Silica Market Size, Share, Trends, Industry Analysis Report

By Type (Amorphous and Crystalline), By End-user Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Nov-2025

- Pages: 126

- Format: PDF

- Report ID: PM6529

- Base Year: 2024

- Historical Data: 2020-2023

What is the silica market size?

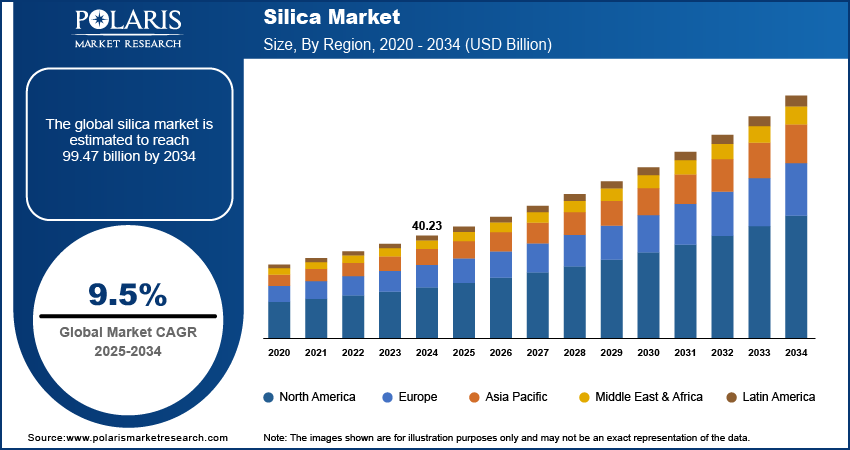

The global silica market size was valued at USD 40.23 billion in 2024, growing at a CAGR of 9.5% from 2025 to 2034. Rising electronics and semiconductor manufacturing along with growth in automotive and transportation applications is boosting the market growth.

Key Insights

- Amorphous silica led the market share in 2024, fueled by its growing application in rubber, coatings, adhesives, and food-grade applications.

- Shale oil and gas segment expected to grow at a fast rate, supported by the widespread application of silica sand as a proppant material during hydraulic fracturing.

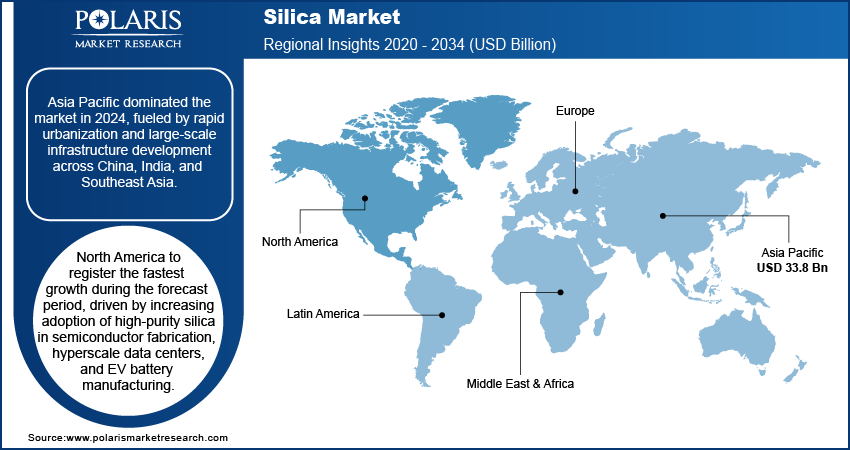

- Asia Pacific region held the largest share in global silica market in 2024 due to faster urbanization and huge-scale infrastructure growth throughout China, India, and Southeast Asia.

- China dominated the regional market driven by the robust electronics manufacturing, semiconductor fabs, and solar module production.

- North America is forecast to grow at a high rate during the forecast period, led by increasing demand for high-purity silica in semiconductor production, hyperscale data centers, and EV battery production.

- The U.S. led the regional market owing to increasing solar panel installations, propelling demand for high-grade silica employed in photovoltaic glass and wafer manufacturing.

Industry Dynamics

- Increasing demand from the electronics and semiconductor manufacturing industry is boosting silica consumption.

- Rising automotive and transportation applications are further boosting market growth.

- Raw material price volatility hinders market stability and investment planning.

- Ultra-purification technologies and nano-silica manufacturing offer strong market opportunities.

