Oil Condition Monitoring Market Size, Share, Trends, Industry Analysis Report

By Offering (Hardware, Software, Services), By End Use, By Industry, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM6454

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

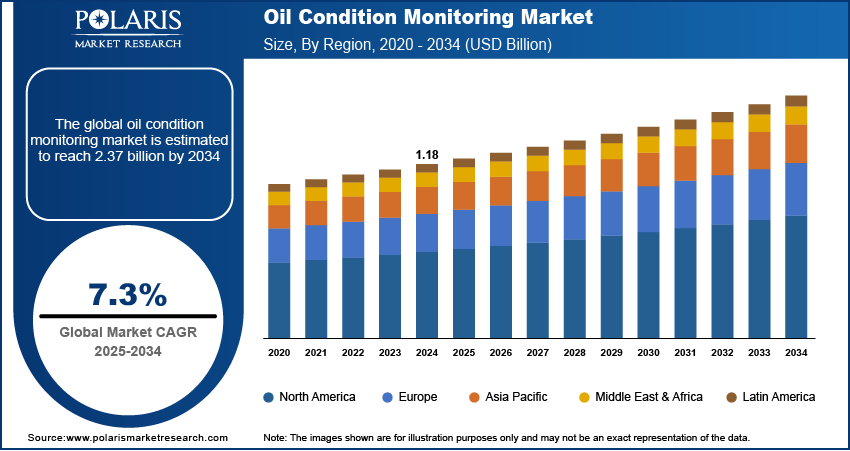

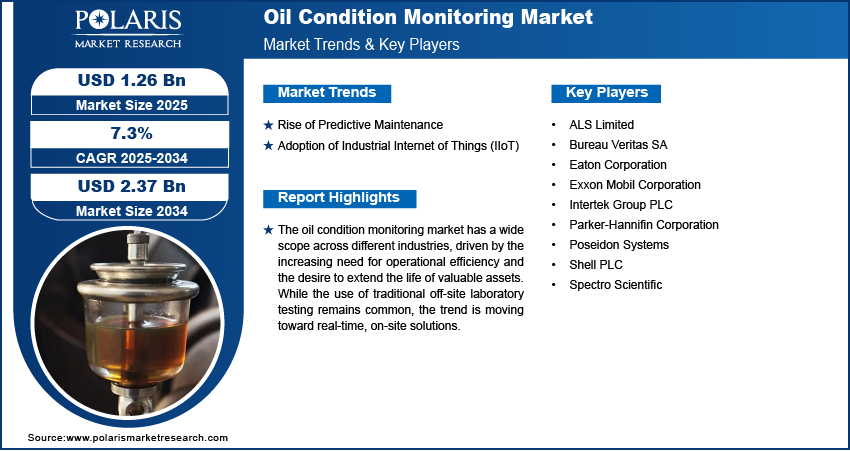

The global oil condition monitoring market size was valued at USD 1.18 billion in 2024 and is anticipated to register a CAGR of 7.3% from 2025 to 2034. The sector is growing because more companies are adopting predictive maintenance to reduce costs and prevent equipment failures. Another key driver is the increasing use of the Industrial Internet of Things and smart sensors. This technology allows for real-time monitoring and advanced data analysis, which helps extend the life of equipment.

Key Insights

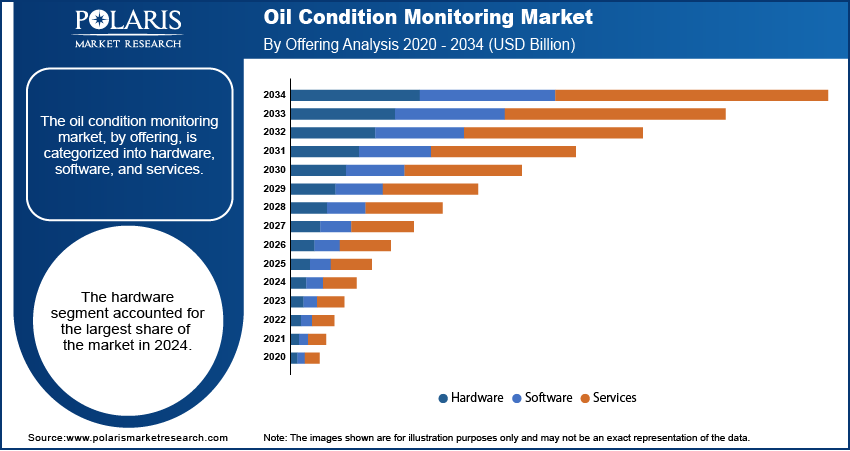

- By offering, the hardware segment held the largest share. This is attributed to the fact that it forms the essential foundation for any monitoring system.

