Building Envelope Adhesives & Sealants Market Size, Share, Trends, Industry Analysis Report

By Technology (Solvent-Less, Solvent-Based, Water-Based), By Adhesive Resin, By Adhesive Applications, By Sealant Resin, By Sealant Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6456

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

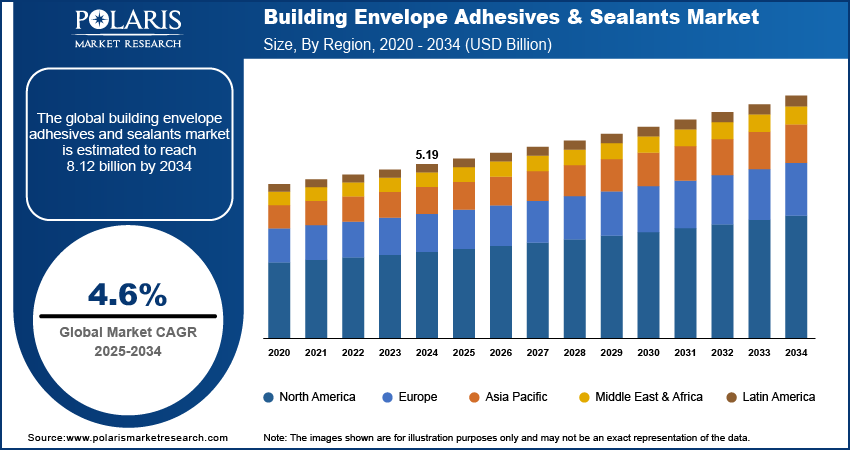

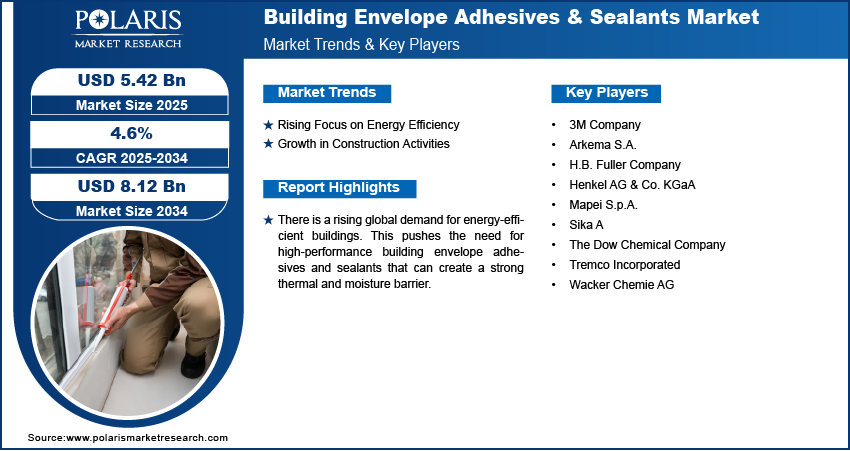

The global building envelope adhesives & sealants market size was valued at USD 5.19 billion in 2024 and is anticipated to register a CAGR of 4.6% from 2025 to 2034. The growing focus on energy efficiency and sustainability in buildings is a major driver. Building codes and regulations are becoming stricter, which increases the demand for high-performance products. In addition, the rise in construction activities worldwide, especially in developing regions, is boosting the demand for these materials.