Market Statistics

- 2024 Market Size: USD 40.23 Billion

- 2034 Projected Market Size: USD 99.47 Billion

- CAGR (2025–2034): 9.5%

- Asia Pacific: Largest Market Share

What is silica market involves?

The silica market involves high-purity silicon dioxide materials that are used in various glass production, electronics, foundry, construction, personal care, and industrial processes. Growth in the market is fueled by increasing usage of specialty glass and semiconductor parts, growth in coatings and rubber industries, as well as improved application of high-performance silica in filtration, additives, and reinforcement processes.

Silica is experiencing increasing usage as a strengthening agent, filler, and thickener in paints, adhesives, and sealants within the chemical and coatings industry. Its application to enhance mechanical strength, durability, and viscosity stability positions it as a valuable additive in high-performance industrial products. This extensive material integration is reinforcing silica's role in manufacturing value chains.

Ongoing technological development in silica processing is allowing manufacturer to produce high-purity, specialty-grade silica for specialized industrial uses. Producers are turning their attention to engineered particle size, surface treatment, and functionalized grades to satisfy performance needs through advanced formulations. These innovations are widening the range of applications of silica across new industries.

Drivers & Opportunities

Which are the factors driving silica market?

Rising demand from electronics and semiconductor manufacturing: High-purity silica is increasingly used in semiconductor manufacturing for the production of optical fibers, and photovoltaic used in solar energy systems. According to the Semiconductor Industry Association, global semiconductor sales totaled USD 627.6 billion in 2024, up by 19.1% from 2023. This increasing electronics manufacturing is speeding up demand for ultrapure silica, thus fueling the market growth.

Growth in automotive and transportation applications: The growing automotive industry is propelling increasing silica consumption for application in tires, light-weight composites, and innovative material blends that enable fuel efficiency and performance. As per the European Automobile Manufacturers Association, worldwide auto sales amounted to 74.6 million units during 2024, posting a 2.5% increase compared to the prior year. This increasing manufacturing base is boosting silica demand in mobility applications.

Segmental Insights

By Type

On the basis of type the market is segmented into amorphous and crystalline. The amorphous segment holds dominant market share, owing to its increasing usage in rubber, coatings, adhesives, as well as food-grade applications.

The crystalline segment is anticipated to expand at high growth rate fueled by its widespread use in construction, foundry, glass, and metallurgical processes.

By End-user Industry

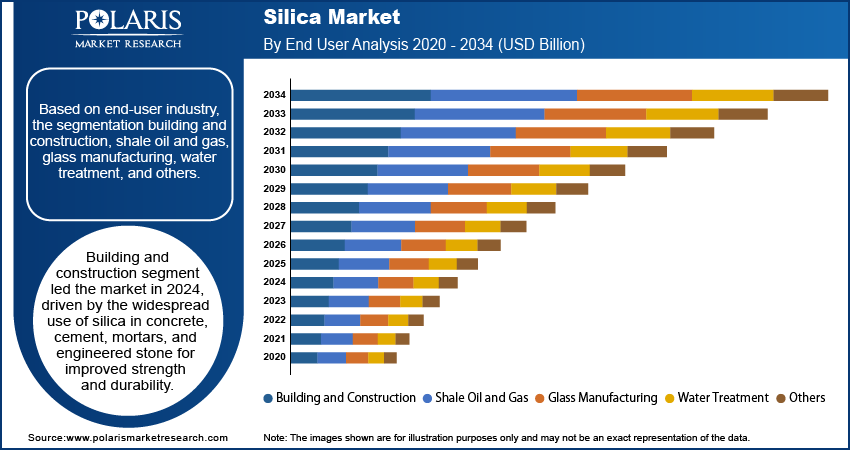

Based on end-user, the market is segmented into building and construction, shale oil and gas, glass production, water treatment, and others. Building and construction led the market, propelled by extensive applications of silica in concrete, cement, mortars, and engineered stone for enhanced strength and durability.

The shale oil and gas segment is expected to expand at a rapid rate over the forecast period, due to the use of silica sand in hydraulic fracturing as a proppant material.

Regional Analysis

Asia Pacific led the silica market due to high-speed urbanization and bulk infrastructure development in China, India, and Southeast Asia in construction, glass, and industry end uses. Also, growth in automotive and tire manufacturing bases is pushing increased consumption of reinforcing silica used in rubber and tire compounding.