- By end use, the engine segment held the largest share. This is due to its widespread application across a variety of industries, from transportation to agriculture.

- By industry, the automotive and transportation segment held the largest share because of the large volume of vehicles and heavy machinery using such products.

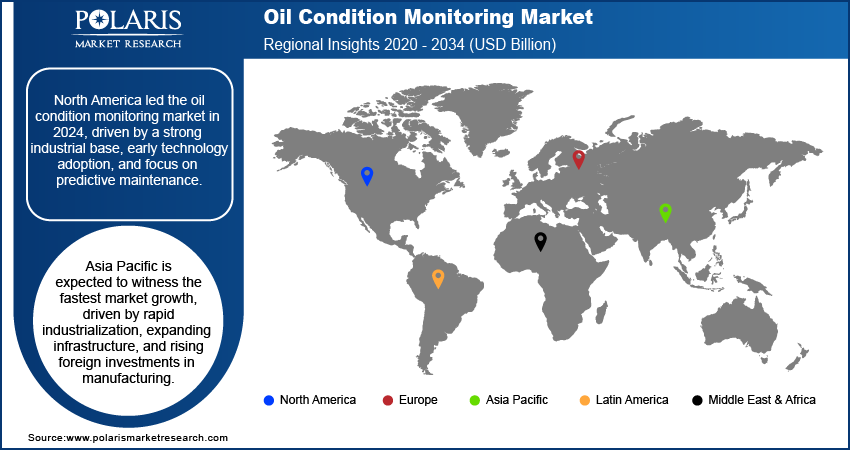

- By region, North America dominates the share because of its advanced industrial base and early adoption of advanced technologies.

Industry Dynamics

- The increasing adoption of predictive maintenance by industries is a major driver, as it helps businesses to save costs and reduce unexpected equipment breakdowns. Due to these advantages, companies are shifting from traditional time-based maintenance to a more efficient system that reacts to the actual condition of machinery.

- Growing focus on improving operational efficiency and extending the life of assets drives the market development. By using this monitoring, companies can understand the health of their machinery and make informed decisions. The monitoring leads to less downtime and a longer working life of their equipment.

- The rising focus on Industry 4.0 and the increasing use of the Industrial Internet of Things (IIoT) boost the industry growth. The use of smart sensors and real-time data analysis enables continuous monitoring, providing detailed insights that were not possible before.

Market Statistics

- 2024 Market Size: USD 1.18 billion

- 2034 Projected Market Size: USD 2.37 billion

- CAGR (2025–2034): 7.3%

- North America: Largest market in 2024

AI Impact on Oil Condition Monitoring Market

- The adoption of AI is turning oil condition monitoring into a strategic asset for safety, reliability, and cost control.

- AI technology analyzes particle moisture, count, viscosity, and oxidation levels to predict equipment failures before they happen. In critical sectors such as energy, transportation, and manufacturing, the prediction minimizes unplanned downtime and extends asset life.

- AI systems optimize lubricant selection and oil change intervals, which reduces costs and improves sustainability.

Oil condition monitoring involves the regular analysis of lubricants to check the health and performance of machinery. This process helps detect early signs of equipment wear, contamination, or other issues, which allows for proactive maintenance and reduces the risk of unexpected breakdowns.

Rising focus on strict government regulations and environmental policies drives the demand for oil condition monitoring. Industries such as oil and gas, mining, and power generation are required to comply with specific rules about emissions and waste management. Companies are using this technology to make sure their equipment is running efficiently and to avoid oil spills or other environmental damage that could lead to heavy fines.

Another driver is the ongoing advancement of technology. The development of new sensors, along with the growing use of the Industrial Internet of Things (IIoT) and artificial intelligence (AI), has made oil condition monitoring more accurate and accessible. For instance, the U.S. Environmental Protection Agency (EPA) has rules under the Clean Air Act that encourage industries to use technology that captures harmful emissions, and oil condition monitoring can play a part in ensuring equipment is running at its best to meet these standards.

Drivers and Trends

Rise of Predictive Maintenance: Various industries across the world are shifting from traditional maintenance methods to more modern, data-driven approaches. Instead of fixing equipment after its breakdown or sticking to a fixed schedule, companies use real-time data to predict when machinery needs servicing. This shift to predictive maintenance helps prevent costly unplanned downtime and extends the life of valuable assets, which is a major reason for the growing demand for oil condition monitoring. The ability to know exactly when to maintain a machine based on the actual condition of its oil saves both time and money.

More proactive approach to maintenance supports operational improvements. Industrial facilities in the U.S. use predictive maintenance technologies to reduce unexpected equipment failures, leading to better overall energy efficiency. Predictive analysis is used to make smarter maintenance decisions, which drives the market expansion.