Key Insights

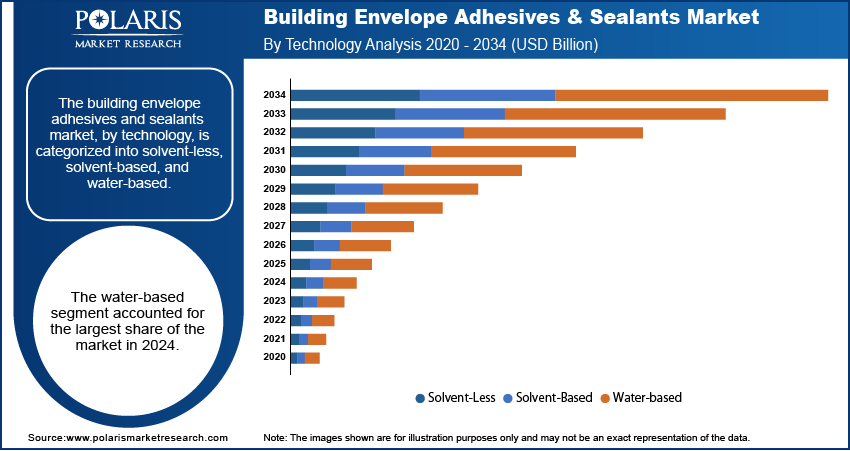

- By technology, the water-based technology segment held the largest share in 2024. The growth driven by eco-friendliness, low VOC emissions, and regulatory support.

- The polyurethane resin segment holds the largest share in 2024. This is due to its superior flexibility, durability, and bonding strength.

- The roofing application segment dominated the share in 2024. This is supported by rising construction activity and demand for weather-resistant adhesive solutions.

- The silicone resin segment held the largest share in 2024, driven by excellent thermal stability, water resistance, and versatility.

- Asia Pacific held the largest revenue share in 2024, fueled by rapid urbanization, industrial growth, and increasing construction activity across emerging economies.

Industry Dynamics

- The rising global focus on energy efficiency is a key driver. This is because these sealants are essential for creating an airtight building envelope, which prevents air and moisture leaks, ultimately reducing a building's energy use for heating and cooling.

- Increased worldwide construction activities, particularly in emerging economies, are boosting demand. Urbanization and government investments in infrastructure and residential construction projects are leading to a surge in new buildings. The new building construction requires high-performance materials, such as building envelope adhesives and sealants.

- The imposition of stringent government regulations and building codes for environmental and safety standards propels the demand for building envelope adhesives and sealants. These rules push for the use of materials with low volatile organic compounds (VOCs), which leads to more sustainable and eco-friendly products.

Market Statistics

- 2024 Market Size: USD 5.19 billion

- 2034 Projected Market Size: USD 8.12 billion

- CAGR (2025–2034): 4.6%

- Asia Pacific: Largest market in 2024

Building envelope adhesives and sealants are chemical products used to seal and bond various parts of a building's exterior, such as roofs, walls, and windows. They create a protective barrier against external elements such as air, water, heat, and moisture, which helps improve the building's energy efficiency and durability.

The growing use of modular and prefabricated construction adhesive methods drives the demand for building envelope adhesives and sealants. These modern building techniques involve creating building components off-site in a factory setting. This process requires quick-setting and high-strength adhesives and sealants to bond the panels and sections together efficiently before they are moved to the construction site. These products help speed up the building process while ensuring the final structure is strong and weather-tight.

Rising focus on complying with green building standards and certifications propels the use of materials with a lower environmental impact. There is an increased demand for products with low or zero volatile organic compounds (VOCs) emissions. The products create a healthier indoor environment by reducing the release of harmful chemicals. For instance, the U.S. Green Building Council's LEED certification program encourages the use of materials that meet stringent environmental standards, which boosts the requirement for eco-friendly building envelope adhesives and sealants.

Drivers and Trends

Rising Focus on Energy Efficiency: Building envelopes, including the roof, walls, windows, and foundation, act as a barrier between the outdoor and indoor environments. Effective sealing and bonding of these building components with high-performance adhesives and sealants are required to prevent air and moisture leakage. These products reduce the energy consumption needed for heating and cooling by minimizing thermal transfer. It helps in lowering a building's overall energy consumption and carbon footprint.

The U.S. Department of Energy's 2023 "Better Buildings Progress Report" noted that over 900 public and private partners have collectively saved more than $18.5 billion in energy costs since the program began. This shows a strong and ongoing commitment to improving energy efficiency across the building sector. The increased demand for energy-efficient structures, driven by environmental goals and economic savings, boosts the use of specialized adhesives and sealants.

Growth in Construction Activities: The population across the globe is growing. Also, more people are moving to cities. As a result, there is a rising need for new residential, commercial, and industrial buildings. The surge in construction, especially in developing regions, boosts the demand for building materials, including sealants and adhesives. These products are highly used to ensure the durability and structural integrity of new buildings. It makes them an essential part of modern construction.