China Silica Market Overview

China led the Asia pacific market, driven by the growing electronics, semiconductor fabs, and solar module production. According to the Semiconductor Industry Association, the Chinese government allocated more than USD 150 billion from 2014 to 2030 to enhance its indigenous semiconductor ecosystem, contributing enormously to the demand for high-quality silica materials.

North America Silica Market Insights

North America is projected to register rapid growth in the silicas market due to rising demand for high-purity silica in semiconductor production, hyperscale data centers, and EV battery manufacturing. Also, the rising oil & gas industry, particularly for hydraulic fracturing (frac sand) applications is further accelerating the market growth.

The U.S. Silica Market Analysis

The U.S. dominated the market in North America, due to the high solar panel installations growth, which generates huge demand for high-quality silica in solar photovoltaic glass and wafer production. Solar represented 56% of all new electricity-generating capacity added in the U.S. grid in the first half of 2025, totaling 18 GW installed, according to the Solar Energy Industries Association.

Europe Silica Market Assessment

Europe held significant share in silica market, driven by increasing investments in EV and battery production. In 2025, six flagship EV battery cell manufacturing projects received around USD 920 million worth of grants from the European Commission under the Innovation Fund, from revenues of the EU ETS. Also, stringent environmental laws are driving the application of low-emission and green materials, driving silica adoption in coatings, polymers, and rubber substitutes.

Key Players & Competitive Analysis

The global silica market is moderately competitive, with businesses targeting product purity, particle size management, and specialty uses in industries like chemicals, construction, coatings, electronics, and pharmaceuticals. Businesses are investing in innovative processing technologies, surface treatments, and tailored formulations to address the increasing demand for high-performance silica in industrial as well as consumer applications. Sustainability drivers, regulatory compliance, and strategic alliances with downstream users are becoming predominant factors in determining competition as well as expanding the market on a global basis.

Who are the major players in silica market?

Key companies operating in the global silica market include Cabot Corporation, Evonik Industries AG, Fuso Chemical Co., Ltd., Glimmerglass Ltd., Grace Davison (a division of W. R. Grace & Co.), Imerys S.A., J.M. Huber Corporation, Kao Corporation, Lorde Silica Industries Ltd., Nissan Chemical Corporation, Omya International AG, PPG Industries Inc., Red River Silica Inc., Sibelco NV, and Tosoh Corporation.

Key Players

- Cabot Corporation

- Evonik Industries AG

- Fuso Chemical Co., Ltd.

- Glimmerglass Ltd.

- Grace Davison

- Imerys S.A.

- J.M. Huber Corporation

- Kao Corporation

- Lorde Silica Industries Ltd.

- Nissan Chemical Corporation

- Omya International AG

- PPG Industries Inc.

- Red River Silica Inc.

- Sibelco NV

- Tosoh Corporation

Silica Industry Developments

In October 2025, HPQ Silicon Inc. completed the seventh test series of its Fumed Silica Reactor (FSR) pilot plant, which is a proprietary reactor, under a collaborative development with PyroGenesis Inc. This is a milestone towards commercializing a direct-quartz-to-fumed-silica process that is energy-saving and has lower carbon emissions than conventional processes.

In September 2025, Solvay opened its first production unit of bio-circular highly dispersible silica (HDS) in Livorno, Italy. The new silica is manufactured from bio-based sodium silicate sourced from rice husk ash, playing a role in a circular economy by giving value to agricultural by-products.

Silica Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Amorphous

- Fumed/Pyrogenic

- Hydrated

- Crystalline

- Quartz

- Tridymite

- Cristobalite

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- Building and Construction

- Shale Oil and Gas

- Glass Manufacturing

- Water Treatment

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Silica Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 40.23 Billion |

|

Market Size in 2025 |

USD 43.95 Billion |

|

Revenue Forecast by 2034 |

USD 99.47 Billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 40.23 billion in 2024 and is projected to grow to USD 99.47 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Cabot Corporation, Evonik Industries AG, Fuso Chemical Co., Ltd., Glimmerglass Ltd., Grace Davison (a division of W. R. Grace & Co.), Imerys S.A., J.M. Huber Corporation, Kao Corporation, Lorde Silica Industries Ltd., Nissan Chemical Corporation, Omya International AG, PPG Industries Inc., Red River Silica Inc., Sibelco NV, and Tosoh Corporation.

The amorphous segment dominated the market revenue share in 2024.

The shale oil and gas segment is projected to witness the fastest growth during the forecast period.