Adoption of Industrial Internet of Things (IIoT): Adoption of Industrial Internet of Things (IIoT): The widespread demand for IIoT across industries boosts the industry expansion. In IIoT, industrial machinery is connected to sensors for continuous data collection and transmission. In oil condition monitoring, sensors can be placed directly on equipment to measure oil temperature, pressure, and particle counts in real time. This constant flow of data enables immediate analysis and alerts, enabling maintenance teams to react to issues as they happen.

A 2024 report European Commission's Eurostat, titled "Final Energy Consumption in Industry," highlights that more EU manufacturing companies are using IIoT for energy management. These technologies are often part of a wider effort to improve efficiency and reduce environmental impact. The integration of IIoT with monitoring solutions is making the process more efficient and automated, which is increasing the overall penetration and adoption of this technology.

Segmental Insights

Offering Analysis

Based on offering, the segmentation includes hardware, software, and services. The hardware segment held the largest share in 2024. This is because every oil condition monitoring solution needs physical components such as sensors, analyzers, and other devices to collect data from the machinery. These devices are the foundation of any monitoring program, as they are responsible for gathering the raw data on oil quality, temperature, and particle count. As companies continue to invest in setting up monitoring systems across their operations, the demand for these tangible products remains high. The essential nature of hardware, which includes everything from simple test kits to complex online sensor arrays, ensures that this segment continues to be the dominant.

The software segment is anticipated to register the highest growth rate during the forecast period. Hardware is the base for data collection. However, software is used to turn data into useful insights. The increasing use of the Industrial Internet of Things and artificial intelligence is leading to more advanced software solutions. These programs can analyze vast amounts of data in real time, predict maintenance needs, and provide detailed reports. As more companies seek ways to collect data and get actionable intelligence from it, the demand for sophisticated software that can handle these tasks is rising quickly.

End Use Analysis

Based on end use, the segmentation includes turbines, compressor, engines, hydraulic systems, and others. The engines segment held the largest share in 2024. Engines are components in vehicles used in a wide variety of industries, such as construction, transportation, agriculture, and power generation. The constant use and demanding operating conditions these engines face, such as high temperatures and pressures, make regular oil analysis essential. Monitoring the condition of engine oil helps prevent premature wear and tear, detect contamination, and ensure optimal performance. Since engines are so common in both mobile and stationary equipment around the world, the need to protect these critical assets with consistent monitoring drives the segment's significant share.

The hydraulic systems segment is anticipated to register the highest growth rate during the forecast period. Hydraulic systems are used in a variety of machinery, from heavy construction equipment and industrial presses to aerospace applications. The demand for highly precise and reliable machinery is increasing across many industries, and this directly boosts the need for effective monitoring of hydraulic fluid. Contaminated or degraded hydraulic fluid can lead to serious system failures and costly downtime. As industries automate more of their operations and rely on these systems for complex tasks, the need for proactive monitoring becomes even more important. This rising focus on precision and uptime is fueling the fast-paced growth of the hydraulic systems segment.

Industry Analysis

Based on industry, the segmentation includes automotive & transportation, oil & gas, energy & power, metal & mining, food & beverage, pharmaceuticals, chemicals, and others. The automotive & transportation segment held the largest share in 2024. This dominance is mainly attributed to the high number of vehicles and machinery relying on transmissions, engines, and other systems with large oil reserves. The rising need for regular oil monitoring is critical across numerous industries, from commercial trucks and buses to construction and agricultural equipment. In these industries, oil monitoring is required to ensure vehicle uptime, safety, and operational efficiency. The high scale and continuous use of these vehicles and electric vehicles make the sector a primary consumer of oil condition monitoring services and products. The ongoing push to extend vehicle life and reduce maintenance costs across global transportation networks also contributes to this segment's dominant position.

The metals and mining segment is anticipated to register the highest growth rate during the forecast period. This is because equipment in this sector operates in extremely harsh and demanding conditions, which puts significant stress on machinery and lubricants. In mining, large-scale equipment such as excavators, haul trucks, electric trucks, and crushers are vital to operations, and any unplanned breakdown can cause major financial losses. Companies in the sector increasingly adopt this technology to protect their assets, increase productivity, and ensure the safety of their workers. The rising shift toward more automated and complex machinery in mining operations also propels the need for advanced monitoring solutions to avoid failures and optimize performance.

Regional Analysis

North America oil condition monitoring market accounted for the largest share in 2024. The region's strong industrial infrastructure and high adoption of modern technologies such as predictive maintenance and IIoT are major reasons for this. There is a rising demand for solutions that can reduce operational costs and enhance equipment reliability across industries such as oil and gas, manufacturing, transportation, and others. The mature industrial landscape and the presence of major technology companies also contribute to the region's strong standing.