According to a February 2024 report from the U.S. Census Bureau titled "Monthly Construction Spending, December 2023," the value of private residential construction in the U.S. was estimated at a seasonally adjusted annual rate of $911.7 billion in December 2023. This figure was 1.4% higher than the revised estimate from November 2023, showing the ongoing growth in the construction sector. This expansion of new construction projects contributes to the rising demand for building envelope adhesives and sealants.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes solvent-less, solvent-based, and water-based. The water-based segment held the largest share in 2024 as these products are considered more eco-friendly and safer to use. They contain very low or zero Volatile Organic Compounds (VOCs), which aligns with the growing global push for green building practices and stricter environmental regulations. These adhesives and sealants use water as a solvent, making them easy to clean up and reducing health risks for workers during application. Their versatility allows them to be used on many different surfaces, both porous and non-porous, and they provide strong, long-lasting bonds. The widespread use of these materials in both new construction and renovation projects, particularly for indoor applications, contributes significantly to their dominance. As public awareness regarding the harmful impact of VOCs grows and as governments enact more protective laws, the demand for water-based solutions continues to rise.

The solvent-less segment is anticipated to register the highest growth rate during the forecast period. This is due to a strong shift toward more sustainable and safer building materials. Solvent-less products, such as hot-melt adhesives and reactive systems, do not contain VOCs and are entirely free of solvents. This makes them ideal for applications where indoor air quality is a primary concern. The push from government bodies and building certification programs for materials that have a minimal environmental footprint is also driving this growth. These products offer superior performance in terms of strength and durability, and they can cure quickly, which helps speed up construction timelines. As the landscape continues to prioritize health, safety, and environmental responsibility, the demand for solvent-less technologies is set to increase rapidly, making it the fastest-growing part of the market.

Adhesive Resin Analysis

Based on adhesive resin, the segmentation includes polyurethane, epoxy, acrylic, rubber, and others. The polyurethane segment held the largest share in 2024. Polyurethane-based products are highly versatile for a variety of applications on a building’s exterior. The polyurethane products are used for sealing and bonding materials on walls, roofs, floors, and facades since they can handle movement and stress from building settlement and temperature changes. Their ability to resist chemicals, moisture, and UV radiation also contributes to the long-term performance and lifespan of a building envelope. This reliability and ongoing product developments make polyurethane a preferred choice for builders and contractors.

The acrylic resin segment would register the highest growth rate during the forecast period. The growing demand for eco-friendly and low-VOC products is a key factor driving this growth. Acrylic-based adhesives and sealants are often water-based, which means they contain fewer harmful chemicals and are safer for both the environment and people. They provide good adhesion and weathering properties, which makes them suitable for numerous indoor and outdoor uses. As the construction industry increasingly adopts green building standards and regulations become stricter, the demand for these sustainable solutions is increasing rapidly. The ease of application and clean-up also makes them appealing to a broader user base, from professional contractors to DIY enthusiasts.

Adhesive Applications Analysis

Based on adhesive applications, the segmentation includes roofing, walls, subfloors, and others. The roofing segment held the largest share in 2024. A roof protects against rain, wind, UV radiation, and extreme temperatures. High-performance adhesives and sealants are essential to ensure that roofing materials, such as membranes, tiles, and flashing, are properly bonded and sealed to prevent water leaks and air infiltration. Further, the high cost of roof repairs and replacement prompts building owners and contractors to invest in reliable products that provide long-lasting durability. The continuous need for roof maintenance and replacement in new and existing buildings contributed to the dominance of this segment.

The walls application segment is anticipated to register the highest growth rate during the forecast period. The introduction of modern building designs and an increasing focus on energy efficiency drive the use of advanced wall systems that rely heavily on adhesives and sealants. These products are used for installing insulation, sealing wall panels, and creating a continuous air and water barrier across the building's facade. The use of complex materials and construction methods, including exterior insulation and finish systems (EIFS) and prefabricated wall panels, propels the requirement for specialized adhesive and sealant solutions. As new construction and renovation projects increasingly focus on creating highly insulated and airtight walls to meet stricter energy codes, the demand for these products is rising rapidly.

