusable products is expanding as more men seek treatment for prostate conditions and incontinence. Cultural stigma around urinary issues is gradually reducing, due to health education campaigns and support from healthcare providers. Growth in medical tourism, especially for urological surgeries, further boosts potential.

China Male Urinary Incontinence Market Insights

The market in China is projected to witness rapid growth during the forecast period due to its rapidly aging population and increasing prevalence of chronic diseases such as diabetes and prostate disorders. More men are seeking diagnosis and treatment for incontinence symptoms driven by greater health awareness and rising disposable income. Government initiatives to improve elderly care and expand healthcare services in rural areas are further supporting growth. Younger generations are more proactive in seeking care. The rise of online pharmacies and e-commerce platforms is further making incontinence products more accessible, driving strong growth in urban and suburban regions.

Europe Male Urinary Incontinence Market Overview

The industry in Europe is expected to experience significant growth in the future, driven by a well-established healthcare system, aging population, and high awareness levels. Countries such as the UK, France, Italy, and Germany are investing in elderly care and preventive health services, which support early diagnosis and long-term management of incontinence. Reimbursement policies and public health campaigns have encouraged men to seek treatment options ranging from absorbent products to surgical interventions. Additionally, advancements in incontinence technologies and growing acceptance of wearable and reusable products are helping reduce stigma. The region’s focus on quality healthcare fuels product innovation and demand, thereby driving the growth.

Germany Male Urinary Incontinence Market Outlook

The market in Germany is expected to experience significant growth driven by its aging male population, strong healthcare infrastructure, and supportive insurance system. The country has a high rate of early screening and treatment for prostate conditions, which contributes to the growing number of men managing urinary incontinence. German consumers further show a strong preference for high-quality, medically approved products. Pharmacies and offline medical supply stores remain key distribution channels. Additionally, Germany’s leadership in medical device innovation and manufacturing place it as a hub for urological product development in Europe, thereby fueling the growth.

Key Players and Competitive Analysis

The industry is competitive, with several key players focusing on innovation, product development, and global reach. Companies such as BD, Boston Scientific, and Teleflex Incorporated lead with advanced urology solutions, including catheters, slings, and surgical implants. Consumer-focused brands such as Kimberly-Clark, Attends (Domtar), and First Quality offer disposable absorbent products tailored for comfort and discretion. Medline, Cardinal Health, and Essity leverage strong distribution networks and healthcare partnerships to ensure wide product availability. Coloplast, Hollister, and PAUL HARTMANN AG specialize in continence care with high-quality, skin-friendly materials and user-centric designs. ABENA and Ontex Healthcare target cost-effective and eco-friendly incontinence products, expanding access to different market segments. As awareness of male incontinence grows, so does the emphasis on discreet, effective, and comfortable solutions. Competitive dynamics are driven by product innovation, aging populations, and the increasing demand for both medical and lifestyle-friendly management options. Strategic acquisitions and collaborations further shape the evolving landscape.

Key Players

- ABENA

- Attends Healthcare Products, Inc. (Domtar Corporation)

- BD

- Boston Scientific Corporation

- Cardinal Health

- Coloplast Corp.

- Essity

- First Quality

- Hollister Incorporated

- Kimberly-Clark Worldwide Inc.

- Medline

- Ontex Healthcare

- PAUL HARTMANN AG

- Teleflex Incorporated

Male Urinary Incontinence Industry Developments

In December 2024, Sumitomo Pharma America launched GEMTESA (vibegron) following FDA approval for treating men with overactive bladder symptoms receiving BPH therapy, marking it as the first β3 agonist approved for this indication in the U.S., expanding treatment options significantly.

Male Urinary Incontinence Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Non-Absorbents

- Urinary Catheters

- Drainage Bags

- External Compression Devices/Penile Clamps

- Artificial Urinary Sphincter

- Others

- Absorbents

- Underwear & Briefs

- Drip Collectors & Bed Protectors

- Pads & Guards

By Incontinence Type Output Outlook (Revenue, USD Billion, 2020–2034)

- Stress Urinary Incontinence

- Urge Urinary Incontinence

- Overflow Incontinence

- Functional Urinary Incontinence

- Mixed Urinary Incontinence

By Usage Output Outlook (Revenue, USD Billion, 2020–2034)

- Reusable

- Disposable

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Homecare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Male Urinary Incontinence Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.59 Billion |

|

Market Size in 2025 |

USD 8.05 Billion |

|

Revenue Forecast by 2034 |

USD 13.93 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.59 billion in 2024 and is projected to grow to USD 13.93 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are ABENA; Attends Healthcare Products, Inc. (Domtar Corporation); BD; Boston Scientific Corporation; Cardinal Health; Coloplast Corp.; Essity; First Quality; Hollister Incorporated; Kimberly-Clark Worldwide Inc.; Medline; Ontex Healthcare; PAUL HARTMANN AG; and Teleflex Incorporated.

The absorbent segment dominated the market share in 2024.

The reusable segment is expected to witness the significant growth during the forecast period.