U.S. Oil Condition Monitoring Market Insights

In North America, the U.S. is a significant contributor to the region. The country's large and diverse industrial base, including sectors such as aerospace, power generation, and manufacturing, provides a strong foundation for growth. Companies in the U.S. are focused on improving operational efficiency and are willing to invest in advanced monitoring solutions. This, along with a high degree of technological awareness, makes the U.S. a leading country in the adoption of these technologies.

Europe Oil Condition Monitoring Market Overview

Europe is also a very important region, driven by its robust manufacturing sector and strong focus on sustainability. European industries are increasingly adopting advanced monitoring technologies to optimize machinery performance and comply with strict environmental regulations. The region's emphasis on industrial automation and the push for greater energy efficiency across sectors such as automotive and power generation contribute to the steady growth.

The Germany oil conditioning market holds the largest share in Europe. As a leader in manufacturing and engineering, Germany has a strong tradition of implementing advanced industrial solutions. The country's focus on Industry 4.0 initiatives and smart factories has created a significant demand for sophisticated oil condition monitoring systems. German companies are at the forefront of using technology to improve production processes, and this commitment to innovation supports the development.

Asia Pacific Oil Condition Monitoring Market Overview

The Asia Pacific market is expected to experience the fastest growth. This is due to rapid industrialization, growing infrastructure development, and increasing foreign investments in manufacturing across countries in the region. As new factories and plants are built, the demand for modern maintenance solutions is rising. Companies are also becoming more aware of the benefits of preventing equipment failure and reducing downtime, which is fueling the adoption of these technologies.

China Oil Condition Monitoring Market Overview

China is a key country driving the market growth in Asia Pacific. With its massive manufacturing sector and ongoing government initiatives to modernize the sector, China is a huge consumer of these monitoring solutions. The country's "Made in China 2025" plan encourages the use of advanced technologies to improve industrial efficiency and quality. This has led to widespread investments in systems that can ensure the reliability and performance of machinery, making China a leader in the region's expansion.

Key Players and Competitive Insights

The oil condition monitoring market comprises a mix of large corporations and specialized companies. Companies such as General Electric Company, Eaton Corporation, and Parker-Hannifin Corporation are a few prominent players. They have broad product portfolios that serve multiple industries. Meanwhile, companies such as Spectro Scientific (an AMETEK company) and Poseidon Systems focus on specific technologies and solutions. The competitive landscape is shaped by innovation in sensor technology, the integration of IIoT platforms, and the ability to offer comprehensive service packages that go beyond just hardware. Companies are competing on the quality of their products and on the value of their data analysis and diagnostic services.

Eaton Corporation, Parker-Hannifin Corporation, Shell PLC, Intertek Group PLC, Poseidon Systems, Exxon Mobil Corporation, Spectro Scientific, Bureau Veritas SA, and ALS Limited are a few key market players.

Key Players

- ALS Limited

- Bureau Veritas SA

- Eaton Corporation

- Exxon Mobil Corporation

- Intertek Group PLC

- Parker-Hannifin Corporation

- Poseidon Systems

- Shell PLC

- Spectro Scientific

Oil Condition Monitoring Industry Developments

June 2024: Eaton introduced the PFS 02 particle flow sensor specifically for aerospace applications. This device is designed for continuous monitoring of hydraulic and lubrication oil contamination.

May 2024: Intertek Group plc formed a strategic partnership with Korea Testing & Research Institute to facilitate global market access for manufacturers of electrical and electronic products. This collaboration allows Korean companies to leverage Intertek’s CB test reports for Korea Certification and to obtain Intertek’s S Mark for compliance with European standards.

Oil Condition Monitoring Market Segmentation

By Offering Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- Software

- Services

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Turbines

- Compressor

- Engines

- Hydraulic Systems

- Others

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- Automotive & Transportation

- Oil & Gas

- Energy & Power

- Metal & Mining

- Food & Beverage

- Pharmaceuticals

- Chemicals

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oil Condition Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.18 billion |

|

Market Size in 2025 |

USD 1.26 billion |

|

Revenue Forecast by 2034 |

USD 2.37 billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.18 billion in 2024 and is projected to grow to USD 2.37 billion by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Eaton Corporation, Parker-Hannifin Corporation, Shell PLC, Intertek Group PLC, Poseidon Systems, Exxon Mobil Corporation, Spectro Scientific, Bureau Veritas SA, and ALS Limited.

The hardware segment accounted for the largest share of the market in 2024.

The hydraulic systems segment is expected to witness the fastest growth during the forecast period.