Sealant Resin Analysis

Based on sealant resin, the segmentation includes polyurethane, silicone, acrylic, silane modified polymer, and others. In 2024, the silicone segment held the largest share. Excellent performance characteristics of silicone make it ideal for sealing a building’s exterior, which drives the segment dominance. Silicone sealants offer high resistance to extreme temperatures, moisture, and UV light. It ensures that they remain flexible and durable over a long period. Silicone sealants are especially important for various applications, including sealing windows, curtain walls, and joints where there is constant movement. Their stability and long-lasting performance give them an advantage over other resins in terms of durability. This wide range of benefits makes them a go-to choice for many professional contractors and builders, which contributes to their dominance.

The silane-modified polymer (SMP) resin segment is anticipated to register the highest growth rate during 2025–2034. The increasing demand for sustainable and high-performance products that are free of isocyanates and solvents drives the growth of the segment. SMP sealants combine the best properties of silicone and polyurethane sealants. It offers strong adhesion, good flexibility, and excellent resistance to weathering without the use of harmful chemicals. They are a popular choice for many applications, from general construction to industrial uses. As the construction industry shifts toward greener materials and complying with stringent environmental standards, the demand for SMP sealants is rising quickly.

Regional Analysis

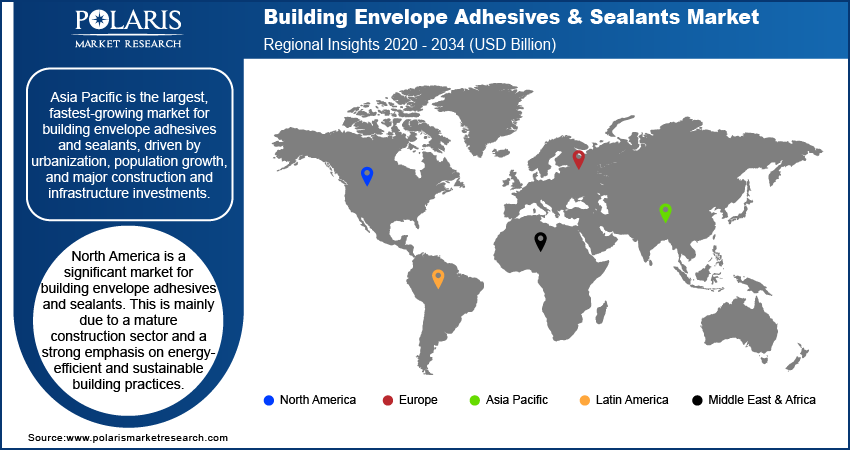

The Asia Pacific building envelope adhesives & sealants market accounted for the largest share in 2024. This is due to rapid urbanization, increasing population, and huge investments in infrastructure and construction projects across the region. The expanding residential and commercial construction sectors in countries with fast-growing economies are driving a high volume of demand. As living standards improve, there is also a greater focus on building quality and durability, which boosts the need for these products.

China Building Envelope Adhesives & Sealants Market Insights

In Asia Pacific, China dominated the revenue share in 2024. The country's massive and continuous construction boom, including everything from residential complexes to large-scale infrastructure, makes it a key consumer. The rapid development of urban areas and increasing government-led projects propelled the need for building materials. The rising focus on green building practices in the country, aimed at tackling environmental concerns, is boosting the demand for high-performance and eco-friendly adhesives and sealants.

North America Building Envelope Adhesives & Sealants Market Insights

North America accounted for a significant market revenue share in 2024. The mature construction sector and a rising emphasis on energy-efficient and sustainable building practices propel the demand for building envelope adhesives and sealants across the region. Regulations and building codes, which promote green buildings and low energy consumption, drive demand for high-performance products that ensure airtightness. In addition, the rising trend of renovating and retrofitting existing structures leads to steady industry growth, as older buildings are updated to comply with modern efficiency standards.

U.S. Building Envelope Adhesives & Sealants Market Overview

In North America, the U.S. held the largest revenue share in 2024. The large and active construction sector, including both residential and commercial projects, creates a consistent need for building envelope adhesives and sealants. The trend toward using high-performance materials to meet strict energy codes is especially strong here. The rising use of insulated panels, prefabricated elements, and other advanced building systems boosts the need for specialized adhesives and sealants to ensure a durable and efficient building envelope.

Europe Building Envelope Adhesives & Sealants Market Trends

Rising push for sustainable infrastructure development and compliance with environmental regulations fuels the European industry growth. The region's commitment to minimize carbon emissions bolstered the adoption of energy-efficient building standards. This push for "nearly zero-energy buildings" contributed to the increasing demand for high-quality adhesives and sealants that enhance a building's thermal performance. Furthermore, the renovation of older buildings, especially in urban areas, plays a key role in industry expansion, as these projects often require modern sealing solutions to improve energy efficiency.

In Europe, the Germany building envelope adhesives & sealants market holds the largest share. It is a major region for construction and manufacturing. Its strong economy and advanced building standards make it a leading country. The German government and industry have a strong focus on passive house standards and other green building initiatives. This creates a high demand for premium building envelope materials, including the most advanced adhesives and sealants.

Key Players and Competitive Insights

The market for building envelope adhesives and sealants is shaped by strong competition among a number of key players. These companies, including H.B. Fuller, Henkel AG & Co. KGaA, Sika AG, The Dow Chemical Company, Arkema (Bostik), and The 3M Company, are focused on innovation to gain an edge. The competitive landscape is marked by a focus on developing new products that are more sustainable, durable, and easy to apply. Companies are investing in research to create materials that are low in volatile organic compounds (VOCs) and offer enhanced performance, such as better weather resistance and faster curing times.

A few prominent companies include 3M Company, H.B. Fuller Company, Henkel AG & Co. KGaA, Sika AG, Arkema S.A., The Dow Chemical Company, Wacker Chemie AG, Mapei S.p.A., and Tremco Incorporated.

Key Players

- 3M Company

- Arkema S.A.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Mapei S.p.A.

- Sika A

- The Dow Chemical Company

- Tremco Incorporated

- Wacker Chemie AG

Building Envelope Adhesives & Sealants Industry Developments

March 2025: Sika AG acquired Cromar Building Products, a well-known supplier of roofing systems in the UK. This acquisition helps Sika strengthen its position in the UK's market and expand its product offerings through distribution channels.

February 2024: Henkel signed an agreement to acquire Seal for Life Industries, a specialized supplier of protective coating and sealing solutions.

Building Envelope Adhesives & Sealants Market Segmentation

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Solvent-Less

- Solvent-Based

- Water-Based

By Adhesive Resin Outlook (Revenue – USD Billion, 2020–2034)

- Polyurethane

- Epoxy

- Acrylic

- Rubber

- Others

By Adhesive Applications Outlook (Revenue – USD Billion, 2020–2034)

- Roofing

- Walls

- Subfloors

- Others

By Sealant Resin Outlook (Revenue – USD Billion, 2020–2034)

- Polyurethane

- Silicone

- Acrylic

- Silane Modified Polymer

- Others

By Sealant Application Outlook (Revenue – USD Billion, 2020–2034)

- Facade Panel Fixing

- Wall Joints

- Sanitary

- Passive Fire Protection

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Building Envelope Adhesives & Sealants Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.19 billion |

|

Market Size in 2025 |

USD 5.42 billion |

|

Revenue Forecast by 2034 |

USD 8.12 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.19 billion in 2024 and is projected to grow to USD 8.12 billion by 2034

The global market is projected to register a CAGR of 4.6% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include 3M Company, H.B. Fuller Company, Henkel AG & Co. KGaA, Sika AG, Arkema S.A., The Dow Chemical Company, Wacker Chemie AG, Mapei S.p.A., and Tremco Incorporated.

The water-based segment accounted for the largest share of the market in 2024.

The acrylic segment is expected to witness the fastest growth during the forecast period.